PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851644

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851644

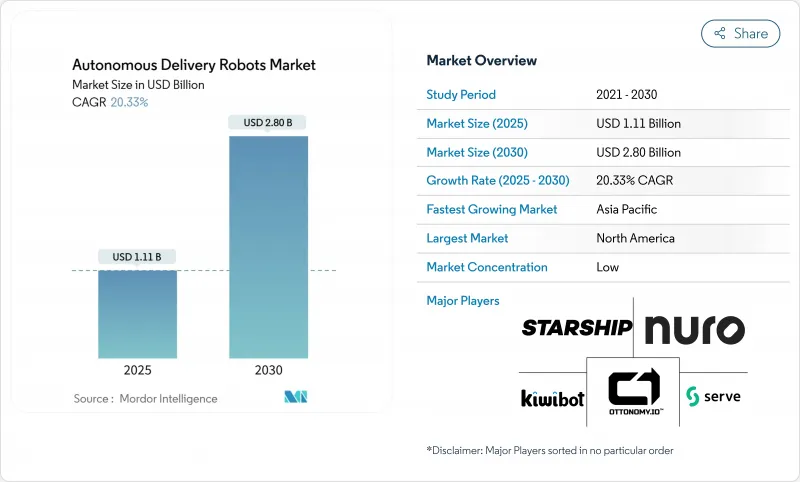

Autonomous Delivery Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The autonomous delivery robots market is currently valued at USD 1.11 billion and is projected to reach USD 2.8 billion by 2030, advancing at a 20.33% CAGR.

Growth is grounded in rising labor shortages, swift technological maturation, and supportive regulations that ease sidewalk deployments. Major logistics spenders continue to view the technology as mission-critical; Amazon alone targets USD 200 billion of automation savings through robotic solutions. North America leads adoption thanks to 32.1% 2024 share, while Asia-Pacific follows at 25% as aging populations increase demand for contact-free healthcare logistics. Outdoor sidewalk robots dominate with 58% share, and hybrid all-terrain units post the fastest 27.8% CAGR, signaling a clear preference for platforms that handle both urban and indoor routes. Competitive activity remains intense as venture-backed specialists scale fleets in partnership with delivery platforms, while automotive incumbents pursue healthcare and industrial niches. Headwinds tied to payload limits and high LiDAR costs persist, yet rapid sensor price declines and new community-engagement strategies point to a wider addressable base over the forecast horizon.

Global Autonomous Delivery Robots Market Trends and Insights

Rapid Expansion of On-Demand Grocery Delivery

On-demand grocery services now anchor sustainable unit economics for autonomous fleets because high order density offsets traditional driver costs. Kroger integrated driverless trucks into its Dallas operations to accelerate fulfillment and trim logistics spend. Retailers also embed in-store shelf-scanning robots to reduce the documented 4.5% revenue leakage linked to stock-outs, as shown by Simbe Robotics' rollout across 60 SpartanNash stores. Together these moves confirm that grocery chains are shifting robotics from pilot status to core infrastructure, widening order volumes available to last-mile robots.

Rising Labor Shortages and Wage Inflation

North American fulfillment centers face acute staffing gaps that push companies toward automated alternatives. The U.S. manufacturing sector projects a 2 million-worker shortage by 2030, and last-mile driver turnover amplifies cost pressure. Falling industrial robot prices-down 50% in the past decade-and further declines predicted by EY strengthen the investment case. High urban delivery density then allows operators to hit utilization targets that yield faster payback on autonomous assets.

High Upfront Cost of LiDAR and Sensor Suites

Navigation hardware often accounts for the largest capital item in a delivery robot. Emerging ultrasonic alternatives such as Sonair cut sensor spend by up to 80% while keeping a 180 X 180 degree detection envelope. Cartken's lidar-free vision stack already operates profitably on public sidewalks, proving that cost-efficient sensing can meet reliability thresholds. Even so, broad rollout waits on regulatory validation of these novel sensor mixes.

Other drivers and restraints analyzed in the detailed report include:

- ESG-Driven Push for Zero-Emission Last-Mile Vehicles

- Aging Population Spurring Intra-Hospital Delivery Automation

- Vandalism and Theft Incidents in South-American Metros

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Outdoor robots generated 58% of 2024 revenue, anchoring the autonomous delivery robots market through well-tested sidewalk operations. This dominance reflects reliable partnerships with food aggregators and local regulators that allow scalable city deployments. Operators continue to refine chassis for curbs, crosswalks, and pedestrian interaction, reinforcing their urban stronghold.

Hybrid all-terrain units expand rapidly at 27.8% CAGR because retail and hospitality customers ask for seamless door-to-door service that crosses thresholds. Suppliers respond by integrating four-wheel steering, modular cargo pods, and ruggedized suspension, a trend evident in Avride's pivot to NVIDIA-powered four-wheel platforms. Indoor service robots maintain niche roles in campuses and hospitals where controlled corridors permit higher autonomy without full street-grade sensing.

Food delivery retained 42.5% revenue share in 2024, proving that frequent small-ticket orders still underpin the autonomous delivery robots market. High repetition optimizes asset utilization and simplifies route learning, supporting fleet-level profitability for platforms such as Serve Robotics.

Grocery and convenience segments rise 24.3% annually as retailers chase sub-hour fulfillment. Robots accommodate temperature-controlled totes and door-step protocols that boost basket size and tip-influenced economics. Parcel courier services also advance, but payload ceilings still limit heavier SKUs, keeping focus on lightweight e-commerce orders for now.

The Autonomous Delivery Robots Market Report is Segmented by Robot Type (Indoor, Outdoor, Hybrid), Application (Food, Grocery, Parcel, and More), Load Capacity (Up To 10kg, 10-25kg, 25-80kg, Above 80kg), End-User (Healthcare, Hotels, Retail, and More), Component (Hardware, Software and More), Propulsion (Electric, Hydrogen, Hybrid), Level of Autonomy, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 32.1% share in 2024, reflecting high wage inflation and a supportive patchwork of state-level rules. California and Texas host the largest urban pilots, with Serve Robotics targeting 2,000 units by year-end 2025 under an Uber Eats framework. College-town deployments add scale; Grubhub and Yandex plan rollouts across 250 campuses, potentially forming the world's densest robot network.

Asia-Pacific followed with a 25% stake as Japan and South Korea accelerate healthcare and smart-city programs. South Korea's sidewalk-friendly legislation caps robot speed at 15 km/h and weight at 500 kg, unlocking commercial trials in apartment complexes and hospitals. Toyota's Potaro system shows the model for intra-hospital use, highlighting APAC's focus on aging-related logistics.

Europe contributes a solid revenue base, aided by stringent ESG mandates that penalize diesel vans in city centers. Starship Technologies operates in Germany and the UK under regulatory exemptions that let slow-moving robots share pedestrian zones. Operators still navigate complex, multi-jurisdiction approval processes, slowing scale, yet the environmental tailwinds keep adoption on a steady path.

- Starship Technologies

- Nuro Inc.

- Kiwibot

- Serve Robotics Inc.

- Ottonomy.IO

- Relay Robotics Inc.

- Postmates Inc. (Serve by Uber)

- Aethon Inc.

- Segway Robotics Inc.

- Neolix

- Udelv Inc.

- JD Logistics (Jian Robots)

- Alibaba Cainiao (Xiaomanlv)

- Yandex Rover

- FedEx Roxo

- Amazon Scout

- Rival Robotics Inc.

- TeleRetail (Aitonomi AG)

- Daxbot

- Locus Robotics (campus variant)

- Kiwi Campus SAS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid expansion of on-demand grocery delivery in urban Asia

- 4.2.2 Rising labor shortages and wage inflation in North-American fulfilment

- 4.2.3 ESG-driven push for zero-emission last-mile vehicles in the EU

- 4.2.4 Aging population spurring intra-hospital delivery automation in Japan

- 4.2.5 24/7 contact-free services demand in Middle-East luxury hotels

- 4.2.6 5G edge-compute enabling higher robot autonomy in dense city cores

- 4.3 Market Restraints

- 4.3.1 Municipal sidewalk regulation variability in US cities

- 4.3.2 Limited payload capacity restricting ROI for bulk goods

- 4.3.3 High upfront cost of LiDAR and sensor suites

- 4.3.4 Vandalism and theft incidents in S-American metros

- 4.4 Value-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Impact of Macro-Trend Analysis

- 4.7 Regulatory Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Robot Type

- 5.1.1 Indoor Service Robots

- 5.1.2 Outdoor Autonomous Delivery Robots

- 5.1.3 Hybrid All-Terrain Robots

- 5.2 By Application

- 5.2.1 Food Delivery

- 5.2.2 Grocery and Convenience Deliveries

- 5.2.3 Parcel and Courier (E-commerce)

- 5.2.4 Healthcare Supply and Medication

- 5.2.5 Hospitality Room-Service

- 5.2.6 Industrial Campus Logistics

- 5.3 By Load Capacity

- 5.3.1 Up to 10 kg

- 5.3.2 10 - 25 kg

- 5.3.3 25 - 80 kg

- 5.3.4 Above 80 kg

- 5.4 By End-User Industry

- 5.4.1 Healthcare Facilities

- 5.4.2 Hospitality and Hotels

- 5.4.3 Retail and E-commerce Logistics

- 5.4.4 Corporates and Academic Campuses

- 5.4.5 Airports and Transportation Hubs

- 5.4.6 Smart Cities and Municipal Agencies

- 5.5 By Component

- 5.5.1 Hardware

- 5.5.2 Software / AI Stack

- 5.5.3 After-Sales Services and Fleet Management

- 5.6 By Propulsion Type

- 5.6.1 Electric Battery

- 5.6.2 Hydrogen Fuel Cell

- 5.6.3 Hybrid Energy Harvesting

- 5.7 By Level of Autonomy

- 5.7.1 Semi-Autonomous (Human-Supervised)

- 5.7.2 Fully Autonomous (Level 4)

- 5.7.3 Swarm/Clustered Autonomous Network (Level 5)

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Chile

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.4 Middle East

- 5.8.4.1 United Arab Emirates

- 5.8.4.2 Saudi Arabia

- 5.8.4.3 Turkey

- 5.8.5 Africa

- 5.8.5.1 South Africa

- 5.8.5.2 Kenya

- 5.8.6 Asia-Pacific

- 5.8.6.1 China

- 5.8.6.2 Australia

- 5.8.6.3 Japan

- 5.8.6.4 Singapore

- 5.8.6.5 India

- 5.8.6.6 South Korea

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Starship Technologies

- 6.4.2 Nuro Inc.

- 6.4.3 Kiwibot

- 6.4.4 Serve Robotics Inc.

- 6.4.5 Ottonomy.IO

- 6.4.6 Relay Robotics Inc.

- 6.4.7 Postmates Inc. (Serve by Uber)

- 6.4.8 Aethon Inc.

- 6.4.9 Segway Robotics Inc.

- 6.4.10 Neolix

- 6.4.11 Udelv Inc.

- 6.4.12 JD Logistics (Jian Robots)

- 6.4.13 Alibaba Cainiao (Xiaomanlv)

- 6.4.14 Yandex Rover

- 6.4.15 FedEx Roxo

- 6.4.16 Amazon Scout

- 6.4.17 Rival Robotics Inc.

- 6.4.18 TeleRetail (Aitonomi AG)

- 6.4.19 Daxbot

- 6.4.20 Locus Robotics (campus variant)

- 6.4.21 Kiwi Campus SAS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment