PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851665

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851665

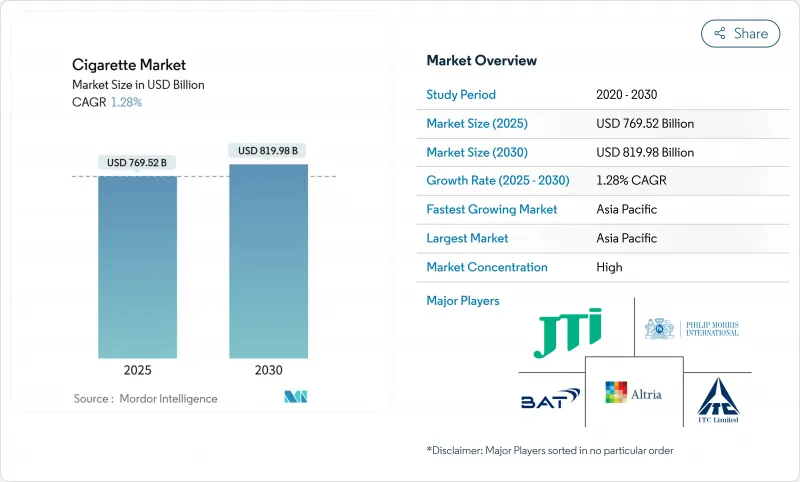

Cigarette - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cigarette market was valued at USD 769.52 billion in 2025 and is projected to grow to USD 819.98 billion by 2030, marking a modest CAGR of 1.28%.

The industry is shifting from volume expansion to value capture, emphasizing premium positioning and pricing power as mature economies face declining unit sales. In emerging nations, rising incomes, social smoking culture, and innovative product formats offer growth opportunities despite stringent public health regulations. Challenges include regulatory complexities, plain packaging mandates, and rising excise taxes, which are squeezing profit margins. Leading players are adopting automation, diversifying into reduced-risk products, and leveraging scale, compliance expertise, and omnichannel reach to gain competitive advantages, creating significant barriers for new entrants.

Global Cigarette Market Trends and Insights

Effective marketing and advertising campaigns

Successful marketing and advertising initiatives serve as a significant driver for the cigarette market. Companies in this sector invest heavily in innovative campaigns to enhance brand visibility, attract new consumers, and retain existing ones. For instance, Philip Morris International increased its marketing spend from USD 862 million in 2023 to USD 1,015 million in 2024 . Firms like Philip Morris and British American Tobacco leverage social media, celebrity endorsements, and targeted campaigns to appeal to specific demographics. They also focus on loyalty programs and exclusive offers to strengthen consumer retention. These strategies help maintain competitiveness, expand their consumer base in emerging markets, and comply with regional regulations, collectively driving market growth.

Technological advancements in terms of production

Technological advancements in production processes are driving growth in the global cigarette market. Automated manufacturing systems have improved production efficiency, reduced costs, and maintained consistent quality. According to the World Health Organization (WHO), modern machinery enables faster production while meeting quality standards. The Tobacco Institute of India highlights that advanced technologies help manufacturers comply with regulations and optimize resources. These advancements enhance production capabilities and enable manufacturers to adapt to market demands. Additionally, the European Commission emphasizes technology's role in anti-counterfeiting measures, such as track-and-trace systems, which monitor supply chains and prevent counterfeit products. The China National Tobacco Corporation (CNTC) has also invested in research and development to improve efficiency and introduce innovative cigarette variants. These efforts underscore the importance of technology in shaping the global cigarette market's competitive landscape.

High production and operational costs

High production and operational costs act as a significant restraint in the global cigarette market. The rising costs of raw materials, such as tobacco, paper, and filters, coupled with increasing labor expenses, have escalated the overall production costs for manufacturers. Additionally, stringent government regulations and compliance requirements, including taxes and health warnings, further contribute to operational expenses. These factors collectively challenge the profitability of cigarette manufacturers, compelling them to either absorb the costs or pass them on to consumers, which could impact demand. The growing emphasis on sustainable and eco-friendly production practices also adds to the operational burden, as companies invest in new technologies and processes to meet environmental standards. Such cost pressures are expected to continue influencing the market dynamics during the forecast period.

Other drivers and restraints analyzed in the detailed report include:

- Nicotine addiction and peer influence

- Introduction of herbal cigarettes

- Age and access restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, conventional tobacco blends dominated the market, accounting for 84.61% of total revenue. This stronghold underscores the weight of regulatory barriers on flavored products in key economies, where stringent policies have curtailed both availability and consumer uptake. In a bid to diminish the allure of flavored tobacco, especially among youth, governments have enacted stringent measures, including outright bans. While these regulations have curtailed the market share of flavored alternatives, the latter are slowly making headway, boasting a projected CAGR of 1.75% during the forecast period. This uptick is largely fueled by adult smokers in more liberal markets, where lenient regulatory frameworks permit exploration of novel options. Here, flavored cigarettes are becoming the go-to for those seeking variety and unique taste experiences.

This burgeoning demand signals a notable shift in consumer preferences, moving from traditional offerings to a realm of innovative flavors. Backing this trend are manufacturers' savvy marketing strategies and product innovations. Companies are rolling out diverse flavor options, from menthol to fruit and spice-infused variants, aligning with the evolving palate of consumers. These flavor introductions are bolstered by cutting-edge product design and packaging advancements, all aimed at amplifying the smoking experience and broadening their audience. Consequently, flavored cigarettes are establishing a distinct presence in the global cigarette arena, navigating the hurdles of regulatory challenges in select regions.

In 2024, king-size cigarettes hold a 52.61% market share, but slim formats are growing faster at a 1.45% CAGR, driven by consumer preferences for sophistication and reduced tobacco content. Slim cigarettes appeal not only for aesthetics but also for containing less tobacco while maintaining similar pricing, increasing per-gram profitability. Regular and super-slim formats cater to niche segments, with super-slim products popular among female and health-conscious smokers. This format shift reflects premiumization trends, as slim designs are linked to premium branding and lifestyle.

Manufacturers benefit from slim cigarettes due to reduced tobacco use and efficient packaging, optimizing costs while supporting premium pricing. This shift aligns with harm reduction regulations, as slim cigarettes can be marketed as containing less tobacco without explicit health claims. However, resistance may arise in traditional markets where king-size cigarettes dominate. Companies adapting to these transitions demonstrate market responsiveness and manufacturing flexibility, gaining competitive advantages in evolving markets.

The Cigarette Market is Segmented by Flavor Type (Flavored and Conventional); Format (Slim, Super Slim, King Size, and Regular); Category (Mass and Premium), End User (Men and Women), Distribution Channel (Convenience/Grocery Stores, Speciality Stores and More); and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, the Asia-Pacific region holds a dominant 49.26% share of the global cigarettes market, with a projected CAGR of 1.61% through 2030. High smoking prevalence in countries like China, India, and Indonesia drives this dominance, with China being the largest global consumer and producer of cigarettes. World Health Organization reports that China is home to over 300 million smokers, accounting for nearly a third of the global total . Factors such as a large population, rising disposable incomes in urban areas, and the influence of Western lifestyles contribute to market growth. Additionally, cultural acceptance of smoking in certain areas and the availability of diverse cigarette products at varying price points further support the region's expansion.

Europe remains a significant player in the global cigarettes market, supported by established tobacco companies and steady demand for premium products. Countries like Germany, the United Kingdom, and France contribute substantially, driven by preferences for high-quality and innovative offerings such as slim and flavored cigarettes. However, stringent regulations, including smoking bans, plain packaging laws, and rising excise taxes, pose challenges. Increasing health awareness and the growing adoption of alternatives like e-cigarettes and heated tobacco products are gradually shifting consumer preferences, potentially impacting the traditional market.

North America and the Middle East and Africa exhibit contrasting trends in the cigarettes market. North America shows a mature market with declining smoking rates due to health consciousness and regulatory measures, though demand for innovative products like menthol and capsule cigarettes persists. In contrast, the Middle East and Africa region experiences moderate growth, driven by urbanization, a young population, and the popularity of flavored cigarettes. However, economic disparities, regulatory challenges, and rising health awareness in both regions could limit market growth in the long term.

- British American Tobacco PLC

- Japan Tobacco International

- Altria Group Inc.

- ITC Limited

- China National Tobacco Corporation

- Imperial Brands PLC

- KT&G Corp.

- Philip Morris International

- 22nd Century Group

- Taiwan Tobacco and Liquor Corporation

- VST Industries Ltd.

- Djarum Group

- Scandinavian Tobacco Group

- Godfrey Phillips India Ltd.

- Vector Group Ltd.

- Smoore International Holdings Ltd.

- Khyber Tobacco Company Limited (KTC)

- PT Gudang Garam Tbk

- Vietnam National Tobacco Corporation

- PT Wismilak Inti Makmur

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Effective marketing and advertising campaigns

- 4.2.2 Technological advancements in terms of production

- 4.2.3 Nicotine addiction and peer influence

- 4.2.4 Introduction of herbal cigarettes

- 4.2.5 Increasing premiumization trend

- 4.2.6 Growing consumer shift toward capsule and menthol flavors

- 4.3 Market Restraints

- 4.3.1 High production and operational costs

- 4.3.2 Health campaign opposition

- 4.3.3 Age and access restrictions

- 4.3.4 Stringent regulatory framework

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Flavor Type

- 5.1.1 Flavored

- 5.1.2 Conventional

- 5.2 By Format

- 5.2.1 Slim

- 5.2.2 Super Slim

- 5.2.3 King Size

- 5.2.4 Regular

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By End User

- 5.4.1 Men

- 5.4.2 Women

- 5.5 By Distribution Channel

- 5.5.1 Convenience/Grocery Stores

- 5.5.2 Specialty Stores

- 5.5.3 Online Retail Stores

- 5.5.4 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 Indonesia

- 5.6.3.6 South Korea

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 British American Tobacco PLC

- 6.4.2 Japan Tobacco International

- 6.4.3 Altria Group Inc.

- 6.4.4 ITC Limited

- 6.4.5 China National Tobacco Corporation

- 6.4.6 Imperial Brands PLC

- 6.4.7 KT&G Corp.

- 6.4.8 Philip Morris International

- 6.4.9 22nd Century Group

- 6.4.10 Taiwan Tobacco and Liquor Corporation

- 6.4.11 VST Industries Ltd.

- 6.4.12 Djarum Group

- 6.4.13 Scandinavian Tobacco Group

- 6.4.14 Godfrey Phillips India Ltd.

- 6.4.15 Vector Group Ltd.

- 6.4.16 Smoore International Holdings Ltd.

- 6.4.17 Khyber Tobacco Company Limited (KTC)

- 6.4.18 PT Gudang Garam Tbk

- 6.4.19 Vietnam National Tobacco Corporation

- 6.4.20 PT Wismilak Inti Makmur

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK