PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851626

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851626

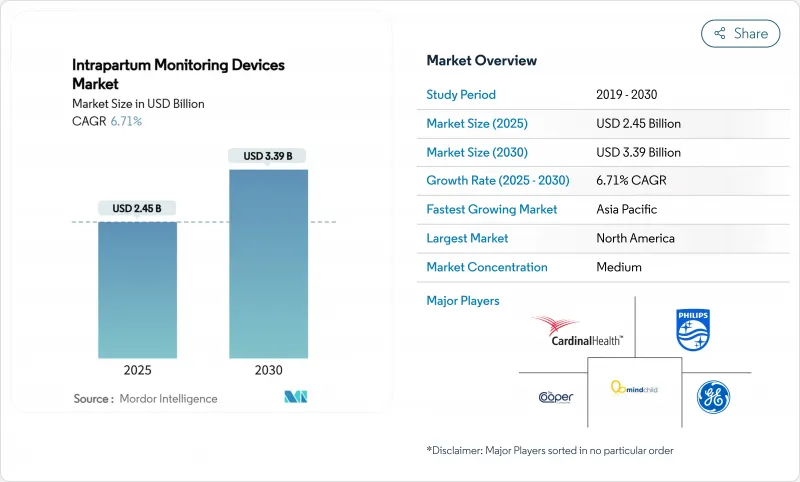

Intrapartum Monitoring Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The intrapartum monitoring devices market size reached USD 2.45 billion in 2025 and is forecast to climb to USD 3.39 billion by 2030 at a 6.71% CAGR.

Growth momentum reflects the rapid pairing of artificial intelligence with traditional cardiotocography, where deep-learning models have achieved 97.9% accuracy in separating fetal and maternal heart signals. Rising pre-term birth prevalence-up 12% in the United States between 2014 and 2022-and the parallel increase in NICU admissions fuel demand for smarter surveillance during labor. Healthcare providers also favor non-invasive technologies that improve maternal mobility; these external systems captured almost 70% of 2024 revenues and continue to expand as reimbursement frameworks reward patient-comfort metrics. Meanwhile, manufacturers differentiate through portable, AI-ready devices that serve rural facilities and emergency teams, a positioning reinforced by policy mandates requiring fetal monitoring hardware in all labor rooms from January 2026.

Global Intrapartum Monitoring Devices Market Trends and Insights

Rapid Adoption of Non-Invasive Fetal ECG Technology

Non-invasive fetal electrocardiography offers beat-to-beat heart-rate analysis without belts or scalp electrodes, matching or surpassing Doppler accuracy, particularly in high-BMI patients. Its freedom of movement boosts maternal satisfaction scores, a metric now tied to hospital reimbursement. Pandemic-era remote-monitoring pilots validated home-based ECG patches that transmit continuous data to clinicians, lowering exposure risk while sustaining oversight. Health-system purchasing committees thus rank mobility, comfort, and signal robustness as core criteria, pushing suppliers to embed ECG channels into wireless patch platforms. Start-ups focused on AI interpretation layer additional value by converting continuous waveforms into actionable alerts within seconds.

Rising Pre-Term Births & NICU Admissions

Worldwide, 13.4 million babies were born preterm in 2020, equivalent to 9.9% of live births . In the United States, NICU admissions rose from 8.7% in 2016 to 9.8% in 2023. Each NICU day costs USD 3,000-5,000, making early intrapartum detection financially attractive to payers . Advanced monitoring that flags decelerations or uterine tachysystole minutes earlier can reduce emergency cesareans and neurodevelopmental morbidity. The trend is amplified by women delaying childbirth; pregnancies in mothers > 35 years carry higher risks and more often trigger continuous electronic surveillance rather than intermittent auscultation.

High Capital Outlay for Advanced Central Surveillance Stations

Hospitals investing in multi-bed fetal telemetry platforms often face seven-figure budgets when integration with EHR, cybersecurity hardening, and staff re-training are included. Prisma Health's USD 41 million smart-bed deployment across 1,500 units illustrates the scale of capital commitments. Procurement tenders such as BARTS Health NHS Trust's site-wide vital-signs monitoring call for open APIs and ISO 27001 compliance, adding IT overhead. Under-funded community hospitals postpone upgrades, creating a tiered technology landscape where rural mothers receive palpation or intermittent doppler checks instead of continuous CTG.

Other drivers and restraints analyzed in the detailed report include:

- Government Mandates on Intrapartum Monitoring Standards

- Growth of High-Risk Pregnancies in Women More Than 35 Years

- Stringent FDA & EU-MDR Clinical Evidence Demands

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electrodes retained 65.45% revenue in 2024, underscoring their indispensable role in signal capture across all modalities. Yet monitors post a faster 7.12% CAGR, reflecting demand for multi-parameter, AI-ready platforms that house fetal, maternal, and uterine channels in one chassis. GE's Novii wireless patch incorporates ECG and EMG within a belt-free shell that elevates patient comfort while satisfying documentation mandates. Samsung's USD 92.4 million Sonio purchase highlights the premium on ultrasound-linked analytics that augment CTG workflows. Such integrations deliver holistic intrapartum monitoring devices market value propositions that transcend hardware replacement cycles. Electrode unit sales nonetheless rise steadily because each monitor still needs disposable or reusable transducers, preserving a large consumables revenue stream.

Second-generation monitors bundle cloud connectivity and decision support, shifting purchasing criteria from hardware specifications toward software roadmaps. EDAN's F3 fetal monitor offers on-board CTG analytics, easing interpretation load for junior staff. Vendors exploring subscription-based algorithm updates can smooth revenue while hospitals gain access to continuously improving classifications without capital refresh. The resulting convergence repositions monitors as software platforms backed by consumable electrodes, ensuring lasting traction within the intrapartum monitoring devices market.

Non-invasive systems captured 69.91% of 2024 revenue and are forecast for a 7.21% CAGR, maintaining dual leadership in size and growth. External Doppler ultrasound and tocodynamometers dominate routine obstetric care because they avoid cervical dilation and infection risk. Intrapartum monitoring devices market size gains further as new patches relay signals via Bluetooth, freeing mothers to ambulate or use birthing balls without strap readjustments. Internal scalp electrodes and intrauterine pressure catheters remain the precision gold standard when obesity, malpresentation, or signal noise impede external readings. Recent trials show internal CTG neither raises cesarean incidence nor worsens neonatal outcomes versus external monitoring, potentially broadening clinical indications. However, the need for ruptured membranes limits usage.

Hybrid telemetry arranges dual benefits: high-fidelity signals plus mobility. University of Helsinki findings on simultaneous maternal pulse recording confirm that artifact filtering prevents neonatal encephalopathy, accelerating adoption of multiparameter solutions. External platforms therefore evolve to include maternal ECG channels that auto-subtract cross-talk, reinforcing non-invasive dominance inside the intrapartum monitoring devices market.

The Intrapartum Monitoring Devices Market Report is Segmented by Product Type (Electrodes, Monitors), Monitoring Method (Invasive, Non-Invasive), Portability (Fixed, Portable), End-User (Hospitals, Specialty Clinics, Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 42.29% stake stems from stringent standards and high per-capita healthcare spending. Forthcoming CMS rules compel universal fetal-monitor access, and NICU admissions edging toward 10% of births intensify monitoring sophistication. Yet 2024 saw multiple rural obstetric unit shutdowns and rising malpractice premiums, pushing health systems to pilot tele-CTG hubs that extend oversight without on-site specialists. Vendor partnerships, such as Philips' collaboration with Georgia health plans for remote maternal programs, illustrate how the intrapartum monitoring devices market adapts to workforce deficits.

Asia-Pacific claims the speed crown at 7.45% CAGR, lifted by maternal mortality reduction drives and urban hospital construction booms. Governments subsidize digital health pilots that outfit district maternity wards with Bluetooth CTG linked to cloud dashboards in tertiary centers. In Japan and South Korea, AI-interpretation pilots expedite decision making, while emerging economies prioritize basic device deployment alongside midwife training. The Asian Development Bank's integrated-care grants finance hybrid maternal-NCD telemetry networks, further scaling demand.

Europe sits in a regulatory sweet spot: EU-MDR harmonization simplifies cross-border certifications, and established reimbursement structures cover advanced CTG usage. French hospitals using Masimo SafetyNet for premature newborn early discharge evidence willingness to invest in telemonitoring when cost-benefit aligns. Middle East, Africa, and South America remain nascent but promising. Sub-Saharan Africa's digital-health lens positions mobile CTG as a leapfrog technology in regions lacking fixed infrastructure.

- GE Healthcare

- Koninklijke Philips

- Medtronic

- Natus Medical

- Cardinal Health

- Analogic Corp.

- Shenzhen Mindray Bio-Medical

- Nihon Kohden Corp.

- Dragerwerk

- Arjo-Huntleigh (Huntleigh Healthcare)

- Samsung Group

- EDAN Instruments

- Cooper Surgical (The Cooper Companies)

- Stryker

- Olympus Corp.

- Bionet Co. Ltd.

- Monica Healthcare

- Nonin Medical

- Wallach Surgical Devices

- MindChild Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of non-invasive fetal ECG technology

- 4.2.2 Rising pre-term births & NICU admissions

- 4.2.3 Government mandates on intrapartum monitoring standards

- 4.2.4 Growth of high-risk pregnancies in women more than 35 yrs

- 4.2.5 AI-powered real-time labour analytics embedded in CTG systems

- 4.2.6 Reimbursement uplifts for remote labour wards in Sub-Saharan Africa

- 4.3 Market Restraints

- 4.3.1 High capital outlay for advanced central surveillance stations

- 4.3.2 Stringent FDA & EU-MDR clinical evidence demands

- 4.3.3 Cyber-security liabilities of Wi-Fi enabled CTG monitors

- 4.3.4 Shortage of trained obstetric nurses

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Electrodes

- 5.1.1.1 Intra-uterine Pressure Catheters (IUPC)

- 5.1.1.2 Fetal Scalp Electrodes

- 5.1.1.3 Uterine Contraction Transducers

- 5.1.1.4 Fetal Heart-Rate Transducers

- 5.1.2 Monitors

- 5.1.1 Electrodes

- 5.2 By Monitoring Method

- 5.2.1 Invasive

- 5.2.2 Non-Invasive

- 5.3 By Portability

- 5.3.1 Fixed

- 5.3.2 Portable

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Specilaty Clinics

- 5.4.3 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GE Healthcare

- 6.3.2 Koninklijke Philips N.V.

- 6.3.3 Medtronic plc

- 6.3.4 Natus Medical Inc.

- 6.3.5 Cardinal Health

- 6.3.6 Analogic Corp.

- 6.3.7 Shenzhen Mindray Bio-Medical

- 6.3.8 Nihon Kohden Corp.

- 6.3.9 Dragerwerk AG & Co. KGaA

- 6.3.10 Arjo-Huntleigh (Huntleigh Healthcare)

- 6.3.11 Samsung Medison

- 6.3.12 EDAN Instruments

- 6.3.13 Cooper Surgical (The Cooper Companies)

- 6.3.14 Stryker Corp.

- 6.3.15 Olympus Corp.

- 6.3.16 Bionet Co. Ltd.

- 6.3.17 Monica Healthcare

- 6.3.18 Nonin Medical

- 6.3.19 Wallach Surgical Devices

- 6.3.20 MindChild Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment