PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851609

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851609

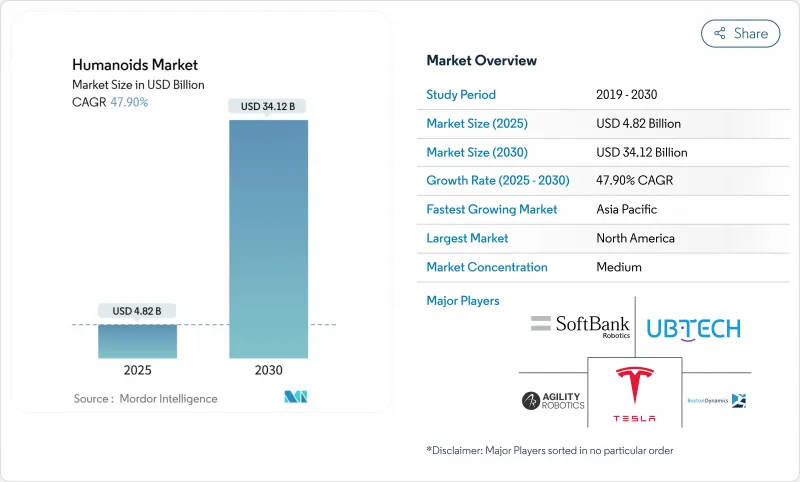

Humanoids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The humanoids market size is valued at USD 4.82 billion in 2025 and is forecast to reach USD 34.12 billion by 2030, advancing at a 47.9% CAGR.

Rapid cost declines in artificial intelligence hardware, demographic ageing in the G7 and China, and widening industrial labour gaps are converging to push humanoid robots from pilot projects to core operational assets across healthcare, manufacturing, and logistics. Venture investment flows exceeding USD 4 billion in 2024-2025, together with China's and South Korea's "Humanoid 2025" policies, are accelerating time-to-market for new platforms. Enterprises are prioritising human-scale form factors capable of using existing tools and infrastructure, while software advances turn once-static machines into adaptable co-workers. As these factors reinforce each other, the humanoids market is becoming a pivotal solution for countries seeking productivity gains without expanding their human workforce.

Global Humanoids Market Trends and Insights

Aging-Population Care Gap Intensifies Demand

Japan's population aged 65 years and older reached 29.1% in 2024, and healthcare worker deficits may exceed 2.4 million by 2030. Hospitals are turning to humanoids for continuous patient monitoring, medication rounds, and social interaction, trimming operating costs by 30-40% while keeping quality consistent. Honda's Haru units now assist nurses in Spanish geriatric wards, demonstrating cross-border relevance. Retail and hospitality operators facing similar labour gaps are introducing reception and service robots to protect customer experience despite shrinking staff levels. South Korea already operates 1,102 robots per 10,000 employees, the highest robot density worldwide.

AI Cost Curve Falling Below USD 25 k Per Unit

Economies of scale, standardised actuators, and low-cost GPUs are pushing manufactured costs down from USD 35,000 in 2025 to a targeted USD 13,000-17,000 by 2030. Tesla expects to build 10,000 Optimus units priced at USD 20,000-30,000 each, reflecting automotive-style throughput. Apptronik's partnership with Google DeepMind ties large-language-model reasoning to Apollo's manipulation skills, compressing what once required USD 100,000 servers onto edge processors. Battery pack prices, already 85% lower than 2010 levels thanks to the electric-vehicle industry, further erode total cost of ownership.

High Cap-ex & TCO Above USD 0.50/hr Compared with Cobots

Operating a humanoid costs USD 0.75-1.25 per hour today, versus USD 0.35-0.50 for six-axis cobots. Precision gearboxes, 25-plus degrees of freedom, and richer sensor arrays inflate both acquisition and maintenance outlays. Nevertheless, in tasks demanding human reach and navigation, cobots require costly re-engineering of facilities, offsetting their per-hour advantage. In developed economies where average factory wages top USD 45,000, a humanoid's USD 25,000-35,000 annual running cost is increasingly competitive.

Other drivers and restraints analyzed in the detailed report include:

- Factory Labour Shortages in G7 & China

- National "Humanoid 2025" Programmes (China, South Korea)

- Safety / Liability Regulation Uncertainty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The wheel-drive class held 63% of 2024 revenues, underscoring current user preference for energy-efficient, low-maintenance mobility in flat-floored plants and fulfilment centres. This dominance meant the wheel cohort accounted for the largest slice of the humanoids market share that year. However, the biped category is expanding at a 59% CAGR, signalling that the humanoids market will pivot toward full human-environment compatibility as costs fall.

Improved model-predictive controllers, compliant ankle joints, and whole-body coordination algorithms are delivering steady-state walking above 1.5 m/s while cutting energy draw by 30%. Hybrid and multi-leg robots remain niche solutions for disaster response where debris or uneven terrain precludes wheels. As AI motion planners mature, buyers anticipate re-deploying the same biped unit across multiple sites, raising lifetime value and tightening the link between software updates and operational output.

Hardware captured 68% of the humanoids market size in 2024, reflecting large capital bills for actuators, composite frames, and high-resolution sensor stacks. Yet software revenue is tracking a 57.34% CAGR, outpacing any mechanical upgrade cycle.

Cloud-enhanced vision, natural-language models, and reinforcement-learning stacks enable the same chassis to perform kitting in the morning and concierge duties after hours. As recurring licence fees overtake one-off hardware margins, vendors are shifting to service-level agreements that guarantee uptime, security patches, and feature drops. This echo of the smartphone ecosystem positions code as the foremost differentiator even inside a physical-goods category, and heightens buyer focus on cybersecurity and data-ownership clauses.

The Humanoids Market Report is Segmented by Motion Type (Wheel-Drive, Biped, Hybrid/Multi-leg), Component (Hardware, Software, Services), End-User Industry (Healthcare Facilities, Retail & Shopping Centres, Manufacturing & Warehousing, and More), Form Factor (Full-Size Greater Than 140cm, Mid-Size 100-140cm, Small Less Than 100cm, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38% of global 2024 revenue, catalysed by USD 2 billion in venture rounds and early regulatory sandboxes that cut deployment risk. United States OEMs such as Tesla, Boston Dynamics, and Agility Robotics collectively secured USD 1.2 billion during 2024-2025, bankrolling commercial tooling and pilot roll-outs. Canada's universities specialise in compliant-actuator research, and Mexico supplies precision gear casings, threading NAFTA supply-chain integration into humanoid economics.

Asia-Pacific is the fastest-growing theatre, advancing at a 55% CAGR to 2030. China's USD 10 billion National Humanoid programme aligns provincial grants, military adoption, and purchasing quotas, while six local firms target >= 1,000 units each for 2025 volume. South Korea's KRW 3.5 trillion stimulus channels funds through its policy bank to private labs, fostering R&D and domestic content rules. Japan's automotive heritage yields high-precision strut and joint modules, and India supplies cloud-control middleware at lower cost. Collectively, these forces scale output and compress unit costs, bolstering the humanoids market across emerging Asian economies.

Europe posts steady, policy-led growth. Germany's Industrie 4.0 facilities adopt humanoids to keep high-mix assembly at home rather than offshoring. The EU's draft AI liability directive compels rigorous fail-safe designs, adding qualification overhead but reducing long-run reputational risk. France and the United Kingdom emphasise advanced haptic-sensor R&D, while Nordic eldercare pilots validate robots in long-term-care settings. Although certification timelines push some buyers to slower roll-outs, established automotive suppliers in Germany and Italy are lining up to build sub-assemblies, reinforcing trans-Atlantic competition.

- Honda Motor Co., Ltd.

- Toyota Motor Corporation

- SoftBank Robotics Group Corp.

- UBTECH Robotics Inc.

- PAL Robotics SL

- Hanson Robotics Ltd.

- Kawada Robotics Corporation

- Promobot LLC

- Invento Robotics Pvt. Ltd.

- ROBOTIS Co., Ltd.

- Boston Dynamics Inc.

- Tesla, Inc. (Optimus)

- Agility Robotics LLC

- Figure AI, Inc.

- Engineered Arts Ltd.

- Unitree Robotics Co., Ltd.

- Fourier Intelligence Co., Ltd.

- Xiaomi Corp. - Robotics Lab

- Samsung Electronics Co., Ltd.

- Apptronik Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging-population care gap intensifies demand

- 4.2.2 AI cost curve falling below USD 25k per unit

- 4.2.3 Factory labor shortages in G7 and China

- 4.2.4 National "Humanoid 2025" programs (China, S-Korea)

- 4.2.5 IEC/ISO elderly-care robot safety standards

- 4.2.6 EV motor and battery supply-chain spill-overs

- 4.3 Market Restraints

- 4.3.1 High cap-ex and TCO above USD 0.50 /hr compared with cobots

- 4.3.2 Safety / liability regulation uncertainty

- 4.3.3 Rare-earth magnet supply bottlenecks

- 4.3.4 Societal acceptance and labour-union pushback

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Motion Type

- 5.1.1 Wheel-drive

- 5.1.2 Biped

- 5.1.3 Hybrid / Multi-leg

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By End-user Industry

- 5.3.1 Healthcare Facilities

- 5.3.2 Retail and Shopping Centres

- 5.3.3 Manufacturing and Warehousing

- 5.3.4 Hospitality (Hotels, Theme Parks)

- 5.3.5 Academic and Research Institutes

- 5.4 By Form Factor

- 5.4.1 Full-size (Greater than 140 cm)

- 5.4.2 Mid-size (100-140 cm)

- 5.4.3 Small (Less than 100 cm)

- 5.4.4 Upper-torso only

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Honda Motor Co., Ltd.

- 6.4.2 Toyota Motor Corporation

- 6.4.3 SoftBank Robotics Group Corp.

- 6.4.4 UBTECH Robotics Inc.

- 6.4.5 PAL Robotics SL

- 6.4.6 Hanson Robotics Ltd.

- 6.4.7 Kawada Robotics Corporation

- 6.4.8 Promobot LLC

- 6.4.9 Invento Robotics Pvt. Ltd.

- 6.4.10 ROBOTIS Co., Ltd.

- 6.4.11 Boston Dynamics Inc.

- 6.4.12 Tesla, Inc. (Optimus)

- 6.4.13 Agility Robotics LLC

- 6.4.14 Figure AI, Inc.

- 6.4.15 Engineered Arts Ltd.

- 6.4.16 Unitree Robotics Co., Ltd.

- 6.4.17 Fourier Intelligence Co., Ltd.

- 6.4.18 Xiaomi Corp. - Robotics Lab

- 6.4.19 Samsung Electronics Co., Ltd.

- 6.4.20 Apptronik Inc.

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment