PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851639

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851639

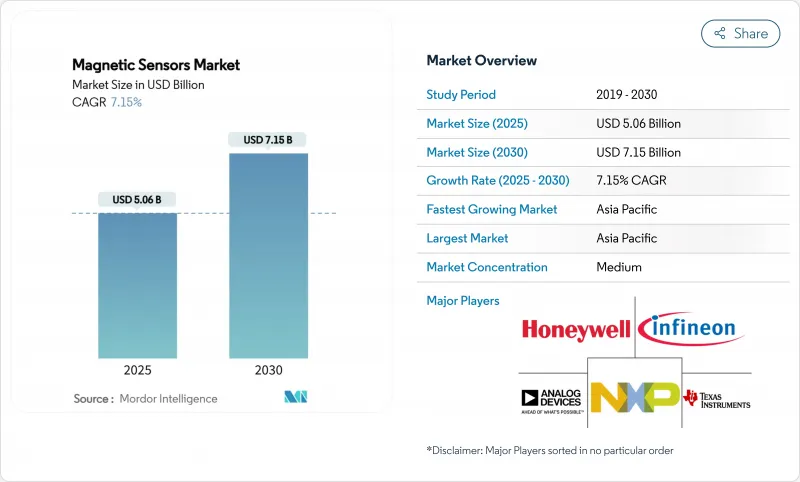

Magnetic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The magnetic sensor market size is worth USD 5.06 billion in 2025 and is forecast to reach USD 7.15 billion by 2030, reflecting a 7.15% CAGR.

Rising electric-vehicle drivetrain mandates, the advance of Industry 4.0 production lines, and expanding 3-axis sensing in consumer devices underpin this steady growth. Automakers are specifying higher-accuracy position and current sensors to meet functional-safety targets, while smartphone and wearable brands integrate miniature tunnel-magnetoresistance (TMR) dies for augmented-reality and indoor-navigation functions. Data-center operators champion quantum-grade TMR heads to lift storage density, pushing suppliers toward premium, high-sensitivity designs. Supply-chain risk around rare-earth magnets remains an overhang, forcing companies to invest in recycling, local processing, and substitute materials. Competitive intensity is moderate as leading vendors focus on vertical integration, TMR portfolio expansion, and digital-output roadmaps to protect margins in an environment of Hall-effect price erosion.

Global Magnetic Sensors Market Trends and Insights

EV drivetrain electrification mandates

Electric-vehicle regulations in the European Union and California spur wider sensor deployment, stretching from rotor position and temperature tracking to battery-management subsystems. Continental's e-Motor Rotor Temperature Sensor trims measurement tolerance to 3 °C, allowing designers to cut rare-earth magnet content while protecting performance assemblymag.com. Such precision supports both compliance targets and cost-containment strategies across EV platforms.

Proliferation of 3-axis magnetic sensing in smartphones and wearables

Handset vendors embed 3-D magnetic sensors to deliver augmented-reality overlays and accurate indoor navigation. Miniature TMR dies meet the angular-accuracy and power requirements, stimulating cross-industry demand spillovers. TDK's Nivio(TM) xMR component measures biomagnetic fields in a footprint smaller than laboratory-grade SQUIDs, hinting at medical-device spill-over potential.

Price erosion in commoditised Hall-effect ICs

Hall-effect devices face rising competition from low-cost Chinese fabs. The 42% fall in neodymium prices since 2024 compounds pressure by eroding the material-cost moat once held by premium suppliers. Vendors therefore channel R&D into differentiated TMR and GMR lines or integrate signal-processing blocks to sustain pricing power.

Other drivers and restraints analyzed in the detailed report include:

- Growing ADAS and e-motor position needs in automotive

- Factory automation shift to Industry 4.0

- Supply-chain concentration in rare-earth magnetics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

TMR sensors are expanding at 8.80% CAGR, the fastest pace among major technologies. Hall-effect solutions still hold 48.0% of the magnetic sensor market share in 2024 due to mature tooling and attractive pricing. Yet automotive safety systems and Industry 4.0 robots now specify sub-degree angular accuracy across -40 °C to +150 °C ranges, a window where TMR excels. Allegro MicroSystems markets XtremeSense(TM) implementations with 10 X sensitivity and 50% lower current draw than Hall-effect peers.

GMR represents a middle path for customers demanding enhanced sensitivity without the cost premium of TMR, while AMR retains a niche in linear industrial encoders requiring simple signal chains. Fluxgate and SQUID devices serve high-end laboratory, defense, and medical equipment. The technology mix suggests Hall-effect incumbency in cost-sensitive lines will persist, but TMR will absorb most incremental value creation within the magnetic sensor market.

Automotive accounted for 56.0% of the magnetic sensor market size in 2024. The proliferation of electric powertrains and ADAS keeps that base stable, yet the standout growth story is data centers. Quantum-grade TMR heads for HDDs and SSDs help hyperscalers raise terabyte density at a 9.60% CAGR. Operators also deploy Hall-based current sensors in power-distribution units to optimize rack-level energy use amid decarbonization targets. Industrial automation contributes steady volume as factories digitize assembly lines, while healthcare opens nascent upside through non-invasive imaging and implant monitoring supported by TDK's biomagnetic innovations.

Magnetic Sensor Market is Segmented by Technology (Hall-Effect, AMR, GMR, TMR, Other Technologies), Application (Automotive, Consumer Electronics, and More), End-Use Industry (Automotive OEMs and Tier-1s, Consumer Electronics OEMs, and More), Output Signal (Digital, Analog), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the magnetic sensor market with 42.0% share in 2024 and is heading toward a 9.40% CAGR, powered by China's semiconductor fabs and Japan's precision sensor know-how. Chinese export curbs on rare-earths create both threat and windfall: domestic fabs gain a captive magnet supply, while export-oriented carmakers scramble for alternate sourcing. Japan's TMR roadmap leverages metrology depth to push sensor miniaturization that feeds both auto and medical verticals. South Korea's storage-device majors lift demand for high-density TMR heads, and India's expanding vehicle output widens the regional customer base.

North America remains pivotal despite material-supply pain points. Allegro MicroSystems booked USD 1.05 billion sales in fiscal 2024, up 38% in e-mobility-linked lines. State incentives for domestic rare-earth processing underpin projects such as Noveon Magnetics' Texas plant, though volumes will lag Asia for several years. Automakers rely heavily on local sensor design centers to meet National Highway Traffic Safety Administration software-update requirements.

- Infineon Technologies AG

- Allegro MicroSystems LLC

- NXP Semiconductors NV

- TDK Corporation

- Honeywell International Inc.

- Analog Devices Inc.

- STMicroelectronics NV

- Murata Manufacturing Co. Ltd

- TE Connectivity Ltd

- Texas Instruments Inc.

- NVE Corporation

- Crocus Technology Inc.

- Omron Corporation

- Asahi Kasei Microdevices (AKM)

- Diodes Incorporated

- Melexis NV

- ams-OSRAM AG

- Sensitec GmbH

- TT Electronics plc

- Robert Bosch GmbH

- Lake Shore Cryotronics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV drivetrain electrification mandates

- 4.2.2 Proliferation of 3-axis magnetic sensing in smartphones and wearables

- 4.2.3 Growing ADAS and e-motor position needs in automotive

- 4.2.4 Factory automation shift to Industry 4.0

- 4.2.5 On-board DC-fast-charging current monitoring

- 4.2.6 Quantum-grade TMR adoption in data-center HDD/SSD heads

- 4.3 Market Restraints

- 4.3.1 Price erosion in commoditised Hall-effect ICs

- 4.3.2 Supply-chain concentration in rare-earth magnetics

- 4.3.3 EMI compliance costs for high-speed electrification platforms

- 4.3.4 IP litigation risk around xMR sensor patents

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Hall-Effect

- 5.1.2 Anisotropic Magnetoresistance (AMR)

- 5.1.3 Giant Magnetoresistance (GMR)

- 5.1.4 Tunnel Magnetoresistance (TMR)

- 5.1.5 Other Technologies

- 5.2 By Application

- 5.2.1 Automotive

- 5.2.2 Consumer Electronics

- 5.2.3 Industrial Automation

- 5.2.4 Healthcare and Medical Devices

- 5.2.5 Aerospace and Defense

- 5.2.6 Data-Center and Server Storage

- 5.2.7 Other Applications

- 5.3 By End-Use Industry

- 5.3.1 Automotive OEMs and Tier-1s

- 5.3.2 Consumer Electronics OEMs

- 5.3.3 Industrial Equipment Manufacturers

- 5.3.4 Energy and Utilities

- 5.3.5 Healthcare OEMs

- 5.3.6 Aerospace and Defense Primes

- 5.4 By Output Signal

- 5.4.1 Digital (IC/SPI, SENT, PSI5)

- 5.4.2 Analog (Linear Voltage/Current)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN-5

- 5.5.4.6 Australia and New Zealand

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Israel

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 UAE

- 5.5.5.5 South Africa

- 5.5.5.6 Nigeria

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Infineon Technologies AG

- 6.4.2 Allegro MicroSystems LLC

- 6.4.3 NXP Semiconductors NV

- 6.4.4 TDK Corporation

- 6.4.5 Honeywell International Inc.

- 6.4.6 Analog Devices Inc.

- 6.4.7 STMicroelectronics NV

- 6.4.8 Murata Manufacturing Co. Ltd

- 6.4.9 TE Connectivity Ltd

- 6.4.10 Texas Instruments Inc.

- 6.4.11 NVE Corporation

- 6.4.12 Crocus Technology Inc.

- 6.4.13 Omron Corporation

- 6.4.14 Asahi Kasei Microdevices (AKM)

- 6.4.15 Diodes Incorporated

- 6.4.16 Melexis NV

- 6.4.17 ams-OSRAM AG

- 6.4.18 Sensitec GmbH

- 6.4.19 TT Electronics plc

- 6.4.20 Robert Bosch GmbH

- 6.4.21 Lake Shore Cryotronics Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment