PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851608

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851608

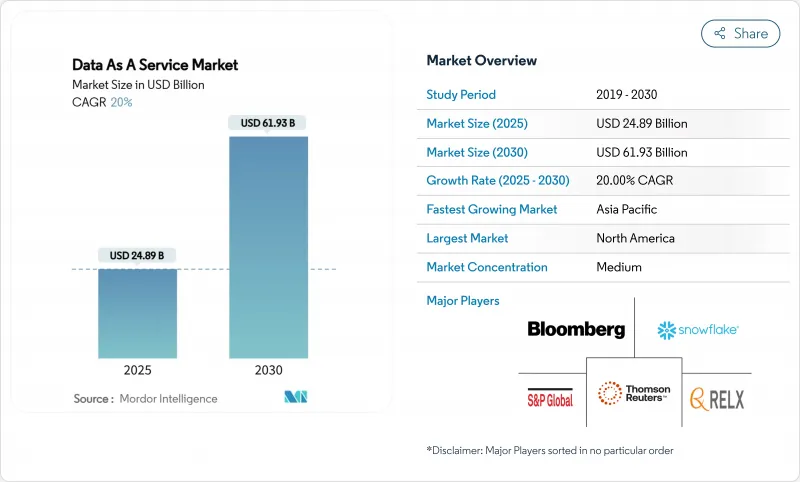

Data As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Data as a Service market size reached USD 24.89 billion in 2025 and is projected to advance to USD 61.93 billion by 2030, reflecting a robust 20.0% CAGR.

Enterprises accelerate spending to monetize proprietary data, adopt API-first delivery, and support AI models that demand refreshable external datasets. Real-time analytics expectations, falling unit costs for cloud storage, and the rise of nanodataset marketplaces collectively widen the addressable opportunity. Leadership teams report measurable gains, with 91% of firms citing tangible improvements in efficiency and decision speed from analytics investments. Sector growth remains uneven: BFSI anchors early adoption, healthcare records the fastest trajectory, and hybrid deployment models surge as organizations balance data sovereignty with cost control. North America supplies the largest revenue pool, yet Asia-Pacific leads in growth as data-localization laws and digital transformation agendas converge.

Global Data As A Service Market Trends and Insights

Enterprise Shift Toward Data-Driven Decision-Making

Organizations that embed unified data platforms record information-retrieval cycles that are three to five times faster and response-accuracy improvements of 50-70% . Finance institutions highlight strong returns from anti-fraud programs yet acknowledge capability gaps in advanced AI use cases, spurring incremental spending on robust data infrastructure. Adoption accelerates as executives treat data as a strategic corporate asset rather than an IT by-product. Investment therefore shifts toward integration layers able to blend internal records with premium external feeds in real time. The driver supports sustained demand for scalable, schema-agnostic services across verticals.

Explosion of Unstructured Data and Real-Time Analytics Demand

Unstructured content already represents 80% of enterprise data while attracting disproportionately low budgets, underscoring an untapped monetization pool. Venture financing in unstructured-data tooling-exemplified by a USD 40 million round for AI-ready data pipelines-signals confidence in specialized processing platforms . Live-time analytics, measured in milliseconds, has shifted marketing execution toward hyper-personalization that raises conversion metrics. Organisations adopting retrieval-augmented generation frameworks report 70-90% reductions in AI hallucinations, reinforcing the business case for continuous data refresh. Collectively these trends widen the scope of the Data as a Service market and encourage investment in vector databases and streaming pipelines.

Data-Privacy and Cybersecurity Concerns

Twenty US states enacted comprehensive privacy statutes by mid-2024, and a proposed federal bill would introduce nationwide standards that raise compliance costs. Forty-six percent of enterprises cite privacy as their primary impediment to data-quality goals. Sector-specific rules add complexity: healthcare organisations must align patient-data controls with HIPAA while scaling cloud adoption. Jurisdiction-based residency mandates force providers to maintain multiple in-region copies, increasing operational overhead. These factors temper uptake, especially in highly regulated verticals, until automation and policy-as-code tooling mature.

Other drivers and restraints analyzed in the detailed report include:

- Falling Cloud Storage and Compute Costs

- AI RAG Frameworks' Appetite for Refreshable External Data

- Data-Quality and Interoperability Gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The BFSI sector retained 28.7% of overall revenue in 2024, anchoring the Data as a Service market through stringent compliance mandates and sophisticated fraud-detection workloads. Healthcare logged a 22.5% CAGR, the fastest among industries, as hospitals embrace AI-supported diagnostics and population-health analytics. IT and telecommunications firms integrate datasets for network optimisation, while governments expand e-services that depend on secure data exchanges. Manufacturing and energy incumbents deploy predictive-maintenance models requiring continuous sensor feeds.

Healthcare organisations spent an average USD 38 million on cloud services in 2024 and reported 72% satisfaction with migration outcomes. The convergence of electronic health records, imaging repositories, and genomics drives demand for unstructured-data pipelines. Retailers leverage real-time feeds for personalised recommendations that raise basket sizes, whereas education institutions pilot AI-infused learning platforms. These varied use cases reinforce the strategic relevance of the Data as a Service market.

Public-cloud instances captured 54.0% of 2024 revenue, benefiting from mature security certifications and rich managed-service toolkits. Hybrid and multi-cloud approaches, however, post the strongest growth at 23.1% CAGR as organisations optimise data placement to mitigate egress fees and satisfy residency requirements. Private-cloud options persist where latency and sovereignty hold sway, notably in finance and defence.

Ninety percent of enterprises intend to run hybrid strategies by 2027, reflecting widespread recognition that workload characteristics vary in elasticity and sensitivity. Data-fabric architectures and cross-plane control layers thus rise in popularity, enabling fluid movement without vendor lock-in. As cost calculators quantify egress liabilities, finance chiefs lobby for placement policies that keep analytic tables close to AI runtimes. These developments enlarge the addressable base for Data as a Service market platforms that advertise deployment neutrality.

Data As A Service Market Report is Segmented by End-User Industry (BFSI, IT and Telecommunications, and More), Deployment Model (Public Cloud, Private Cloud, Hybrid/Multi-cloud), Data Type (Structured Data, Unstructured Data, Semi-Structured Data), End-User Enterprise Size (Large Enterprises, and More), Application (Real-Time Operational Analytics, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 39.4% of 2024 revenue, sustained by well-capitalised buyers and deep venture ecosystems that refine data-infrastructure innovations. AWS alone serves an estimated 4.2 million global customers, illustrating the region's cloud maturity. United States data-centre consumption reached 176 TWh in 2023 and could rise to 325-580 TWh by 2028 as generative-AI workloads proliferate. Canada emphasises sovereignty, stimulating demand for in-country marketplace nodes that comply with residency statutes. The regional policy mix encourages privacy-enhancing technologies that underpin secure multi-party analytics and broaden the Data as a Service market.

Asia-Pacific records the fastest expansion, advancing at a 24.9% CAGR as governments channel capital toward digital corridors and cloud zones. India benefits from the Digital India programme and hyperscaler region launches, while Japan secures multi-billion-dollar commitments from Microsoft and AWS for next-generation facilities. Mobile services add 5.3% to regional GDP, creating a vast stream of localisation-driven datasets . Local data-marketplaces thrive under residency rules, shaping deployment choices for global providers.

Europe posts steady gains as the GDPR framework and sustainability mandates steer architectural decisions. Providers like Global Switch commit to 100% renewable electricity usage by 2030, aligning data-centre expansions with green-energy goals. France, Germany, and the Nordics attract capacity through resilient grids and cool climates that trim PUE ratios. South America's growth concentrates in Brazil where fiscal incentives entice cloud operators, whereas the Middle East and Africa see selective uptake clustered in fintech hubs. Location strategy remains a core purchase criterion as 80% of US data-centre load resides in just 15 states, revealing concentration risks.

- Bloomberg Finance L.P.

- Dow Jones and Company, Inc.

- Environmental Systems Research Institute, Inc.

- Equifax Inc.

- FactSet Research Systems Inc.

- IBM Corporation

- Oracle Corporation

- SAP SE

- Thomson Reuters Corporation

- Morningstar, Inc.

- Moody's Analytics, Inc.

- Mastercard Advisors LLC

- S&P Global Inc.

- RELX PLC (LexisNexis Risk Solutions)

- ZoomInfo Technologies Inc.

- Snowflake Inc.

- Experian PLC

- Verisk Analytics, Inc.

- CoreLogic, Inc.

- TransUnion LLC

- NielsenIQ (The Nielsen Company LLC)

- SafeGraph Inc.

- GapMaps Pty Ltd.

- Apify Technologies s.r.o.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Enterprise shift toward data-driven decision-making

- 4.2.2 Explosion of unstructured data and real-time analytics demand

- 4.2.3 Falling cloud storage/compute costs

- 4.2.4 AI RAG frameworks' appetite for refreshable external data

- 4.2.5 Data-localization laws fuelling regional data marketplaces

- 4.2.6 API-first ''nano-datasets'' monetisation platforms

- 4.3 Market Restraints

- 4.3.1 Data-privacy and cybersecurity concerns

- 4.3.2 Data-quality and interoperability gaps

- 4.3.3 Rising hyperscaler egress fees compressing margins

- 4.3.4 ESG scrutiny of energy-intensive data pipelines

- 4.4 Value Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End-User Industry

- 5.1.1 BFSI

- 5.1.2 IT and Telecommunications

- 5.1.3 Government and Public Sector

- 5.1.4 Retail and E-commerce

- 5.1.5 Healthcare and Life Sciences

- 5.1.6 Manufacturing

- 5.1.7 Energy and Utilities

- 5.1.8 Education

- 5.1.9 Others

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid / Multi-cloud

- 5.3 By Data Type

- 5.3.1 Structured Data

- 5.3.2 Unstructured Data

- 5.3.3 Semi-structured Data

- 5.4 By End-user Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By Application

- 5.5.1 Real-time Operational Analytics

- 5.5.2 Customer and Marketing Intelligence

- 5.5.3 Risk and Compliance Management

- 5.5.4 Supply-Chain and Logistics Optimisation

- 5.5.5 Fraud Detection and Credit Scoring

- 5.5.6 Product and Pricing Analytics

- 5.5.7 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bloomberg Finance L.P.

- 6.4.2 Dow Jones and Company, Inc.

- 6.4.3 Environmental Systems Research Institute, Inc.

- 6.4.4 Equifax Inc.

- 6.4.5 FactSet Research Systems Inc.

- 6.4.6 IBM Corporation

- 6.4.7 Oracle Corporation

- 6.4.8 SAP SE

- 6.4.9 Thomson Reuters Corporation

- 6.4.10 Morningstar, Inc.

- 6.4.11 Moody's Analytics, Inc.

- 6.4.12 Mastercard Advisors LLC

- 6.4.13 S&P Global Inc.

- 6.4.14 RELX PLC (LexisNexis Risk Solutions)

- 6.4.15 ZoomInfo Technologies Inc.

- 6.4.16 Snowflake Inc.

- 6.4.17 Experian PLC

- 6.4.18 Verisk Analytics, Inc.

- 6.4.19 CoreLogic, Inc.

- 6.4.20 TransUnion LLC

- 6.4.21 NielsenIQ (The Nielsen Company LLC)

- 6.4.22 SafeGraph Inc.

- 6.4.23 GapMaps Pty Ltd.

- 6.4.24 Apify Technologies s.r.o.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment