PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851607

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851607

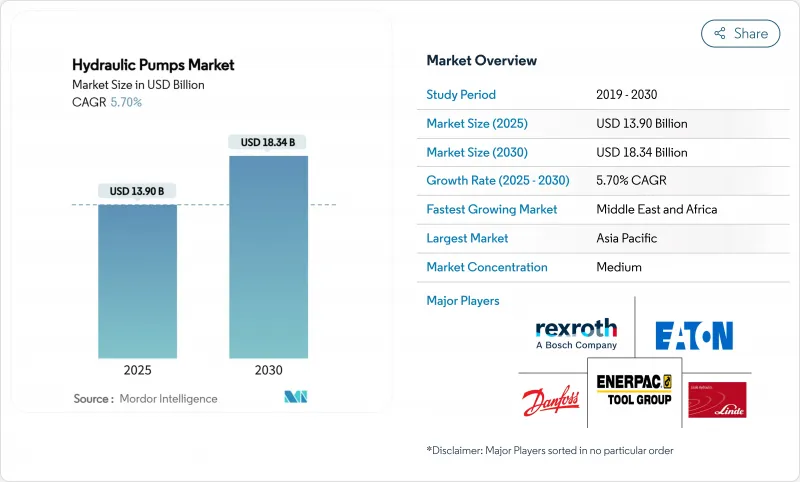

Hydraulic Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hydraulic pumps market size is estimated at USD 13.9 billion in 2025 and is forecast to climb to USD 18.34 billion by 2030, advancing at a 5.70% CAGR.

Robust demand for high-capacity fluid-power equipment in construction, renewable energy, and automated manufacturing keeps the market on a steady expansion path. Infrastructure renewal programmes in China and India, combined with process-industry upgrades in the European Union and North America, continue to anchor baseline demand. Energy transition investments are unlocking new opportunities in wind-turbine pitch and yaw systems, hydrogen electrolyser compression modules, and grid-scale battery storage cooling circuits. Manufacturers are responding with higher-efficiency piston pump designs, intelligent control packages, and remanufacturing services that align with circular-economy mandates. Competition remains moderate, with global leaders reinforcing digital portfolios while regional suppliers target cost-sensitive applications.

Global Hydraulic Pumps Market Trends and Insights

Infrastructure renewal programs in China and India

Government-funded construction pipelines in both nations sustain annual demand for more than 13.5 million hydraulic pump units by 2025. Localization rules for public-sector projects incentivise joint ventures, channelling roughly USD 4.2 billion into high-tech pump production and accelerating domestic capability building. Regional contractors adopting Chinese equipment standards are extending the supply chain into the Middle East and Africa, broadening export prospects for APAC manufacturers. These programmes are expected to underpin baseline demand through 2027, particularly for units rated above 5000 psi.

Industrial automation (Industry 4.0 retrofits)

Smart power units equipped with variable-frequency drives trim idle-time energy consumption by 25%. IoT gateways stream real-time data into predictive-maintenance platforms, cutting operating costs by 45% and reducing unplanned emissions events by 75%, as shown in UK water-utility trials with Sulzer controllers. Digital twin models enable remote optimisation that delivers 30% energy savings and 20% reduction in total cost of ownership. Cyber-security remains a rising concern following US CISA advisories on pump-controller vulnerabilities carrying CVSS scores up to 9.8.

Volatile nickel-steel prices

Nickel-bearing alloy costs climbed through late-2024 on renewed US infrastructure spending before receding, then rebounded in early-2025, compressing pump-maker margins and complicating inventory planning. High-pressure (>3000 psi) models suffer the most, as safety codes mandate premium steel grades. Chinese producers, reliant on imported high-grade alloy, face added currency risk and logistics surcharges.

Other drivers and restraints analyzed in the detailed report include:

- Off-highway electrification needs electro-hydraulic pumps

- Hydrogen electrolyser build-out (>1000 bar pumps)

- Rapid penetration of all-electric actuators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gear pumps retained 37% revenue share in 2024 on the strength of mobile-machinery demand. Piston pumps are outpacing at 6.80% CAGR to 2030 as OEMs migrate toward higher volumetric efficiency and precise displacement control. Parker Hannifin's PV140 piston series recorded 14,000 operating hours between overhauls in Australian mining vehicles, illustrating lifecycle cost advantages. Vane and screw pumps continue serving niche applications requiring smooth flow or marine-grade reliability.

Second-generation piston designs use hardened spool valves and reinforced swash plates to extend mean-time-between-failure to 15,000 hours, doubling service life relative to legacy units. Their adoption in telehandlers, excavators, and injection-moulding machines underscores a systemic pivot toward energy optimisation and reduced CO2 footprints. The hydraulic pumps market size for piston technology is expected to capture an incremental share in both industrial and renewable-energy installations.

The 3000-5000 psi class represented 42% of global value in 2024, covering mainstream construction and agricultural rigs. Pumps rated above 5000 psi are growing 8.30% annually, propelled by hydrogen compression, offshore wind, and advanced machining centres. North Ridge Pumps' multi-stage boosters, certified for ATEX zones, meet electrolyser developers' need for continuous duty at 1000 bar. Below-3000-psi units maintain volume stability in cost-sensitive markets where performance thresholds remain modest.

Upstream innovation focuses on sealing systems and micro-finish surfaces to curb leakage at extreme pressures. Material-science breakthroughs in duplex stainless and nano-coatings aim to raise fatigue resistance, while real-time pressure-derating algorithms prevent catastrophic failures. These advances reinforce the hydraulic pumps market share held by high-pressure specialists amid energy-transition projects.

Hydraulic Pumps Market Segmented by Pump Type (Gear, Vane, and More), Operating-Pressure Range (<3, 000 Psi, 3, 000 - 5, 000 Psi, >5, 000 Psi), Application (Mobile Hydraulics, Industrial Machinery, Process and Energy), End-User Vertical (Construction, Oil and Gas, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

APAC's leadership derives from unmatched production scale and domestic consumption, with China alone purchasing 13.5 million units in 2025. Government programmes such as India's Smart Cities Mission funnel capital into water-management, metro-rail, and affordable-housing projects requiring high-pressure hydraulic systems. Japanese suppliers continue to set benchmarks for reliability; Kawasaki's K3VL axial piston line is frequently specified on premium excavators. Supply-chain disruptions and skilled-labour shortages encourage automation and regional diversification into Vietnam and Indonesia.

The Middle East's swift growth rests on oil-and-gas reinvestment and renewable diversification agendas. Saudi Arabia's Public Investment Fund channels billions into solar- and wind-farm construction, where hydraulic yaw and pitch drives underpin turbine uptime. UAE's transmission grid upgrades import high-pressure pumps for substation cooling and seawater desalination. Joint-venture manufacturing in Dammam and Abu Dhabi shortens lead times and meets local-content mandates.

North America and Europe maintain technologically advanced fleets. The US Infrastructure Investment and Jobs Act revived civil works outlays, fuelling replacements across skid-steer loaders and pavers. EU regulations promoting circular-economy compliance create new remanufacturing revenue and elevate demand for eco-design pumps certified under EN ISO 14971. Both regions contend with an ageing technician workforce, prompting wider deployment of remote diagnostics to ease service bottlenecks.

- Bosch Rexroth AG

- Eaton Corporation plc

- Danfoss Power Solutions A/S

- Enerpac Tool Group Corp.

- Linde Hydraulics GmbH and Co. KG

- Dynamatic Technologies Limited

- HYDAC International GmbH

- Parker Hannifin Corporation

- Kawasaki Heavy Industries Ltd.

- Daikin Industries Ltd.

- Bucher Hydraulics GmbH

- KYB Corporation

- Shimadzu Corporation

- Permco Inc.

- Casappa S.p.A.

- Ningbo Baichi Hydraulic

- HAWE Hydraulik SE

- Sun Hydraulics LLC

- Bosch Mahle Turbosystems Hydraulic (BMT)

- Bosch Rexroth India Pvt Ltd (regional)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure renewal programmes in China and India

- 4.2.2 Industrial automation (Industry 4.0 retrofits)

- 4.2.3 Off-highway electrification needs electro-hydraulic pumps

- 4.2.4 Wind-turbine yaw and pitch system demand

- 4.2.5 Hydrogen electrolyser build-out (>1 000 bar pumps)

- 4.2.6 Mandatory remanufacturing quotas (EU Circular Economy)

- 4.3 Market Restraints

- 4.3.1 Volatile nickel-steel prices

- 4.3.2 Rapid penetration of all-electric actuators

- 4.3.3 Cyber-security risks in smart pumps

- 4.3.4 Shortage of certified fluid-power technicians

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Pump Type

- 5.1.1 Gear

- 5.1.2 Vane

- 5.1.3 Piston

- 5.1.4 Screw

- 5.2 By Operating-Pressure Range

- 5.2.1 <3,000 psi

- 5.2.2 3,000 - 5,000 psi

- 5.2.3 >5,000 psi

- 5.3 By End-user Vertical

- 5.3.1 Construction

- 5.3.2 Oil and Gas

- 5.3.3 Power Generation

- 5.3.4 Food and Beverage

- 5.3.5 Water and Waste-water

- 5.3.6 Chemicals

- 5.3.7 Others (Agriculture, Mining, Automotive)

- 5.4 By Application

- 5.4.1 Mobile Hydraulics

- 5.4.2 Industrial Machinery

- 5.4.3 Process and Energy (incl. wind, hydro, hydrogen)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of Latin America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Bosch Rexroth AG

- 6.4.2 Eaton Corporation plc

- 6.4.3 Danfoss Power Solutions A/S

- 6.4.4 Enerpac Tool Group Corp.

- 6.4.5 Linde Hydraulics GmbH and Co. KG

- 6.4.6 Dynamatic Technologies Limited

- 6.4.7 HYDAC International GmbH

- 6.4.8 Parker Hannifin Corporation

- 6.4.9 Kawasaki Heavy Industries Ltd.

- 6.4.10 Daikin Industries Ltd.

- 6.4.11 Bucher Hydraulics GmbH

- 6.4.12 KYB Corporation

- 6.4.13 Shimadzu Corporation

- 6.4.14 Permco Inc.

- 6.4.15 Casappa S.p.A.

- 6.4.16 Ningbo Baichi Hydraulic

- 6.4.17 HAWE Hydraulik SE

- 6.4.18 Sun Hydraulics LLC

- 6.4.19 Bosch Mahle Turbosystems Hydraulic (BMT)

- 6.4.20 Bosch Rexroth India Pvt Ltd (regional)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment