PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851663

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851663

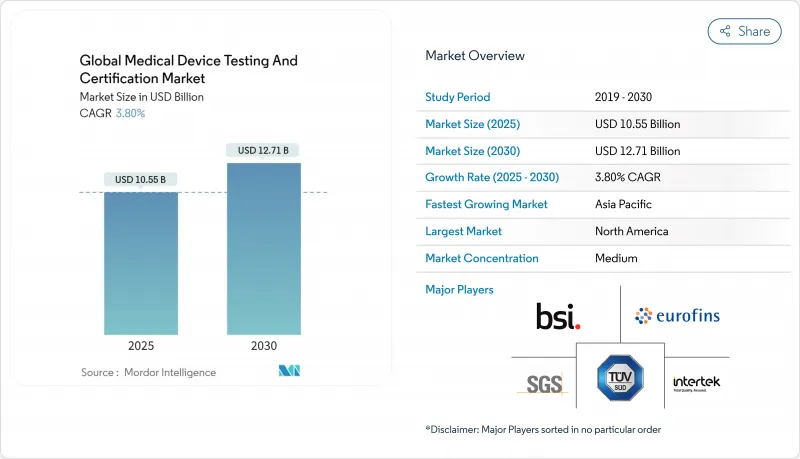

Global Medical Device Testing And Certification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The medical device testing & certification services market reached a value of USD 10.55 billion in 2025 and is forecast to attain USD 12.71 billion by 2030, advancing at a 3.8% CAGR over the period.

Demand is shaped by the simultaneous enforcement of the EU Medical Device Regulation (MDR) and the United States Food and Drug Administration (FDA) cybersecurity mandate, both of which expand validation scope and documentation depth. Mid-risk Class II devices dominate compliance volumes, while proliferating AI/ML algorithms and connected home diagnostics introduce novel test protocols that spur premium service demand. North America remains the revenue leader, although Asia-Pacific is registering the fastest laboratory expansion because China and India tightened national device laws in 2024, prompting foreign and domestic producers to outsource complex assays. Market participants with multi-jurisdictional accreditations benefit from persistent capacity constraints at EU notified bodies, which have doubled lead times since 2023. Sustainability audits, driven by European public procurement rules, and end-to-end cybersecurity assessments are emerging as differentiators that allow laboratories to charge higher margins for integrated engagements.

Global Medical Device Testing And Certification Market Trends and Insights

Regulatory tightening under EU MDR and FDA Safer Devices Act

The 2024-2028 MDR transition window obliges every legacy device to re-seek CE marking under 23 General Safety and Performance Requirements, tripling technical-file depth for many manufacturers ec.europa.eu. Concurrently, Section 524B of the Safer Devices Act mandates U.S. pre-market submissions that include Software Bills of Materials and vulnerability management plans, expanding documentation for every connected product. The combined effect triggered a 40% surge in notified-body applications and elongated average review times beyond 24 months, prompting firms to outsource larger validation packages to accredited laboratories.

Rise in AI/ML-enabled devices driving specialized validation needs

The FDA's public database recorded 882 cleared AI/ML medical devices by May 2024, up 45% year-on-year. Each algorithm demands bias detection, dataset shift analysis, and real-world performance monitoring, tests that exceed classical verification. The EU AI Act, classifying medical AI as "high risk", further requires lifecycle risk management. Laboratories offering algorithm audit services therefore command premium pricing, and this service line is forecast to become a core revenue pillar of the medical device testing & certification services market over the coming decade.

Limited capacity & long lead times at notified bodies

Only 43 notified bodies serve the entire EU under MDR, and application-to-certification ratios exceed 4:1. Average review times rose from 14 months in 2022 to more than 26 months by late-2024. Manufacturers have consequently withdrawn certain low-margin products from the EU, shrinking potential testing volumes and tempering growth in the medical device testing & certification services market.

Other drivers and restraints analyzed in the detailed report include:

- Growth of home & wearable diagnostics expanding test volumes

- Mandatory cybersecurity pre-market submissions

- High testing costs for SMEs & start-ups

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Testing services held 56.56% of medical device testing & certification services market share in 2024, reflecting their status as the unavoidable regulatory entry ticket for all device classes. Certification services track behind because only EU and UK routes legally require third-party auditing, whereas the U.S. relies more on manufacturer self-attestation. However, as regulators intensify post-market surveillance, inspection & auditing revenues are gaining momentum. Cybersecurity and software validation-still statistically nested within testing services-represent the fastest revenue stream, posting 5.2% CAGR on account of the FDA and Health Canada mandates. Laboratories that integrate biological, mechanical, and digital-security benches in one location cut total turn-around time by up to 30%, enabling premium billing and reinforcing competitive moat. Consequently, the medical device testing & certification services market is shifting toward bundled, subscription-like quality-assurance contracts that lock in multi-year revenue visibility.

Continued investments in automated sample preparation and high-throughput analytics have trimmed direct labor per report by nearly 10% since 2022, raising operating margins. Certification services, hampered by notified-body scarcity, are forecast to grow at a slower 2.5% but remain indispensable for EU market access, sustaining a defensive revenue floor.

The Medical Device Testing Market Report Segments the Industry Into by Service Type (Testing Services, Inspection Services and More), by Device Class (Class I, Class II, and More), by Testing Type (Biocompatibility Testing, Sterility & Microbiology Testing and More), and by Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 38.95% of the medical device testing & certification services market in 2024, anchored by the FDA's streamlined 510(k) and Breakthrough Device pathways that catalyze continuous product launches. Domestic laboratories benefit from deep payer systems that fund innovation and from a regulatory environment that explicitly recognizes several voluntary consensus standards, shortening validation cycles. From 2025-2030, the region is set to expand at 3.2% CAGR, slower than the global mean due to maturity.

Asia-Pacific is the clear volume engine, forecast to grow 6.7% annually. China's updated Medical Device Regulation, effective July 2024, compels local producers to secure third-party biocompatibility and packaging data, driving steady sample inflows to regional labs. India's Medical Device Rules amendment of 2024 extended third-party audit requirements to additional product categories, adding incremental demand. Foreign players are rapidly opening satellite laboratories in Suzhou, Bangalore, and Kuala Lumpur to capture the rising tide.

Europe suffered near-term drag from notified-body scarcity; however, once capacity normalizes, deferred applications will convert to billable tests, helping the region regain momentum beyond 2027. Latin America and the Middle East & Africa remain nascent but benefit from harmonization initiatives, which require proof of compliance with reference-market standards-typically executed by global lab networks.

- SGS

- Intertek Group

- TUV SUD

- UL Solutions

- Eurofins

- BSI Group

- TUV Rheinland

- TUV Nord

- Dekra SE

- Bureau Veritas

- DNV GL

- Nemko

- NSF International

- Nelson Labs

- Element Materials Technology

- Charles River

- Smithers

- Pace Analytical Services

- Merieux NutriSciences

- Medistri

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory tightening under EU MDR & FDA Safer Devices Act

- 4.2.2 Rise in AI/ML-enabled devices driving specialized validation needs

- 4.2.3 Growth of home & wearable diagnostics expanding test volumes

- 4.2.4 Mandatory cybersecurity pre-market submissions (FDA 2024)

- 4.2.5 ESG-driven sustainability audits becoming procurement criteria

- 4.2.6 Skill-gap certifications for biomedical tech workforce

- 4.3 Market Restraints

- 4.3.1 Limited capacity & long lead times at Notified Bodies

- 4.3.2 High testing costs for SMEs & start-ups

- 4.3.3 Scarcity of standardized datasets for AI algorithm validation

- 4.3.4 Fragmented sustainability compliance requirements

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Type (Value)

- 5.1.1 Testing Services

- 5.1.2 Certification Services

- 5.1.3 Inspection & Auditing Services

- 5.1.4 Others

- 5.2 By Device Class (Value)

- 5.2.1 Class I

- 5.2.2 Class II

- 5.2.3 Class III

- 5.2.4 In Vitro Diagnostic Devices

- 5.3 By Testing Type (Value)

- 5.3.1 Biocompatibility Testing

- 5.3.2 Sterility & Microbiology Testing

- 5.3.3 Electrical Safety & EMC

- 5.3.4 Software & Cybersecurity Testing

- 5.3.5 Mechanical & Physical Testing

- 5.3.6 Packaging & Shelf-life Testing

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 SGS SA

- 6.3.2 Intertek Group plc

- 6.3.3 TUV SUD

- 6.3.4 UL Solutions

- 6.3.5 Eurofins Scientific

- 6.3.6 BSI Group

- 6.3.7 TUV Rheinland

- 6.3.8 TUV Nord

- 6.3.9 Dekra SE

- 6.3.10 Bureau Veritas

- 6.3.11 DNV GL

- 6.3.12 Nemko

- 6.3.13 NSF International

- 6.3.14 Nelson Labs

- 6.3.15 Element Materials Technology

- 6.3.16 Charles River Laboratories

- 6.3.17 Smithers

- 6.3.18 Pace Analytical

- 6.3.19 Merieux NutriSciences

- 6.3.20 Medistri SA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment