PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851650

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851650

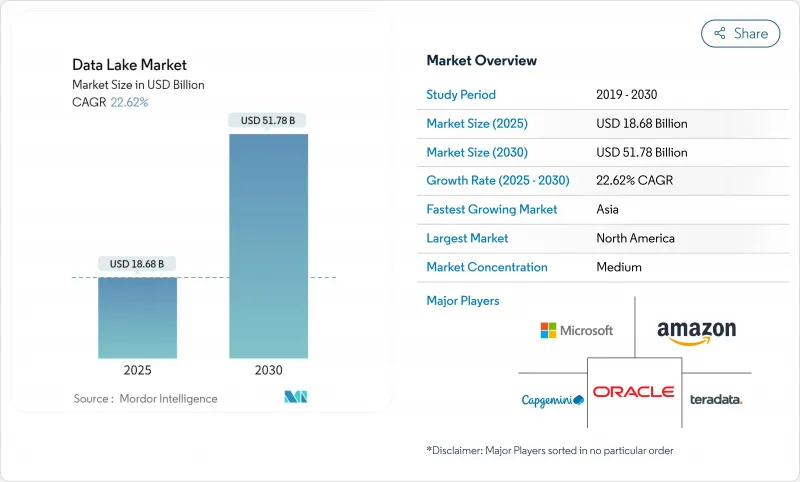

Data Lake - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The data lakes market is valued at USD 18.68 billion in 2025 and is on track to reach USD 51.78 billion by 2030, registering a 22.62% CAGR.

Growth stems from surging unstructured data volumes generated by generative-AI pipelines, expanding regulatory record-keeping mandates, and the shift toward lakehouse architectures that collapse lake and warehouse footprints into a single tier. Fortune 500 firms report 35-40% total-cost savings after embracing lakehouses, while real-time ESG and risk-stress workloads are extending use cases into industrial and financial domains. Serverless open-table formats now anchor multi-cloud portability strategies, and automated governance layers are emerging to prevent "swamp" pitfalls without throttling innovation.

Global Data Lake Market Trends and Insights

Explosion of unstructured and multimodal data from GenAI workloads

Generative-AI applications create vast image, audio, and text payloads that demand schema-on-read storage. Enterprises expect 30% of the global 175 zettabyte data sphere to require real-time processing by 2025, a profile unsuited to rigid warehouses. Data lakes therefore become the default landing zone for multi-modal corpora used in prompt-engineering loops.Google Cloud's lakehouse blueprint shows how native-format storage paired with vector indexing accelerates foundation-model fine-tuning while lowering storage bills. Firms delaying adoption risk slower innovation cycles and higher unit-costs on AI workloads.

Data-residency mandates in Europe accelerating cloud-based lake adoption

The EU Data Governance Act and Data Act compel organizations to localize sensitive workloads. Hyperscalers are responding: AWS is investing EUR 7.8 billion in a sovereign-cloud region that ships with embedded data-location controls. Enterprises now deploy region-segmented data lakes that meet residency rules yet remain queryable through federated engines, sparking demand for lineage-rich metadata catalogs capable of surfacing cross-border data usage in audit reports.

Metadata drift creating "data swamps"

When ingestion outpaces catalog updates, data lakes devolve into unsearchable repositories. By 2025, global data volume will reach 163 zettabytes, heightening the risk of siloed files with missing context. Enterprises are responding by adopting automated lineage trackers such as Unity Catalog, which logs every read-write and flags orphaned assets. Without similar controls, governance overhead can erase savings projected from lakehouse consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Lakehouse convergence delivering 35-40% TCO savings

- Serverless table formats unlocking multi-cloud portability

- Skilled lake-engineering talent shortfall in emerging regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 70% of data lakes market revenue in 2024, equating to a data lakes market size of USD 13.08 billion. The dominance comes from enterprises standardizing on storage engines, query accelerators, and governance suites that form the backbone of AI-ready environments. Vendors bundle cost-optimizer dashboards, automated tiering, and native open-table support, maintaining relevance as workloads evolve.

The services sub-segment is racing ahead at a 25.8% CAGR to 2030, reflecting demand for migration blueprints, performance tuning, and 24X7 managed operations. Many firms lack staff who can re-platform legacy Hadoop estates, so they contract specialists that promise predictable SLA outcomes. The tight talent market ensures professional-services bookings will keep growing faster than the overall data lakes market

Cloud deployments captured 65% of the data lakes market share in 2024 as organizations sought instant scalability and integrated security. Elastic object stores like Amazon S3 eliminate CapEx while delivering lifecycle automation that auto-tiers cold data to low-cost classes. Analytics engines then spin up on demand, keeping compute spend aligned with project tempo.

Hybrid and multi-cloud configurations are expanding at 24% CAGR to 2030. Open-table formats let one metadata definition span on-prem and public-cloud buckets, slashing replication needs. Regional compliance rules further fuel hybrid strategies, as firms pin regulated workloads in sovereign regions yet still query them through cross-cloud fabrics. As a result, the data lakes market size for hybrid environments is rising in lockstep with sovereign-cloud launches.

The Data Lakes Market Report is Segmented by Offering (Solutions, and Services), Deployment (Cloud, and Hybrid/Multi-Cloud), Organization Size (Large Enterprises, and SMEs), Business Function (Operations and Supply-Chain, Finance and Risk, and More), End-User Vertical (IT and Telecom, Healthcare and Life Sciences, and More), and Geography (North America, Asia, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38% of 2024 revenue and continues to set benchmarks in architecture maturity. Financial institutions lengthen time-series retention to meet evolving stress-test templates, while hospital networks build multimodal patient graphs that underpin AI-driven diagnostics. Venture capital also fuels governance-start-up formation, ensuring a vibrant ecosystem.

Asia-Pacific is the fastest-expanding region, clocking a 24.1% CAGR through 2030. Governments in Japan, India, and Singapore sponsor sovereign-cloud projects, spurring demand for region-compliant lake zones. Telcos in China analyze massive 5G logs for capacity planning, whereas Indonesian fintechs share fraud-intelligence lakes to curb cybercrime. Vendors establishing APAC headquarters, such as Wasabi in Japan, aim to catch the projected 36% IaaS upturn.

Europe accelerates adoption under strict data-sovereignty mandates. The European Strategy for Data drives investment in local hosting, and AWS will open a Brandenburg region by late 2025 to satisfy residency rules. Manufacturers store real-time Scope-3 emissions for CSRD reporting, and banks refine Basel III calculations inside audit-ready lakes. The European Banking Authority's 2025 stress-test templates reinforce technical requirements that lakehouses fulfill.

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Oracle Corporation

- Snowflake Inc.

- SAP SE

- Cloudera Inc.

- Teradata Corporation

- Informatica Inc.

- Databricks Inc.

- Hitachi Vantara LLC

- Dell Technologies Inc.

- Atos SE

- SAS Institute Inc.

- Zaloni Inc.

- Dremio Corporation

- Qubole Inc.

- Talend SA

- HPE (Ezmeral)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of Unstructured and Multimodal Data from GenAI Workloads

- 4.2.2 Data-Residency Mandates in Europe Accelerating Cloud-based Lake Adoption

- 4.2.3 Lakehouse Convergence Driving 35-40% TCO Savings for Fortune-500 Firms

- 4.2.4 Serverless Table Formats Unlocking Multi-Cloud Portability

- 4.2.5 Real-Time ESG Scope-3 Data Capture Requirements in Industrial Sector

- 4.2.6 Regulatory Stress-Testing in Financial Services Demanding Decade-Scale Tick Data Retention

- 4.3 Market Restraints

- 4.3.1 Metadata Drift Creating "Data Swamps" and Raising Governance Cost

- 4.3.2 Skilled Lake Engineering Talent Shortfall in Emerging Regions

- 4.3.3 Latency-Sensitive Workloads Still Favoring Warehouses over Lakes

- 4.3.4 Opaque Consumption-Based Cloud Pricing Complicating Budget Forecasts

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Data Discovery and Cataloging

- 5.1.1.2 Data Integration and ETL/ELT

- 5.1.1.3 Analytics and Visualization Tools

- 5.1.1.4 Governance and Security Platforms

- 5.1.2 Services

- 5.1.2.1 Professional Services (Consulting, Integration)

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.1.1 Public Cloud

- 5.2.1.2 Private Cloud

- 5.2.1.3 Hybrid/Multi-Cloud

- 5.2.2 On-Premise

- 5.2.1 Cloud

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Mid-Size Enterprises (SMEs)

- 5.4 By Business Function

- 5.4.1 Operations and Supply-Chain

- 5.4.2 Finance and Risk

- 5.4.3 Sales and Marketing

- 5.4.4 Human Resources

- 5.5 By End-User Vertical

- 5.5.1 IT and Telecom

- 5.5.2 BFSI

- 5.5.3 Healthcare and Life Sciences

- 5.5.4 Retail and E-commerce

- 5.5.5 Manufacturing and Industrial

- 5.5.6 Media and Entertainment

- 5.5.7 Government and Public Sector

- 5.5.8 Energy and Utilities

- 5.5.9 Others (Education, Hospitality)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Peru

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 Australia

- 5.6.4.5 New Zealand

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Amazon Web Services (AWS)

- 6.3.2 Microsoft Corporation

- 6.3.3 Google LLC

- 6.3.4 IBM Corporation

- 6.3.5 Oracle Corporation

- 6.3.6 Snowflake Inc.

- 6.3.7 SAP SE

- 6.3.8 Cloudera Inc.

- 6.3.9 Teradata Corporation

- 6.3.10 Informatica Inc.

- 6.3.11 Databricks Inc.

- 6.3.12 Hitachi Vantara LLC

- 6.3.13 Dell Technologies Inc.

- 6.3.14 Atos SE

- 6.3.15 SAS Institute Inc.

- 6.3.16 Zaloni Inc.

- 6.3.17 Dremio Corporation

- 6.3.18 Qubole Inc.

- 6.3.19 Talend SA

- 6.3.20 HPE (Ezmeral)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment