PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851649

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851649

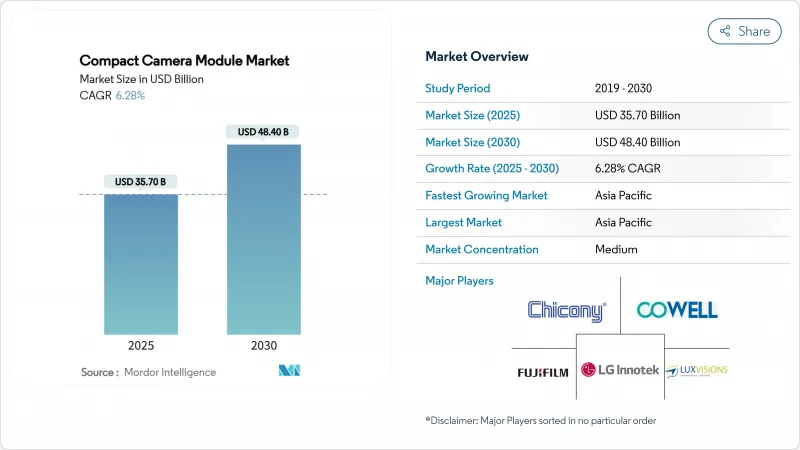

Compact Camera Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The compact camera module market reached USD 35.7 billion in 2025 and is forecast to attain USD 48.4 billion by 2030, advancing at a 6.28% CAGR sony-semicon.com.

Growth is being propelled by multi-camera smartphones, regulatory mandates for advanced driver assistance systems (ADAS), and new use cases in extended reality (XR) and industrial automation. Suppliers are shifting from single units to multi-camera arrays that incorporate periscope zoom, under-display sensors, and short-wave infrared (SWIR) capability, elevating both average selling prices and shipment volumes. Asia-Pacific retains the manufacturing hub advantage, while Vietnam's incentive-backed facilities and Japan's export controls reshape global supply distribution. Patent litigation, notably around tetraprism zoom lenses, underscores how intellectual property remains a decisive competitive lever. Simultaneously, AI-driven process controls such as LG Innotek's defect-cutting platform are compressing production costs and improving yield rates, reinforcing competitiveness.

Global Compact Camera Module Market Trends and Insights

Multi-camera smartphones (>50 MP CIS) accelerating demand in China and India

Smartphone makers are standardizing triple and quad-camera setups, multiplying unit demand as each handset now carries three to four compact camera modules instead of a single assembly. Sony's 50 MP LYT-818 sensor and Samsung's stacked CIS roadmap intensify competition and compress cost curves, enabling mid-tier devices to adopt high-resolution imaging. Chinese brands use camera specs as primary differentiation, pushing foundries such as SmartSens to scale capacity after USD 225 million Series D funding.

ADAS mandates driving surround-view camera installations in EU and United States vehicles

The EU's GSR2 rules, effective July 2024, plus forthcoming US FMVSS 127 standards mandate automatic emergency braking and pedestrian detection systems, igniting demand for multi-camera ADAS suites. Samsung Electro-Mechanics has responded with water-repellent, heated enclosures that secure reliability under harsh conditions. Automotive revenue is projected to outpace the overall compact camera module market at a 13.8% CAGR through 2030.

Japan-China CIS export controls tightening tier-2 supply

Tokyo's updated critical materials list complicates shipments of advanced CMOS components to Chinese plants, forcing companies such as Toppan to relocate certain lines while Vietnamese incentives lure new projects. The transition period creates cost swings and planning uncertainty throughout the compact camera module market supply chain.

Other drivers and restraints analyzed in the detailed report include:

- Industrial and healthcare retrofits with SWIR-enabled CCMs

- XR/AR headsets requiring 6-DOF inside-out tracking cameras

- Low yield in wafer-level optics for 8K video modules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Image sensors delivered 41.3% of 2024 revenue, underscoring their role as the value core of the compact camera module market. Sony's 3D-stacked architecture enables system miniaturization and premium pricing, while Apple's multivendor strategy injects Samsung into a domain long dominated by Sony. Lens makers pursue hybrid glass-plastic blends to withstand extreme automotive temperatures, and assembly houses confront margin pressure as integration complexity rises.

Voice coil motors (VCMs) for autofocus and optical image stabilization register the quickest 7.2% CAGR, driven by vehicle vibration demands and multi-camera smartphones. The segment's momentum shows how downstream requirements ripple back to components, reshaping the compact camera module market investment priorities. The supply shift also mitigates single-supplier risk, smoothing delivery to handset and vehicle OEMs.

Auto-focus modules captured 78.8% in 2024 and continue to gain at 6.3% CAGR, intertwined with premium photography features that require rapid, precise focal adjustment. LG Innotek's tetraprism lens for iPhone 16 Pro exemplifies how flagship requirements cascade through the focus chain. Periscope-zoom actuator disputes, however, expose vulnerability to intellectual-property breakdowns.

Fixed-focus modules still ship into budget handsets, wearable sensors, and certain industrial devices where simplicity and reliability trump optical flexibility. Yet even in these arenas, algorithmic enhancements such as AI-based denoising elevate baseline performance, indirectly sustaining the compact camera module market momentum.

The Compact Camera Module Market Report is Segmented by Component (Image Sensor, Lens, Camera Module Assembly, and VCM (AF and OIS)), Focus Type (Auto-Focus, and Fixed-Focus), Pixel Resolution (Upto 8 MP, 9-20 MP, 21-48 MP, and Above 48 MP), End-Use Application (Mobile, Consumer Electronics, Automotive, Healthcare, Security and Surveillance, and Industrial), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific maintained 66.8% share in 2024 due to integrated supply chains spanning wafer fabrication to final assembly. China spearheads investment in advanced sensors, South Korea innovates in AI-optimized production, and Vietnam scales with incentive-laden facilities that diversify risk away from concentrated coastal Chinese hubs.

North America and Europe form premium application centers. The EU's GSR2 regulation secures long-term demand for automotive camera arrays, while US firms pioneer XR camera technologies through patent-heavy R&D.

The Middle East and Africa, though starting from a smaller base, exhibit the fastest 7.3% CAGR as smartphone penetration and vehicle safety rules rise. Investment in 5G networks and assembly clusters supports steadily improving ecosystem maturity, signaling incremental contribution to the compact camera module market over the forecast horizon.

- LG Innotek Co., Ltd

- Samsung Electro-Mechanics Co., Ltd

- Sunny Optical Technology (Group) Co., Ltd

- OFilm Group Co., Ltd

- Sharp Corp.

- Chicony Electronics Co., Ltd

- Cowell E Holdings Inc.

- Primax Electronics Ltd

- Sony Corp.

- STMicroelectronics N.V.

- ams OSRAM AG

- OmniVision Technologies Inc.

- Fujifilm Corp.

- Largan Precision Co., Ltd

- Hon Hai Precision (Foxconn)

- LuxVisions Innovation Limited (Lite-On Technology Corporation)

- Leica Camera AG (Leica Microsystems Imaging Solutions)

- Teledyne Lumenera

- Leopard Imaging Inc.

- CM Technology Co., Ltd

- Fujikura Ltd

- Canon Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Multi-Camera Smartphones (Above 50 MP CIS) Accelerating Demand in China and India

- 4.2.2 ADAS Mandates Driving Surround-View Camera Installations in EU and United States Vehicles

- 4.2.3 Industrial and Healthcare Retrofits with SWIR-Enabled CCMs

- 4.2.4 XR/AR Headsets Requiring 6-DOF Inside-Out Tracking Cameras

- 4.2.5 Adoption of Optical Under-Display Selfie Modules by Korean OEMs

- 4.2.6 Vietnam Government Incentives for Export-Oriented CCM Assembly

- 4.3 Market Restraints

- 4.3.1 Japan-China CIS Export Controls Tightening Tier-2 Supply

- 4.3.2 Low Yield in Wafer-Level Optics for 8 K Video Modules

- 4.3.3 Patent Wars over Periscope-Zoom Actuators

- 4.3.4 Copper-Driven Shortfall in Automotive-Grade VCSEL Coils

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.5.1 Component-wise Technological Advancements

- 4.5.2 Average Cameras per Device - Smartphones vs. Light Vehicles

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Image Sensor

- 5.1.2 Lens

- 5.1.3 Camera Module Assembly

- 5.1.4 VCM (AF and OIS)

- 5.2 By Focus Type

- 5.2.1 Auto-Focus

- 5.2.2 Fixed-Focus

- 5.3 By Pixel Resolution

- 5.3.1 Upto 8 MP

- 5.3.2 9-20 MP

- 5.3.3 21-48 MP

- 5.3.4 Above 48 MP

- 5.4 By End-use Application

- 5.4.1 Mobile

- 5.4.2 Consumer Electronics (Ex-Mobile)

- 5.4.3 Automotive

- 5.4.4 Healthcare

- 5.4.5 Security and Surveillance

- 5.4.6 Industrial

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Southeast Asia

- 5.5.3.6 Rest of Asia-Pacific-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 LG Innotek Co., Ltd

- 6.4.2 Samsung Electro-Mechanics Co., Ltd

- 6.4.3 Sunny Optical Technology (Group) Co., Ltd

- 6.4.4 OFilm Group Co., Ltd

- 6.4.5 Sharp Corp.

- 6.4.6 Chicony Electronics Co., Ltd

- 6.4.7 Cowell E Holdings Inc.

- 6.4.8 Primax Electronics Ltd

- 6.4.9 Sony Corp.

- 6.4.10 STMicroelectronics N.V.

- 6.4.11 ams OSRAM AG

- 6.4.12 OmniVision Technologies Inc.

- 6.4.13 Fujifilm Corp.

- 6.4.14 Largan Precision Co., Ltd

- 6.4.15 Hon Hai Precision (Foxconn)

- 6.4.16 LuxVisions Innovation Limited (Lite-On Technology Corporation)

- 6.4.17 Leica Camera AG (Leica Microsystems Imaging Solutions)

- 6.4.18 Teledyne Lumenera

- 6.4.19 Leopard Imaging Inc.

- 6.4.20 CM Technology Co., Ltd

- 6.4.21 Fujikura Ltd

- 6.4.22 Canon Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment