PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851657

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851657

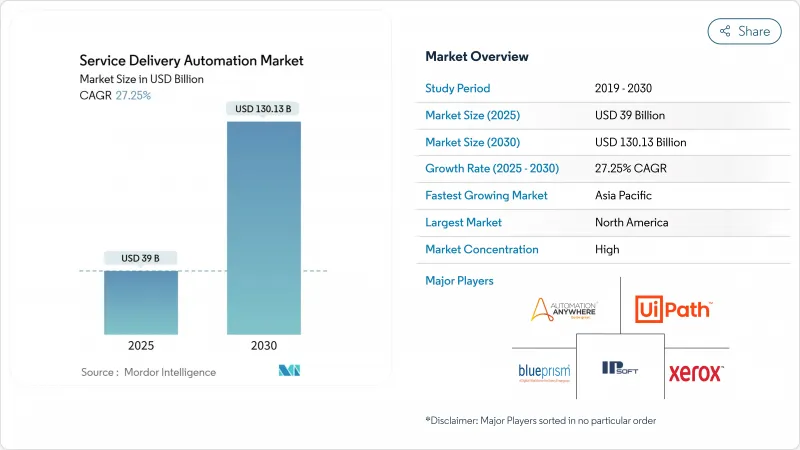

Service Delivery Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The service delivery automation market is valued at USD 39 billion in 2025 and is projected to grow at a 27.25% CAGR, reaching USD 130.13 billion by 2030.

Demand stems from enterprises seeking lower operating costs, faster cycle times, and higher accuracy across customer-facing and back-office processes. Hyperautomation- the combination of RPA, AI, and low-code tools- is expanding use cases from simple task execution to cognitive decision making, pushing adoption beyond early pilots into enterprise-wide rollouts. Vendor competition is intensifying as leading platforms embed generative AI, reducing total cost of ownership,, and shifting to usage-based cloud delivery. North America accounts for the largest regional spend, yet Asia-Pacific shows the steepest growth curve as local service centers and digital-first SMEs embrace cloud automation at scale.

Global Service Delivery Automation Market Trends and Insights

Cost-reduction imperative

Enterprises continue to automate labor-intensive, high-volume workflows and record average savings of 30-40% per process. Banks that deploy RPA often earn 3-10 times ROI in year one and cut exception-handling errors markedly. Internal surveys by platform vendors reveal that 88% of employees experience higher job satisfaction after repetitive tasks are automated, signaling that cost savings align with workforce experience gains. This sentiment is strongest in BFSI, telecommunications and shared service centers where wage differentials are high.

Operational efficiency and SLA demand

Tighter service-level targets have forced organizations to accelerate process cycle times while reducing rework. Financial control teams that add service delivery automation report 90% fewer reporting errors and close books up to 85 times faster than previously manual workflows. Customer response metrics also benefit: automated triage bots resolve service tickets within minutes, boosting retention in subscription-based businesses where renewal hinges on rapid issue resolution.

Skilled automation architect scarcity

Cognitive automation projects require multi-disciplinary talent covering process engineering, data science and risk controls. Yet senior architects remain in short supply as demand outpaces training pipelines, delaying high-value deployments and forcing companies to contract premium-priced consultants. Low-code citizen-developer tooling helps, but complex cross-system orchestration still relies on experienced designers.

Other drivers and restraints analyzed in the detailed report include:

- Digital-first and cloud-first transformation

- RPA maturity and lower TCO

- High up-front integration and change-management cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IT Process Automation held 56% of service delivery automation market share in 2024 owing to well-defined run-book scripts and clear ROI benchmarks. Service desk teams that automate password resets, backup checks and incident routing cut mean-time-to-resolve by up to 40%. In parallel, the Cognitive/AI-based Automation segment is expanding at a 40.20% CAGR, fueled by advances in large language models and image analytics that let bots interpret unstructured inputs. Underwriters now deploy cognitive bots to assess claim documents and flag anomalies in real time, unlocking new revenue streams alongside efficiency wins. As firms layer AI onto foundational RPA estates, the service delivery automation market anticipates a platform refresh cycle centred on intelligent orchestration.

This evolution changes purchasing criteria. Buyers increasingly seek solutions that combine task automation, decision support and continuous learning inside one license. Vendors respond by embedding native AI or partnering with hyperscale AI services, creating a convergence that shifts spend away from niche script-only tools toward unified suites. The service delivery automation market is therefore tilting toward fewer but broader deployments that serve both IT and business operations under a single governance framework.

Software Platforms represented 61.56% of 2024 revenue because every automation journey begins with a licence. These platforms now ship with built-in computer vision, process mining and governance consoles that accelerate proof-of-value builds. However, Services are projected to outpace software at a 15.00% CAGR. As automation scales to hundreds of processes, enterprises need roadmap design, change management, bot health monitoring, and continuous improvement programs that internal teams struggle to absorb. Consulting firms and system integrators thus bundle frameworks for value assessment, citizen-developer enablement and center-of-excellence operation. The result is a steady shift in budget mix from pure licences toward ongoing managed services inside the service delivery automation market.

The service delivery automation market size for managed services is expanding particularly fast in regulated industries where continuous compliance testing and audit logs are mandatory. Vendors now offer "automation-as-a-service" models with shared responsibility matrices covering SLA adherence, version upgrades and security patching. This subscription-oriented delivery appeals to SMEs that lack an internal IT operations bench yet want enterprise-grade reliability.

The Service Delivery Automation Market Report Segments the Industry Into by Type (IT Process Automation, Business Process Automation, and More), Component (Software Platforms, and Services), Deployment Mode (On-Premise, and Cloud), Organization Size (Large Enterprises, and Small and Medium Enterprises), End-User Industry (BFSI, Information Technology Services, Telecommunications and Media, and More), and Geography.

Geography Analysis

North America remains the largest hub for the service delivery automation market, supported by high labor costs, mature cloud infrastructure and headquarters of leading platform vendors. Financial institutions and healthcare systems spearhead adoption, often integrating cognitive bots with analytics to predict exceptions and pre-empt SLA breaches. Generative AI experimentation is widespread, with firms piloting large language models to draft legal summaries and compliance narratives.

Asia-Pacific records the steepest growth trajectory. India and the Philippines host global service centers keen to reduce attrition costs through digital workers, while Chinese insurers automate claims to manage surging policy volumes. Government stimulus for smart manufacturing and logistics digitization fuels warehouse automation that relies on orchestration bots to schedule AGVs. Local vendors offer price-sensitive bundles, accelerating penetration into medium-sized enterprises across ASEAN markets.

Europe exhibits steady uptake across Northern and Western economies. The EU's General Data Protection Regulation prompts businesses to embed controls that log every bot action, aligning automation with audit trails. Manufacturing conglomerates in Germany and Benelux automate shop-floor reporting, while public agencies in the Nordics deploy chatbots to handle citizen queries in multiple languages. Decision making is cautious: IT spending favors projects with transparent payback, driving phased roll-outs that still contribute significant volume to the overall service delivery automation market.

- UiPath SRL

- Automation Anywhere Inc.

- IBM Corporation

- Blue Prism Ltd

- NICE Ltd

- IPsoft Inc.

- Xerox Holdings Corporation

- Celaton Limited

- Arago GmbH

- Accenture plc

- AutomationEdge Technologies

- Pegasystems Inc.

- Microsoft Corporation

- SAP SE

- ServiceNow Inc.

- WorkFusion Inc.

- Kofax Inc.

- Cognizant Technology Solutions

- Infosys Ltd

- Tech Mahindra Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost-reduction Imperative

- 4.2.2 Demand for Operational Efficiency and SLAs

- 4.2.3 Digital-First and Cloud-first Transformation

- 4.2.4 RPA Platform Maturity and Lower TCO

- 4.2.5 Hyperautomation Convergence (iPaaS + RPA + LCAP)

- 4.2.6 Generative-AI Copilots Enabling Citizen Developers

- 4.3 Market Restraints

- 4.3.1 Scarcity of Skilled Automation Architects

- 4.3.2 High Up-front Integration and Change-management Cost

- 4.3.3 Multitenant Workflow Security and Compliance Gaps

- 4.3.4 ESG Scrutiny on Automation Energy Footprint

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 IT Process Automation

- 5.1.2 Business Process Automation

- 5.1.3 Robotic Process Automation

- 5.1.4 Cognitive/AI-based Automation

- 5.2 By Component

- 5.2.1 Software Platforms

- 5.2.2 Services (Consulting, Integration, Support)

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud

- 5.3.3 Hybrid

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-user Industry

- 5.5.1 Banking, Financial Services and Insurance (BFSI)

- 5.5.2 Information Technology Services

- 5.5.3 Telecommunications and Media

- 5.5.4 Healthcare and Pharmaceuticals

- 5.5.5 Retail and Consumer Goods

- 5.5.6 Manufacturing and Logistics

- 5.5.7 Hospitality and Transportation

- 5.5.8 Other Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Rest of Europe

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Egypt

- 5.6.4.2.3 Nigeria

- 5.6.4.2.4 Rest of Africa

- 5.6.5 Asia-Pacific

- 5.6.5.1 China

- 5.6.5.2 India

- 5.6.5.3 Japan

- 5.6.5.4 South Korea

- 5.6.5.5 ASEAN

- 5.6.5.6 Australia

- 5.6.5.7 New Zealand

- 5.6.5.8 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 UiPath SRL

- 6.4.2 Automation Anywhere Inc.

- 6.4.3 IBM Corporation

- 6.4.4 Blue Prism Ltd

- 6.4.5 NICE Ltd

- 6.4.6 IPsoft Inc.

- 6.4.7 Xerox Holdings Corporation

- 6.4.8 Celaton Limited

- 6.4.9 Arago GmbH

- 6.4.10 Accenture plc

- 6.4.11 AutomationEdge Technologies

- 6.4.12 Pegasystems Inc.

- 6.4.13 Microsoft Corporation

- 6.4.14 SAP SE

- 6.4.15 ServiceNow Inc.

- 6.4.16 WorkFusion Inc.

- 6.4.17 Kofax Inc.

- 6.4.18 Cognizant Technology Solutions

- 6.4.19 Infosys Ltd

- 6.4.20 Tech Mahindra Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment