PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851587

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851587

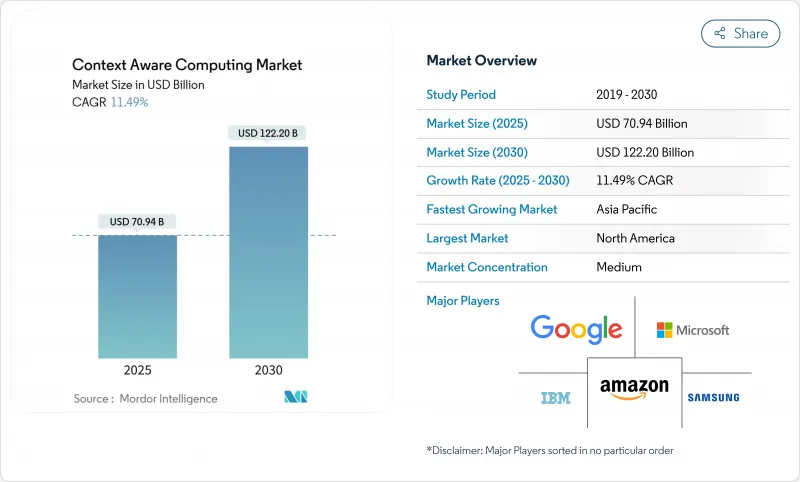

Context Aware Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The context-aware computing market size is valued at USD 70.94 billion in 2025 and is forecast to reach USD 122.20 billion by 2030, advancing at an 11.49% CAGR.

This outlook reflects the structural shift from reactive digital experiences toward predictive, intent-driven services that anticipate a user's needs before explicit input. Widespread deployment of AI inference engines, falling edge hardware costs, and nationwide 5G coverage now permit real-time contextual analytics on billions of endpoints. Demand intensifies as enterprises seek hyper-personalised engagement, operational efficiency, and privacy-first architectures that keep sensitive data local. Hardware remains the revenue backbone, yet software orchestration layers are becoming the main source of competitive differentiation in the context aware computing market.

Global Context Aware Computing Market Trends and Insights

AI-powered Intent Prediction Boosts UX

Large language models and machine-learning pipelines embedded in smartphones, vehicles, and retail kiosks now anticipate user goals, suggesting next actions or auto-completing tasks. Apple Intelligence analyses in-device behaviour, ambient conditions, and messaging style to curate prompts and automate workflows. Organisations deploying comparable models gain higher user retention because experiences feel intuitive and effortless. Value scales rapidly because each interaction refines the model, reinforcing network effects. Capital expenditure on AI infrastructure is rising sharply, evidenced by Oracle's USD 30 billion partnership with OpenAI focused on high-density GPU clusters. As predictive accuracy improves, consumers increasingly expect proactive services as a baseline capability in the context aware computing market.

Edge-computing Cost Decline Widens Adoption

Advanced 3 nm and 4 nm process nodes have reduced cost per tera-ops and improved performance-per-watt. Qualcomm's latest Snapdragon platform embeds a dedicated NPU that supports multimodal context analysis on battery-powered devices, eliminating constant cloud calls. Lower total ownership cost unlocks small and medium-enterprise deployment across smart retail shelving, factory automation, and field-service wearables. This broadening addressable base accelerates unit shipments of sensors and gateways, reinforcing demand in the context aware computing industry.

Privacy-first Regulations Restrict Data Use

GDPR-style mandates require explicit consent, data minimisation, and erasure rights that curtail the unfettered data harvesting once common in mobile applications. Firms now pursue federated learning, differential privacy, and on-premises inference to comply, but these techniques often reduce model accuracy and slow roll-outs. Vendors able to deliver privacy-by-design frameworks gain a trust advantage yet must absorb higher engineering costs. The regulatory swing keeps some enterprises cautious, tempering the near-term growth of the context aware computing market.

Other drivers and restraints analyzed in the detailed report include:

- 5G Rollout Enables Real-time Context Data

- Surge in IoT Endpoints Creates Data Deluge

- High Integration Complexity with Legacy IT

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware held 52% revenue share in 2024 on the strength of sensors, edge gateways, and smart wearables that underpin inference workloads. Sensors for motion, biometrics, and environment represent the largest line-item because every contextual decision starts with precise data capture. Gateways aggregate this input and run first-pass analytics, shortening feedback loops in the context aware computing market. Meanwhile, software outpaces hardware growth at 13.20% CAGR through 2030. Context management middleware harmonises disparate streams, while analytics engines transform raw signals into predictive recommendations. Professional services revenue reflects the steep learning curve enterprises face when tuning data pipelines, security, and compliance. Managed services adoption rises as firms outsource daily operations to focus on business logic.

Software now determines end-user value creation. Middleware vendors bundle schema mapping, identity resolution, and policy enforcement, turning platform choice into a strategic decision. AI inference libraries optimise power draw by splitting workloads across CPU, GPU, and NPU resources. These technical breakthroughs let developers craft granular experiences-such as adaptive in-car infotainment-without rewriting code for every chipset. Resulting demand reinforces upstream sensor and gateway shipments, advancing the context aware computing market size for integrated solutions.

The Context Aware Computing Market is Segmented by Type (Hardware, Software), Vendor (Device Manufacturers, Mobile Network Operators, and More), End-User Industry (BFSI, Consumer Electronics, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Size and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America delivered 39% of global revenue in 2024, buoyed by robust venture investment, early 5G rollout, and cloud adoption. Enterprises in the United States deploy context-rich customer journeys to lift retention and cross-sell rates. Canada's public-sector digital strategies add to base demand for privacy-centric deployments.

Asia-Pacific records the highest growth trajectory at 14.80% CAGR through 2030. National 5G coverage, device manufacturing hubs, and sizeable digital-native populations combine to expand the context aware computing market. China's 2.57 billion IoT endpoints demonstrate the depth of contextual data available to local ecosystem players. Government stimulus for smart city, healthcare, and industrial upgrade projects further accelerates uptake.

Europe advances on differentiated priorities, balancing innovation with strict privacy law compliance. Vendors that integrate consent management and data localisation win enterprise contracts. The Middle East leverages smart-city megaprojects-such as NEOM in Saudi Arabia-to trial large-scale context platforms. Africa shows leapfrog potential because cloud-native mobile services offer practical solutions where legacy infrastructure is thin. South America's steady smartphone adoption rounds out global demand, with telcos pushing edge computing nodes to support low-latency contextual apps.

- IBM Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Google LLC (Alphabet)

- Oracle Corporation

- Amazon Web Services Inc.

- Verizon Communications Inc.

- Samsung Electronics Co. Ltd.

- Intel Corporation

- Apple Inc.

- Qualcomm Inc.

- Ericsson AB

- Huawei Technologies Co. Ltd.

- Bosch Sensortec GmbH (Robert Bosch GmbH)

- Honeywell International Inc.

- SAP SE

- ATandT Inc.

- Telefonica S.A.

- LG Electronics Inc.

- Baidu Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-powered intent prediction boosts UX

- 4.2.2 Edge-computing cost decline widens adoption

- 4.2.3 5G rollout enables real-time context data

- 4.2.4 Surge in IoT endpoints creates data deluge

- 4.2.5 In-car infotainment personalisation demand

- 4.2.6 Context-as-a-Service APIs for SME apps

- 4.3 Market Restraints

- 4.3.1 Privacy-first regulations restrict data use

- 4.3.2 High integration complexity with legacy IT

- 4.3.3 Model bias risks in context inference

- 4.3.4 Limited battery life on wearable devices

- 4.4 Industry Value-Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Hardware

- 5.1.1.1 Sensors

- 5.1.1.2 Edge Gateways

- 5.1.1.3 Smart Wearables

- 5.1.2 Software

- 5.1.2.1 Context Management Middleware

- 5.1.2.2 Analytics and Inference Engines

- 5.1.3 Services

- 5.1.3.1 Professional Services

- 5.1.3.2 Managed Services

- 5.1.1 Hardware

- 5.2 By Vendor

- 5.2.1 Device Manufacturers

- 5.2.2 Mobile Network Operators

- 5.2.3 Online and Social Platforms

- 5.2.4 Independent Software Vendors

- 5.3 By End-User Industry

- 5.3.1 BFSI

- 5.3.2 Consumer Electronics

- 5.3.3 Media and Entertainment

- 5.3.4 Automotive

- 5.3.5 Healthcare

- 5.3.6 Telecommunication

- 5.3.7 Logistics and Transportation

- 5.3.8 Other Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Middle East

- 5.4.4.1 Israel

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 Turkey

- 5.4.4.5 Rest of Middle East

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Egypt

- 5.4.5.3 Rest of Africa

- 5.4.6 South America

- 5.4.6.1 Brazil

- 5.4.6.2 Argentina

- 5.4.6.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Google LLC (Alphabet)

- 6.4.5 Oracle Corporation

- 6.4.6 Amazon Web Services Inc.

- 6.4.7 Verizon Communications Inc.

- 6.4.8 Samsung Electronics Co. Ltd.

- 6.4.9 Intel Corporation

- 6.4.10 Apple Inc.

- 6.4.11 Qualcomm Inc.

- 6.4.12 Ericsson AB

- 6.4.13 Huawei Technologies Co. Ltd.

- 6.4.14 Bosch Sensortec GmbH (Robert Bosch GmbH)

- 6.4.15 Honeywell International Inc.

- 6.4.16 SAP SE

- 6.4.17 ATandT Inc.

- 6.4.18 Telefonica S.A.

- 6.4.19 LG Electronics Inc.

- 6.4.20 Baidu Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment