PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851655

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851655

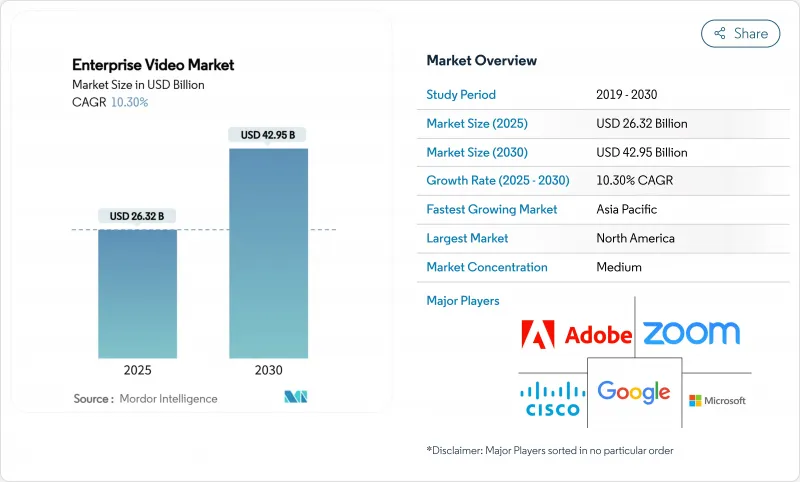

Enterprise Video - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The enterprise video market is valued at USD 26.32 billion in 2025 and is forecast to grow to USD 42.95 billion by 2030, advancing at a 10.3% CAGR.

The expansion reflects the shift from video as a meeting tool to a mission-critical infrastructure that supports workflow automation, data-driven decision making, and global collaboration. Cloud-native platforms, AI-powered analytics, and private 5G networks are improving scalability, caption accuracy, and sub-25 millisecond end-to-end latency, which together elevate user expectations for always-on, ultra-responsive experiences. Rising hybrid-work norms continue to anchor budget allocations for video, while vendor consolidation-illustrated by the Brightcove acquisition-signals a platform race toward full-stack offerings. Concurrently, mounting cybersecurity insurance premiums and skills shortages in video-workflow orchestration temper adoption curves for some late-moving enterprises.

Global Enterprise Video Market Trends and Insights

Cloud-first video architecture adoption

The migration to cloud-native stacks enables elastic scaling, API-driven integrations, and global content distribution at lower upfront cost. Enterprises retain sensitive archives on-premises yet push compute-heavy analytics to public clouds, reducing local hardware refresh cycles. Multi-cloud routing safeguards against vendor lock-in and latency variation, and it lets IT teams match diverse workloads with the optimal cost-performance region. Even so, "cloud-exit" strategies are surfacing as some firms rebalance spend toward private infrastructure when monthly egress fees outweigh elasticity benefits.

AI-powered live-caption accuracy breakthroughs

Automatic speech recognition models now deliver up to 98% precision under favorable acoustics, lifting video accessibility beyond regulatory compliance into a productivity advantage. Rich language support-spanning 140 tongues-facilitates cross-border collaboration while searchable transcripts unlock evergreen knowledge repositories. Enterprises embed these AI captions directly in content management systems to raise engagement metrics and speed content localization. The advance also fuels inclusive hiring practices because Deaf and hard-of-hearing employees access meetings in real time without third-party captioners.

High total cost of ultra-low-latency infrastructure

Enterprises seeking sub-25 millisecond round-trip performance must invest in private 5G, edge CDN nodes, and GPU-accelerated encoders. Capital plans frequently exceed budget allocations, as hyperscalers earmark USD 75 billion in 2025 capex for AI and networking backbones that downstream customers must partially absorb. LED video walls alone range between USD 380 and USD 1,200 per ft2, making large-format displays viable only for cash-rich organizations. Ongoing operational costs-from on-call engineers to redundancy circuits-further widen total cost of ownership.

Other drivers and restraints analyzed in the detailed report include:

- Growth of hybrid and remote workforces

- BYOD proliferation across enterprises

- IT staff skill shortages in video-workflow orchestration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Video Conferencing segment delivered USD 11.08 billion and held 42.1% of enterprise video market share in 2024, reflecting its entrenchment as the default collaboration medium. Video Analytics, though smaller in absolute value, is projected to outpace all other categories at an 18.7% CAGR, adding more than USD 4 billion to enterprise video market size by 2030. This momentum stems from AI engines that detect anomalies, extract metadata, and trigger workflow automations across security, manufacturing, and retail settings.

Adoption patterns reveal convergence between once-distinct categories. Conferencing vendors bundle analytics for speaker sentiment, while content-management platforms embed live-stream modules to support hybrid events. AI video generators, such as Google's Veo 3, blur production and distribution boundaries by enabling non-specialists to create branded assets in seconds. The result is a mosaic ecosystem where enterprises choose flexible modules that integrate through open APIs rather than monolithic suites, a dynamic that further accelerates innovation cycles within the enterprise video market.

Software products retained 51.7% share of enterprise video market size in 2024, underpinning meeting, streaming, and archival functions. Yet the Services category will rise fastest at a 14.2% CAGR. Outsourced orchestration, 24/7 monitoring SLAs, and AI tuning services appeal to organizations lacking in-house expertise. Hardware remains essential for encoding, room endpoints, and edge caching, but value is migrating to software-defined components pre-installed on commodity devices.

Bundled "video-as-a-service" offerings illustrate the shift. Providers supply managed encoder racks, transcoding software, and analytics dashboards under a predictable monthly fee, bundling proactive maintenance and feature updates. This model lowers total cost of ownership and supports SMEs that previously could not justify dedicated video teams. As a result, service providers are rapidly expanding consulting arms, certification programs, and managed eCDN portfolios, defending margins as pure software licensing becomes price-competitive.

The Report Covers the Global Enterprise Video Market Growth and It is Segmented by Type (Video Conferencing, Video Content Management, Webcasting and Live Streaming, Video Analytics, and Other Types), Component (Hardware, Software, and Services), Deployment (On-Premises, and Cloud), End-User Industry (BFSI, Healthcare, IT and Telecommunications, and More), Organization Size (SMEs, and Large Enterprises), and Geography.

Geography Analysis

North America secured 34.6% of enterprise video market share in 2024 on the back of expansive broadband penetration, early SaaS adoption, and robust federal investment in telework infrastructure. Growth is moderating as large enterprises optimize existing deployments, prioritizing AI add-ons and advanced analytics rather than net-new seat licenses. Even so, edge acceleration nodes around tier-2 cities extend low-latency streaming into under-served areas, preserving incremental revenue.

Asia-Pacific is the fastest-growing territory, registering a 12.8% CAGR as mobile broadband upgrades and 5G private-network pilots proliferate. Indigenous champions-Tencent Meeting in China and Itochu-backed EasyRooms in Japan-tailor interfaces, compliance modules, and language packs to local norms[3]. Government digitalization programs and manufacturing modernization efforts underpin demand for inspection-grade video analytics, further bolstering regional uptake within the enterprise video market.

Europe follows a steady trajectory shaped by GDPR compliance mandates. Enterprises gravitate toward vendors offering in-region data centers and stringent privacy certifications, driving cooperation between U.S. platforms and EU-based cloud hosts. South America plus the Middle East and Africa represent emerging footholds where cloud-first strategies leapfrog legacy on-premises rollouts. Telco partnerships that bundle video suites with high-speed connectivity lower adoption hurdles for mid-market firms across these regions.

- Cisco Systems, Inc.

- Microsoft Corporation

- Zoom Video Communications, Inc.

- Google LLC

- Adobe Inc.

- Brightcove Inc.

- IBM Corporation

- Kaltura Inc.

- Panopto

- Poly (HP Inc.)

- Avaya Inc.

- Vbrick Systems, Inc.

- Mediaplatform, Inc.

- Vidyo, Inc.

- Vimeo, Inc.

- Qumu Corporation

- Harmonic Inc.

- JW Player

- Lifesize, Inc.

- Ooyala (Telstra)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first video architecture adoption

- 4.2.2 AI-powered live-caption accuracy breakthroughs

- 4.2.3 Growth of hybrid and remote workforces

- 4.2.4 BYOD proliferation across enterprises

- 4.2.5 Low-latency 5G private networks in campuses

- 4.2.6 Compliance-driven demand for secure archival

- 4.3 Market Restraints

- 4.3.1 High total cost of ultra-low-latency infrastructure

- 4.3.2 Inter-country data-sovereignty barriers

- 4.3.3 IT staff skill shortages in video-workflow orchestration

- 4.3.4 Rising cyber-insurance premiums on video breaches

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Video Conferencing

- 5.1.2 Video Content Management

- 5.1.3 Webcasting and Live Streaming

- 5.1.4 Video Analytics

- 5.1.5 Other Types

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Mode

- 5.3.1 On-Premises

- 5.3.2 Cloud

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 IT and Telecommunications

- 5.4.4 Retail and E-commerce

- 5.4.5 Education

- 5.4.6 Government and Public Sector

- 5.4.7 Manufacturing

- 5.4.8 Media and Entertainment

- 5.4.9 Others

- 5.5 By Organization Size

- 5.5.1 Small and Medium Enterprises (SMEs)

- 5.5.2 Large Enterprises

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Rest of Europe

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Egypt

- 5.6.4.2.3 Nigeria

- 5.6.4.2.4 Rest of Africa

- 5.6.5 Asia-Pacific

- 5.6.5.1 China

- 5.6.5.2 India

- 5.6.5.3 Japan

- 5.6.5.4 South Korea

- 5.6.5.5 ASEAN

- 5.6.5.6 Australia

- 5.6.5.7 New Zealand

- 5.6.5.8 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems, Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Zoom Video Communications, Inc.

- 6.4.4 Google LLC

- 6.4.5 Adobe Inc.

- 6.4.6 Brightcove Inc.

- 6.4.7 IBM Corporation

- 6.4.8 Kaltura Inc.

- 6.4.9 Panopto

- 6.4.10 Poly (HP Inc.)

- 6.4.11 Avaya Inc.

- 6.4.12 Vbrick Systems, Inc.

- 6.4.13 Mediaplatform, Inc.

- 6.4.14 Vidyo, Inc.

- 6.4.15 Vimeo, Inc.

- 6.4.16 Qumu Corporation

- 6.4.17 Harmonic Inc.

- 6.4.18 JW Player

- 6.4.19 Lifesize, Inc.

- 6.4.20 Ooyala (Telstra)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment