PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851629

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851629

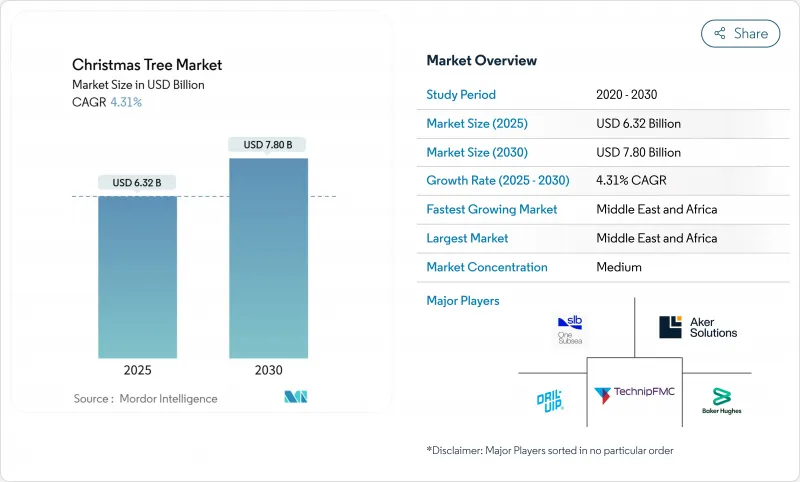

Christmas Tree - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Christmas Tree Market size is estimated at USD 6.32 billion in 2025, and is expected to reach USD 7.80 billion by 2030, at a CAGR of 4.31% during the forecast period (2025-2030).

Steady demand comes from a new wave of deep- and ultra-deepwater final investment decisions (FIDs), wider adoption of AI-enabled subsea controls, and the gradual standardization of modular, hybrid tree designs. Operators are redeploying capital toward high-pressure reservoirs, where 20,000 psi systems unlock resources once deemed uneconomic. At the same time, growing carbon-capture-and-storage (CCS) projects extend the application range of tree technology, turning legacy wells into dual hydrocarbon and CO2 injection assets. Supply-chain friction for high-integrity forgings and crude-price swings above USD 15/bbl remain the largest headwinds, but the underlying shift toward subsea tie-backs and brownfield optimization continues to insulate the Christmas tree market from wider energy-cycle volatility.

Global Christmas Tree Market Trends and Insights

Deep-water FID Resurgence Boosts Tree Demand

Final investment decisions for deepwater projects accelerated in 2024, headlined by BP's Kaskida (USD 5 billion, six 20 ksi wells, 80,000 bpd from 2029). TotalEnergies' GranMorgu in Suriname (USD 10.5 billion, 220,000 bpd) and Shell's Gato do Mato in Brazil (120,000 bpd) underscore the scale of sanctioned capital. These projects funnel more than USD 20 billion toward subsea hardware over the next five years, directly lifting Christmas tree demand. Operators' willingness to adopt 20 ksi designs signals confidence in drilling technologies that lower lifecycle cost per barrel, reinforcing a multi-year order pipeline for high-specification trees.

Integration of Subsea Hardware & AI-Driven Controls

Artificial-intelligence platforms now monitor valve positions, flow rates, and pressure anomalies in real time, delivering predictive maintenance that cuts unplanned downtime. ADNOC generated USD 500 million in value from AI in 2023 while lowering CO2 emissions. Umbilical-less control schemes further reduce capex in ultra-deepwater settings where traditional umbilicals are cost-prohibitive. Remote operations centers oversee multiple wells, trimming offshore staffing needs and elevating safety outcomes. Machine-learning algorithms refine choke-valve adjustments to maximize reservoir drawdown, lengthening equipment life. These capabilities position AI-enabled trees as core infrastructure for new offshore developments where extreme depth or weather challenges require manual intervention.

Supply-Chain Bottlenecks for High-Integrity Forgings

Critical forgings manufactured from AerMet 100 or MP35N alloys face 12-18-month lead times as only a handful of mills meet the required non-destructive-testing standards. Higher volumes of 20 ksi hardware exacerbate the squeeze because forgings must endure ultra-high pressures without hydrogen-induced stress cracking. With offshore EPC contract awards topping USD 52 billion in 2024, component demand outpaces qualified capacity. Operators are therefore locking in long-lead items earlier, increasing project-planning complexity.

Other drivers and restraints analyzed in the detailed report include:

- Latin-America's Ultra-Deep Pre-Salt Project Pipeline

- CCS & Subsea Tie-backs Repurposing Existing Wells

- Volatile Brent Above USD 15/bbl Swing Deters Long-Cycle FIDs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vertical systems, long the industry's default, held 85% share of the Christmas tree market in 2024. Their compatibility with legacy wellheads and decades of accumulated operating data underpin sustained demand. Conversely, horizontal units are gaining ground on high-intervention wells where ESP retrieval is frequent, translating to a 5% CAGR outlook. The Christmas tree market size for vertical systems is slated to reach USD 6.0 billion by 2030, whereas horizontal configurations, though smaller, are moving into higher-pressure service windows once limited to vertical designs.

Ongoing R&D introduces "hybrid" architectures that marry vertical tubing-head profiles with horizontal valve blocks. For example, OneSubsea's monobore design streamlines completion timing for operators such as BP and TotalEnergies. Spool trees, incorporating side-mount valves, allow workovers without full tree removal and serve as a technological bridge between traditional forms. The interplay of field-proven reliability and intervention efficiency keeps both designs relevant and boosts optionality for end users.

The Christmas Tree Market Report is Segmented by Type (Horizontal Tree and Vertical Tree), Location of Deployment (Onshore and Offshore), Water Depth (Shallow (Below 300 M), Deepwater (300 To 1500 M), Ultra-Deepwater (Above 1500 M)), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Size and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Middle East and Africa region dominates the Christmas tree market with a 43% share in 2024 and retains a 5% growth trajectory through 2030. National oil companies in the Arabian Gulf push brownfield recompletions while West Africa's frontier finds, notably in Namibia, insert fresh greenfield demand. Local-content statutes of 20-25% compel global OEMs to partner with regional workshops, accelerating skills transfer and fostering a nascent supply chain that, over time, is expected to moderate landed costs.

North America anchors a sizable slice of spending via Gulf of Mexico deepwater activity. Projects such as BP's Paleogene 20 ksi programs and Mexico's Trion, where Woodside Energy chose Dril-Quip wellhead systems, highlight the region's appetite for high-pressure trees. Canada's Atlantic offshore adds niche volumes, while US shale basins keep onshore volumes elevated despite price swings. Environmental permitting remains strict, nudging operators toward trees with embedded leak-detection sensors and lower fugitive-emission profiles.

South America is the growth engine thanks to Petrobras' 280-well program and the construction of FPSOs capable of 225,000 bpd apiece. Emphasis on corrosion-resistant metallurgy and standardized connectors defines procurement specs across the region. Europe sustains steady orders in the North Sea, now increasingly linked to CCS initiatives such as Northern Lights, whereas Asia-Pacific broadens the map with Philippine, Malaysian, and Indonesian projects exploring deeper waters. Together, these trends diversify revenue streams, lessening over-reliance on any single basin and promoting resilience across the Christmas tree market.

- TechnipFMC PLC

- SLB (OneSubsea & Cameron)

- Baker Hughes Company

- Aker Solutions ASA

- Dril-Quip Inc.

- Halliburton Company

- NOV Inc.

- Weatherford International plc

- Yantai Jereh Petroleum Equipment

- Worldwide Oilfield Machine

- Shengji Group

- Oceaneering International

- Expro Group

- Forum Energy Technologies

- Kongsberg Gruppen ASA

- Siemens Energy AG

- ABB Ltd (Pressure Control)

- INTERA Ltd

- GE Vernova (Former GE Oil & Gas assets)

- Plexus Holdings plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Deep-water FID resurgence boosts tree demand

- 4.2.2 Integration of subsea hardware & AI-driven controls

- 4.2.3 Latin-America's ultra-deep pre-salt project pipeline

- 4.2.4 CCS & subsea tie-backs repurposing existing wells

- 4.2.5 Standardized modular "hybrid" tree designs cut CAPEX

- 4.2.6 National-oil-company local-content mandates

- 4.3 Market Restraints

- 4.3.1 Supply-chain bottlenecks for high-integrity forgings

- 4.3.2 Volatile Brent Above $15/bbl swing deters long-cycle FIDs

- 4.3.3 Growing investor scrutiny on Scope-1 emissions

- 4.3.4 Limited rig availability drives day-rate inflation

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Rig-Count and CAPEX Outlook

- 4.8 Brent and Henry-Hub Price Outlook

- 4.9 Upstream Project Pipeline Tracker

- 4.10 Porter's Five Forces

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitute Products & Services

- 4.10.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Horizontal Tree

- 5.1.2 Vertical Tree

- 5.2 By Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 By Water Depth

- 5.3.1 Shallow (Below 300 m)

- 5.3.2 Deepwater (300 to 1500 m)

- 5.3.3 Ultra-Deepwater (Above 1500 m)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Nordic Countries

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 ASEAN Countries

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 TechnipFMC PLC

- 6.4.2 SLB (OneSubsea & Cameron)

- 6.4.3 Baker Hughes Company

- 6.4.4 Aker Solutions ASA

- 6.4.5 Dril-Quip Inc.

- 6.4.6 Halliburton Company

- 6.4.7 NOV Inc.

- 6.4.8 Weatherford International plc

- 6.4.9 Yantai Jereh Petroleum Equipment

- 6.4.10 Worldwide Oilfield Machine

- 6.4.11 Shengji Group

- 6.4.12 Oceaneering International

- 6.4.13 Expro Group

- 6.4.14 Forum Energy Technologies

- 6.4.15 Kongsberg Gruppen ASA

- 6.4.16 Siemens Energy AG

- 6.4.17 ABB Ltd (Pressure Control)

- 6.4.18 INTERA Ltd

- 6.4.19 GE Vernova (Former GE Oil & Gas assets)

- 6.4.20 Plexus Holdings plc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment