PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907314

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907314

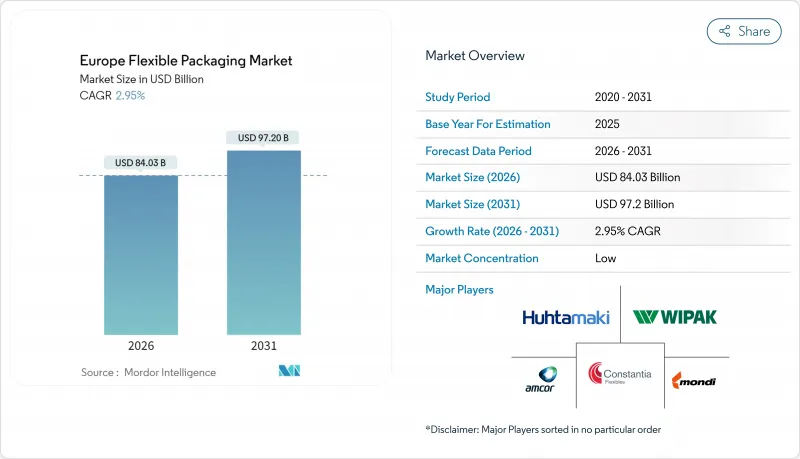

Europe Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe flexible packaging market size in 2026 is estimated at USD 84.03 billion, growing from 2025 value of USD 81.62 billion with 2031 projections showing USD 97.2 billion, growing at 2.95% CAGR over 2026-2031.

This trajectory follows tougher EU recycling mandates, expanding e-commerce parcel volumes, and accelerating demand for convenience foods that need extended shelf life. Mono-material film innovation is gathering pace as the Packaging and Packaging Waste Regulation (PPWR) pushes for 30% recycled plastic content by 2030, while biodegradable options are scaling from a small base. Brand owners continue to migrate toward lightweight pouches that cut logistics costs, yet films and wraps still dominate on volume thanks to their versatility in food and industrial lines. Moderate competitive intensity-as the seven largest suppliers together control only about one quarter of sales-creates room for regional specialists to capture niche opportunities in barrier technology and digital printing.

Europe Flexible Packaging Market Trends and Insights

Surge in Demand for Recyclable Mono-Material Films Driven by EU Circular Economy Targets

The PPWR obliges every package sold in Europe to be recyclable by 2030, prompting converters to redesign multilayer structures into mono-material formats that pass mechanical recycling streams. Nestle reports 60% carbon-footprint savings from polypropylene retort pouches for pet food, while Saica Flex plans a fully recyclable portfolio by 2025 that integrates post-consumer recyclate. Paper's exemption from recycled-content quotas gives a lift to paper-based alternatives such as Koehler Paper's NexPlus barrier line. To compensate for lost multilayer performance, suppliers are testing ORMOCER and other inorganic coatings that cut oxygen transmission rates by 95% on PP substrates. Extended Producer Responsibility fees now penalize non-recyclable materials, compressing timetables for adoption.

Accelerated Growth of E-Commerce Elevating Demand for Flexible Mailer & Protective Formats

Online retail continues to expand double-digit in many EU markets, spurring uptake of lightweight mailers and protective films that reduce freight cost per parcel. Digital presses such as HP Indigo 200K allow brands to personalize outer graphics for seasonal or regional promotions, while cutting set-up waste versus flexography. Uteco's SapphireAQUA hybrid platform prints 1,200 X 1,200 DPI at 150 mpm using low-migration, water-based inks that fulfil food-contact rules. Smaller e-commerce brands increasingly outsource fulfillment, channeling more volume through indirect distributors who favor flexible formats compatible with automated packing lines.

Stringent EU Plastics & Packaging-Waste Regulations Increasing Compliance Costs

Smaller converters face steep investments to certify recyclability, integrate recycled resin, and redesign graphics to meet harmonized labeling. Extended Producer Responsibility fees for non-compliant packs can add 50% or more to delivered cost, squeezing margins until new lines come on-stream. PFAS bans hitting in 2026 will force reformulation of grease-resistant coatings for food wraps, while labeling rules effective 2028 drive artwork changeovers across thousands of SKUs.

Other drivers and restraints analyzed in the detailed report include:

- Consumer Shift Toward Convenience & Portion-Control Products Boosting Flexible Pouch Adoption

- Technological Advances in High-Barrier Co-Extrusion Enhancing Shelf-Life for Ready Meals

- Limited Recycling Infrastructure for Multi-Layer Films Hampering Circularity Goals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics contributed 61.88% of Europe flexible packaging market share in 2025, powered by polyethylene's cost-to-performance edge in food and e-commerce lines. Petro-based substrates maintain leadership today, yet the Europe flexible packaging market is witnessing brisk interest in bio-based and compostable films expanding at a 5.66% CAGR as brand owners chase PPWR alignment. Paper and paperboard enjoy an exemption from recycled-content quotas, and suppliers such as Koehler Paper are making headway with barrier-coated grades that hit 81.5% recycling rates. Metalized structures still serve pharma and premium food where absolute barrier rules, but stand largely insulated from volume swings thanks to niche demand. Chemical recycling initiatives for PET, including depolymerization to virgin-like feedstock, aim to secure food-grade resin streams by 2027, a milestone that could stabilise PET's position amid rising recycled-content targets.

Europe flexible packaging market players are trialing hybrid laminates that pair traditional polyolefin layers with biodegradable coatings to accelerate soil decomposition while preserving seal integrity during shelf life. BOPP remains the workhorse for transparent snack films, whereas CPP is favoured for retortable lidding thanks to its sealability. Bioplastics, currently a sliver of overall tonnage, are moving beyond compostable shopping bags into high-barrier structures with blending of PLA, PBAT, and starch. Converters anticipate cost parity with fossil-based grades only after 2028, pending feedstock scale-up and mandates that spur demand.

Films and wraps carried 43.92% of Europe flexible packaging market share in 2025 because they serve high-volume categories such as bakery, cheese, and industrial components. Nonetheless, pouches are clocking a 6.55% CAGR through 2031, buoyed by retortable pet-food packs and microwaveable ready meals that fit on-the-go consumer lifestyles. Stand-up formats improve shelf utilisation and brand visibility, which retailers reward with premium placement. Nestle's recyclable retort pouch illustrates how brands can cut carbon footprints by 60% versus legacy structures while maintaining performance Packaging Digest.

Bag formats continue to dominate agricultural seeds, fertilizers, and DIY markets, where bulk weight limits the appeal of thin-wall alternatives. Digital printing's rise allows converters to offer SKU-level customisation in lot sizes below 5,000 units without compromising unit economics, encouraging niche gourmet brands to adopt pouch packaging earlier in their lifecycle. Overwraps and shrink sleeves remain relevant as tamper-evidence solutions in beverages and pharmaceuticals but face scrutiny over recyclability. Double-digit growth in European pet ownership further underpins demand for retort and stand-up pouches that guarantee product freshness and aroma protection.

The Europe Flexible Packaging Market Report is Segmented by Material Type (Plastics, Paper and Paperboard, and More), Product Type (Pouches, Bags, and More), End-User Industry (Food, Beverage, Healthcare and Pharmaceuticals, and More), Distribution (Direct Sales, Indirect Sales), and Country (Germany, United Kingdom, France, Italy, Spain, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor PLC

- Mondi Group

- Huhtamaki Oyj

- Constantia Flexibles GmbH

- Sealed Air Corporation

- Coveris Management GmbH

- ProAmpac LLC

- Novolex Holdings Inc.

- Sonoco Products Company

- Bischof + Klein SE & Co. KG

- Wipak Oy

- Schur International A/S

- Gualapack SpA

- ePac Holdings LLC

- Danaflex Group

- Cellografica Gerosa SpA

- Di Mauro Officine Grafiche SpA

- Bak Ambalaj Sanayi ve Ticaret AS

- Flextrus AB

- Sipospack Kft.

- Clondalkin Flexible Packaging

- Innovia Films Ltd.

- AR Packaging Group AB

- RKW Group

- Plastopil Hazorea Co. Ltd.

- Schur Flexibles Group

- Glenroy Inc.

- Leefung ASG Europe

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Demand for Recyclable Mono-Material Films Driven by EU Circular Economy Targets

- 4.2.2 Accelerated Growth of E-Commerce Elevating Demand for Flexible Mailer & Protective Formats in Europe

- 4.2.3 Consumer Shift Toward Convenience & Portion-Control Products Boosting Flexible Pouch Adoption

- 4.2.4 Technological Advances in High-Barrier Co-Extrusion Enhancing Shelf-Life for Ready Meals

- 4.2.5 Rising Penetration of Digital & Hybrid Printing Enabling Short Runs and Mass Personalisation

- 4.2.6 Rapid Expansion of European Pet-Food Industry Using Retort & Stand-Up Pouches

- 4.3 Market Restraints

- 4.3.1 Stringent EU Plastics & Packaging-Waste Regulations Increasing Compliance Costs

- 4.3.2 Limited Recycling Infrastructure for Multi-Layer Films Hampering Circularity Goals

- 4.3.3 Volatile Polyolefin & Aluminium-Foil Prices Post-Energy Crisis Impacting Margins

- 4.3.4 Competitive Pressure from Rigid Recyclable Alternatives Among Sustainability-Minded Brands

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Investment Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastics

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Bi-orientated Polypropylene (BOPP)

- 5.1.1.3 Cast Polypropylene (CPP)

- 5.1.1.4 Polyethylene Terephthalate (PET)

- 5.1.1.5 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.1.1.6 Other Plastics Types

- 5.1.2 Paper and Paperboard

- 5.1.3 Metal

- 5.1.4 Biodegradable and Compostable Materials

- 5.1.1 Plastics

- 5.2 By Product Type

- 5.2.1 Pouches

- 5.2.2 Bags

- 5.2.3 Films and Wraps

- 5.2.4 Other Product Type

- 5.3 By End-User Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Healthcare and Pharmaceuticals

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Industrial

- 5.3.6 Other End-Use Industries

- 5.4 By Distribution

- 5.4.1 Direct Sales

- 5.4.2 Indirect Sales

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Mondi Group

- 6.4.3 Huhtamaki Oyj

- 6.4.4 Constantia Flexibles GmbH

- 6.4.5 Sealed Air Corporation

- 6.4.6 Coveris Management GmbH

- 6.4.7 ProAmpac LLC

- 6.4.8 Novolex Holdings Inc.

- 6.4.9 Sonoco Products Company

- 6.4.10 Bischof + Klein SE & Co. KG

- 6.4.11 Wipak Oy

- 6.4.12 Schur International A/S

- 6.4.13 Gualapack SpA

- 6.4.14 ePac Holdings LLC

- 6.4.15 Danaflex Group

- 6.4.16 Cellografica Gerosa SpA

- 6.4.17 Di Mauro Officine Grafiche SpA

- 6.4.18 Bak Ambalaj Sanayi ve Ticaret AS

- 6.4.19 Flextrus AB

- 6.4.20 Sipospack Kft.

- 6.4.21 Clondalkin Flexible Packaging

- 6.4.22 Innovia Films Ltd.

- 6.4.23 AR Packaging Group AB

- 6.4.24 RKW Group

- 6.4.25 Plastopil Hazorea Co. Ltd.

- 6.4.26 Schur Flexibles Group

- 6.4.27 Glenroy Inc.

- 6.4.28 Leefung ASG Europe

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment