PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851572

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851572

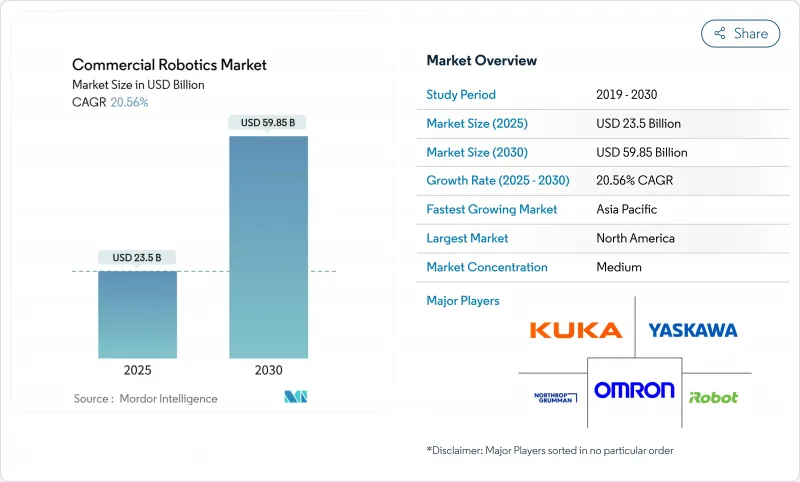

Commercial Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The commercial robotics market size is valued at USD 23.50 billion in 2025 and is projected to register USD 59.85 billion by 2030, advancing at a 20.6% CAGR.

Robust demand stems from the fusion of artificial intelligence with edge-computing hardware that allows robots to execute perception and manipulation tasks locally, trimming latency to single-digit milliseconds. Acute labor shortages continue to tighten across manufacturing and logistics, pushing automation budgets higher as companies look to fill a projected 8.5 million U.S. job gap by decade-end. Government procurement cycles further stimulate orders for defense and security platforms, while large e-commerce players deploy hundreds of thousands of mobile robots to compress fulfillment times. Concurrently, China's state-backed USD 138 billion capital plan underscores Asia-Pacific's accelerating demand for autonomous systems.

Global Commercial Robotics Market Trends and Insights

Technological Convergence of AI, Edge Computing and Robotics

The commercial robotics market benefits from on-device AI inference that offsets cloud latency, enables split-second navigation choices, and supports generative task planning. Amazon operates more than 750,000 warehouse robots that deliver 25% efficiency gains by pairing vision models with local processing. John Deere's second-generation autonomy stack illustrates how edge AI permits centimeter-level steering in crop rows, enhancing uptime in unstructured fields. As large movement models mature, robots switch from rules-based motion to self-learning routines, reframing capital equipment into upgradeable digital assets. This shift elevates software value and propels the commercial robotics market toward platform economics where algorithm improvements lift installed-base capability without mechanical retrofits.

Rising Labor Shortages and Wage Inflation

Manufacturers struggle to staff production lines as demographic shifts shrink labor pools. Vacancies could remove 2 million workers from U.S. factories by 2030, leading to an estimated USD 55 billion redirection of capital toward automation since 2021. Robotics mitigates repetitive and hazardous tasks, improving retention while sustaining throughput. As hardware prices have fallen to USD 10,856 per industrial robot, payback periods for mid-sized plants now average 1-3 years. Subscription financing models further lower entry barriers. Consequently, the commercial robotics market is positioned as a labor-augmentation tool rather than a displacement threat, aligning with corporate mandates to secure talent and productivity simultaneously.

High Up-front Cost of Robotic Systems

Total deployment budgets still top USD 100,000 once integration and training are included, delaying adoption for smaller firms. Robot-as-a-Service contracts help flatten capital curves by bundling equipment, software, and maintenance into monthly fees. Tennant's USD 32 million agreement with Brain Corp underpins 6,500 autonomous cleaning units already in service, proving subscription models in facility care. Modular designs and standardized interfaces aim to trim engineering hours, but ecosystem tooling remains nascent, especially in emerging economies where integrator networks are thin.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of E-commerce Boosting Warehouse Robotics

- Increased Government and Defense Spend on Unmanned Systems

- Cyber-security Vulnerabilities in Connected Robots

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware generated 66.5% of 2024 revenue, underscoring the capital intensity of actuators, drives, and sensor payloads that form each robotic platform's physical backbone. Yet software posted a 22.1% CAGR, reflecting enterprise migration toward intelligence-defined value. Over 80% of ABB's portfolio now bundles AI features that enable real-time path planning, dynamic force control, and digital twin-based simulation. Services contributed residual revenue but are widening as installed bases mature.

Software gains illustrate a strategic pivot. As hardware components commoditize, algorithm stacks dictate differentiation. Amazon's tactile-sensor-equipped Vulcan robot moves 75% of stock-keeping units once reserved for human pickers, a feat impossible without advanced gripping software. Consequently, the commercial robotics market size for software is projected to outpace mechanical build spend by late decade, reshaping supplier power balances and enabling subscription monetization.

Drones accounted for 38.1% of 2024 turnover, buoyed by inspection, mapping, and last-mile delivery services authorized under FAA Part 108 rules that permit beyond-visual-line-of-sight flights. Medical platforms posted the swiftest rise at 21.3% CAGR, with hospitals installing additional da Vinci systems to satisfy minimally invasive procedure demand. Intuitive Surgical recorded USD 2.25 billion Q1 2025 revenue on a 15% system-base expansion.

The category shift underscores healthcare's appetite for precision and demographic-driven eldercare requirements. Meanwhile, field robots demonstrate traction in agriculture and construction, while autonomous guided vehicles dominate structured industrial pathways. Portfolio diversity signals that the commercial robotics market will rely on multi-modal platform growth rather than single-category dominance.

The Commercial Robotics Market Report is Segmented by Component (Hardware, Software, and Services), Type of Robot (Drones/UAVs, Field Robots, Medical Robots, and More), Application (Medical and Healthcare, Defense and Security, Agriculture and Forestry, Marine and Offshore, and More), Mobility (Stationary Robots, Mobile Ground Robots, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 36.5% revenue leadership in 2024, driven by defense outlays and hyperscale e-commerce deployments that utilize extensive autonomous fleets. Funded research programs and venture capital clusters accelerate commercialization cycles, allowing quick transition from pilot pilots to full plant-scale installations. Technology exports from Silicon Valley further support platform standardization in Canada and Mexico.

Asia-Pacific posts the steepest trajectory at 21.6% CAGR through 2030. China's pledge to inject nearly USD 138 billion backs industrial robot supply chains, raising indigenous supplier share from 30% to 47% between 2020 and 2023. National plans in Japan and South Korea collectively allocate more than USD 1 billion for humanoid and manufacturing-grade robots, channeling public-private partnerships into commercialization. Rapid urbanization and wage escalations across Southeast Asia further cultivate adoption among local manufacturers seeking productivity gains.

Europe remains a mature but innovation-active market, combining established automotive automation with stringent safety standards. The region's fit-for-55 emissions plan favors service robots that optimize energy and waste footprints. Middle East and Africa and South America remain nascent, constrained by integrator scarcity and limited financing. Nonetheless, port automation projects and mining robots are slowly catalyzing pilot orders that foreshadow longer-term demand.

- ABB Ltd.

- FANUC Corp.

- KUKA AG

- Yaskawa Electric Corp.

- Mitsubishi Electric Corp.

- Northrop Grumman Corp.

- Omron Adept Technologies Inc.

- iRobot Corp.

- Honda Motor Co. Ltd.

- Alphabet Inc. (Intrinsic X)

- Boston Dynamics Inc.

- DJI Technology Co. Ltd.

- Teradyne Inc. (Universal Robots and Mobile Industrial Robots)

- Amazon Robotics (Amazon.com Inc.)

- Intuitive Surgical Inc.

- AgEagle Aerial Systems Inc.

- SANY Heavy Industry Co. Ltd.

- Insitu Inc. (Boeing)

- Baidu Apollo Robotics

- Kraken Robotics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological convergence of AI, edge computing and robotics

- 4.2.2 Rising labor shortages and wage inflation

- 4.2.3 Expansion of e-commerce boosting warehouse robotics

- 4.2.4 Increased government and defense spend on unmanned systems

- 4.2.5 Eldercare service-robot adoption in super-aging economies

- 4.2.6 Regulatory fast-tracking of inspection robots for critical infrastructure

- 4.3 Market Restraints

- 4.3.1 High up-front cost of robotic systems

- 4.3.2 Cyber-security vulnerabilities in connected robots

- 4.3.3 Supply-chain risk for rare-earth permanent-magnet materials

- 4.3.4 Shortage of skilled integrators and maintenance technicians

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type of Robot

- 5.2.1 Drones / UAVs

- 5.2.2 Field Robots

- 5.2.3 Medical Robots

- 5.2.4 Autonomous Guided Robots

- 5.2.5 Other Types

- 5.3 By Application

- 5.3.1 Medical and Healthcare

- 5.3.2 Defense and Security

- 5.3.3 Agriculture and Forestry

- 5.3.4 Marine and Offshore

- 5.3.5 Warehousing and Logistics

- 5.3.6 Other Applications

- 5.4 By Mobility

- 5.4.1 Stationary Robots

- 5.4.2 Mobile Ground Robots

- 5.4.3 Aerial Robots

- 5.4.4 Marine / Underwater Robots

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 FANUC Corp.

- 6.4.3 KUKA AG

- 6.4.4 Yaskawa Electric Corp.

- 6.4.5 Mitsubishi Electric Corp.

- 6.4.6 Northrop Grumman Corp.

- 6.4.7 Omron Adept Technologies Inc.

- 6.4.8 iRobot Corp.

- 6.4.9 Honda Motor Co. Ltd.

- 6.4.10 Alphabet Inc. (Intrinsic X)

- 6.4.11 Boston Dynamics Inc.

- 6.4.12 DJI Technology Co. Ltd.

- 6.4.13 Teradyne Inc. (Universal Robots and Mobile Industrial Robots)

- 6.4.14 Amazon Robotics (Amazon.com Inc.)

- 6.4.15 Intuitive Surgical Inc.

- 6.4.16 AgEagle Aerial Systems Inc.

- 6.4.17 SANY Heavy Industry Co. Ltd.

- 6.4.18 Insitu Inc. (Boeing)

- 6.4.19 Baidu Apollo Robotics

- 6.4.20 Kraken Robotics Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment