PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851508

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851508

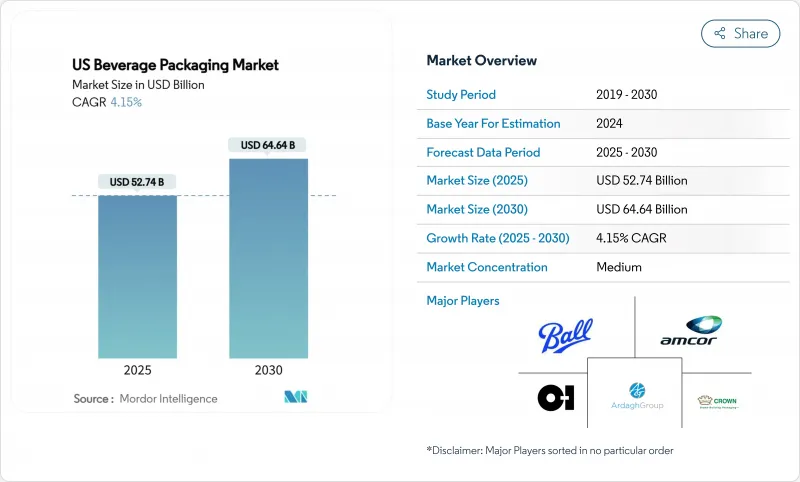

US Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US beverage packaging market reached USD 52.74 billion in 2025 and is forecast to expand to USD 64.64 billion in 2030, registering a 4.15% compound annual growth rate (CAGR).

Steady value growth is underpinned by aluminum-centric strategies that align with tightening sustainability regulations, rising recycled-content mandates, and consumer preference for easily recyclable formats. Brand owners increasingly treat packaging as a cost-effective lever for carbon-reduction targets, fostering demand for lightweight metal containers and high-barrier flexible films. Supplier price actions-such as Ball Corporation's January 2025 surcharge on 12-ounce cans-and minimum-order hikes continue to reshape cost curves for craft producers, widening the gap between large and small beverage companies. Parallel expansion of ready-to-drink (RTD) coffee, energy, and functional beverages is accelerating the migration from multilayer plastic bottles toward aluminum cans and slim bottles with premium graphics. Finally, e-commerce growth is nudging the design of "ship-in-own-container" formats that eliminate secondary corrugate, reduce breakage, and create new premiumization avenues.

US Beverage Packaging Market Trends and Insights

Sustainability-driven lightweighting and rPET mandates

California's AB 793 set a 15% recycled-content floor for PET beverage containers in 2022 that rises to 50% by 2030, providing a blueprint that New York, New Jersey, and Massachusetts lawmakers are actively considering. Recycled PET carries 15-25% cost premiums over virgin resin, compelling brands to invest in lightweighting that reduces polymer usage by 8-12% per container. PepsiCo's 100% rPET shift on select water lines trimmed carbon emissions by 31% while retaining shelf integrity. Compliance-driven line retrofits add USD 0.03-0.08 per unit in logistics and processing overhead, yet brands are capturing 5-8% price lifts by marketing lower-carbon packaging.

Surge in RTD coffee and energy drink launches

RTD energy beverages now account for 37% of convenience-store RTD sales, up from 28% in 2020, and nearly every major launch uses aluminum formats. Monster Beverage derives 97% of its global volume from aluminum containers, enabling USD 7.1 billion in 2025 net sales while offsetting commodity inflation through premium pricing. Aluminum's light- and oxygen-barrier attributes help maintain coffee aromatics and functional ingredient stability, extending shelf life without chilled distribution and lowering cold-chain costs by up to 30%. New RTD coffee stock-keeping units (SKUs) rose 73% from 2018-2023, and 60% of those used cans because of flavor preservation and decoration versatility.

Volatile virgin resin prices

Monomer price swings-particularly ethylene and paraxylene-regularly reach 25-30 c/lb in Gulf Coast spot markets, destabilizing PET cost structures for bottled water and carbonated soft drink (CSD) producers. Forward hedging is limited, causing quarterly margin compression for small bottlers.

Other drivers and restraints analyzed in the detailed report include:

- Craft beer's switch to aluminum cans

- E-commerce-tailored "ship-in-own-container" formats

- Glass furnace capacity rationalization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic kept the largest share at 45.3% in 2024, yet metal packaging is projected to post a 6.2% CAGR, the fastest among all materials. The US beverage packaging market size for metal containers is forecast to exceed USD 27 billion by 2030, reflecting consumer preference for infinitely recyclable formats and regulatory credit for higher post-consumer recycled (PCR) content. Aluminum's barrier properties guard flavor volatility in energy drinks and RTD coffee, supporting premium shelf pricing that offsets higher unit costs.

Ball Corporation targets 90% recycling rates and 85% recycled content by 2030, creating a closed-loop narrative that resonates with retailers pursuing Scope 3 emission cuts. Glass faces headwinds from furnace closures and energy-intensive melting, while paperboard cartons gain momentum through 97% renewable Elopak Pure-Pak structures that reach cost parity with PET at high volume. Recycled PET shortages still restrain plastic penetration despite aggressive lightweighting that cuts polymer content by up to 15%.

Bottles commanded 27.8% of the US beverage packaging market in 2024; however, cans are pacing at a 7.1% CAGR, driven by portability, refrigeration efficiency, and customizable printing. Cans' stackable geometry yields 20-25% freight savings over glass bottles, encouraging conversion among craft beer, flavored seltzer, and vitamin-enriched water producers.

Over 70% of 2025 beverage launches are in cans compared with 45% five years earlier, according to Can Manufacturers Institute data. Digital-print technology accelerates SKU proliferation by shrinking lead times from weeks to days, vital for limited edition RTD coffee collaborations. Bottle innovation centers on lightweight refillable PET and glass, while pouches and cartons appeal to niche use cases such as children's beverages or aseptic dairy alternatives.

US Beverage Packaging Market is Segmented by Material (Plastic, Metal, Glass, Paperboard), Product Type (Bottles, Cans, Pouches, Cartons, Beer Kegs), Application (Alcoholic Beverages, Milk and Dairy Alternatives, Energy and Functional Drinks, Carbonated Soft Drinks and Water, Other Beverages), Packaging Format (Rigid, Flexible). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ball Corporation

- Crown Holdings Inc.

- Owens-Illinois Inc.

- Ardagh Group

- Amcor plc

- Berry Global Inc.

- Silgan Holdings Inc.

- WestRock Co.

- Berlin Packaging

- Sonoco Products Co.

- CCL Containers Inc.

- Graphic Packaging Holding

- Tetra Pak Inc.

- SIG Combibloc

- Canpack S.A.

- Plastipak Holdings Inc.

- Novolex

- Printpack Inc.

- ProAmpac LLC

- American Canning

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustainability-driven lightweighting and rPET mandates

- 4.2.2 Surge in RTD coffee/energy drink launches

- 4.2.3 Craft beer's switch to aluminum cans

- 4.2.4 E-commerce-tailored "ship-in-own-container" formats

- 4.2.5 Tethered-cap rule (CFR Title 21 update) spurring redesigns

- 4.2.6 Premiumpositioning through aluminum's recyclability credentials

- 4.3 Market Restraints

- 4.3.1 Volatile virgin resin prices

- 4.3.2 Glass furnace capacity rationalization

- 4.3.3 Deposit-return expansions raising compliance costs

- 4.3.4 Recycled PET feedstock shortages

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Metal

- 5.1.3 Glass

- 5.1.4 Paperboard

- 5.2 By Product Type

- 5.2.1 Bottles

- 5.2.2 Cans

- 5.2.3 Pouches

- 5.2.4 Cartons

- 5.2.5 Beer Kegs

- 5.3 By Application

- 5.3.1 Alcoholic Beverages

- 5.3.2 Milk and Dairy Alternatives

- 5.3.3 Energy and Functional Drinks

- 5.3.4 Carbonated Soft Drinks and Water

- 5.3.5 Other Beverages

- 5.4 By Packaging Format

- 5.4.1 Rigid

- 5.4.2 Flexible

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ball Corporation

- 6.4.2 Crown Holdings Inc.

- 6.4.3 Owens-Illinois Inc.

- 6.4.4 Ardagh Group

- 6.4.5 Amcor plc

- 6.4.6 Berry Global Inc.

- 6.4.7 Silgan Holdings Inc.

- 6.4.8 WestRock Co.

- 6.4.9 Berlin Packaging

- 6.4.10 Sonoco Products Co.

- 6.4.11 CCL Containers Inc.

- 6.4.12 Graphic Packaging Holding

- 6.4.13 Tetra Pak Inc.

- 6.4.14 SIG Combibloc

- 6.4.15 Canpack S.A.

- 6.4.16 Plastipak Holdings Inc.

- 6.4.17 Novolex

- 6.4.18 Printpack Inc.

- 6.4.19 ProAmpac LLC

- 6.4.20 American Canning

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment