PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851653

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851653

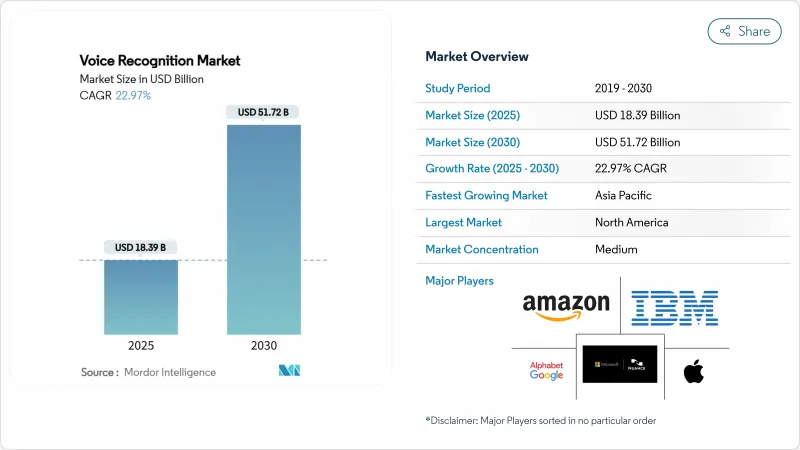

Voice Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global voice recognition market size reached USD 18.39 billion in 2025 and is forecast to advance at a 22.97% CAGR to attain USD 51.72 billion by 2030.

Market expansion reflects three concurrent forces: the rapid roll-out of edge artificial intelligence (AI) chipsets, regulatory pressure for modernising emergency communications networks, and enterprise migration to voice biometrics for customer authentication. Software-centric architectures now dominate because 70.7% of market value sits in software development kits and application-programming-interface platforms, while cloud deployment accounts for 62.1% of implementations in 2024. Regionally, Asia led with 32.5% market share in 2024 on the back of multilingual interface demand and strong chip manufacturing ecosystems; speech recognition technology remained the principal technology pillar with 81.2% share, yet embedded on-device processing delivered the fastest 25% CAGR, showing a decisive shift from cloud-only designs to hybrid or fully local inference engines.

Global Voice Recognition Market Trends and Insights

Explosion of Voice-AI Chips in Edge Devices across Asia

The release of 14 offline AI speech chips by Chipintelli and MediaTek's MR Breeze ASR 25 model signal escalating investment in specialised silicon optimised for regional languages. Localisation delivers lower latency, resolves privacy concerns tied to cloud streaming, and entrenches domestic supply chains that historically depended on North American hyperscalers. Asian semiconductor firms leverage this advantage to offer device OEMs turnkey voice stacks that handle code-switching in markets such as Indonesia, Vietnam, and India, reinforcing the region's leadership in edge inference innovation.

Regulatory Push for Voice-Enabled 911 and Emergency Dispatch Upgrades in North America

New FCC rules obligate US carriers to route 911 calls via IP-based Session Initiation Protocol, cut misrouting below a 165-meter radius at 90% confidence, and support real-time text and video. Voice recognition vendors positioned around emergency services gain a predictable revenue ramp because compliance deadlines fall within a 6-12-month horizon for nationwide and regional operators. The mandate creates a template likely to influence European public safety networks, expanding total addressable demand for voice analytics that enrich incident data with transcribed speech and metadata.

Accent and Dialect Recognition Gaps Limiting Adoption in Africa

Tests across 93 African accents showed medical entity error rates that still required 25-34% refinement via accent-specific fine-tuning. NaijaVoices' 1,800-hour dataset cut word-error rates for Whisper models by 75.86%, but the cost and complexity of curating culturally rich corpora slow commercial roll-outs. Intron Health's USD 1.6 million seed round underlines investor recognition of the problem, yet it also highlights the capital demands of localised model training.

Other drivers and restraints analyzed in the detailed report include:

- Automotive OEM Shift to Embedded Voice OS for Cockpit Personalisation

- BFSI Adoption of Voice Biometrics to Replace Knowledge-Based Authentication in Europe

- Privacy Regulations (GDPR, India DPDP) Restricting Cloud Voice-Data Retention

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud delivery generated 62.1% of global revenue in 2024, and that share is projected to widen as enterprises prioritise rapid rollout, continuous model updates, and broad language coverage. Financial institutions and healthcare providers increasingly select hybrid architectures that keep raw recordings on premises but pool model-training insights in the cloud. The approach balances compliance with the performance gains of aggregated learning. On-premise deployments therefore remain relevant for sovereign-data mandates, explaining why the segment still posts double-digit growth through 2030.

Demand for high-availability voice endpoints has pushed hyperscalers to expose turnkey APIs. Consequently, total cost of ownership falls for mid-sized enterprises, and barriers to entry lower for independent developers. The result is a wider application funnel for voice recognition market adoption, extending beyond consumer devices into process automation, logistics, and field-service workflows. The voice recognition market size for cloud implementations is set to approach USD 32 billion by 2030, reflecting both new workloads and expansion of existing deployments.

Software platforms captured 70.7% of global spend in 2024, a decisive margin that underpins the industry's pivot from proprietary hardware to modular, developer-friendly tooling. The availability of RESTful APIs and pre-built language models removes the need for bespoke silicon in many use cases. Services, although representing a smaller base, rise at 23.7% CAGR as enterprises engage specialist vendors for domain tuning, accent adaptation, and security compliance.

Hardware maintains relevance where edge latency, offline availability, or acoustic beam-forming matter, such as in automotive infotainment or industrial head-mounted displays. Yet most new entrants bypass hardware by consuming platform-as-a-service offerings, illustrating an expanding gap between horizontally oriented software providers and vertically integrated hardware specialists.

Voice Recognition Market is Segmented by Deployment (Cloud, On-Premise), Component (Software/SDK, Hardware, Services), Technology (Speech Recognition, Voice Biometrics, Edge Voice AI), Device Type (Smartphones, Smart Speakers, Automotive, Wearables, POS), Application (Authentication, Voice Search, and More), End-User Vertical (Automotive, BFSI, and Morel), and by Geography. Market Forecasts in Value (USD).

Geography Analysis

Asia generated 32.5% of 2024 turnover, reflecting the region's semiconductor capacity and linguistic diversity. Domestic policy supports AI acceleration; Japan's initiative to fund Southeast Asian language models is one example. North America remains technology's early-adopter hub but ceded share to Asia because of aggressive localisation and lower device costs. Europe grew steadily, influenced by automotive and BFSI thematic adoption.

The Middle East exhibits the quickest 23.1% CAGR as Gulf smart-city programmes embed conversational kiosks in citizen-services infrastructure. South America records mid-teens growth from e-commerce voice search and banking authentication. Africa faces a lag because accent diversity complicates universal models; however, donor-funded language projects and telecom upgrades may unlock latent demand from 2027 onward.

- Apple Inc.

- Alphabet Inc. (Google LLC)

- Amazon.com Inc.

- Nuance Communications Inc. (Microsoft)

- IBM Corporation

- Baidu Inc.

- Samsung Electronics Co. Ltd.

- SoundHound AI Inc.

- iFLYTEK Co. Ltd.

- Sensory Inc.

- Cerence Inc.

- Verint Systems Inc.

- NICE Ltd.

- ElevenLabs

- Auraya Systems Pty Ltd.

- Intron Health

- PlayAI

- Mobvoi Information Technology Co. Ltd.

- Deepgram Inc.

- AssemblyAI Inc.

- Speechmatics Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of Voice-AI Chips in Edge Devices across Asia

- 4.2.2 Regulatory Push for Voice-Enabled 911 and Emergency Dispatch Upgrades in North America

- 4.2.3 Automotive OEM Shift to Embedded Voice OS for Cockpit Personalisation

- 4.2.4 BFSI Adoption of Voice Biometrics to Replace Knowledge-Based Authentication in Europe

- 4.2.5 Rapid Proliferation of Voice Commerce in Smart-Speaker Centric Households

- 4.2.6 Growth of Multilingual Voice UX Demand in Emerging APAC Markets

- 4.3 Market Restraints

- 4.3.1 Accent and Dialect Recognition Gaps Limiting Adoption in Africa

- 4.3.2 Privacy Regulations (GDPR, India DPDP) Restricting Cloud Voice Data Retention

- 4.3.3 High Cost of Annotated Domain-Specific Speech Corpora

- 4.3.4 Persistent Accuracy Lags in Noisy Industrial Environments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Component

- 5.2.1 Software/SDK

- 5.2.2 Hardware (ASIC, DSP, Microphone Arrays)

- 5.2.3 Services (Managed and Professional)

- 5.3 By Technology

- 5.3.1 Speech Recognition

- 5.3.2 Speaker/Voice Biometrics

- 5.3.3 Embedded/Edge Voice AI

- 5.4 By Device Type

- 5.4.1 Smartphones and Tablets

- 5.4.2 Smart Speakers and Displays

- 5.4.3 Automotive Infotainment and Telematics

- 5.4.4 Wearables (TWS, Smart-watch, AR/VR)

- 5.4.5 Commercial Kiosks and POS

- 5.5 By Application

- 5.5.1 Authentication and Security

- 5.5.2 Voice Search and Command

- 5.5.3 Transcription and Captioning

- 5.5.4 Virtual Assistants and Chatbots

- 5.5.5 Medical Documentation

- 5.6 By End-user Vertical

- 5.6.1 Automotive

- 5.6.2 Banking and Financial Services

- 5.6.3 Telecommunications

- 5.6.4 Healthcare Providers

- 5.6.5 Government and Defence

- 5.6.6 Consumer Electronics

- 5.6.7 Retail and E-commerce

- 5.6.8 Industrial and Manufacturing

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 ASEAN

- 5.7.4.6 Australia

- 5.7.4.7 New Zealand

- 5.7.4.8 Rest of Asia Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 GCC

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Israel

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Egypt

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Apple Inc.

- 6.4.2 Alphabet Inc. (Google LLC)

- 6.4.3 Amazon.com Inc.

- 6.4.4 Nuance Communications Inc. (Microsoft)

- 6.4.5 IBM Corporation

- 6.4.6 Baidu Inc.

- 6.4.7 Samsung Electronics Co. Ltd.

- 6.4.8 SoundHound AI Inc.

- 6.4.9 iFLYTEK Co. Ltd.

- 6.4.10 Sensory Inc.

- 6.4.11 Cerence Inc.

- 6.4.12 Verint Systems Inc.

- 6.4.13 NICE Ltd.

- 6.4.14 ElevenLabs

- 6.4.15 Auraya Systems Pty Ltd.

- 6.4.16 Intron Health

- 6.4.17 PlayAI

- 6.4.18 Mobvoi Information Technology Co. Ltd.

- 6.4.19 Deepgram Inc.

- 6.4.20 AssemblyAI Inc.

- 6.4.21 Speechmatics Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment