PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851573

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851573

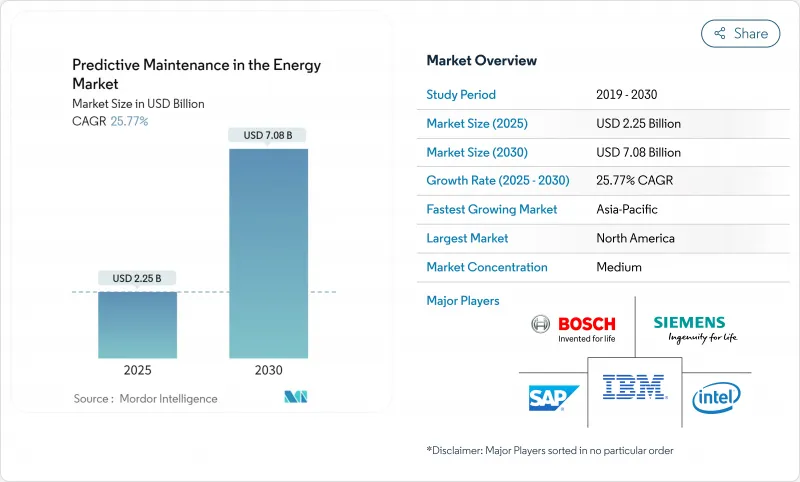

Predictive Maintenance In The Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The predictive maintenance in the energy market size reached USD 2.25 billion in 2025 and is on track to hit USD 7.08 billion by 2030, reflecting a compelling 25.77% CAGR over the forecast period.

Unrelenting electrification, surging data-center build-outs, and mounting grid-reliability concerns are pushing asset owners to replace run-to-failure routines with data-driven models that lower the lifetime cost of ownership while stretching remaining asset life. Regulatory mandates such as the EPA's 90% carbon-capture rule for long-term coal plants and the EU's Corporate Sustainability Reporting Directive are catalyzing digitalization budgets because operators must now prove both uptime and emissions performance. Simultaneously, rapid IIoT sensor price declines and maturing AI algorithms are shrinking payback cycles to 18-24 months for large fleets, amplifying adoption momentum across turbine halls, substations, and midstream pipelines. Vendors that fuse edge computing with cloud analytics already report nine-figure savings driven by shorter outage windows and optimized part inventories.

Global Predictive Maintenance In The Energy Market Trends and Insights

Integration of IIoT, AI and Big-Data Analytics

The fusion of low-cost sensors with AI pattern-recognition algorithms is recasting maintenance from reactive to prescriptive modes across turbine decks and compressor stations.Siemens' Senseye platform now generates digital behavior models automatically, slicing maintenance spend by up to 40% while addressing acute workforce shortages. Chevron's real-time anomaly detection for leak prevention safeguards continuous power delivery to energy-intensive data-center clusters. Edge nodes process torrents of vibration and temperature data locally before forwarding condensed insights to the cloud for fleet-wide pattern mining, creating near-autonomous ecosystems that schedule interventions without human prompts. These developments place predictive maintenance in the energy market squarely at the center of digital-transformation roadmaps for asset-heavy utilities.

Cost Pressure to Cut Unplanned Downtime

Escalating outage penalties and demand spikes from AI workloads are making downtime a board-level risk, moving predictive maintenance from a discretionary line item to an operational imperative. NextEra Energy's gas-turbine program delivered a 23% outage reduction and USD 25 million in annual savings, validating the hard ROI underpinning the predictive maintenance in the energy market. Large oil-and-gas operators have documented 20-40% asset-life extension through optimized service intervals, compounding value over decades-long equipment cycles. Firms that lag on adoption face customer-experience erosion and higher delivered-energy costs as competitors sustain higher asset availability with leaner spares inventories.

High Upfront Implementation and Integration Cost

Comprehensive sensor retrofits, edge gateways, and cloud orchestration commonly push project budgets into eight figures for large utilities, deterring cash-constrained operators in developing economies. GE Vernova's nearly USD 600 million U.S. factory upgrades illustrate the scale of modernization needed to unlock predictive value at fleet level. Rising copper and rare-earth prices have inflated hardware outlays by up to 25% since 2024. Nonetheless, leading adopters recuperate capital within two years, and financial barriers are softening as vendors roll out subscription models linked to performance guarantees, reiterating the long-term competitiveness of the predictive maintenance in the energy market.

Other drivers and restraints analyzed in the detailed report include:

- Aging Energy Infrastructure and Grid Reliability Focus

- Regulatory Mandates on Safety / Emissions

- Rising Cyber-Security Vulnerabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions controlled 65.3% of the predictive maintenance in the energy market in 2024, reflecting operators' preference for unified platforms that amalgamate analytics, visualization, and workflow automation. Software suites capable of ingesting terabytes of turbine and transformer data per day remain central, while embedded sensors equipped with on-device inference augment edge intelligence, reducing unnecessary data egress and accelerating insights. Services, although smaller in absolute revenue, sprint ahead at 25.9% CAGR as utilities and independent power producers rely on vendors for integration, change management, and 24X7 monitoring.

Service providers benefit from widening talent gaps in data science and rotating-machinery physics. Integration and implementation are especially valued when operators migrate legacy historian databases into cloud data lakes without production interruptions. Managed services, often structured as outcome-based contracts, guarantee availability metrics that align vendor incentives with asset performance. As clients prioritize outcomes over toolkits, the predictive maintenance in the energy industry is steadily morphing into a service-oriented market where operational excellence overrides feature checklists.

Cloud deployments represented 72.6% share of the predictive maintenance in the energy market in 2024, a position expected to strengthen as algorithm complexity and data volumes outstrip on-premise compute capacity. A single offshore wind farm now generates tens of terabytes of SCADA and lidar data daily; instant scalability and continuous model retraining favor cloud-native architectures. Edge-cloud hybrids mitigate latency for load-shedding or blade-pitch adjustments, keeping mission-critical loops local while bulk analytics run centrally.

On-premise systems persist in remote basins and nuclear sites with stringent sovereignty or latency requirements, yet most vendors bundle cloud connectors for future migration. Honeywell's 5G-enabled smart-meter roll-out with Verizon exemplifies the shift: secure cellular backhaul funnels sub-second telemetry into an AI engine that forecasts transformer hot-spots days in advance. Such use cases underscore why the predictive maintenance in the energy market is entwined with broader grid-digitalization initiatives premised on ubiquitous, low-latency connectivity.

Predictive Maintenance in the Energy Sector Market is Segmented by Offering (Solutions and Services), Deployment Model (Cloud, On-Premise), End-User Industry (Power Generation, Renewables, Oil and Gas, and More), Asset Type (Turbines and Rotating Equipment, Transformers and Sub-Stations, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America retained leadership with 27.9% of 2024 revenue, supported by federal infrastructure programs, aggressive utility spending, and early adoption of AI platforms. The Energy Information Administration projects domestic electricity demand to rise 15-20% by 2030, partly due to hyperscale data centers, intensifying the focus on outage prevention. Cloud-native regulatory environments and ample venture financing further accelerate new-tech pilots, anchoring regional dominance in the predictive maintenance in the energy market.

Europe maintains steady momentum driven by the Green Deal's decarbonization targets and strict outage-penalty regimes that elevate reliability metrics. The Corporate Sustainability Reporting Directive obliges utilities to disclose real-time emissions and energy-efficiency KPIs, for which predictive-maintenance datasets are highly synergistic. Large fleet operators are combining digital twins with satellite-based vegetation monitoring to meet both compliance and resilience goals.

Asia-Pacific is the fastest-growing territory at 26.5% CAGR, buoyed by China's state-backed digital-grid blueprint and Southeast Asia's rapid electrification. China Southern Power Grid's end-to-end digital transformation shows how leapfrog technology can embed predictive workflows directly into new infrastructure, bypassing legacy bottlenecks. Concurrently, India and Indonesia invest heavily in transmission upgrades, creating greenfield demand for cloud-delivered analytics. The Middle East and Africa, though smaller, show rising interest as mega-projects under Vision 2030 and similar initiatives demand flawless uptime under harsh desert conditions, expanding the predictive maintenance in the energy market footprint.

- IBM Corporation

- SAP SE

- Siemens AG

- GE Digital

- ABB Ltd

- Schneider Electric SE

- Intel Corporation

- Robert Bosch GmbH

- Accenture plc

- Honeywell International Inc.

- Hitachi Energy Ltd.

- Emerson Electric Co.

- Aspen Technology, Inc.

- AVEVA Group plc

- Uptake Technologies Inc.

- SparkCognition, Inc.

- Senseye Ltd.

- SKF Group

- Bentley Systems, Inc.

- Mitsubishi Electric Corporation

- Caterpillar Inc. (Asset Intelligence)

- DNV AS

- KONUX GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging energy infrastructure and grid reliability focus (mainstream)

- 4.2.2 Integration of IIoT, AI and big-data analytics (mainstream)

- 4.2.3 Cost pressure to cut unplanned downtime (mainstream)

- 4.2.4 Regulatory mandates on safety / emissions (mainstream)

- 4.2.5 Drone- and satellite-enabled remote sensing fusion (under-the-radar)

- 4.2.6 Digital-twin-driven risk-based maintenance (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 High upfront implementation and integration cost (mainstream)

- 4.3.2 Rising cyber-security vulnerabilities (mainstream)

- 4.3.3 Scarcity of energy-domain data-science talent (under-the-radar)

- 4.3.4 Data-ownership and liability disputes in multi-party assets (under-the-radar)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, 2024-2030)

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Software Platforms

- 5.1.1.2 Embedded Hardware and Sensors

- 5.1.2 Services

- 5.1.2.1 Integration and Implementation

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Model

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By End-user Industry

- 5.3.1 Power Generation (Thermal, Nuclear, Hydro)

- 5.3.2 Renewables (Wind, Solar, Storage)

- 5.3.3 Oil and Gas (Upstream, Mid, Downstream)

- 5.3.4 Utilities and TandD

- 5.3.5 Mining and Minerals

- 5.4 By Asset Type

- 5.4.1 Turbines and Rotating Equipment

- 5.4.2 Transformers and Sub-stations

- 5.4.3 Pipelines and Compressors

- 5.4.4 Pumps and Valves

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 SAP SE

- 6.4.3 Siemens AG

- 6.4.4 GE Digital

- 6.4.5 ABB Ltd

- 6.4.6 Schneider Electric SE

- 6.4.7 Intel Corporation

- 6.4.8 Robert Bosch GmbH

- 6.4.9 Accenture plc

- 6.4.10 Honeywell International Inc.

- 6.4.11 Hitachi Energy Ltd.

- 6.4.12 Emerson Electric Co.

- 6.4.13 Aspen Technology, Inc.

- 6.4.14 AVEVA Group plc

- 6.4.15 Uptake Technologies Inc.

- 6.4.16 SparkCognition, Inc.

- 6.4.17 Senseye Ltd.

- 6.4.18 SKF Group

- 6.4.19 Bentley Systems, Inc.

- 6.4.20 Mitsubishi Electric Corporation

- 6.4.21 Caterpillar Inc. (Asset Intelligence)

- 6.4.22 DNV AS

- 6.4.23 KONUX GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment