PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851579

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851579

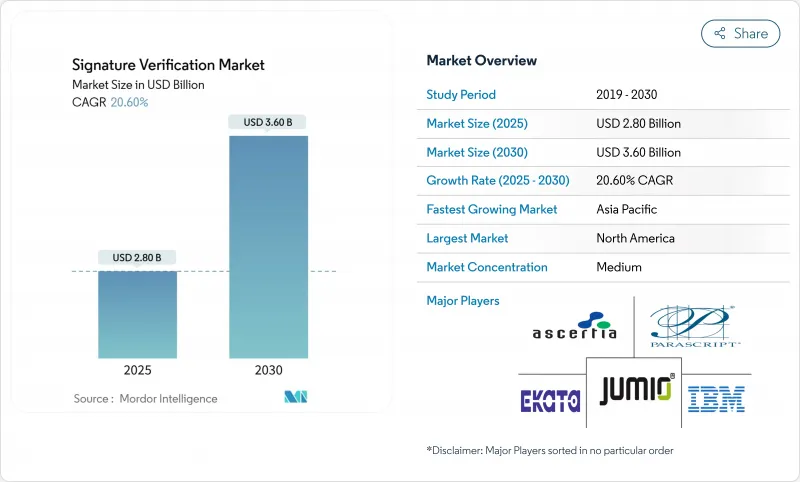

Signature Verification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The signature verification market reached USD 2.8 billion in 2025 and is expected to grow to USD 3.6 billion by 2030, delivering a 20.6% CAGR over the forecast period.

Momentum is fueled by eIDAS 2.0 in Europe and 21 CFR Part 11 in the United States, both of which compel regulated sectors to adopt trustworthy digital-signature validation. Rising fraud losses, advances in AI-driven forgery analytics, and rapid cloud migration further elevate demand. Government programs ranging from AI-assisted mail-in ballot processing to Aadhaar-linked wallets expand use-cases and geographic reach. Meanwhile, multimodal authentication and API-first delivery models are reshaping competitive positioning across the signature verification market.

Global Signature Verification Market Trends and Insights

Compliance mandates under eIDAS 2.0 & U.S. CFR Part 11

The harmonized push from Brussels and Washington is forcing enterprises to modernize outdated electronic-record systems. eIDAS 2.0 obliges all EU citizens to hold interoperable digital identity wallets by 2026, raising the bar for qualified electronic signatures backed by certified trust service providers. Simultaneously, updated FDA guidance stresses audit trails and risk-based validation, compelling pharmaceutical sponsors to shift toward AI-enabled signature verification platforms. Multinationals consequently seek unified verification architectures that satisfy both regimes, accelerating consolidation around cloud players capable of global policy compliance.

Surge in mail-in ballot signature checks post-2024 elections

Thirty-one U.S. states now require signature verification for absentee ballots, elevating demand for high-throughput systems. North Carolina's pilot demonstrated that automated platforms processed 1,000 ballots per hour, cutting manual review time by 95%. California subsequently mandated technology-assisted review with manual fail-safes, placing auditability above speed. Vendors able to accommodate multicultural signature variation and age-related changes command premium pricing as election agencies pay for accuracy, adjudication transparency, and regulatory audit features.

Variability across capture devices & legacy silo integration

Organizations often rely on a patchwork of signature pads, tablets, and mobile apps, each producing data at different resolutions and sampling rates. Algorithms must compensate for inconsistent pressure curves and timing data, which inflates false-reject rates and raises total cost of ownership. Integrating modern verification with legacy record systems adds complexity, as siloed data prevents holistic fraud analytics. Smaller institutions postpone upgrades because replacing hardware exceeds perceived benefits, restraining near-term adoption despite compelling security gains.

Other drivers and restraints analyzed in the detailed report include:

- Fin-crime losses driving AI-based check-fraud analytics

- Cloud-native APIs embedded in e-signature suites

- High FRR in multicultural voter rolls sparks litigation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software accounted for 58% of the 2024 signature verification market, reflecting widespread adoption of cloud-native AI models that deliver real-time fraud detection across web, mobile, and branch channels. Hardware devices such as signature pads remain entrenched in regulated environments, yet their share will continue to erode as remote workflows dominate. The software segment is forecast to post a 23.7% CAGR through 2030, propelled by SDKs that embed verification inside banking, healthcare, and government portals. Vendors are layering behavioral analytics atop static image comparison, thereby reducing manual review rates and shrinking decision latency. Edge-deployable models address locations with intermittent connectivity, broadening appeal to logistics and field-service use-cases. Continuous model retraining also enables vendors to counter emerging attack patterns without customer-side code changes, underscoring software's structural advantage within the signature verification market.

Hardware, though slower-growing, retains niche relevance where physical custody of wet-ink signatures is non-negotiable. Courts, notaries, and select life-sciences labs still require in-person capture using certified devices that append cryptographic timestamps. Yet procurement cycles in these verticals remain long, capital budgets fixed, and retrofit costs high. As cloud economics shift decision criteria toward operating expenditure, many buyers now phase out devices at end-of-life, migrating to mobile capture plus back-end AI validation. This transition reinforces the ascendancy of software-centric business models and cements provider focus on subscription revenue streams rather than one-time hardware sales.

On-premises deployments represented 55% of the signature verification market size in 2024 as heavily regulated banks, insurers, and life-sciences firms favored local control for audit and latency reasons. However, cloud/SaaS installations are projected to compound at 28.2% annually through 2030, narrowing the installed-base gap on economies of scale and universal API reach. Cloud platforms concentrate model training in centralized environments, leveraging diverse datasets that sharpen accuracy against deepfake threats. Elastic compute provisioning cuts idle infrastructure spending, a critical advantage for election boards that process workloads in intense bursts during peak voting periods.

Regional cloud zones support data-residency mandates under GDPR and eIDAS 2.0 while maintaining uniform policy engines. Hybrid architectures-local storage of signature artefacts combined with cloud-based inference-offer a compliance-friendly bridge for cautious adopters. Providers bolster value propositions with uptime SLAs, automated patching, and seamless feature rollouts that would be cost-prohibitive in isolated data centers. As organizations conclude that operational agility outweighs perceived sovereignty risks, the signature verification market is poised for an accelerated shift toward SaaS subscriptions.

Signature Verification Market Report is Segmented by Solution Type (Hardware, Software), Deployment Model (On-Premises, Cloud / SaaS), Authentication Mode (Stand-Alone Signature, Multimodal (signature + Doc Image / ID / Liveness)), End-User Industry (Financial Services, Healthcare and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 34% of 2024 revenue, supported by mature regulatory regimes and venture-backed innovation ecosystems. States introduced automated ballot-signature systems to enhance electoral integrity after the 2024 cycle, driving rapid upgrades among election boards. Financial institutions also escalated adoption to blunt check-fraud schemes that escalated in sophistication and scale, leveraging AI analytics to detect subtle signature deviations at deposit time. Patent enforcement remains a double-edged sword: USAA's ongoing licensing victories generate revenue but elevate compliance costs for banks integrating remote-deposit modules. The region's focus on audit readiness under FDA Part 11 further solidifies demand for specialized platforms that document signature provenance and chain-of-custody.

Asia Pacific is forecast to deliver the highest regional CAGR of 25.44% between 2025 and 2030, anchored by India's Aadhaar-linked wallets and surging mobile-payment ecosystems. Massive transaction volumes and episodic fraud incidents encourage the Reserve Bank of India to tighten KYC norms, prompting banks to embed multimodal signature verification in onboarding workflows. Japan and South Korea advance finger-vein and behavioural-biometric research, often pairing those technologies with signature analysis for high-trust enterprise login. Local data-sovereignty mandates spur demand for regionally hosted inference clusters, which cloud hyperscale's provide through in-country availability zones, ensuring that the signature verification market meets stringent residency rules while still leveraging global threat-intelligence feeds.

Europe's growth narrative revolves around eIDAS 2.0, which formalizes qualified electronic signatures and compels cross-border interoperability throughout the bloc. Certified trust service providers play a pivotal role in issuing digital certificates embedded within signature payloads, raising technical requirements for algorithmic verification. Brexit complicates UK-EU workflows, forcing vendors to maintain dual compliance stacks while promising seamless user experiences. GDPR expectations of privacy-by-design push providers to adopt federated-learning techniques, training models without exporting signature artefacts beyond jurisdictional boundaries. As a result, European buyers weigh algorithmic precision alongside demonstrable privacy safeguards, favouring vendors that deliver both.

- Mitek Systems Inc.

- Parascript LLC

- IBM Corp.

- Adobe Inc.

- DocuSign Inc.

- Ascertia Ltd

- Jumio Corp.

- Ekata Inc.

- Acuant Inc.

- SutiSoft Inc.

- CERTIFY Global Inc.

- Scriptel Corp.

- iSign Solutions Inc.

- Veriff

- Hitachi Ltd. (Biometric systems)

- HID Global (Assa Abloy)

- Signicat AS

- Topaz Systems Inc.

- Aratek Biometrics

- Biometric Signature ID

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Compliance mandates under eIDAS 2.0 and U.S. CFR Part 11

- 4.2.2 Surge in mail in ballot signature checks post-2024 elections

- 4.2.3 Fin-crime losses driving AI-based check-fraud analytics

- 4.2.4 Cloud-native APIs embedded in e-signature suites

- 4.2.5 GenAI forged-signature detection algorithms

- 4.2.6 Indias Aadhaar linked digital signature wallets (UPI 3.0)

- 4.3 Market Restraints

- 4.3.1 Variability across capture devices and legacy silo integration

- 4.3.2 High FRR in multicultural voter rolls sparks litigation

- 4.3.3 Data-sovereignty limits on cross-border model training

- 4.3.4 Patent litigation risk (e.g., MITK vs USAA)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (AI, edge, GenAI)

- 4.7 Porters Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Hardware

- 5.1.1.1 Signature pads and sensors

- 5.1.1.2 Biometric terminals / kiosks

- 5.1.2 Software

- 5.1.2.1 Static (offline) verification

- 5.1.2.2 Dynamic (online) verification

- 5.1.2.3 SDK / API platforms

- 5.1.1 Hardware

- 5.2 By Deployment Model

- 5.2.1 On-premise

- 5.2.2 Cloud / SaaS

- 5.3 By Authentication Mode

- 5.3.1 Stand-alone signature

- 5.3.2 Multimodal (signature + doc image / ID / liveness)

- 5.4 By End-user Industry

- 5.4.1 Financial Services

- 5.4.2 Government and Elections

- 5.4.3 Healthcare

- 5.4.4 Transport and Logistics

- 5.4.5 Legal and Real-estate

- 5.4.6 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Recent Devs.)

- 6.4.1 Mitek Systems Inc.

- 6.4.2 Parascript LLC

- 6.4.3 IBM Corp.

- 6.4.4 Adobe Inc.

- 6.4.5 DocuSign Inc.

- 6.4.6 Ascertia Ltd

- 6.4.7 Jumio Corp.

- 6.4.8 Ekata Inc.

- 6.4.9 Acuant Inc.

- 6.4.10 SutiSoft Inc.

- 6.4.11 CERTIFY Global Inc.

- 6.4.12 Scriptel Corp.

- 6.4.13 iSign Solutions Inc.

- 6.4.14 Veriff

- 6.4.15 Hitachi Ltd. (Biometric systems)

- 6.4.16 HID Global (Assa Abloy)

- 6.4.17 Signicat AS

- 6.4.18 Topaz Systems Inc.

- 6.4.19 Aratek Biometrics

- 6.4.20 Biometric Signature ID

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment