PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851654

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851654

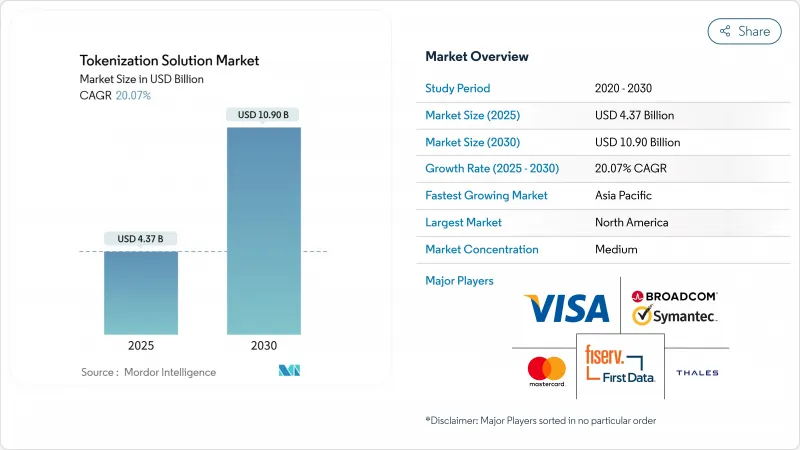

Tokenization Solution - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The tokenization solution market size stands at USD 4.37 billion in 2025 and is forecast to reach USD 10.90 billion by 2030, reflecting a 20.07% CAGR across the period.

Investment momentum stems from widespread digital-first commerce, stricter payment security mandates, and rapid shifts toward cloud-native infrastructure. Mandatory PCI DSS 4.0 timelines, especially in the United States and Canada, have compelled enterprises to prioritise token vault modernisation or vaultless migration, compressing decision cycles and accelerating deployments. Converging regulatory urgency with the promise of operational agility positions the tokenization solution market as a cornerstone of next-generation payment architecture. At a geographic level, North America accounts for 39% of 2024 revenue, yet Asia Pacific is compounding fastest on the back of mobile wallet ubiquity and government-backed real-time payment rails. Competitive intensity is rising as fintechs pioneer vaultless designs and large processors embed network tokenisation directly into issuer services.

Global Tokenization Solution Market Trends and Insights

Surge in Tokenisation Adoption for Contactless & Mobile Wallet Payments in Asia

Mobile payment transactions in Asia Pacific more than doubled year-on-year in early 2024, drawing tokenisation into the region's core payments stack. Japan's plan for a joint ASEAN QR network by fiscal 2025, covering 2 million domestic merchants, showcases the scale at which cross-wallet interoperability now depends on network tokens. China's mobile payment throughput, projected above CNY 1,100 trillion by 2029, relies on tokenised credentials to secure super-app ecosystems. With Japan's cashless ratio topping 39.3% in 2024, regional policy targets drive merchants toward tokenisation as a precondition for subsidy eligibility. This network effect compels global processors to deepen Asian partnerships to retain addressable volume.

Mandatory PCI DSS 4.0 Compliance Deadlines Boosting Tokenisation Investments in North America

PCI DSS 4.0 elevates cardholder-data obligations, making tokenisation the quickest path to scope reduction and audit-cost containment. Enterprises that tokenise sensitive fields can quarantine fewer systems under annual assessment, freeing security budgets for proactive threat-hunting and zero-trust initiatives. Continuous-monitoring clauses in the new standard align with real-time analytics embedded in modern token platforms, allowing boards to evidence compliance on demand. Cloud-delivered tokenisation services further compress deployment timelines, accelerating time-to-value for omnichannel retailers and fintech issuers.

Interoperability Gaps Among Proprietary Token Service Providers

Disparate token formats and proprietary APIs hinder multi-rail payment acceptance, elevating integration cost and vendor-lock-in risk. Government agencies mandated to diversify suppliers must often maintain parallel token infrastructures, draining CapEx and complicating governance. Absence of a universal token exchange protocol also impedes cross-border commerce, where mismatched schemes require complex translation gateways that inflate processing fees.

Other drivers and restraints analyzed in the detailed report include:

- Rising Fraud Losses in Card-Not-Present Transactions Driving Vaultless Tokenisation Uptake in Europe

- Expansion of BNPL Platforms Demanding Tokenised Credentials Integration

- High Latency Concerns in Token Vault Architectures for High-Frequency Trading Firms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions accounted for 72% of 2024 revenue, testifying to the foundational role of platform software in the tokenization solution market. Professional and managed services are forecast to grow at a 20.90% CAGR, aided by scarce in-house expertise and continuous compliance obligations that favour outsourcing. Enterprises leverage advisory engagements to map data flows and reduce PCI exposure, then transition to ongoing service contracts for token maintenance. Tokenization-as-a-Service frameworks blur the boundary between product and service, lowering entry barriers for mid-market adopters. AI-enabled documentation tools, such as Marqeta Docs AI, further accelerate onboarding by automating code-snippet generation.

The solutions segment remains critical for enterprises demanding extensibility into proprietary payment flows or hybrid on-premise deployments. Feature roadmaps increasingly embed artificial-intelligence analytics that surface fraud patterns within the token stream, turning passive controls into active decision engines. Vendors that pair extensible APIs with compliance attestation are best placed to lock in long-cycle enterprise accounts.

Cloud held 64% of 2024 revenue and will sustain leadership with a 21.50% CAGR, reflecting the structural advantage of global point-of-presence coverage and elastic scaling. Integrations with existing identity-and-access-management stacks allow security teams to unify policy enforcement, speeding audits and breach preparation. Edge compute extensions reduce network hops, closing the latency gap that once favoured on-premise deployments. Post-quantum cryptography roadmaps hosted by hyperscalers further tip the balance by de-risking future algorithmic transitions.

On-premise installations persist in industries with strict residency mandates or mainframe dependencies. Hybrid architectures offer a middle path, retaining local key custody while bursting tokenisation workloads to the cloud during seasonal spikes. As zero-trust frameworks mature, even conservative sectors may offload non-core workloads, shrinking the on-premise footprint over the forecast horizon.

The Tokenization Solution Market Report is Segmented by Component (Solutions, Services), Deployment Mode (On-Premise, Cloud), Tokenization Technique (Vaulted Tokenization, and More), Application Area (Payment Security, Customer Authentication, and More), End-User Industry (BFSI, Retail and E-Commerce, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 39% of 2024 revenue for the tokenization solution market, anchored by early cloud adoption and a strict payment-security compliance regime. PCI DSS 4.0 deadlines have compressed upgrade cycles, tipping many late adopters toward managed tokenisation services. Market saturation is approaching in core credit-card verticals, so providers are pivoting to adjacent use cases such as healthcare payments and government disbursements.

Asia Pacific is pacing the field with a 20.40% CAGR through 2030, catalysed by mobile-wallet penetration and public-sector digitalisation funds. Japan's ASEAN QR project and Alipay+ merchant expansion exemplify how cross-border wallets leverage network tokens for currency-agnostic settlement. China's super-app ecosystems continue to scale, demanding ultra-high-throughput token engines capable of handling peak shopping festivals. India's unified payments infrastructure offers fertile ground for tokenisation providers that can tailor to local Aadhaar identity norms.

Europe remains a steady adopter, balancing GDPR constraints with strong fraud-prevention incentives. Vaultless implementations resonate with regulators wary of centralised data stores, while national digital-ID programmes open fresh opportunities for citizen-service tokenisation.Fragmented rule sets still complicate pan-European roll-outs, but scheme-level harmonisation is gradually lowering technical barriers.

- Thales Group

- Broadcom Inc. (Symantec Enterprise)

- Visa Inc.

- Mastercard Inc.

- Fiserv Inc. (First Data)

- Worldpay LLC (FIS)

- PayPal Holdings Inc. (Braintree)

- American Express Company

- Protegrity USA Inc.

- TokenEx LLC

- Entrust Corporation

- Rambus Inc. (Bell ID)

- Sequent Software Inc.

- CardConnect Corporation

- Bluefin Payment Systems

- Marqeta Inc.

- Adyen N.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Tokenization Adoption for Contactless and Mobile Wallet Payments in Asia

- 4.2.2 Mandatory PCI DSS 4.0 Compliance Deadlines Boosting Tokenization Investments in North America

- 4.2.3 Rising Fraud Losses in Card-Not-Present Transactions Driving Vaultless Tokenization Uptake in Europe

- 4.2.4 Expansion of "Buy Now Pay Later" Platforms Demanding Tokenized Credentials Integration

- 4.2.5 Emergence of Network Tokenization Programs by Card Schemes Accelerating Merchant Enrolment

- 4.3 Market Restraints

- 4.3.1 Interoperability Gaps among Proprietary Token Service Providers

- 4.3.2 High Latency Concerns in Token Vault Architectures for High-Frequency Trading Firms

- 4.3.3 Limited Awareness of Non-Payment Tokenization Use-Cases in Mid-Tier Healthcare Providers

- 4.3.4 Vendor Lock-in Risk Restricting Adoption by Government Agencies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.5.1 Regulatory Landscape

- 4.5.2 Technological Innovations (Tokenization-as-a-Service, Cloud HSM)

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Tokenization Technique

- 5.3.1 Vaulted Tokenization

- 5.3.2 Vaultless Tokenization

- 5.4 By Application Area

- 5.4.1 Payment Security

- 5.4.2 Customer Authentication

- 5.4.3 Fraud Prevention and Risk Management

- 5.4.4 Compliance and Audit Management

- 5.4.5 Others

- 5.5 By End-User Industry

- 5.5.1 BFSI

- 5.5.2 Retail and E-commerce

- 5.5.3 IT and Telecommunications

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Transportation and Logistics

- 5.5.6 Government and Public Sector

- 5.5.7 Energy and Utilities

- 5.5.8 Media and Entertainment

- 5.5.9 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Nordics

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Australia

- 5.6.4.7 New Zealand

- 5.6.4.8 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Funding

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Thales Group

- 6.4.2 Broadcom Inc. (Symantec Enterprise)

- 6.4.3 Visa Inc.

- 6.4.4 Mastercard Inc.

- 6.4.5 Fiserv Inc. (First Data)

- 6.4.6 Worldpay LLC (FIS)

- 6.4.7 PayPal Holdings Inc. (Braintree)

- 6.4.8 American Express Company

- 6.4.9 Protegrity USA Inc.

- 6.4.10 TokenEx LLC

- 6.4.11 Entrust Corporation

- 6.4.12 Rambus Inc. (Bell ID)

- 6.4.13 Sequent Software Inc.

- 6.4.14 CardConnect Corporation

- 6.4.15 Bluefin Payment Systems

- 6.4.16 Marqeta Inc.

- 6.4.17 Adyen N.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Emerging Use-Cases Beyond Payments (Healthcare Records, Digital Twins)

- 7.3 Tokenization in IoT Edge Devices