PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851628

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851628

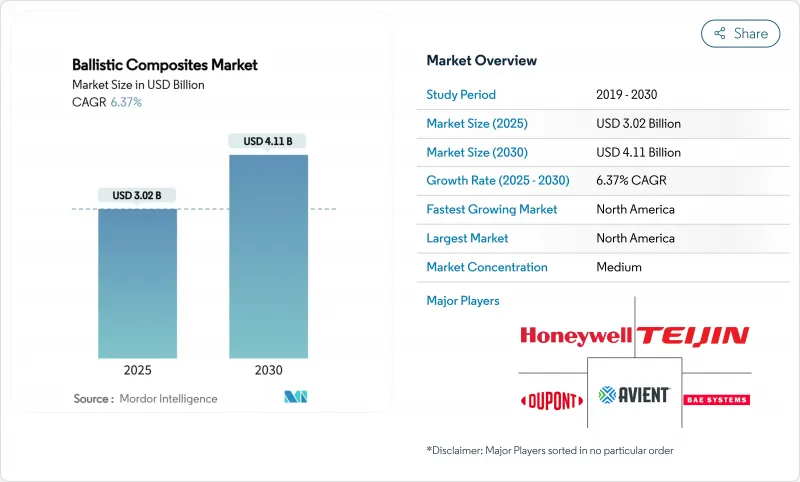

Ballistic Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ballistic Composites Market size is estimated at USD 3.02 billion in 2025, and is expected to reach USD 4.11 billion by 2030, at a CAGR of 6.37% during the forecast period (2025-2030).

Steady gains come from defense modernization, autonomous vehicle shielding, and the aerospace sector's persistent drive to trim airframe mass without sacrificing crew safety. Demand growth concentrates on lighter yet tougher laminate configurations, wider adoption of hybrid fiber lay-ups, and the migration of advanced composite tooling from the aerospace supply chain into armor production lines. Aramid fibers reinforce much of today's armor solutions, while polymer matrices enable manufacturers to balance multi-hit performance with processing flexibility. North America retains its pole position thanks to the United States Army's high-budget soldier modernisation programs and next-generation vehicle platforms that rely on sophisticated armor architectures. Meanwhile, Asia-Pacific commands attention with accelerated procurement of personal protection gear for large infantry forces. Technology launches such as DuPont's Kevlar EXO, which delivers 30% higher tensile strength than standard aramid, showcase the innovation pace that underpins the ballistic composites market.

Global Ballistic Composites Market Trends and Insights

Rise in Global Defence Expenditure

Defense spending escalation across major economies fundamentally reshapes ballistic composites demand patterns, shifting procurement priorities toward advanced materials that deliver superior protection-to-weight ratios. The United States Army's Ground X-Vehicle Technologies program exemplifies this trend, targeting 50% weight reduction while maintaining survivability through innovative composite armor systems rather than traditional steel plating. This strategic pivot reflects military planners' recognition that future combat effectiveness depends on mobility and agility rather than passive armor thickness. Asian defense markets are experiencing parallel modernization drives, with countries like India integrating advanced ballistic helmets into standard infantry equipment, as demonstrated by MKU Limited's delivery of Kavro Doma 360 helmets to the Indian Army in 2025. The procurement shift toward composite materials creates sustained demand growth that transcends traditional cyclical defense spending patterns.

Lightweighting Push in Aerospace and Defence Platforms

Aerospace and defense manufacturers are pursuing aggressive weight reduction strategies that position ballistic composites as critical enablers of next-generation platform performance. Carbon fiber composites in missile applications demonstrate 40-50% weight reductions compared to aluminum alternatives, enabling extended operational ranges and enhanced payload capacities that directly translate to tactical advantages . The trend extends to extreme-temperature hypersonic systems. In 2025, Canopy Aerospace secured a USD 2.8 million U.S. Air Force contract for reusable thermal-protection tiles that withstand ballistic impact during re-entry. Cross-pollination of thermal and ballistic requirements gives the ballistic composites market new growth vectors.

High Processing and Qualification Costs

The ballistic composites industry faces substantial barriers from complex processing requirements and extensive qualification protocols that significantly inflate production costs and market entry thresholds. NIJ Standard 0101.07, implemented in 2024, introduces more rigorous testing methodologies for ballistic-resistant body armor, requiring manufacturers to invest in advanced testing facilities and extended qualification timelines . Military standards such as STANAG 4569 add further complexity with multi-angle, multi-velocity shot matrices that only a handful of laboratories can deliver. Investment in controlled-atmosphere hot presses, fibre tension rigs, and computerised drape forming lines inflates entry costs, favouring incumbents within the ballistic composites market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Soldier-Modernisation Programmes in Emerging Economies

- Development of Terrain Motor Vehicles With Ballistic Protection

- Volatile Aramid and Ultra-high Molecular Weight Polyethylene (UHMWPE) Precursor Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aramid fibre held 43.69% share of ballistic composites market size in 2024 and is forecast to expand at a 6.40% CAGR. The latest Kevlar EXO fibre improves tensile strength by 30% while maintaining flame resistance, enabling thinner armour panels and improved soldier mobility. UHMWPE is narrowing the gap, appealing to customers that prioritise weight reduction and moisture resistance. S-glass remains prominent in vehicular armour where high-temperature exposure is common. Competitive tension is intensifying as research laboratories demonstrate carbon-nanotube yarns with dynamic strength above 14 GPa, a level that could redefine the ballistic composites market.

Aramid suppliers defend their position through improved surface treatments that enhance matrix adhesion and through partnerships with fabric weavers that can tailor multiaxial lay-ups for multi-hit scenarios. UHMWPE producers are expanding capacity in Asia to stabilise lead times and costs. Hybrid laminates that blend aramid, UHMWPE, and carbon fibres balance tensile strength, delamination resistance, and thermal robustness. Bio-based fibre initiatives, though still niche, attract defence agencies focused on sustainability targets, signalling the long-term diversification path within the ballistic composites market.

The Ballistic Composites Market Report is Segmented by Fiber Type (Aramids, Ultra-High Molecular Weight Polyethylene, and More), Matrix Type (Polymer, Polymer-Ceramic, and Metal), Application (Vehicle Armor, Body Armor, Helmet and Face Protection, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the ballistic composites market with 43.16% revenue share in 2024 and is expected to grow at a 6.51% CAGR through 2030. The Future Long-Range Assault Aircraft program relies on Integris Composites armour fitted into the Bell V-280 Valor airframe, a clear sign of sustained demand. Robust federal defense budgets, resilient supply chains, and university-backed testing infrastructure underpin regional dominance.

Asia-Pacific is the fastest-scaling region outside North America. China, India, Japan, and South Korea invest in lighter individual protection equipment and domestically produced vehicle armour. India's Light Combat Vehicle program specifies composite applique kits to reduce curb weight, reflecting a shift from steel-only hulls. South Korea integrates fibre-metal laminates in K2 Black Panther tanks to improve mine resistance without weight penalties.

Europe revives timid defence budgets amid heightened security concerns. Manufacturers such as International Armored Group operate an expanded vehicle plant in Bulgaria, ensuring shorter lead times for NATO contracts. Germany tests the Leopard 2 ARC 3.0 with an active protection suite and modular composite skirts, pushing demand for interchangeable composite modules across allied fleets.

- Atomic-6, Inc.

- Avient Corporation

- BAE Systems

- Barrday Inc.

- CoorsTek Inc.

- DuPont

- Gurit Services AG, Zurich

- Hardwire LLC

- Hexcel Corporation

- Honeywell International Inc.

- Integris

- MKU Limited

- Morgan Advanced Materials

- Plastic Reinforcement Fabrics Ltd

- Point Blank Enterprises, Inc.

- Rheinmetall AG

- Roihu Inc.

- Safariland,LLC

- Southern States, llc

- TEIJIN LIMITED

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Global Defence Expenditure

- 4.2.2 Lightweighting Push in Aerospace and Defence Platforms

- 4.2.3 Rapid Soldier-modernisation Programmes in Emerging Economies

- 4.2.4 Development of Terrain Motor Vehicles With Ballistic Protection

- 4.2.5 Growing Demand for Multi-hit Hybrid Armour for Autonomous Ground Vehicles

- 4.3 Market Restraints

- 4.3.1 High Processing and Qualification Costs

- 4.3.2 Volatile Aramid and Ultra-high Molecular Weight Polyethylene (UHMWPE) Precursor Supply

- 4.3.3 Perfluoroalkyl and Polyfluoroalkyl Substances (PFAS)-related Environmental Regulations on Aramid Finishing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Fiber Type

- 5.1.1 Aramids

- 5.1.2 Ultra-High Molecular Weight Polyethylene (UHMWPE)

- 5.1.3 S-glass

- 5.1.4 Other Fiber Types (Carbon Fiber, Bio-based and Natural Fiber Hybrids, etc.)

- 5.2 By Matrix Type

- 5.2.1 Polymer

- 5.2.2 Polymer-Ceramic

- 5.2.3 Metal

- 5.3 By Application

- 5.3.1 Vehicle Armor

- 5.3.2 Body Armor

- 5.3.3 Helmet and Face Protection

- 5.3.4 Other Applications (Aircraft and Marine Protection, High-performance Sporting Goods, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Atomic-6, Inc.

- 6.4.2 Avient Corporation

- 6.4.3 BAE Systems

- 6.4.4 Barrday Inc.

- 6.4.5 CoorsTek Inc.

- 6.4.6 DuPont

- 6.4.7 Gurit Services AG, Zurich

- 6.4.8 Hardwire LLC

- 6.4.9 Hexcel Corporation

- 6.4.10 Honeywell International Inc.

- 6.4.11 Integris

- 6.4.12 MKU Limited

- 6.4.13 Morgan Advanced Materials

- 6.4.14 Plastic Reinforcement Fabrics Ltd

- 6.4.15 Point Blank Enterprises, Inc.

- 6.4.16 Rheinmetall AG

- 6.4.17 Roihu Inc.

- 6.4.18 Safariland,LLC

- 6.4.19 Southern States, llc

- 6.4.20 TEIJIN LIMITED

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Development of Bio-Based Ballistic Fibers