PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851544

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851544

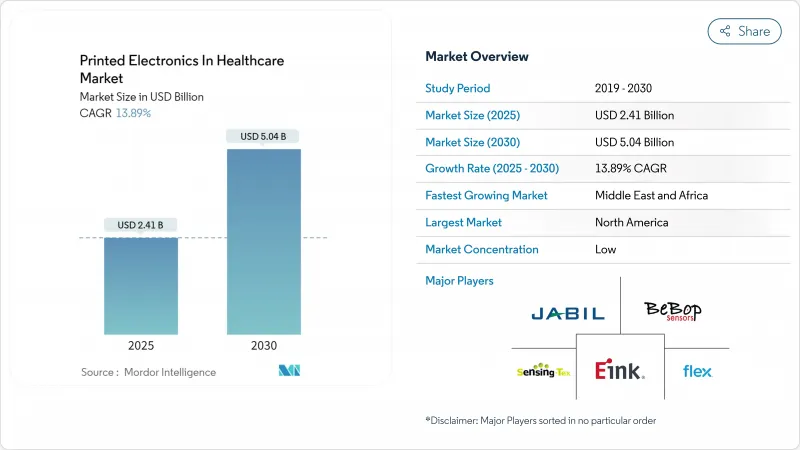

Printed Electronics In Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The printed electronics market size in healthcare is currently valued at USD 2.41 billion and is forecast to achieve USD 5.04 billion by 2030, reflecting a 13.89% CAGR.

This vigorous expansion stems from the technology's ability to deliver flexible, lightweight, and disposable medical devices at unit costs traditional silicon manufacturing cannot match. Strong demand for remote patient-monitoring wearables, growth in smart pharmaceutical packaging, and rapid innovation in biocompatible conductive inks anchor near-term growth. North America's early regulatory clarity and generous NIH grants accelerate commercialization pipelines, while Asia-Pacific's push for point-of-care diagnostics widens the customer base. Meanwhile, breakthroughs in self-healing conductors and stretchable substrates promise fresh revenue streams as clinical adoption hurdles are cleared.

Global Printed Electronics In Healthcare Market Trends and Insights

Rapid Uptake of Remote Patient-Monitoring Wearable Patches in United States Homecare

Medicare's broader reimbursement for telehealth, coupled with FDA clearance of skin-friendly glucose and cardiac patches, fuels wide deployment of printed sensors in the home-care channel. Hybrid microfluidic-regulated patches now capture multi-parameter vitals, handing care teams granular longitudinal data without clinic visits. U.S. systems report fewer readmissions and higher patient satisfaction, confirming tangible cost savings. Device makers scaling in this environment set a compelling precedent for EU and APAC health systems as they evaluate reimbursement frameworks.

EU Falsified Medicines Directive Catalyzing Smart Pharma-Packaging with Printed RFID

Full serialization under the EU Falsified Medicines Directive forces pharmaceutical producers to embed authentication features on every retail pack. Printed RFID and NFC tags, fabricated on high-speed flexographic lines, now satisfy both traceability and tamper evidence at unit cost levels acceptable to generic and branded manufacturers. Global drug firms adopting EU-compliant packaging extend the same solutions to APAC logistics hubs, creating a multiplier effect on demand for conductive inks optimized for paper and foil substrates.

FDA and EMA Validation Cycles Delaying Commercial Roll-outs

Actual 510(k) reviews often stretch to 6-7 months, well beyond nominal timelines, as examiners request extra bench and clinical data on novel substrates. De novo classifications lengthen approvals further, and the new European MDR imposes additional clinical performance studies, forcing dual submission tracks. Rising cybersecurity and AI documentation requirements add layers of testing cost, prompting some mid-cap firms to defer U.S. launches in favor of pilot deployments in MEA or South America.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Point-of-Care Disposable Biosensors for Infectious Disease Detection in Asia

- Cold-Chain Integrity Needs Boosting Printed Temperature Sensors for Vaccines

- Sterilization and Biocompatibility Challenges of Polymer Substrates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Printed biosensors held 41.8% of the printed electronics market in 2024. Glucose strips and continuous glucose monitors dominate the installed base, buoyed by over-the-counter U.S. approvals that destigmatize routine monitoring. Infectious disease assays remain a growth engine in APAC public-health tenders, while emerging pH and wound-monitor patches broaden clinical reach.

Stretchable and flexible hybrid electronics is projected to post a 16.3% CAGR, the fastest among types. Self-healing conductive meshes now survive repeated strain cycles without delamination, allowing week-long cardiac or neuro monitoring. Printed RFID labels for pharma packs add a second demand pillar, especially as global serialization mandates mature

Screen printing captured 52.9% of the printed electronics market in 2024 thanks to proven throughput and low per-unit costs for disposable electrodes. Mature process controls ease FDA filing, making it the default for high-volume biosensors.

Aerosol jet and 3D methods are growing at a 14.7% CAGR. Their ability to deposit conductive tracks inside 3D microfluidic channels has cut prototyping times from days to minutes. Early adopters in Switzerland and Singapore have demonstrated sub-100 µm channel fidelity at pilot scale, enabling rapid design iteration for lab-on-chip diagnostics.

The Printed Electronics in Healthcare Market Report is Segmented by Type (Printed Biosensors, Printed Physiological Sensors, Printed RFID/NFC Labels, and More), Printing Technology (Screen Printing, Inkjet Printing, and More), Application (Patient Monitoring, Diagnostic Testing, Drug Delivery, and More), End-User (Hospitals, Home Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America posted 40.8% of global revenue in 2024, benefiting from FDA's early digital-health frameworks and NIH funding streams that de-risk material R&D. Multicenter trials at Mayo Clinic and Cleveland Clinic validate remote monitoring endpoints, smoothing procurement approvals for regional hospital networks. Canadian research clusters in Ontario add specialized substrate expertise, further bolstering continental leadership.

Europe remains a strategic stronghold. The region's pharmaceutical giants must comply with the Falsified Medicines Directive, locking in sustained demand for serialized smart tags. Germany's precision-machinery heritage supports high-volume printing presses, while the United Kingdom channels venture funding into flexible IC startups. Public health authorities in France and Nordic nations augment uptake through preventive-care reimbursement for remote sensors.

The Middle East and Africa is forecast to deliver a 15.4% CAGR, the fastest worldwide. National health expansions in Saudi Arabia and the United Arab Emirates allocate budget lines for connected diagnostics, seeing printed electronics as a quick path to rural coverage without heavy infrastructure. South Africa's regulatory agency aligns its device code to FDA classification, accelerating import approvals. This momentum signals a step-change in the region's medical technology self-sufficiency.

- DuPont de Nemours, Inc.

- Henkel AG and Co. KGaA

- Nissha Co., Ltd. (Nissha Medical)

- Flex Ltd. (Health Solutions)

- Molex LLC (Sensable)

- GE Healthcare

- Abbott Laboratories (FreeStyle Libre Sensors)

- Medtronic plc (Printed Electrodes)

- Jabil Inc. (Blue Sky Center)

- Zimmer Biomet (Smart Implants)

- NovaCentrix Corp.

- PragmatIC Semiconductor Ltd.

- Thinfilm Electronics ASA

- Toppan Printing Co., Ltd. (Healthcare Labels)

- PolyIC GmbH and Co. KG

- GSI Technologies LLC

- PV Nano Cell Ltd.

- Coatema Coating Machinery GmbH

- Bebop Sensors Inc.

- Sensing Tex S.L.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Uptake of Remote Patient-Monitoring Wearable Patches in United States Homecare

- 4.2.2 EU Falsified Medicines Directive Catalyzing Smart Pharma-Packaging with Printed RFID

- 4.2.3 Surge in Point-of-Care Disposable Biosensors for Infectious Disease Detection in Asia

- 4.2.4 Chronic-Disease Burden Driving Demand for Flexible Printed Electrodes in Cardiology

- 4.2.5 Cold-Chain Integrity Needs Boosting Printed Temperature Sensors for Vaccines

- 4.2.6 NIH and EU Horizon Grants Funding Bio-Compatible Conductive-Ink R&D

- 4.3 Market Restraints

- 4.3.1 FDA and EMA Validation Cycles Delaying Commercial Roll-outs

- 4.3.2 Sterilization and Biocompatibility Challenges of Polymer Substrates

- 4.3.3 Humidity-Driven Degradation Limiting Shelf-Life of Printed Biosensors

- 4.3.4 Reimbursement Ambiguity for Wearable Diagnostics in Emerging Markets

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 Printing Technology Snapshot

- 4.5.1.1 Screen Printing

- 4.5.1.2 Inkjet Printing

- 4.5.1.3 Gravure and Flexography

- 4.5.1.4 Aerosol Jet and Other Emerging Techniques

- 4.5.1 Printing Technology Snapshot

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Printed Biosensors

- 5.1.1.1 Glucose Sensors

- 5.1.1.2 Infectious-Disease Test Strips

- 5.1.1.3 Other Biosensors

- 5.1.2 Printed Physiological Sensors

- 5.1.2.1 ECG/EEG Electrodes

- 5.1.2.2 Temperature/pH Patches

- 5.1.3 Printed RFID/NFC Labels

- 5.1.4 Stretchable and Flexible Hybrid Electronics

- 5.1.5 Printed Microfluidics

- 5.1.6 Other Printed Components (Antennas, Heaters)

- 5.1.1 Printed Biosensors

- 5.2 By Printing Technology

- 5.2.1 Screen Printing

- 5.2.2 Inkjet Printing

- 5.2.3 Gravure/Flexography

- 5.2.4 Aerosol Jet and 3D Printing

- 5.3 By Application

- 5.3.1 Patient Monitoring and Wearables

- 5.3.2 Diagnostic Testing and Point-of-Care

- 5.3.3 Drug Delivery and Smart Patches

- 5.3.4 Pharmaceutical Packaging and Anti-Counterfeit

- 5.3.5 Medical Imaging and Therapeutic Devices

- 5.3.6 Others

- 5.4 By End-user

- 5.4.1 Hospitals and Clinics

- 5.4.2 Home Healthcare Providers

- 5.4.3 Pharmaceutical and Biotech Companies

- 5.4.4 Diagnostic Laboratories

- 5.4.5 Academic and Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 DuPont de Nemours, Inc.

- 6.4.2 Henkel AG and Co. KGaA

- 6.4.3 Nissha Co., Ltd. (Nissha Medical)

- 6.4.4 Flex Ltd. (Health Solutions)

- 6.4.5 Molex LLC (Sensable)

- 6.4.6 GE Healthcare

- 6.4.7 Abbott Laboratories (FreeStyle Libre Sensors)

- 6.4.8 Medtronic plc (Printed Electrodes)

- 6.4.9 Jabil Inc. (Blue Sky Center)

- 6.4.10 Zimmer Biomet (Smart Implants)

- 6.4.11 NovaCentrix Corp.

- 6.4.12 PragmatIC Semiconductor Ltd.

- 6.4.13 Thinfilm Electronics ASA

- 6.4.14 Toppan Printing Co., Ltd. (Healthcare Labels)

- 6.4.15 PolyIC GmbH and Co. KG

- 6.4.16 GSI Technologies LLC

- 6.4.17 PV Nano Cell Ltd.

- 6.4.18 Coatema Coating Machinery GmbH

- 6.4.19 Bebop Sensors Inc.

- 6.4.20 Sensing Tex S.L.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment