PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851591

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851591

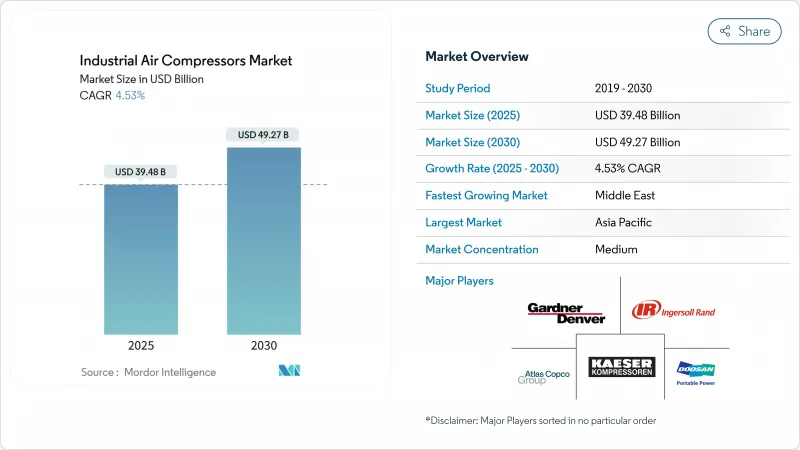

Industrial Air Compressors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Industrial Air Compressors market size is estimated at USD 39.48 billion in 2025 and is forecast to reach USD 49.27 billion by 2030, advancing at a 4.53% CAGR.

Rising investments in energy-efficient production lines, rapid LNG infrastructure build-outs and stricter contamination standards are reshaping product preferences in every major end-use sector. Variable-speed technology, oil-free architectures and IoT-enabled monitoring platforms are gaining traction as plant operators balance emission mandates with total cost-of-ownership goals. Regional momentum remains strongest in Asia-Pacific, while the Middle East delivers the fastest growth on the back of large-scale gas projects. At the same time, raw-material price volatility and tighter European noise rules are compressing margins and extending payback periods, prompting redesigns that lower steel content and improve acoustic performance. The Industrial Air Compressors market continues to demonstrate resilience by aligning product innovation with decarbonization policies and shifting industrial footprints.

Global Industrial Air Compressors Market Trends and Insights

Expansion of Energy-Efficient Manufacturing Facilities in Asia

The semiconductor boom lifted Taiwan's fixed-asset spending by 69% in Q4 2024, with electronics plants adopting Class 0 oil-free systems to guard against contamination. Variable-speed drives that trim energy use up to 35% are now baseline specifications across new lines. Multinationals scaling robotics and additive manufacturing in China and India mirror this focus, anchoring long-term volume for the Industrial Air Compressors market.

Rising Demand for Oil-Free Compressors in Food & Beverage Processing

ISO 8573-1 Class 0 has moved from best practice to regulatory requirement in many jurisdictions, pushing processors toward oil-free screws and scrolls. Hitachi Global Air Power's DS280-450 kW launch addresses requests for higher-power oil-free options. Lower maintenance and avoided lubricant disposal are offsetting the upfront premium, reinforcing adoption across developed markets.

Volatile Steel Prices Inflating Compressor BOM Cost Structures

Steel accounts for up to 50% of compressor production cost, exposing OEMs to margin swings when prices spike. European makers implemented multiple list-price rises in 2024 as energy costs fed into steel inputs. Design efforts to cut plate thickness and switch to composites are under evaluation, yet certification hurdles delay widespread relief.

Other drivers and restraints analyzed in the detailed report include:

- Surging Investments in LNG Infrastructure Requiring High-Pressure Compressors

- Government Incentives for Industrial Energy Audits Favoring Variable-Speed Compressors

- Stringent Noise Emission Norms Escalating Enclosure Costs in Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Positive displacement technology held 76% of the Industrial Air Compressors market share in 2024, reflecting its versatility from general manufacturing to mining. Demand remains stable as rotary screw units balance efficiency and maintenance needs. Dynamic centrifugal compressors, although smaller in volume, are expanding at a 6.8% CAGR as LNG plants and steel mills seek higher flow at consistent pressure.

The Industrial Air Compressors market size for centrifugal units is projected to increase by USD 2.8 billion between 2025 and 2030, supported by energy-efficiency mandates. IoT-enabled controllers and predictive analytics are being embedded across both technologies to lower unplanned downtime. OEMs such as Atlas Copco now bundle Optimizer 4.0 modules with compressor packages to track load profiles and recommend energy-saving modes.

Oil-flooded designs retained cost leadership and 63% share in 2024, yet oil-free systems are advancing at 6.4% CAGR as contamination tolerance narrows in pharmaceuticals and food. The Industrial Air Compressors market size for oil-free screws is on course to climb beyond USD 14 billion by 2030, aided by lower lifecycle maintenance and disposal savings.

Newer two-stage dry screws trim energy use as much as 13.5% versus prior models, improving payback windows. Class 0 certification marketing is influencing purchasing decisions, and beverage bottlers often specify it outright in bid documents.

The Industrial Air Compressor Market Report is Segmented by Compressor Type (Positive Displacement and More), Lubrication (Oil-Flooded, Oil-Free), Pressure Rating (0-20 Bar, 21-100 Bar, Above 100 Bar), Driver/Power Source (Electric and More), Power Rating (>500 KW and More), End-Use Industry (Manufacturing and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 42% of global revenue in 2024, anchored by China's automation surge and India's PLI inducements that encourage in-house air generation. Plant operators favor integrated air stations with energy-recovery modules, a trend reshaping capital-equipment bids. Local assemblers partner with multinational OEMs for technology licensing, further expanding the Industrial Air Compressors market.

North America benefits from reshoring and DOE efficiency rules that spur replacement of legacy fixed-speed fleets. LNG export terminals along the U.S. Gulf Coast order multi-megawatt centrifugal lines, reinforcing regional dominance in high-pressure applications. Canada's focus on low-carbon hydrogen projects adds incremental volume for oil-free screw packages.

The Middle East registers the fastest 5.8% CAGR, driven by gas storage, petrochemical diversification and mega-refinery upgrades. Europe maintains steady demand as end-users prioritize noise compliance and carbon reduction, despite cost pressures from material inflation. Latin America and Africa offer episodic demand tied to mining and infrastructure cycles, with rental fleets bridging project gaps and enlarging the Industrial Air Compressors market footprint.

- Atlas Copco AB

- Ingersoll Rand Inc.

- Kaeser Kompressoren SE

- Sullair LLC (Hitachi Group)

- Gardner Denver Holdings Inc.

- Siemens Energy AG

- Bauer Kompressoren GmbH

- Doosan Portable Power

- ELGi Equipments Ltd.

- Quincy Compressor LLC

- Fusheng Industrial Co. Ltd.

- Kobe Steel Ltd.

- Hanwha Power Systems

- Boge Kompressoren Otto Boge GmbH & Co. KG

- Aerzen Maschinenfabrik GmbH

- CompAir (UK) Ltd.

- Chicago Pneumatic

- VMAC Global Technology Inc.

- Shanghai Screw Compressor Co. Ltd.

- Kobelco KNW (Industrial Air Compressors)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Energy-Efficient Manufacturing Facilities in Asia

- 4.2.2 Rising Demand for Oil-Free Compressors in Food and Beverage Processing

- 4.2.3 Surging Investments in LNG Infrastructure Requiring High-Pressure Compressors

- 4.2.4 Government Incentives for Industrial Energy Audits Favoring Variable-Speed Compressors

- 4.2.5 Rapid Growth of EV Battery Gigafactories Utilizing Dry Screw Compressors

- 4.2.6 Uptick in Brownfield Revamps of Petrochemical Plants in Middle East

- 4.3 Market Restraints

- 4.3.1 Volatile Steel Prices Inflating Compressor BOM Cost Structures

- 4.3.2 Longer Payback Period Versus Blower Alternatives for Low-Pressure Applications

- 4.3.3 Stringent Noise Emission Norms Escalating Enclosure Costs in Europe

- 4.3.4 Skilled Maintenance Labor Shortages Increasing Downtime in Emerging Markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Investment Analysis

- 4.7 Key Case Studies and Implementation Scenarios

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Compressor Type

- 5.1.1 Positive Displacement

- 5.1.1.1 Rotary Screw

- 5.1.1.2 Reciprocating (Piston)

- 5.1.1.3 Scroll

- 5.1.2 Dynamic

- 5.1.2.1 Centrifugal

- 5.1.2.2 Axial

- 5.1.1 Positive Displacement

- 5.2 By Lubrication

- 5.2.1 Oil-Flooded

- 5.2.2 Oil-Free

- 5.3 By Pressure Rating

- 5.3.1 0-20 bar

- 5.3.2 21-100 bar

- 5.3.3 Above 100 bar

- 5.4 By Driver/Power Source

- 5.4.1 Electric

- 5.4.2 Diesel

- 5.4.3 Gas

- 5.5 By Power Rating

- 5.5.1 <=100 kW

- 5.5.2 101-500 kW

- 5.5.3 >500 kW

- 5.6 By End-use Industry

- 5.6.1 Manufacturing

- 5.6.1.1 General Manufacturing

- 5.6.1.2 Metal & Mining

- 5.6.1.3 Electronics & Semiconductors

- 5.6.2 Oil and Gas

- 5.6.2.1 Upstream

- 5.6.2.2 Midstream (Pipeline/LNG)

- 5.6.2.3 Downstream (Refining)

- 5.6.3 Power Generation

- 5.6.4 Chemical and Petrochemical

- 5.6.5 Food and Beverage

- 5.6.6 Pharmaceutical

- 5.6.7 Construction

- 5.6.8 Others (Healthcare, Textiles)

- 5.6.1 Manufacturing

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Nordics

- 5.7.3.7 Rest of Europe

- 5.7.4 Middle East and Africa

- 5.7.4.1 United Arab Emirates

- 5.7.4.2 Saudi Arabia

- 5.7.4.3 South Africa

- 5.7.4.4 Rest of Middle East and Africa

- 5.7.5 Asia-Pacific

- 5.7.5.1 China

- 5.7.5.2 India

- 5.7.5.3 Japan

- 5.7.5.4 South Korea

- 5.7.5.5 Australia

- 5.7.5.6 Rest of Asia-Pacific

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Atlas Copco AB

- 6.4.2 Ingersoll Rand Inc.

- 6.4.3 Kaeser Kompressoren SE

- 6.4.4 Sullair LLC (Hitachi Group)

- 6.4.5 Gardner Denver Holdings Inc.

- 6.4.6 Siemens Energy AG

- 6.4.7 Bauer Kompressoren GmbH

- 6.4.8 Doosan Portable Power

- 6.4.9 ELGi Equipments Ltd.

- 6.4.10 Quincy Compressor LLC

- 6.4.11 Fusheng Industrial Co. Ltd.

- 6.4.12 Kobe Steel Ltd.

- 6.4.13 Hanwha Power Systems

- 6.4.14 Boge Kompressoren Otto Boge GmbH & Co. KG

- 6.4.15 Aerzen Maschinenfabrik GmbH

- 6.4.16 CompAir (UK) Ltd.

- 6.4.17 Chicago Pneumatic

- 6.4.18 VMAC Global Technology Inc.

- 6.4.19 Shanghai Screw Compressor Co. Ltd.

- 6.4.20 Kobelco KNW (Industrial Air Compressors)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need