PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851630

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851630

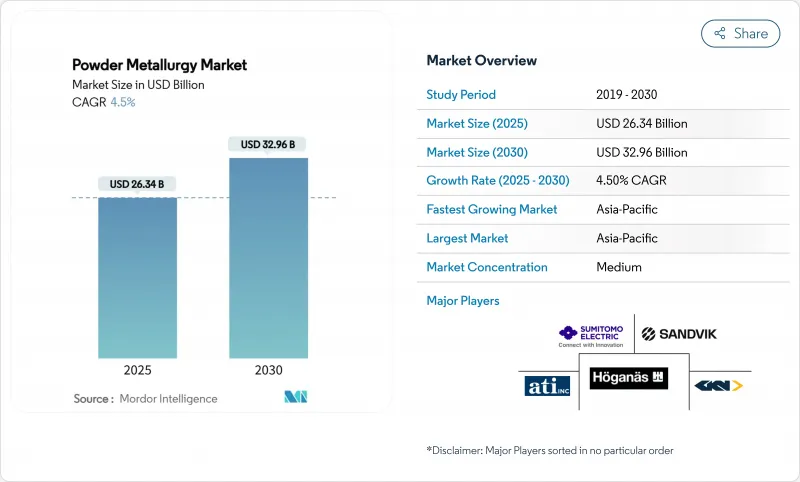

Powder Metallurgy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Powder Metallurgy Market size is estimated at USD 26.34 billion in 2025, and is expected to reach USD 32.96 billion by 2030, at a CAGR of 4.5% during the forecast period (2025-2030).

Expansion is supported by electrification of mobility, demand for complex lightweight parts, and steady penetration into medical, aerospace, and defense supply chains. Asia-Pacific commands the largest regional position and continues to attract new capacity as governments strengthen local materials ecosystems. Meanwhile, North American and European producers are pivoting toward high-value, low-volume applications to offset slower growth in conventional automotive volumes. Competitive intensity is rising as additive processes erode the dominance of press-and-sinter, and as specialty alloy suppliers target e-powertrain, aerospace, and orthopedic customers with powders engineered for higher efficiency and sustainability.

Global Powder Metallurgy Market Trends and Insights

Increasing Preference for Powder Metallurgy in Lightweight E-Powertrain Components

North American OEMs are re-engineering e-powertrains with powder-metallurgy motor cores, gears, and thermal plates that reduce waste and shorten machining cycles. GKN Powder Metallurgy reported that 72% of its 2023 order intake came from propulsion-agnostic parts, confirming a strategic shift toward electrified platforms. Suppliers are also investing in localized battery-grade powders; Soft-magnetic composites cut core losses by up to 20%, giving electric-drive designers a direct efficiency gain. As automakers pursue lighter drivetrains, the powder metallurgy market captures programs once dominated by cast or wrought materials. Standardization of steel-based e-drive powders further streamlines qualification cycles, lowering the entry barrier for second-tier suppliers.

Surge in Demand for Net-Shape Additive Metal Components in Aerospace

European engine and airframe suppliers amplify additive powder consumption to compress lead times and material usage. Collins Aerospace installed two twelve-laser NXG XII 600 machines that slash turbine component delivery from 52 to 8 weeks. Scrap reduction from 50% to over 90% improves inventory turns and carbon intensity, making powder routes competitive against precision casting. A dedicated airworthiness framework from SLM Solutions is helping harmonize process parameters and alloy traceability, easing certification bottlenecks. As the powder metallurgy market becomes entrenched in flight-critical hardware, European service bureaus are expanding nickel-superalloy capacity and diversifying into gamma-titanium powders for next-generation aero-engines.Surge in Demand for Net-Shape Additive Metal Components in Aerospace

Volatility in High-Purity Metal Powder Prices

China introduced export controls on tungsten, tellurium, bismuth, molybdenum, and indium in early 2025, triggering a sharp uptick in spot quotes and creating allocation risk for tool-steel, thermal-management, and magnet-grade powders. Governments are responding with strategic reserves legislation, but project timelines for new mines and refineries constrain short-term relief. Buyers are lengthening contracts and qualifying recycled streams, yet secondary supply cannot fully offset geopolitical disruptions. The powder metallurgy market faces near-term margin pressure until fresh extraction capacity comes online or trade policies stabilize. Energy-intensive ultra-fine powder grades remain particularly exposed because of their limited substitutability.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Localization of Precision Medical Implants Manufacturing

- Defense Modernization Programs Stimulating Refractory Powder Adoption

- Limited Standardization and Qualification Protocols for Safety-Critical Aerospace Parts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The ferrous segment controlled 79% of the powder metallurgy market in 2024 and is projected to rise at 4.62% CAGR through 2030, driven by mature tooling, abundant scrap streams, and robust price-performance economics. Extensive press-and-sinter infrastructure allows high-volume producers to hit densities exceeding 7.4 g/cm3, closing mechanical-property gaps with wrought steels. In parallel, advanced sinter-hardening formulas enable near-net-shape gears and synchronizer hubs that meet e-drive torque loads without secondary heat treatment. Growth is reinforced by hot isostatic pressing that densifies large ferrous turbine disks, increasing appeal in energy and marine engines.

The Powder Metallurgy Market Report Segments the Industry by Material Type (Ferrous and Non-Ferrous), Manufacturing Technology (Press and Sinter, Metal Injection Molding (MIM), and More), Application (Automotive, Industrial Machinery, Electrical and Electronics, Aerospace, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific retained 40% of the global powder metallurgy market share in 2024 and is expected to post the highest 4.8% regional CAGR to 2030, backed by aggressive industrial policy, investment incentives, and fast adoption of additive equipment in China, Japan, and India. China's NMPA clearance for a 3-D-printed tantalum interspinal cage highlights rapid regulatory evolution that accelerates local advanced-powder uptake.

North America is recalibrating its position as EV drivetrains and aerospace rebalance powder consumption. Government funds for critical minerals and harsh-environment materials research prioritize domestic tungsten, niobium, and rare-earth extraction, reducing reliance on politically sensitive imports.

Europe advances through sustainability and digitalization. Hoganas has cut carbon dioxide emissions by 46% since 2018 by transitioning to bio-based reductants and renewable electricity, positioning its powders at the center of low-carbon supply chains. Continental aerospace primes maintain demand for nickel and titanium alloys, while EU defense initiatives raise refractory-powder needs. Eastern European foundries adopt hybrid sinter-binder-jet systems, collaborating with Western machine builders to expand additive capacity. Collectively, these trends reinforce Europe's role as a technology nucleus within the broader powder metallurgy market.

- AMETEK Inc.

- ATI, Inc.

- CNPC POWDER

- CRS Holdings, LLC

- Elementum

- Elmet Technologies

- ERASTEEL

- Fine Sinter Co., Ltd.

- GKN Powder Metallurgy

- Hoganas AB

- Kymera International

- LIBERTY Steel Group

- Metalysis

- Miba AG

- Phoenix Sintered Metals, LLC

- Phoenix Sintered Metals, LLC

- Plansee Group Functions

- POSCO

- Powder Alloy Corporation (PAC)

- Resonac Holdings Corporation

- Rio Tinto

- Sandvik AB

- Sumitomo Electric Industries, Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Preference for Powder Metallurgy in Lightweight E-Powertrain Components among EV OEMs in North America

- 4.2.2 Surge in Demand for Net-Shape Additive Metal Components in Aerospace across Europe

- 4.2.3 Rapid Localization of Precision Medical Implants Manufacturing in Asia-Pacific

- 4.2.4 Defense Modernization Programs Stimulating Adoption of High-Performance Refractory Powders in Middle East

- 4.2.5 Growing Implementation in Electrical and Electromagnetic Applications

- 4.3 Market Restraints

- 4.3.1 Volatility in High-Purity Metal Powder Prices Due to Critical Mineral Supply Constraints

- 4.3.2 Limited Standardization and Qualification Protocols for Safety-Critical Aerospace Parts

- 4.3.3 Competitive Threat from Advanced Casting of Complex Aluminum Components

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value )

- 5.1 By Material Type

- 5.1.1 Ferrous

- 5.1.2 Non-Ferrous

- 5.2 By Manufacturing Technology

- 5.2.1 Press and Sinter

- 5.2.2 Metal Injection Molding (MIM)

- 5.2.3 Additive Manufacturing / Powder Bed Fusion

- 5.2.4 Isostatic Pressing

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Industrial Machinery

- 5.3.3 Electrical and Electronics

- 5.3.4 Aerospace

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Egypt

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 AMETEK Inc.

- 6.4.2 ATI, Inc.

- 6.4.3 CNPC POWDER

- 6.4.4 CRS Holdings, LLC

- 6.4.5 Elementum

- 6.4.6 Elmet Technologies

- 6.4.7 ERASTEEL

- 6.4.8 Fine Sinter Co., Ltd.

- 6.4.9 GKN Powder Metallurgy

- 6.4.10 Hoganas AB

- 6.4.11 Kymera International

- 6.4.12 LIBERTY Steel Group

- 6.4.13 Metalysis

- 6.4.14 Miba AG

- 6.4.15 Phoenix Sintered Metals, LLC

- 6.4.16 Phoenix Sintered Metals, LLC

- 6.4.17 Plansee Group Functions

- 6.4.18 POSCO

- 6.4.19 Powder Alloy Corporation (PAC)

- 6.4.20 Resonac Holdings Corporation

- 6.4.21 Rio Tinto

- 6.4.22 Sandvik AB

- 6.4.23 Sumitomo Electric Industries, Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increasing Adoption of Powder Metallurgy Techniques in Medical Sector