PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910476

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910476

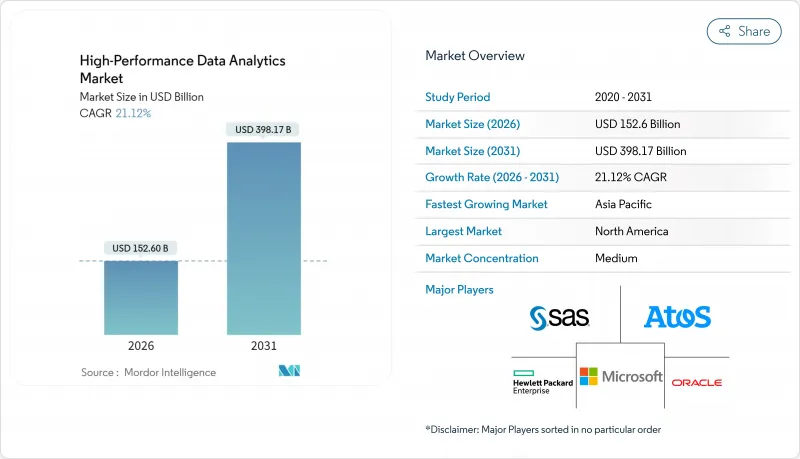

High-Performance Data Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The high-performance data analytics market is expected to grow from USD 125.99 billion in 2025 to USD 152.6 billion in 2026 and is forecast to reach USD 398.17 billion by 2031 at 21.12% CAGR over 2026-2031.

Momentum comes from the convergence of AI, cloud computing, and the swelling volume of enterprise data. Financial services remain a prime adopter as real-time fraud analytics become essential for secure transaction banking. Software accounts for 46.2% revenue, while services are expanding fastest on the back of specialized AI consulting. On-premise deployments presently lead with 57.8% share, yet cloud-based solutions are the clear growth engine at a 30.1% CAGR as providers scale global GPU capacity. Regionally, North America commands 35.4% share, but Asia-Pacific is on track for the quickest gains given sweeping digital-transformation programs. Large enterprises dominate adoption, though SMEs are narrowing the gap thanks to plummeting GPU rental rates, exemplified by USD 3.35-per-hour H100 instances that undercut hyperscaler list prices by more than 90%.

Global High-Performance Data Analytics Market Trends and Insights

Accelerating Adoption of Real-Time Analytics in BFSI for Fraud Detection

Financial institutions have recorded a tenfold rise in social-engineering scams, now 23% of digital-banking fraud cases, prompting rapid rollouts of high-performance fraud-detection engines. TD Bank achieved enterprise-wide real-time monitoring after winning the 2024 FICO Decisions Award. AI-enabled platforms are attaining 98.5% detection accuracy while processing 1 Gbps data streams without latency. As a result, BFSI institutions are embedding low-latency analytics into payment rails, credit-risk scoring, and know-your-customer checks to safeguard reputational and financial capital. These deployments underpin a 5.2% lift in the overall CAGR for the high-performance data analytics market.

Surge in AI/ML Model Training Requiring Petabyte-Scale Data Processing

Generative-AI models are doubling in parameter count every six months, demanding petabyte-scale data ingestion and exascale compute clusters. Hyperscale data-center investment tied to AI workloads is set to climb from USD 162.79 billion in 2024 to USD 608.54 billion by 2030. Providers such as Microsoft and Google have earmarked a combined USD 155 billion for next-generation AI facilities. This capital outlay elevates demand for distributed file systems, high-throughput interconnects, and advanced scheduling software, translating into a 6.8% positive push on market growth.

High Total Cost of Ownership for Dedicated HPC Clusters

Capital expenditure on data-center builds is projected to surpass USD 250 billion in 2025, and expanding power needs add a further USD 500 billion through 2030. Many developing nations face electricity shortfalls that hinder the launch of local HPC facilities. Organizations struggle to justify on-premise clusters once equipment, cooling, and skilled-staff costs are tallied, curbing adoption in resource-constrained regions and trimming overall CAGR by 2.1%.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Edge-to-Cloud HPC for Smart Manufacturing

- Falling Cost-Per-Core for GPU/CPU Clusters Enabling Affordable HPC for SMEs

- Shortage of Skilled HPC & Parallel-Programming Professionals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The software segment generated 45.78% of revenue in 2025, reflecting demand for user-friendly analytics engines, data-fabric layers, and AI orchestration tools. Vendors are embedding workflow automation and feature-store capabilities that hasten model deployment across business units. DevOps integration is tightening feedback cycles, and license structures are shifting toward consumption-based billing that aligns cost with value creation. Hardware sales remain foundational, propelled by silicon advances such as NVIDIA Blackwell Ultra GPUs that field higher tensor-core density for transformer workloads.

Services are the quickest-expanding line, projected at 25.05% CAGR through 2031. Consulting teams now bundle data-strategy design, MLOps implementation, and continuous-model-tuning services, filling expertise gaps in complex hybrid stacks. Providers are launching AI-as-a-Service offerings that include managed feature engineering, bias auditing, and federated-learning orchestration. These shifts broaden addressable demand and lift the high-performance data analytics market size for service engagements, especially among first-time enterprise adopters.

On-premise deployments held 57.05% share in 2025, anchored by sectors that guard latency or sovereignty, including government and banking. Organizations cite direct hardware control and compliance with strict data-residency statutes as prime motives. Many firms also leverage existing data-center sunk costs, optimizing occupancy rates by refreshing nodes rather than migrating wholesale to cloud.

Cloud platforms are climbing at a 29.25% CAGR, propelled by elastic scaling, consumption pricing, and global edge-zone rollouts. Providers have broadened confidential-computing instances and sovereign-cloud regions to mollify regulatory concerns. Hybrid and multi-cloud patterns now dominate greenfield projects, combining local accelerators with burst capacity for AI training. The shift is enlarging the high-performance data analytics market size attached to consumption models while easing entry for resource-constrained enterprises.

The High-Performance Data Analytics Market Report is Segmented by Component (Hardware, Software, and Services), Deployment Model (On-Premise, and On-Demand/Cloud), Organization Size (Small and Medium Enterprises, and Large Enterprises), End-User Industry (BFSI, Government and Defense, Energy and Utilities, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 34.85% revenue leadership in 2025, buoyed by deep hyperscaler footprints and early enterprise AI adoption. U.S. data-center supply rose by 26% year on year to 5.2 GW, matching proliferating AI inference demand. Banks such as TD leverage national payment telemetry for instant fraud scoring, underscoring sector maturity. Rental rates in Northern Virginia advanced 41.6% in 2024, evidencing tight capacity that spurs continued build-outs.

Asia-Pacific is the fastest-growing region with a 27.2% CAGR outlook. India plans to double installed data-center capacity to nearly 1.8 GW by 2026, underwritten by multibillion-dollar commitments from domestic and global investors. Taiwan's facility builds are forecast to exceed USD 3 billion by 2028 to service chip-design simulations and large-language-model training. China is closing the model-quality gap with the United States, with provincial grants catalyzing next-generation AI frameworks. Yet, stringent data-localization rules are compelling firms to engineer country-specific analytics stacks rather than unified global fabrics.

Europe is scaling edge-to-cloud initiatives to modernize manufacturing and critical infrastructure. The EU aims to reach 75% business-cloud adoption and deploy 10,000 climate-neutral edge nodes by 2030. National programs channel capital toward 6G testbeds, telco-edge cloud pilots, and industrial metaverse demonstrators that require low-latency analytics. The opening of the first European AI factories in 2024 provides sovereign compute for automotive, aerospace, and energy firms seeking to train models without exporting data.

- Amazon Web Services, Inc. (AWS)

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Dell Technologies Inc.

- SAS Institute Inc.

- Oracle Corporation

- Fujitsu Limited

- Intel Corporation

- ATOS SE

- Juniper Networks Inc.

- NEC Corporation

- Cisco Systems, Inc.

- Teradata Corporation

- Cray Inc. (HPE Cray)

- Altair Engineering Inc.

- Cloudera, Inc.

- Huawei Technologies Co., Ltd.

- Hitachi Vantara LLC

- Super Micro Computer, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Adoption of Real-Time Analytics in BFSI for Fraud Detection in North America

- 4.2.2 Surge in AI/ML Model Training Requiring Petabyte-Scale Data Processing in Asia

- 4.2.3 Growth of Edge-to-Cloud HPC for Smart Manufacturing in Europe

- 4.2.4 National Defense Big-Data Modernization Programs Across Middle East Governments

- 4.2.5 Renewable-Energy Grid Optimization Initiatives Driving HPC Analytics in South America

- 4.2.6 Falling Cost-per-Core for GPU/CPU Clusters Enabling Affordable HPC for SMEs Globally

- 4.3 Market Restraints

- 4.3.1 High Total Cost of Ownership for Dedicated HPC Clusters in Caribbeans and Africa

- 4.3.2 Shortage of Skilled HPC and Parallel Programming Professionals in Europe and Oceania

- 4.3.3 Data-Sovereignty Regulations Limiting Cross-Border Cloud Analytics in Asia

- 4.3.4 Infrastructure Reliability Issues in Emerging Markets Hampering Continuous Data Streams

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.5.1 High-Performance Cluster Computing Evolution

- 4.5.2 Grid Computing

- 4.5.3 In-Memory Analytics

- 4.5.4 In-Database Analytics

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 Market Size and Growth Forecasts

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Deployment Model

- 5.2.1 On-Premise

- 5.2.2 On-Demand/Cloud

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By End-User Industry

- 5.4.1 Banking, Financial Services and Insurance (BFSI)

- 5.4.2 Government and Defense

- 5.4.3 Energy and Utilities

- 5.4.4 Retail and E-Commerce

- 5.4.5 Healthcare and Life Sciences

- 5.4.6 Telecommunication and IT Services

- 5.4.7 Manufacturing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Peru

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Amazon Web Services, Inc. (AWS)

- 6.3.2 Google LLC

- 6.3.3 Microsoft Corporation

- 6.3.4 IBM Corporation

- 6.3.5 Hewlett Packard Enterprise (HPE)

- 6.3.6 Dell Technologies Inc.

- 6.3.7 SAS Institute Inc.

- 6.3.8 Oracle Corporation

- 6.3.9 Fujitsu Limited

- 6.3.10 Intel Corporation

- 6.3.11 ATOS SE

- 6.3.12 Juniper Networks Inc.

- 6.3.13 NEC Corporation

- 6.3.14 Cisco Systems, Inc.

- 6.3.15 Teradata Corporation

- 6.3.16 Cray Inc. (HPE Cray)

- 6.3.17 Altair Engineering Inc.

- 6.3.18 Cloudera, Inc.

- 6.3.19 Huawei Technologies Co., Ltd.

- 6.3.20 Hitachi Vantara LLC

- 6.3.21 Super Micro Computer, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment