PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851565

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851565

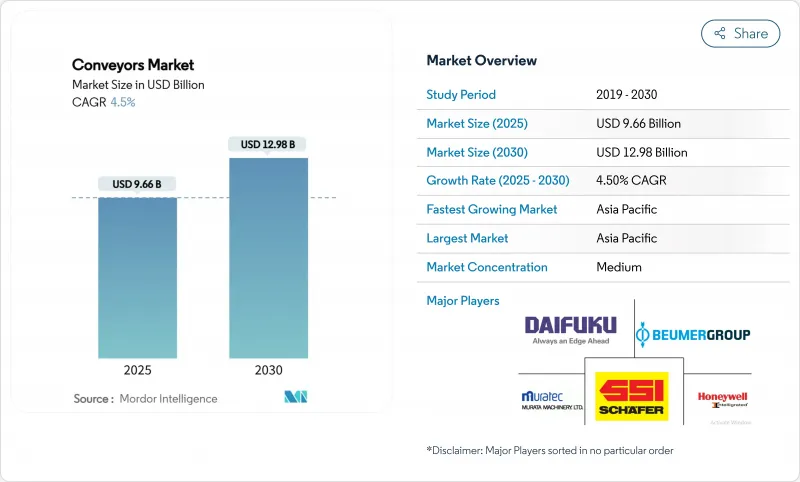

Conveyors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Conveyors Market size is estimated at USD 9.66 billion in 2025, and is expected to reach USD 12.98 billion by 2030, at a CAGR of 4.5% during the forecast period (2025-2030).

The outlook is shaped by rapid e-commerce fulfillment growth, Industry 4.0 investment, and the search for energy efficiency that pushes regenerative-drive adoption capable of 37-39% power savings in downhill duty cycles. Asia-Pacific leads demand, while the Middle East records the fastest expansion as large logistics parks come online. Belt technology retains a plurality of installations, but overhead designs are scaling fastest because factories want floor-space relief. Software-driven predictive maintenance is emerging as the strongest component growth area, cutting unplanned downtime by up to 30% and extending asset life. At the same time, capital-spending hesitancy among smaller enterprises tempers the pace of high-end upgrades, and AGV/AMR substitution places added pressure on traditional fixed lines.

Global Conveyors Market Trends and Insights

Rapid growth of e-commerce fulfillment centres

Urban micro-fulfillment nodes now need conveyor platforms that sort more than 7,200 boxes per hour while occupying minimal floor area. Cafe Amazon's Thailand hub shows the model, handling 20,000 boxes a day across 4,000 outlets via a modular Interroll system. High-throughput crossbelt sorters keep same-day delivery promises, and vertical layouts maximize cubic throughput in space-restricted Asian megacities. Developers specify plug-and-play conveyor modules so that facilities can be re-arranged without civil works. These requirements sustain robust equipment replacement cycles and reinforce the conveyor systems market as a backbone of last-mile logistics.

Increasing demand for automated handling in food and beverage plants

Processors move beyond hygiene compliance toward end-to-end throughput optimization. Balaji Wafers reached zero unplanned downtime by shifting to Activated Roller Belt lines that maintain gentle product handling. Vision-equipped conveyors conduct real-time defect checks, shrinking manual inspection. In high-volume snack packaging, DirectDrive spirals now run for 48 hours straight at Diversified Foods, eliminating historic mechanical failures. Modular plastic belting extends service life, and emerging plant-based product lines require adaptable layouts able to process fragile items with varying moisture profiles.

High upfront CAPEX and long ROI periods

Even with 15% internal rates of return, energy-regenerative drives need six years to recoup capital, a hurdle for cash-constrained firms. Steel price swings between USD 870-950 per ton complicate budgeting. Leasing models exist, yet adoption lags in regions with tight credit markets. This cost tension restrains premium equipment penetration within the conveyor systems market.

Other drivers and restraints analyzed in the detailed report include:

- Rising airport passenger volumes boosting baggage-handling conveyors

- Government incentives for Industry 4.0 modernisation

- AMRs and AGVs emerging as substitute technologies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Belt conveyors retained 39% share in 2024, a cornerstone of mining, food and general manufacturing lines. The Dune Express in Texas proves belt scale, moving 13 million tons annually across 42 miles and removing 25,000 truck trips. Overhead variants lift at an 8.1% CAGR as factories open floor space and improve worker safety. Roller systems benefit from modular frames suited to reconfigurable assembly, while pallet lines serve precision automotive tasks. Across categories, smart sensors push predictive maintenance accuracy above 95%.

The conveyor systems market size for belt solutions is projected to expand alongside sustainable mining and bulk logistics projects, whereas overhead designs capture incremental share by maximizing cubic utilization. Energy-efficient vibratory designs need only 20% of traditional drive force, reflecting cross-segment innovation. Slat and chain lines remain embedded in heavy vehicle production, yet their growth is tempered by rising demand for flexible alternatives.

Unit handling represented 64.3% of 2024 demand, driven by e-commerce and discrete manufacturing workflows that value gentle product control and zero-pressure accumulation. Systems with vision-assisted defect detection now handle classification tasks while improving safety. Bulk handling, though smaller, will outpace unit growth at 8.7% CAGR, keyed to commodities growth and agriculture modernisation. Hybrid installations blur boundaries as plants seek infrastructure able to switch between pallets and granular feed.

In mining, TAKRAF's Collahuasi project underlines heavy-duty bulk capacity requirements. Pharmaceutical cleanrooms depend on vacuum conveyors transferring more than 11,100 liters per hour while preserving sterility. These dual paths sustain diversified revenue streams within the conveyor systems market.

Conveyor Systems Market Report is Segmented by Product Type (Belt, Roller, Pallet, Overhead, Slat/Chain and More), Load Type (Unit Handling, Bulk Handling), End-User Industry (Airport, Retail & E-Commerce, Automotive and More), System Configuration (Fixed/Linear, Modular/Flexible), Component (Conveying Equipment, Drives & Controls, Software & Analytics), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 38% of the conveyor systems market in 2024, anchored by expanding manufacturing clusters in China, India, and Southeast Asia. Daifuku's new Indian factory underscores rising local demand from automotive and electronics verticals. China continues to install heavy-duty bulk belts in mining and port infrastructure, while India leverages SAMARTH Udyog facilities to accelerate smart-factory retrofits. Cleanroom conveyor demand rises with semiconductor investment, and Japan's 310-mile freight line spotlights megaproject ambition.

The Middle East, growing at an 8.9% CAGR, benefits from logistics diversification agendas. Saudi Vision 2030 dedicates USD 106.6 billion to freight corridors such as Oxagon, driving need for high-capacity sortation and port conveyors. The UAE logistics market, valued at USD 20.03 billion in 2025, underpins warehouse automation outlays forecast at USD 1.6 billion by 2025.

North America and Europe continue to modernize legacy installations, spurred by DOE energy-efficiency grants and EU carbon regulations. Regenerative drives see early uptake, especially in Europe where green mandates elevate ROI calculations. South America and Africa show pockets of growth tied to mining and port projects, yet capital constraints slow adoption of analytics-heavy systems.

- Daifuku Co., Ltd.

- SSI Schaefer AG

- Murata Machinery Ltd.

- Mecalux S.A.

- BEUMER Group GmbH & Co. KG

- KNAPP AG

- Swisslog AG (KUKA)

- Honeywell Intelligrated

- Flexco

- Vanderlande Industries

- Dematic (KION Group)

- Interroll Holding AG

- Fives Group

- TGW Logistics Group

- Hytrol Conveyor Company

- Bastian Solutions Inc.

- Siemens Logistics

- Martin Engineering

- Dorner Manufacturing

- Intralox L.L.C.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth of e-commerce fulfilment centres

- 4.2.2 Increasing demand for automated handling in food and beverage plants

- 4.2.3 Rising airport passenger volumes boosting baggage-handling conveyors

- 4.2.4 Government incentives for Industry 4.0 modernisation

- 4.2.5 Urban micro-fulfilment requires compact modular conveyors

- 4.2.6 Energy-regenerative conveyor drives support ESG targets

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX and long ROI periods

- 4.3.2 Retrofit integration risk causing production downtime

- 4.3.3 AMRs and AGVs emerging as substitute technologies

- 4.3.4 OT-IT cyber-vulnerabilities in conveyor control networks

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Belt

- 5.1.2 Roller

- 5.1.3 Pallet

- 5.1.4 Overhead

- 5.1.5 Slat / Chain

- 5.1.6 Screw and Pneumatic

- 5.2 By Load Type

- 5.2.1 Unit Handling

- 5.2.2 Bulk Handling

- 5.3 By End-User Industry

- 5.3.1 Airport

- 5.3.2 Retail and E-commerce

- 5.3.3 Automotive

- 5.3.4 Food and Beverage

- 5.3.5 Pharmaceuticals

- 5.3.6 Mining and Quarrying

- 5.3.7 Manufacturing (Discrete and Process)

- 5.3.8 Others

- 5.4 By System Configuration

- 5.4.1 Fixed / Linear

- 5.4.2 Modular / Flexible

- 5.5 By Component

- 5.5.1 Conveying Equipment

- 5.5.2 Drives and Controls

- 5.5.3 Software and Analytics

- 5.6 By Region

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 Italy

- 5.6.3.4 United Kingdom

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Israel

- 5.6.5.5 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Daifuku Co., Ltd.

- 6.4.2 SSI Schaefer AG

- 6.4.3 Murata Machinery Ltd.

- 6.4.4 Mecalux S.A.

- 6.4.5 BEUMER Group GmbH & Co. KG

- 6.4.6 KNAPP AG

- 6.4.7 Swisslog AG (KUKA)

- 6.4.8 Honeywell Intelligrated

- 6.4.9 Flexco

- 6.4.10 Vanderlande Industries

- 6.4.11 Dematic (KION Group)

- 6.4.12 Interroll Holding AG

- 6.4.13 Fives Group

- 6.4.14 TGW Logistics Group

- 6.4.15 Hytrol Conveyor Company

- 6.4.16 Bastian Solutions Inc.

- 6.4.17 Siemens Logistics

- 6.4.18 Martin Engineering

- 6.4.19 Dorner Manufacturing

- 6.4.20 Intralox L.L.C.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment