PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851662

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851662

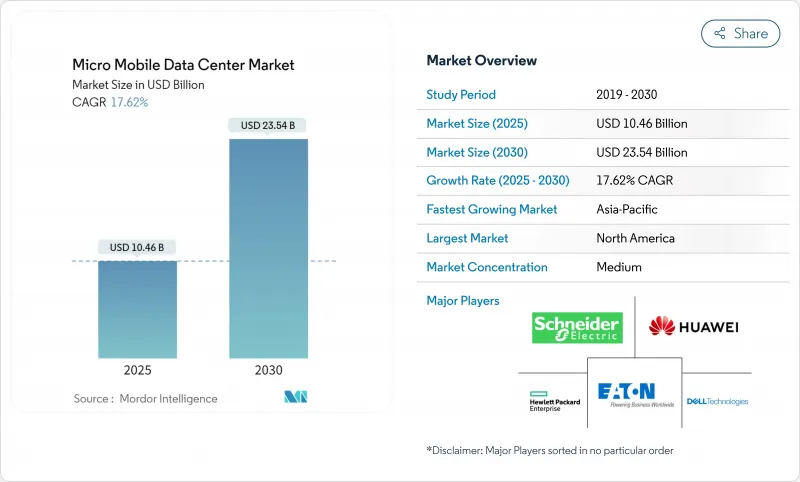

Micro Mobile Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The micro mobile data center market currently stands at USD 10.46 billion in 2025 and is forecast to reach USD 23.54 billion by 2030, expanding at a 17.62% CAGR.

Most of this momentum comes from enterprises pushing compute resources closer to data-generation points to avoid latency, meet real-time analytics needs, and lower backhaul costs. Rapid 5G roll-outs, soaring IoT traffic, and mounting resiliency requirements after high-profile hyperscaler outages are amplifying demand, while modular designs and edge-as-a-service offers shorten deployment times and reduce upfront capital outlays. North America retains leadership on the strength of hyperscaler investment and an advanced telecom backbone, yet Asia-Pacific is growing the fastest as governments back smart-city programs and digital-economy goals. Vendors are responding with pre-integrated, remotely managed systems that simplify life-cycle operations and appeal strongly to resource-constrained SMEs, which already generate a majority of installations.

Global Micro Mobile Data Center Market Trends and Insights

Edge-Computing Push from 5G Roll-Outs

Fifth-generation networks are raising throughput to 10 Gbps and pushing latency below 1 ms, making centralized processing impractical for immersive realities, autonomous mobility, and industrial automation. Carriers are therefore co-locating micro mobile data center market nodes at cell-site edges to host network-function virtualization and multi-access edge computing stacks. Real-time video analytics, AR retail fitting rooms, and cooperative vehicle guidance now execute locally, trimming transport costs and guaranteeing deterministic performance. Spending on edge infrastructure jumped 15.4% to USD 232 billion in 2024, spearheaded by telecom operators eager to monetize 5G capacity.

Exponential IoT Data at Endpoints

Billions of smart sensors in factories, hospitals, and city streets churn out torrents of telemetry that cannot all traverse the WAN. Compact, ruggedized enclosures installed beside manufacturing lines or inside smart-lighting poles let algorithms infer, filter, and compress raw feeds before optionally syncing with the cloud. Localized processing also satisfies data-sovereignty and privacy codes in regulated industries. FS.com observes that edge micro sites improve security by retaining sensitive payloads on premises until policy checkpoints are met.

Talent Scarcity in Edge-Qualified Facility Operations

Running hundreds of distributed enclosures demands personnel who grasp IT, electrical, and mechanical disciplines. Schneider Electric's open courseware has enrolled more than 1 million learners to bridge the projected need for 2.3 million data-center staff by 2025 se.com. Yet recruitment lags, slowing roll-outs in emerging markets.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Retail Omni-Channel Digitization

- Heightened Resilience Needs After Hyperscaler Outages

- Lithium-Ion Thermal-Runaway Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 25-40 RU band represented the largest slice of the micro mobile data center market size at USD 4.2 billion in 2024 and is forecast to advance at 19.23% CAGR. Enterprises favor this footprint because it bundles compute, power, and cooling in a cabinet small enough for branch sites yet roomy enough for future workload expansion. Compact UPS systems with integrated lithium-ion packs from Delta boost density while trimming floor-space requirements.

The 25-40 RU band represented the largest slice of the micro mobile data center market size at USD 4.2 billion in 2024 and is forecast to advance at 19.23% CAGR. Enterprises favor this footprint because it bundles compute, power, and cooling in a cabinet small enough for branch sites yet roomy enough for future workload expansion. Compact UPS systems with integrated lithium-ion packs from Delta boost density while trimming floor-space requirements

Rack-mounted pods accounted for 51.22% of revenue and will maintain lead status thanks to standardized depth and width that align with existing server infrastructure. Customers scale one pod at a time, synchronizing cash spend with application demand and shrinking stranded capacity. Supermicro's rack-scale architecture even lets operators disaggregate NVMe storage and recombine resources on the fly to optimize utilization.

Containerized modules deliver rapid bulk capacity for event venues or remote mining, often arriving factory-sealed with outside-air economizers. Wall-mount nodes satisfy convenience-store chains and quick-service restaurants, where floor space is premium. Vendors now add shock sensors, dust filters, and tamper switches to withstand harsh field conditions, expanding addressable workloads across the broader micro mobile data center market.

Micro Mobile Data Center Market Report Segments the Industry Into Rack Unit Size (Up To 25 RU, and More), Form Factor (Containerized Modules, and More), Application (Instant, Edge-Computing Nodes, and More), Organization Size(Small and Medium Enterprises, and More) End-User Industry(IT and Telecom, BFSI and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 35% of total revenue in 2024 thanks to dense 5G roll-outs, hyperscaler investment in edge POPs, and supportive data-sovereignty statutes for healthcare and finance. The United States dominates, with Northern Virginia, Silicon Valley, and Texas generating heavy demand for campus-adjacent edge nodes that complement megascale builds. Federal initiatives such as microreactor pilots underscore commitment to off-grid power strategies for strategic workloads.

Asia-Pacific will post the highest 18.65% CAGR to 2030 as China, India, Japan, and South Korea accelerate smart-manufacturing and connected-mobility programs. State grants and spectrum allocations encourage telcos and cloud providers to host proximate compute for real-time IoT analytics. Vantage's second Cyberjaya campus and NTT DATA's Jakarta build illustrate a regional shift toward distributed models capable of respecting local data-residency laws.

Europe continues steady expansion led by Germany, the United Kingdom, and France. Strict GDPR rules require localized processing, so factories, hospitals, and fintechs invest in zone-specific clusters instead of shipping data across borders. Equinix's IBX network in Frankfurt, London, and Paris bridges regional hubs to cloud on-ramps while hosting sub-5 ms edge workloads. Emerging adoption in the Middle East, Africa, and South America starts from smaller bases but is buoyed by smart-city budgets and 5G corridor projects, opening fresh terrain for micro mobile data center market suppliers.

- Schneider Electric SE

- Dell Technologies Inc.

- Huawei Technologies Co. Ltd.

- Hewlett Packard Enterprise Development LP

- Eaton Corporation plc

- Vertiv Holdings Co.

- IBM Corporation

- Panduit Corp.

- Zella DC (formerly Zellabox)

- Hitachi Ltd.

- Instant Data Centers LLC

- Dataracks

- Rittal GmbH and Co. KG

- Canovate Group

- Cisco Systems Inc.

- EdgeMicro Inc.

- Vapor IO Inc.

- Cannon Technologies Ltd.

- nLighten (Iliad Group)

- DC Blox Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Edge?computing push from 5G roll-outs

- 4.2.2 Exponential IoT data at endpoints

- 4.2.3 Rapid retail omni-channel digitization

- 4.2.4 Heightened resilience needs after hyperscaler outages

- 4.2.5 Military demand for rugged off-grid compute (under-radar)

- 4.2.6 ESG-driven micro-grid pairing for renewables (under-radar)

- 4.3 Market Restraints

- 4.3.1 Talent scarcity in edge-qualified facility ops

- 4.3.2 Fragmented regulatory codes for modular DCs

- 4.3.3 Lithium-ion thermal-runaway concerns (under-radar)

- 4.3.4 Copper and rare-earth supply-chain volatility (under-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Rack Unit Size

- 5.1.1 Up to 25 RU

- 5.1.2 25 - 40 RU

- 5.1.3 Above 40 RU

- 5.2 By Form Factor

- 5.2.1 Containerized Modules

- 5.2.2 Rack-Mounted Pods

- 5.2.3 Wall-Mounted / Micro-Edge Nodes

- 5.3 By Application

- 5.3.1 Instant / Retrofit Data Center

- 5.3.2 Edge-Computing Nodes

- 5.3.3 High-Density Networks

- 5.3.4 Remote Office and Branch Office

- 5.3.5 Mobile and Tactical Computing

- 5.3.6 Disaster Recovery and Backup

- 5.4 By Organization Size

- 5.4.1 Small and Medium Enterprises

- 5.4.2 Large Enterprises

- 5.5 By End-user Vertical

- 5.5.1 IT and Telecommunication

- 5.5.2 BFSI

- 5.5.3 Retail and E-commerce

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Government and Defense

- 5.5.6 Energy and Utilities

- 5.5.7 Manufacturing and Industrial

- 5.5.8 Education

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Singapore

- 5.6.3.6 Australia

- 5.6.3.7 Malaysia

- 5.6.3.8 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 UAE

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Israel

- 5.6.5.5 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Egypt

- 5.6.6.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Dell Technologies Inc.

- 6.4.3 Huawei Technologies Co. Ltd.

- 6.4.4 Hewlett Packard Enterprise Development LP

- 6.4.5 Eaton Corporation plc

- 6.4.6 Vertiv Holdings Co.

- 6.4.7 IBM Corporation

- 6.4.8 Panduit Corp.

- 6.4.9 Zella DC (formerly Zellabox)

- 6.4.10 Hitachi Ltd.

- 6.4.11 Instant Data Centers LLC

- 6.4.12 Dataracks

- 6.4.13 Rittal GmbH and Co. KG

- 6.4.14 Canovate Group

- 6.4.15 Cisco Systems Inc.

- 6.4.16 EdgeMicro Inc.

- 6.4.17 Vapor IO Inc.

- 6.4.18 Cannon Technologies Ltd.

- 6.4.19 nLighten (Iliad Group)

- 6.4.20 DC Blox Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment