PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851592

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851592

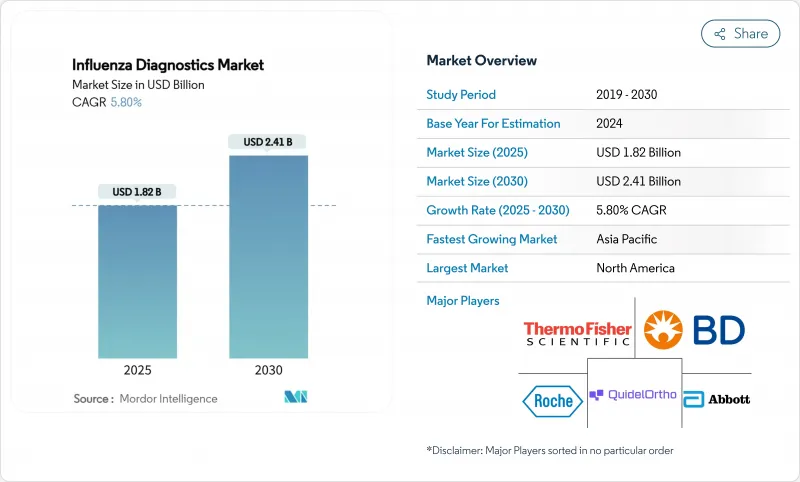

Influenza Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The influenza diagnostics market size stood at USD 1.82 billion in 2025 and is forecast to reach USD 2.41 billion by 2030, advancing at a 5.8% CAGR through the period.

This healthy trajectory follows the market's transition from pandemic-era volatility toward routine, technology-led respiratory disease management. Growth is anchored by wider adoption of molecular platforms that offer higher accuracy than legacy rapid antigen tests, steady government funding for surveillance infrastructure, and rising consumer demand for at-home and point-of-care (POC) solutions. Vendors are consolidating to combine molecular accuracy with near-patient speed, while AI-enabled software is shortening laboratory turnaround times and improving quality control. Regional dynamics further shape demand: North America leads on installed base and reimbursement clarity, whereas Asia Pacific records the fastest uptake thanks to ongoing investment in public-health laboratories.

Global Influenza Diagnostics Market Trends and Insights

Rising Prevalence & Severity of Seasonal and Zoonotic Influenza Outbreaks

A resurgence in seasonal influenza activity has intensified global diagnostic demand, with the CDC logging 39,053 laboratory-confirmed hospitalizations during the 2024-2025 season, the highest rate since 2010-2011.Concurrently, highly pathogenic H5N1 outbreaks generated 38 human cases in California among dairy workers, prompting expanded livestock surveillance. New kits, such as Singapore's Steadfast assay, differentiate highly and low pathogenic strains within three hours, enhancing outbreak response. These events push health systems to retain emergency-level testing capacity year-round, sustaining procurement of high-accuracy molecular platforms.

Growing Adoption of Rapid Point-of-Care Tests in Outpatient Settings

Hospital studies from the University of Southampton showed that POC influenza testing cuts result time to under one hour, enabling faster antiviral initiation and shorter patient stays. Platforms now include molecular options like Abbott's ID NOW, which returns influenza A/B results in 13 minutes with 96.3% sensitivity. AI-enhanced readers further reduce interpretation time to two minutes. Lower transport costs and same-visit treatment support economic arguments for widespread POC deployment in clinics and retail health sites.

Variable Sensitivity & False-Negative Rate of RIDTs

Many RIDTs miss early infections when viral load is low; studies place false-negative rates above 30% for certain commercial kits. The Panbio COVID-19/Flu A&B panel delivered only 80.8% sensitivity for influenza. WHO's 2024 guidance now recommends nucleic-acid tests for severe or high-risk cases. Clinics have introduced confirmatory PCR workflows that erase the speed advantage of RIDTs, curbing segment expansion.

Other drivers and restraints analyzed in the detailed report include:

- Government-Funded Surveillance Programs & Pandemic-Preparedness Budgets

- AI-Powered Result-Interpretation Software Boosting Molecular Workflow Throughput

- High Capital & Running Cost of Molecular Diagnostic Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rapid formats remained dominant with a 41.6% revenue share, yet the influenza diagnostics market is repositioning as clinicians prioritize sensitivity and multiplexing. CRISPR assays show 9.7% CAGR by 2030, led by the Broad Institute's SHINE test that discriminates subtypes in 15 minutes. Molecular panels that bundle influenza A/B, RSV, and SARS-CoV-2 deliver operational efficiency for emergency departments. The influenza diagnostics market size for CRISPR platforms is forecast to expand fastest among all modalities, driven by simplified workflows and shrinking instrument footprints. Direct fluorescent antibody and viral culture testing continue to serve research niches where strain typing or antiviral susceptibility is required, but they no longer influence mainstream purchasing decisions.

Molecular diagnostics, including RT-PCR and isothermal formats, see accelerated uptake as AI tools streamline result interpretation. Multiplex CRISPR-Cas13a strips achieved 100% concordance with RT-qPCR while removing amplification steps. Hospitals prefer syndromic panels that differentiate overlapping respiratory symptoms within a single sample, whereas retail clinics adopt CLIA-waived molecular cartridges for rapid walk-in encounters. This convergence of accuracy and speed positions molecular solutions to erode RIDT leadership as capital barriers abate.

The Influenza Diagnostics Market Report is Segmented by Test Type (Traditional Diagnostic Tests {Rapid Influenza Diagnostic Tests, Viral Culture, and More} and Molecular Diagnostic Tests {RT-PCR, LAMP, and More}), End User (Hospitals and Clinical Laboratories, Independent Diagnostic Laboratories, and More), and Geography (North America, Europe, Asia Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's leadership stems from comprehensive surveillance systems and mature reimbursement models. The CDC coordinates eight regional surveillance hubs spanning 125 countries, yet maintains its largest testing footprint domestically. The influenza diagnostics market size in North America benefits from Thermo Fisher Scientific's USD 2 billion investment to expand domestic manufacturing, aimed at insulating supply chains. Retail pharmacies integrate CLIA-waived molecular cartridges for same-visit care, while health insurers increasingly reimburse home-collection kits, broadening consumer access.

Asia Pacific posts the fastest 8.1% CAGR owing to rapid laboratory build-outs and government funding. WHO's milestone of 11 fully operational national influenza centers across South-East Asia evidences this progress. Japan updated quality-management regulations to align with ISO 13485:2016, smoothing approval pathways for foreign assay developers. China and India funnel vaccine-related mRNA investments into diagnostics, fostering locally made CRISPR cartridges for regional distribution.

Europe remains influential through the In Vitro Diagnostic Regulation (IVDR), which raises conformity-assessment requirements from 15% to nearly 90% of assays. Transition extensions granted in 2024 prevent immediate supply shortages but raise compliance costs that could shift R&D to fewer, higher-value tests. Middle East & Africa and South America pursue capacity growth via multilateral aid and public-private partnerships; the OECD urges diversified sourcing to mitigate logistic shocks experienced during the pandemic. This uneven readiness shapes divergent adoption curves, yet shared emphasis on respiratory surveillance sustains global demand for robust assays.

- Roche

- Abbott Laboratories (incl. ID NOW)

- QuidelOrtho

- Thermo Fisher Scientific (Cepheid, Mesa Bio)

- Beckton Dickinson

- bioMerieux

- Hologic

- Siemens Healthineers

- Danaher Corp. (Cepheid)

- Sekisui Diagnostics

- GenMark Diagnostics (Roche)

- Meridian Bioscience

- Luminex Corp. (DiaSorin)

- QIAGEN

- Bio-Rad Laboratories

- Fujirebio

- Cue Health

- Ellume

- Genetic Signatures

- Lucira Health

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence & Severity Of Seasonal And Zoonotic Influenza Outbreaks

- 4.2.2 Growing Adoption Of Rapid Point-Of-Care (POC) Tests In Outpatient Settings

- 4.2.3 Government-Funded Surveillance Programs & Pandemic Preparedness Budgets

- 4.2.4 AI-Powered Result-Interpretation Software Boosting Molecular Workflow Throughput

- 4.2.5 Commercialization Of Combo SARS-CoV-2/Flu Multiplex Panels Expanding Installed Base

- 4.2.6 Increasing Integration Of Telehealth With Home-Based Flu Testing Kits

- 4.3 Market Restraints

- 4.3.1 Variable Sensitivity & False-Negative Rate Of RIDTs

- 4.3.2 High Capital & Running Cost Of Molecular Diagnostic Platforms

- 4.3.3 Regulatory Uncertainty For CRISPR-Based Influenza Assays

- 4.3.4 Supply Chain Disruptions Affecting Critical Reagents For PCR Assays

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Test Type

- 5.1.1 Traditional Diagnostic Tests

- 5.1.1.1 Rapid Influenza Diagnostic Tests (RIDTs)

- 5.1.1.2 Direct Fluorescent Antibody (DFA) Tests

- 5.1.1.3 Viral Culture

- 5.1.1.4 Rapid Cell Culture

- 5.1.2 Molecular Diagnostic Tests

- 5.1.2.1 Reverse-Transcriptase PCR (RT-PCR)

- 5.1.2.2 Loop-Mediated Isothermal Amplification (LAMP)

- 5.1.2.3 Nicking-Enzyme Amplification Reaction (NEAR)

- 5.1.2.4 CRISPR-based Assays

- 5.1.2.5 Syndromic Multiplex PCR Panels

- 5.1.1 Traditional Diagnostic Tests

- 5.2 By End User

- 5.2.1 Hospitals & Clinical Laboratories

- 5.2.2 Independent Diagnostic Laboratories

- 5.2.3 Point-of-Care Settings

- 5.2.4 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 F. Hoffmann-La Roche AG

- 6.3.2 Abbott Laboratories (incl. ID NOW)

- 6.3.3 QuidelOrtho Corporation

- 6.3.4 Thermo Fisher Scientific (Cepheid, Mesa Bio)

- 6.3.5 Becton, Dickinson & Co.

- 6.3.6 bioMerieux SA

- 6.3.7 Hologic Inc.

- 6.3.8 Siemens Healthineers

- 6.3.9 Danaher Corp. (Cepheid)

- 6.3.10 Sekisui Diagnostics

- 6.3.11 GenMark Diagnostics (Roche)

- 6.3.12 Meridian Bioscience

- 6.3.13 Luminex Corp. (DiaSorin)

- 6.3.14 QIAGEN NV

- 6.3.15 Bio-Rad Laboratories

- 6.3.16 Fujirebio

- 6.3.17 Cue Health

- 6.3.18 Ellume

- 6.3.19 Genetic Signatures

- 6.3.20 Lucira Health

7 Market Opportunities & Future Outlook