PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851526

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851526

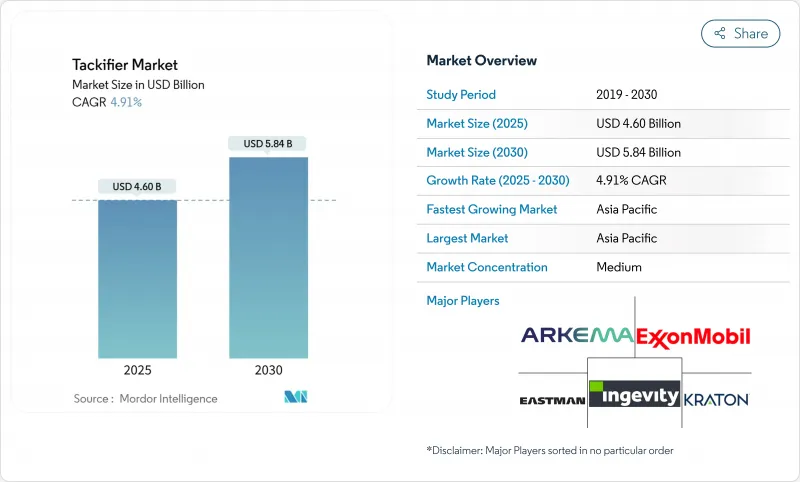

Tackifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Tackifier Market size is estimated at USD 4.60 billion in 2025, and is expected to reach USD 5.84 billion by 2030, at a CAGR of 4.91% during the forecast period (2025-2030).

Sustained demand for pressure-sensitive and hot-melt adhesives in packaging and hygiene products anchors current revenue, while widening use in electric vehicle battery assembly, specialty construction, and low-VOC food packaging broadens future growth pathways. Rapid infrastructure spending across Asia Pacific, stringent emission norms in North America and Europe, and brand owner commitments to bio-based materials collectively reinforce market momentum. Innovation in ultra-low-VOC grades, high-heat hydrocarbon resins, and rosin-derived dispersions allows suppliers to address tightening food-contact and environmental regulations without sacrificing bond performance. Technology shifts toward tackifier-free reactive hot melts and dynamic polyurethane chemistries, alongside crude-oil price swings, remain overarching risks that could temper profitability yet also spur R&D diversification.

Global Tackifier Market Trends and Insights

Rising Demand for Hot-Melt & PSA Adhesives in Packaging and Hygiene

E-commerce parcel volume, combined with premium hygiene products, continues to lift hot-melt and pressure-sensitive adhesive consumption. Tackifier resins provide the critical early-grab and sustained peel strength these fast-running production lines require. H.B. Fuller's Full-Care 6217 shows how formulation tweaks can cut adhesive usage by 20% while improving peel, a direct cost-and-performance benefit to diaper makers. Biodegradable rosin resins gain traction in paper-backed tapes, aligning with brand sustainability pledges. Moisture-management features in feminine care pads push suppliers toward tackifiers that tolerate high humidity yet keep odor low. ExxonMobil's Escorez portfolio illustrates the push for light-color, thermally stable grades serving transparent packaging films where clarity is paramount. These combined needs ensure that the tackifier market remains firmly linked to consumer goods growth through 2030.

Urban Infrastructure Boom in APAC Spurring Construction Adhesives

Mass transit lines, airports, and affordable housing programs across China, India, and ASEAN nations underpin long-run demand for flooring, roofing, and panel bonding adhesives. Moisture-cure systems excel in tropical humidity, and their reliance on tackifier resins for initial wet-out drives incremental volumes. Master Builders Solutions targets INR 500 crore turnover in India by 2028 on the strength of such products. Building codes pushing lightweight composite facades and sandwich panels widen the performance window for synthetic hydrocarbon tackifiers that deliver thermal stability. The China Adhesive Tape Council reports volume gains in building tapes, highlighting how infrastructure and consumer durables intersect. These investments sustain APAC's leadership in tackifier market growth.

Petroleum-Feedstock Price Volatility Hurting Hydrocarbon Resin Margins

Hydrocarbon tackifier lines mirror crude-oil price swings because C5 and C9 streams are co-products of naphtha crackers. Spikes erode margins, stall expansion CAPEX, and constrain R&D budgets. During the 2021 European logistics crunch, adhesive demand slipped 5%, underscoring vulnerability to supply disruptions. Specialty chemical planners now emphasize hedging and agile pricing tools, yet smaller independent resin houses remain exposed. With petroleum resins occupying 65.45% share, extended volatility could redirect buyers toward bio-based grades, reshaping the competitive landscape.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Growth Accelerating Tape & Label Consumption

- Ultra-Low-VOC, Food-Contact Compliant Resin Grades Gain Preference

- Emergence of Tackifier-Free Reactive Hot-Melt Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Petroleum resins delivered 65.45% of 2024 revenue, anchoring the tackifier market with a reliable quality and price-performance balance. C5-C9 hybrids secure tack and heat resistance for automotive interiors and industrial tapes. Meanwhile, rosin grades expand at a 5.15% CAGR as converters pursue renewable content for eco-labels and certified compostable pouches. Tall-oil rosin supply tightens because biofuel refiners draw from the same feed pool, leading to a projected 8% deficit by 2030. Successful suppliers diversify between hydrocarbon and rosin lines, hedging price swings while meeting brand sustainability targets. Terpene resins, though niche, add polarity advantages that improve adhesion to natural rubber and elastic substrates. The tackifier market benefits from this blended feedstock approach, ensuring formulators can balance cost, performance, and green content.

Petroleum producers aim to lock in long-term contracts to preserve stability, but such commitments reduce flexibility when customers pivot to bio-content mandates. Conversely, rosin innovators exploit hydrogenated modifications to match color and odor standards demanded in transparent packaging films. The interplay between cost volatility and sustainability legislation defines feedstock strategy for the decade ahead.

Solid chips and pellets held 81.56% of 2024 sales because converters prefer easy feeding, low dust, and compatibility with established hot-melt equipment. They withstand melting peaks above 150 °C without oxidative degradation, making them indispensable for carton-sealing and woodworking lines. Resin dispersions outpace with 5.32% CAGR, meeting waterborne adhesive growth in labels and flexible laminations. These dispersions reduce VOC output and simplify line cleanup, critical under tighter plant-emission audits. Liquid forms serve ribbon-coating and solvent systems where room-temperature viscosity is needed, yet their market share lags amid solvent abatement costs. For manufacturers, offering multi-form portfolios elevates switching barriers and secures share in specialty end uses that demand customized viscosity profiles.

The Tackifier Market Report is Segmented by Feedstock (Rosin Resins, Petroleum Resins, Terpene Resins), Form (Solid, Liquid, Resin Dispersion), Type (Synthetic, Natural), Application (Tapes and Labels, Assembly, Bookbinding, and More), End-User Industry (Packaging, Building and Construction, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific commanded 36.25% of 2024 revenue and rises at 5.50% CAGR, underpinned by infrastructure investment, surging e-commerce, and expanding diaper penetration. China's adhesive tape production grew at high single digits, aligned with construction and electronics verticals that specify differentiated tackifiers. India's construction chemicals market, sized at INR 20,000 crore in 2025, underscores regional appetite for adhesives that accelerate build cycles. Government policies favoring biodegradable packaging boost rosin-based demand, while volatile tall-oil supply challenges local formulators to secure consistent feedstock.

North America retains innovation leadership through tight VOC caps and FDA food-contact rules steering purchases toward ultra-low-odor grades. Automotive electrification in the United States and Mexico triggers demand for high-heat synthetic resins that secure battery cell stacks. Europe emphasizes circular economy targets and REACH compliance, prompting a pivot to bio-content tackifiers despite higher costs. The 2025 rebound in European construction adhesives signals that regulatory headwinds can coexist with sustainable substitution opportunities.

South America and Middle East & Africa, though smaller, offer upside tied to logistics corridors, consumer goods growth, and foreign direct investment in manufacturing. Saint-Gobain's USD 1.025 billion purchase of FOSROC bolsters distribution of construction adhesives in GCC states and India, an example of global firms placing strategic bets on emerging demand centers. Exchange-rate swings and limited local resin capacity temper immediate growth, but gradual industrialization sets a foundation for tackifier uptake over the next decade.

- Arakawa Chemical Industries, Ltd.

- Arkema

- Eastman Chemical Company

- Exxon Mobil Corporation

- Henkel AG & Co. KGaA

- Ingevity Corporation

- Kolon Industries, Inc.

- Kraton Corporation

- Lawter, a Harima Chemicals, Inc. Company

- Natrochem, Inc.

- SI Group, Inc.

- Teckrez, Inc.

- TWC Group

- Yasuhara Chemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for hot-melt and PSA adhesives in packaging and hygiene

- 4.2.2 Urban infrastructure boom in APAC spurring construction adhesives

- 4.2.3 E-commerce growth accelerating tape and label consumption

- 4.2.4 Ultra-low-VOC, food-contact compliant resin grades gain preference

- 4.2.5 EV battery and lightweight automotive assembly needing high-heat tackifiers

- 4.3 Market Restraints

- 4.3.1 Petroleum-feedstock price volatility hurting hydrocarbon resin margins

- 4.3.2 Emergence of tackifier-free reactive hot-melt systems

- 4.3.3 Sustainability certifications constraining tall-oil and gum-rosin supply

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 Feedstock

- 5.1.1 Rosin Resins

- 5.1.2 Petroleum Resins

- 5.1.3 Terpene Resins

- 5.2 Form

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.2.3 Resin Dispersion

- 5.3 Type

- 5.3.1 Synthetic

- 5.3.2 Natural

- 5.4 Application

- 5.4.1 Tapes and Labels

- 5.4.2 Assembly

- 5.4.3 Bookbinding

- 5.4.4 Footwear, Leather and Rubber

- 5.4.5 Other Applications

- 5.5 End-user Industry

- 5.5.1 Packaging

- 5.5.2 Building and Construction

- 5.5.3 Automotive

- 5.5.4 Non-wovens

- 5.5.5 Footwear

- 5.5.6 Other End-user Industries

- 5.6 Geography

- 5.6.1 Asia-Pacific

- 5.6.1.1 China

- 5.6.1.2 India

- 5.6.1.3 Japan

- 5.6.1.4 South Korea

- 5.6.1.5 Rest of Asia-Pacific

- 5.6.2 North America

- 5.6.2.1 United States

- 5.6.2.2 Canada

- 5.6.2.3 Mexico

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Arakawa Chemical Industries, Ltd.

- 6.4.2 Arkema

- 6.4.3 Eastman Chemical Company

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Ingevity Corporation

- 6.4.7 Kolon Industries, Inc.

- 6.4.8 Kraton Corporation

- 6.4.9 Lawter, a Harima Chemicals, Inc. Company

- 6.4.10 Natrochem, Inc.

- 6.4.11 SI Group, Inc.

- 6.4.12 Teckrez, Inc.

- 6.4.13 TWC Group

- 6.4.14 Yasuhara Chemical Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment