PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851627

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851627

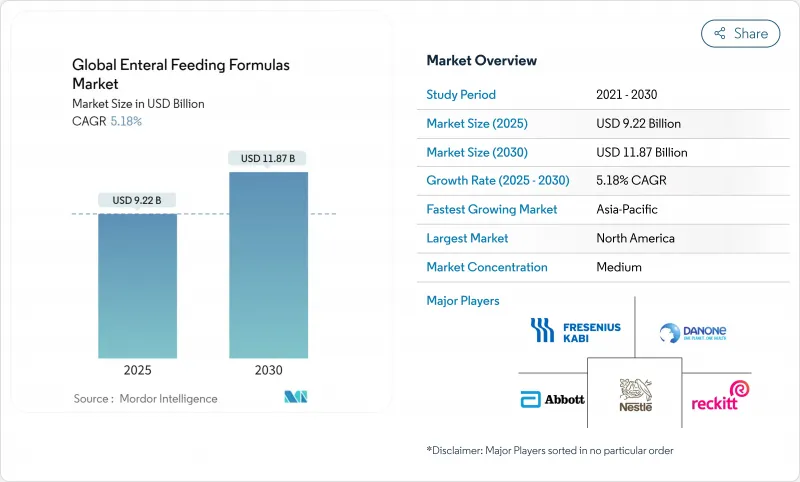

Global Enteral Feeding Formulas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The enteral nutrition market size stands at USD 9.22 billion in 2025 and is forecast to reach USD 11.87 billion by 2030, reflecting a 5.18% CAGR over the period.

Momentum arises from demographic aging, rising chronic disease incidence, and accumulating clinical evidence that tube feeding shortens hospital stays and lowers infection risk versus parenteral options. Technology-enabled pumps, clean-label formulas, and AI-driven nutrient titration broaden clinical acceptance, while capacity expansions by Abbott and Danone underscore sustained demand. Although supply-chain fragilities in amino acids persist, strategic sourcing initiatives and near-shoring temper price volatility. The enteral nutrition market increasingly functions as a core component of chronic-care infrastructure rather than a niche adjunct therapy.

Global Enteral Feeding Formulas Market Trends and Insights

Aging Population & Surge in Chronic Diseases

One in six people globally will be over 65 by 2050, driving sustained demand for specialized tube-feeding solutions. Abbott's Ensure surpassed USD 3 billion sales in 2024, illustrating how older adults prioritize nutritional maintenance. Intensifying diabetes, cardiovascular, and gastrointestinal conditions further enlarge the enteral nutrition market as oral intake declines. Randomized studies show early enteral nutrition lowers mortality and shortens hospital stays, prompting payers to treat feeding tubes as preventive care. Health-system protocols now mandate enteral initiation within 48 hours of ICU admission, cementing its role as first-line therapy rather than secondary support.

Rapid Uptake of Home-Enteral Pumps & Accessories

Home health outlays are rising 6-8% annually, building a supportive payment environment for at-home tube feeding. Kangaroo Connect pumps offer 24-hour batteries and cloud telemetry that caregivers manage via smartphones. U.S. Medicare eased paperwork for enteral claims in 2025, accelerating discharges to community settings. Families value quality-of-life gains as portable pumps reduce tethering to hospital beds. These dynamics push the enteral nutrition market toward decentralized, patient-centric delivery models.

Other drivers and restraints analyzed in the detailed report include:

- Shift from Parenteral to Enteral Nutrition in Acute-Care Settings

- Clean-Label Real-Food Formulas Boosting Patient Adherence

- GI-Related Complications & Aspiration Risk Perceptions

- Fragmented Reimbursement for Disease-Specific Formulas

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Standard polymeric blends retained leadership, accounting for 54.31% of the enteral nutrition market share in 2024, largely due to broad clinical familiarity and lower unit costs. Emerging blenderized real-food offerings captured caregiver interest and are forecast for 6.15% CAGR, propelled by plant-based branding and demonstrated GI benefits.

In response, incumbents incorporate organic pea protein and non-GMO oils into legacy lines, while high-protein and peptide-based variants defend niches where malabsorption or wound healing require elevated amino acid density. Elemental formulas remain essential for severe GI compromise yet face palatability and cost barriers, limiting widespread diffusion. Disease-specific products addressing diabetes or renal impairment align with precision-nutrition trends, signaling future premiumization of the enteral nutrition market.

Isocaloric (≈ 1 kcal/ml) products secured 45.89% share of the enteral nutrition market size in 2024 because they satisfy most standard feeding prescriptions. Hypercaloric (1.2-1.5 kcal/ml) lines will expand 5.89% CAGR, driven by fluid-restricted cardiac and renal patients requiring compact nutrient delivery.

Formulation advances allow higher caloric density without excessive viscosity, improving pump compatibility and patient comfort. Very-high-calorie products (>= 2 kcal/ml) answer severe malnutrition but remain niche due to tolerance issues, whereas low-energy blends meet pediatric and bariatric protocols. Intensifying homecare favors concentrated formats that minimize bag changes and enhance mobility, reinforcing hypercaloric momentum within the enteral nutrition market.

The Enteral Nutrition Report is Segmented by Product Type (Standard Polymeric, High-Protein Polymeric, Peptide-Based, Elemental, Disease-Specific, and More), Caloric Density (Low Energy, Isocaloric, and More), End-User (Hospitals, Long-Term Care, and More), Age Group (Neonates, Pediatrics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 42.23% of global revenue in 2024 due to sophisticated reimbursement systems, high ICU penetration of tube feeding, and rapid uptake of AI-driven pumps. U.S. Medicare's simplified billing codes and Canada's single-payer coverage sustain volume, while Mexico's growing middle class begins demanding premium formulas. Regional manufacturing, exemplified by Abbott's USD 92 million Gujarat facility serving U.S. export as well as Indian domestic demand, bolsters supply resilience.

Europe shows steady uptake under harmonized ESPEN guidelines, yet fragmentation in reimbursement creates variable country growth. Germany emphasizes immune-enhancing blends, the United Kingdom invests in mental-performance nutrition, and Italy's high per-capita supplement spend fosters premium tube-feeding adoption. Spain, conversely, values palatability aligned with culinary culture, spurring R&D on flavor masking.

Asia-Pacific is the fastest-growing arena, projected at 6.19% CAGR through 2030 as China, India, and Southeast Asia modernize ICUs and embrace homecare. Synutra's pivot from infant formula to adult meal replacements in China illustrates category stretch. Joint ventures, such as Nestle-Dr. Reddy's in India, leverage local distribution for specialized products. South America and the Middle East & Africa remain emerging, with Brazil's USD 209 billion food-processing sector and GCC healthcare investments hinting at long-term opportunity.

- Nestle S.A.

- Abbott Laboratories

- Danone

- Fresenius

- B. Braun

- Otsuka

- Meiji Holdings Co., Ltd.

- Ajinomoto Co., Inc.

- Kate Farms, Inc.

- Real Food Blends LLC

- Nutritional Medicinals LLC

- Victus

- Hormel Foods

- Reckitt/Mead Johnson & Company LLC

- DSM-Firmenich

- Cambrooke Therapeutics Inc.

- Yakult Honsha Co., Ltd.

- EA Pharma Co., Ltd.

- Baxter

- Nestle Health Science (Vitaflo)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging population & surge in chronic diseases

- 4.2.2 Shift from parenteral to enteral nutrition in acute-care settings

- 4.2.3 Rapid uptake of home-enteral pumps & accessories

- 4.2.4 Clean-label real-food formulas boosting patient adherence

- 4.2.5 E-prescription-linked AI tools enabling personalized macronutrient titration

- 4.3 Market Restraints

- 4.3.1 GI-related complications & aspiration risk perceptions

- 4.3.2 Fragmented reimbursement for disease-specific formulas

- 4.3.3 Concentrated supply chain for specialty amino-acid blends

- 4.3.4 High viscosity of plant-based blends causing pump occlusion issues

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Standard Polymeric Formulas

- 5.1.2 High-Protein Polymeric Formulas

- 5.1.3 Peptide-Based / Semi-Elemental Formulas

- 5.1.4 Elemental (Amino-Acid) Formulas

- 5.1.5 Disease-Specific Formulas

- 5.1.5.1 Diabetes-Specific

- 5.1.5.2 Renal-Specific

- 5.1.5.3 Hepatic Support

- 5.1.5.4 Oncology / Immunonutrition

- 5.1.5.5 Pulmonary (COPD)

- 5.1.5.6 GI & Malabsorption (IBD, SBS)

- 5.1.6 Immune-Modulating / Synbiotic Formulas

- 5.1.7 Blenderized Real-Food Formulas

- 5.2 By Caloric Density (Value)

- 5.2.1 Low Energy (<1.0 kcal/ml)

- 5.2.2 Isocaloric (≈1.0 kcal/ml)

- 5.2.3 Hypercaloric (1.2 - 1.5 kcal/ml)

- 5.2.4 Very-High Calorie (>=2.0 kcal/ml)

- 5.3 By End-user (Value)

- 5.3.1 Hospitals & Acute-Care Centres

- 5.3.2 Long-Term Care Facilities

- 5.3.3 Home Enteral Nutrition (HEN)

- 5.3.4 Out-patient / Ambulatory Clinics

- 5.4 By Age Group (Value)

- 5.4.1 Neonates (0-28 days)

- 5.4.2 Pediatrics (1 month-17 yrs)

- 5.4.3 Adults (18-64 yrs)

- 5.4.4 Geriatrics (>=65 yrs)

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, and Recent Developments)

- 6.3.1 Nestle S.A.

- 6.3.2 Abbott Laboratories

- 6.3.3 Danone S.A.

- 6.3.4 Fresenius SE & Co. KGaA

- 6.3.5 B. Braun SE

- 6.3.6 Otsuka Pharmaceutical Co., Ltd.

- 6.3.7 Meiji Holdings Co., Ltd.

- 6.3.8 Ajinomoto Co., Inc.

- 6.3.9 Kate Farms, Inc.

- 6.3.10 Real Food Blends LLC

- 6.3.11 Nutritional Medicinals LLC

- 6.3.12 Victus, Inc.

- 6.3.13 Hormel Foods Corporation

- 6.3.14 Reckitt/Mead Johnson & Company LLC

- 6.3.15 DSM-Firmenich

- 6.3.16 Cambrooke Therapeutics Inc.

- 6.3.17 Yakult Honsha Co., Ltd.

- 6.3.18 EA Pharma Co., Ltd.

- 6.3.19 Baxter International Inc.

- 6.3.20 Nestle Health Science (Vitaflo)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment