PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851606

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851606

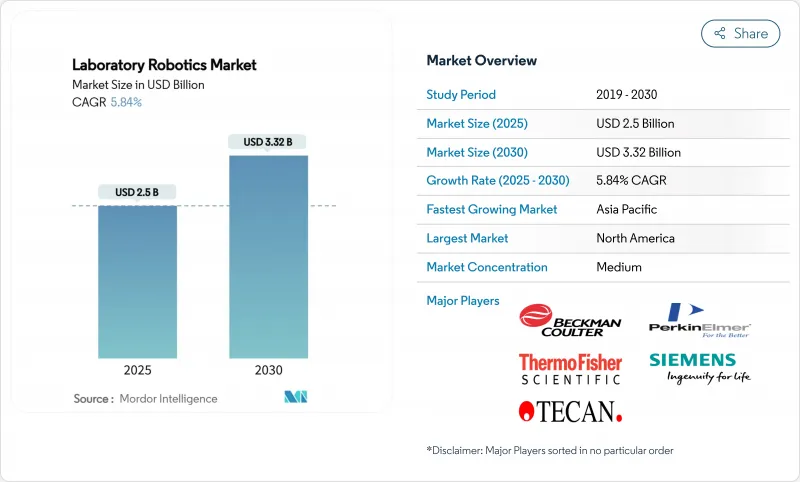

Laboratory Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The laboratory robotics market is valued at USD 2.5 billion in 2025 and is forecast to reach USD 3.32 billion by 2030, advancing at a 5.84% CAGR.

The measured trajectory signals a shift from emergency-driven procurement toward disciplined, long-term automation roadmaps. Demand for FDA-ready systems grows as the Laboratory Developed Tests final rule comes into force in 2025, pushing laboratories toward ISO-15189-compliant robotics. Precision medicine pipelines, sustainability mandates, and modular robotic ecosystems further reinforce investment decisions. Vendors that bundle software, instruments, and validation support continue to capture wallet share, while emerging competitors focus on acoustic dispensing, mobile manipulation, and AI integration to differentiate in the laboratory robotics market.

Global Laboratory Robotics Market Trends and Insights

Rising Demand for Biosafety & Error-Free High-Throughput Screening

Bio-risk mitigation policies now require BSL-3 and BSL-4 facilities to eliminate manual contact with infectious samples. Automated lines at Mayo Clinic process more than 6 million assays annually while halving blood-draw volumes, demonstrating how robotics improve both safety and specimen stewardship. Integrated vision and AI modules flag pipetting anomalies in real time, satisfying data-integrity audits. Vendors add ultraviolet decontamination cycles that run between batches, allowing around-the-clock operation without compromising operator safety. These capabilities underpin steady demand within the laboratory robotics market, especially in reference labs and vaccine-testing centers.

Acceleration of Pandemic-Preparedness Programs

Public-health agencies allocate multibillion-dollar budgets that expressly call for surge-ready automation. CEPI and BARDA grants stipulate platforms that scale from research to mass testing within weeks. The University of Sheffield's self-driving chemistry lab cut polymer discovery timelines by orders of magnitude through closed-loop AI-robot workflows. Manufacturers now design modular carts that laboratories can reconfigure for virology, serology, or vaccine potency assays on short notice. Preparedness funding thus acts as a tailwind for flexible systems across the laboratory robotics market.

High Capital Intensity for ISO-15189 Compliant Installations

ISO 15189:2022 demands rigorous validation and documentation. A2LA accredited the first U.S. lab under the new standard in 2024, highlighting the extensive audit trail required for clinical-grade robotics. Life-science fitouts now average USD 837 per square foot, owing to redundant power, clean-room HVAC, and secure data backbones. Smaller facilities in Latin America and Africa often postpone purchases, tempering near-term uptake within the laboratory robotics market.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Personalized Medicine Requiring Flexible Low-Volume Liquid Handling

- Adoption of AI-Enabled Self-Optimizing "Lab of the Future" Cells

- Scarcity of Robotics-Literate Lab Personnel

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Clinical diagnostics contributed the largest 41% share to the laboratory robotics market in 2024 as hospitals consolidated sample processing under high-throughput lines. Genomics solutions, however, are charted for 11.20% CAGR through 2030, outperforming all other applications. Robotic liquid handlers ensure uniform library prep, a prerequisite for reliable variant calling in oncology and rare-disease panels. Microbiology labs deploy automated pathogen-identification cells that cut turnaround to under three hours, supporting antimicrobial stewardship initiatives. Drug-discovery platforms integrate imaging stages with plate movers for phenotypic screening at scale, while proteomics workflows gain traction as robots couple with high-resolution mass-spectrometers for biomarker discovery.

The laboratory robotics market size tied to genomics workflows will grow in lockstep with falling sequencing costs and rising test volumes. Systems that combine acoustic transfer, environmental controls, and barcode-verified traceability now appear on capital-budget shortlists at national genome centers. Pharmaceutical pipelines lean on these flexible robots to accelerate clinical biomarker validation, reinforcing genomics as the fastest-advancing slice of the laboratory robotics industry.

Pharmaceutical and biotechnology companies accounted for 38.50% of laboratory robotics market revenue in 2024 because R&D spends prioritize validated, closed-loop platforms. Contract research organizations, meanwhile, are on pace for 9.80% CAGR, reflecting sponsor outsourcing trends. CROs invest in cloud-controlled labs where clients trigger robotic protocols remotely, shortening project cycles and freeing internal capacity. Academic institutes pair grants with vendor partnerships to access state-of-the-art automation without full ownership costs. Clinical labs automate to curb staffing shortages, using robots to load analysers overnight and speed patient results.

As trial designs shift toward decentralized and patient-centric formats, CROs embrace mobile robots that can redirect plates among assay stations while documenting custody in real time. The laboratory robotics market benefits because fee-for-service models spread capital expenditure across many sponsors, encouraging continued fleet expansion.

The Laboratory Robotics Market Report is Segmented by Application (Drug Discovery, Clinical Diagnostics, Microbiology, Genomics, Proteomics), End-User (Clinical Labs, Research Labs, Pharma & Biotech, Cros), Robot Type (Liquid-Handling, Sample-Handling, Collaborative Mobile, Fully Integrated), Workflow Stage (Pre-Analytical, Analytical, Post-Analytical), and Geography. Market Forecasts in Value (USD).

Geography Analysis

North America captured 40.80% of laboratory robotics market share in 2024 due to mature biopharma pipelines and early adoption of FDA-compliant automation. Hospital networks accelerate spending to counter staff attrition, while venture-backed biotech hubs in Boston and San Diego install self-optimizing discovery cells. Federal funding via the NIH's Advanced Research Projects Agency for Health further underwrites purchase orders for precision-medicine labs.

Asia-Pacific is projected for 8.30% CAGR through 2030, the highest worldwide. China's Five-Year Plan directs USD 45.2 million into robotics R&D, Japan's New Robot Strategy adds USD 440 million, and Korea earmarks USD 128 million for intelligent systems, catalysing domestic suppliers. Pharmaceutical manufacturers scale quality-control labs alongside production lines to meet ICH and PIC/S standards, driving pull-through for flexible robots. Academic mega-labs focused on population genetics install acoustic handlers and mobile robots to process large-scale biobank specimens.

Europe maintains steady momentum supported by Horizon Europe's USD 183.5 million robotics call. Sustainability statutes nudge laboratories toward energy-efficient robots that reduce compressed-air dependence. German automation firms export modular work cells across the EU, reinforcing intra-regional supply chains. The Middle East and Africa register nascent yet accelerating demand as health-tourism hubs and vaccine-fill-finish plants modernize pathology and QC laboratories. South America benefits from technology-transfer programs paired with local reagent manufacturing, yet broader uptake hinges on credit availability and engineer training pipelines.

- Thermo Fisher Scientific Inc.

- Hamilton Company

- Tecan Group Ltd.

- PerkinElmer Inc.

- Beckman Coulter Life Sciences

- Siemens Healthineers AG

- Anton Paar GmbH

- Agilent Technologies Inc.

- Hudson Robotics Inc.

- Peak Analysis and Automation Ltd.

- Qiagen N.V.

- Abbott Laboratories

- Danaher Corporation (Molecular Devices)

- Biosero Inc.

- Roche Diagnostics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for biosafety and error-free high-throughput screening

- 4.2.2 Acceleration of pandemic-preparedness programs (e.g., CEPI, BARDA funding)

- 4.2.3 Growth of personalized medicine requiring flexible low-volume liquid handling

- 4.2.4 Adoption of AI-enabled self-optimizing lab of the future cells

- 4.2.5 Corporate net-zero roadmaps favouring energy-efficient cobots

- 4.2.6 Under-reported: Integration of robotic micro-factories inside CDMOs

- 4.3 Market Restraints

- 4.3.1 High capital intensity for ISO-15189 compliant installations

- 4.3.2 Scarcity of robotics-literate lab personnel

- 4.3.3 Legacy LIMS interoperability gaps

- 4.3.4 Under-reported: Cyber-security vulnerability of networked lab robots

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Drug Discovery

- 5.1.2 Clinical Diagnostics

- 5.1.3 Microbiology Solutions

- 5.1.4 Genomics Solutions

- 5.1.5 Proteomics Solutions

- 5.2 By End-user

- 5.2.1 Clinical Laboratories

- 5.2.2 Research and Academic Labs

- 5.2.3 Pharmaceutical and Biotechnology Companies

- 5.2.4 Contract Research Organizations

- 5.3 By Robot Type

- 5.3.1 Liquid-Handling Robots

- 5.3.2 Sample-Handling / Plate Movers

- 5.3.3 Collaborative Mobile Lab Robots

- 5.3.4 Fully-Integrated Total Lab Automation Cells

- 5.4 By Workflow Stage

- 5.4.1 Pre-analytical Sample Preparation

- 5.4.2 Analytical / Assay Execution

- 5.4.3 Post-analytical Data Management

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Bahrain

- 5.5.5.4 United Arab Emirates

- 5.5.5.5 Egypt

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Thermo Fisher Scientific Inc.

- 6.4.2 Hamilton Company

- 6.4.3 Tecan Group Ltd.

- 6.4.4 PerkinElmer Inc.

- 6.4.5 Beckman Coulter Life Sciences

- 6.4.6 Siemens Healthineers AG

- 6.4.7 Anton Paar GmbH

- 6.4.8 Agilent Technologies Inc.

- 6.4.9 Hudson Robotics Inc.

- 6.4.10 Peak Analysis and Automation Ltd.

- 6.4.11 Qiagen N.V.

- 6.4.12 Abbott Laboratories

- 6.4.13 Danaher Corporation (Molecular Devices)

- 6.4.14 Biosero Inc.

- 6.4.15 Roche Diagnostics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment