PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851667

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851667

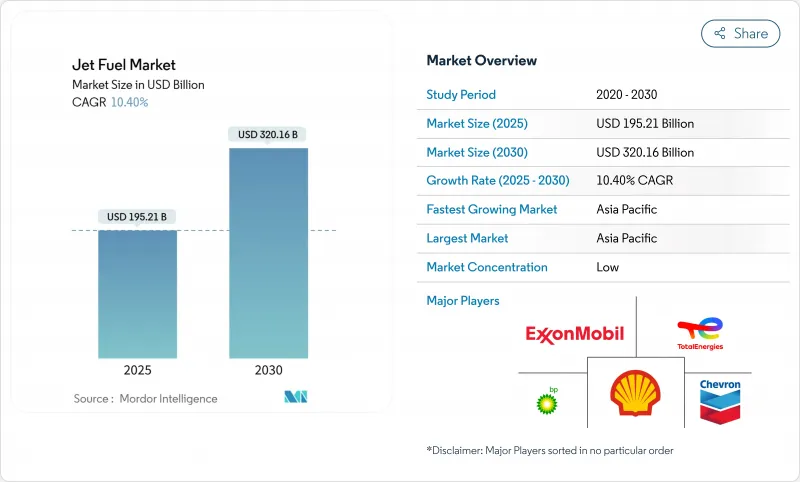

Jet Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Jet Fuel Market size is estimated at USD 195.21 billion in 2025, and is expected to reach USD 320.16 billion by 2030, at a CAGR of 10.40% during the forecast period (2025-2030).

Commercial aviation has rebounded faster than anticipated, with passenger load factors in Asia, North America, and Europe already surpassing 2019 benchmarks as travel demand releases years of pent-up demand. Low-cost carrier expansion, sustained e-commerce-led freighter demand, and mega-hubs' emergence in the Middle East underpin structural growth for the jet fuel market. At the same time, sustainable aviation fuel (SAF) mandates are accelerating procurement shifts despite cost premiums, while feedstock flexibility and refinery configurations give large integrated suppliers a pricing edge. Geopolitical pressures on crude quality and more stringent carbon regulations in Europe create additional price volatility, incentivizing airlines and fuel providers to pursue long-term offtake agreements and investments in blending infrastructure.

Global Jet Fuel Market Trends and Insights

Post-Covid Load-Factor Rebound Lifting Asia Jet A Demand

Domestic traffic in China, India, and key Southeast Asian markets surpassed 2019 levels by late 2023, while international routes sit near 90% recovery. Airlines, facing delayed aircraft deliveries, intensify aircraft utilization, pushing per-aircraft fuel burn above historic norms even as new-generation jets promise lower unit consumption. Concurrent refinery maintenance in Singapore and South Korea adds spot-market tightness, rewarding sellers with flexible storage and blending capability. The resulting uplift spikes for Jet A specifications strain regional logistics yet create premium pricing opportunities for refineries configured for high kerosene yields. Sustained leisure and business travel momentum ensures near-term demand resilience despite looming ticket cost pressures from carbon regulation.

Expansion of Low-Cost Carriers Across Africa & ASEAN

Budget airlines are redrawing intra-regional route maps, elevating seat capacity on secondary city pairs in Nigeria, Kenya, Thailand, and Vietnam. Secondary airports, once marginal fuel nodes, now handle more frequent turnarounds that lift the jet fuel market in regions previously outside major supply chains. New fuel farm investments in Lagos, Nairobi, and Phuket underpin operational reliability, while direct airline-supplier contracts bypass legacy distribution layers, compressing margins yet stimulating volume. The low-cost model's emphasis on high daily utilization squeezes refueling windows, giving integrated suppliers with hydrant infrastructure a service premium. These dynamics solidify longer-term demand even if yield pressures challenge carrier profitability.

EU-ETS Phase-IV Ticket Surcharges Curtail Leisure Flying

Phase IV eliminates free allowances by 2026, driving cost pass-throughs that could trim leisure demand by up to 5% by 2030 as price-sensitive travelers shift to rail or non-EU hubs . Airlines face higher compliance expenditure amid volatile carbon prices, prompting some to redeploy wide-body capacity toward North African or Middle-East gateways where surcharge exposure is lower. Traffic redistribution rather than outright volume loss complicates forecasting but dampens European jet fuel uplift in aggregate. The global jet fuel market absorbs some of this contraction through compensatory growth in Asia and the Middle East, yet suppliers with heavy European exposure must recalibrate refinery yield planning.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Wide-Body Freighter Orders on Trans-Pacific Routes

- Mega-Hub Capacity Builds in Middle-East Fuel Farm Investments

- Fleet Renewal Toward Fuel-Efficient Aircraft Cuts Per-Flight Burn

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Jet A-1 retained 72.5% of 2024 consumption, reflecting its status as the universal specification for commercial and many military operations. Favorable freezing and flash-point properties support reliability across climates, assuring its central role in the jet fuel market. Jet A remains concentrated in North American fleets, while Jet B and TS-1 serve niche requirements in extreme or regional settings.

The "Others" category-led by SAF-records a 17.5% CAGR to 2030, propelled by the EU's escalating blend requirements and voluntary airline commitments. TotalEnergies plans to supply 1.5 million t of SAF annually by 2030, enough to cover roughly half of Airbus' European demand . Current output equals only 0.53% of global needs, magnifying supply-demand imbalance and elevating price premiums. Fines for non-compliance of up to EUR 16,300 per tonne intensify procurement urgency, providing disproportionate revenue upside for early-stage producers. In this context, the alternative grades' jet fuel market size is expected to climb sharply even as absolute volumes remain modest relative to conventional kerosene.

The Jet Fuel Market Report is Segmented Into Fuel Type (Jet A, Jet A-1, Jet B, and Others), Application (Commercial Aviation, Defense Aviation, and General Aviation), Distribution Channel (Into-Plane and Bulk Supply To Fixed-Base Operators), and Geography (North America, Asia-Pacific, Europe, South America, and Middle East and Africa). The Market Size and Forecast are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 36.0% of global consumption in 2024 and is on an 11.5% CAGR path to 2030. China's fleet is forecast to double to 9,740 aircraft by 2043, anchoring regional demand. Southeast Asian carriers, aided by ASEAN open-skies policies, have restored domestic traffic to 100% of 2019 levels, while international routes track above 90% recovery. India adds momentum through rising discretionary income and aggressive capacity expansions by IndiGo and Air India, intensifying the jet fuel market across South Asia.

North America shows modest growth as efficiency gains partially offset capacity additions. FAA projections indicate U.S. international traffic will rise 2.8% annually through 2044, with long-haul yields aided by a resilient premium-class segment. Canada mirrors this trajectory, reaping gains from trans-Pacific freighter volumes linked to Vancouver and Toronto hubs.

Europe faces a mixed outlook. EUROCONTROL expects flights to increase 52% by 2050 despite carbon levies, but SAF blend mandates and EU-ETS surcharges erode near-term leisure travel in lower-income segments. Carriers respond by adding capacity through Istanbul, Dubai, and Doha to dilute exposure, shifting some jet fuel market uplift to Middle-East hubs.

The Middle East benefits from mega-hub strategies and Gulf carriers' long-haul networks. Emirates' record AED 22.7 billion profit signals robust demand, while Saudi Arabia's 2030 tourism drive injects additional growth. Africa's jet fuel market accelerates off a small base; Ethiopian Airlines' multi-hub model and airport upgrades in Lagos and Nairobi unlock intra-continental connectivity, adding distributed fuel demand nodes.

Latin America rebounds on domestic traffic and e-commerce logistics. Brazil's Congonhas and Colombia's El Dorado airports are investing in hydrant expansions, while Chile's JETSMART models add low-cost dynamism. Although the region trails Asia in absolute volume, double-digit growth rates contribute meaningfully to global jet fuel market expansion.

- Shell PLC

- Exxon Mobil Corp

- BP PLC (Air BP)

- Chevron Corp

- TotalEnergies SE

- Qatar Jet Fuel Company (QJet)

- Gazprom Neft PJSC

- Bharat Petroleum Ltd

- Indian Oil Corporation

- China Petroleum & Chemical Corp (Sinopec)

- PetroChina Co Ltd

- Neste OYJ

- LanzaJet Inc.

- Gevo Inc.

- World Fuel Services Corp

- Phillips 66 Aviation

- Vitol Aviation

- PETRONAS Dagangan Berhad

- Petrobras Distribuidora SA

- OMV AG

- Eni SpA

- Saudi Aramco (SAF-focused JVs)

- Idemitsu Kosan Co.

- Rosneft PJSC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Covid Load-Factor Rebound Lifting Asia Jet A Demand

- 4.2.2 Expansion of Low-Cost Carriers Across Africa & ASEAN

- 4.2.3 Surge in Wide-Body Freighter Orders on Trans-Pacific Routes

- 4.2.4 Mega-Hub Capacity Builds in Middle-East Fuel Farm Investments

- 4.2.5 Large-Scale U.S. & NATO Air-Exercises Boosting JP-8 Offtake

- 4.2.6 EU 2 % SAF Blend Mandate Raising Pool Volumes via Density Loss

- 4.3 Market Restraints

- 4.3.1 EU-ETS Phase-IV Ticket Surcharges Curtail Leisure Flying

- 4.3.2 Fleet Renewal Toward Fuel-Efficient Aircraft Cuts Per-Flight Burn

- 4.3.3 High SAF Premium Squeezes Airline Hedging & Fuel Uplift

- 4.3.4 Aromatics-Rich Crude Shortage Lowering USGC Jet Yield

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Fuel Type

- 5.1.1 Jet A

- 5.1.2 Jet A-1

- 5.1.3 Jet B

- 5.1.4 Others [TS-1, Sustainable Aviation Fuel (SAF)]

- 5.2 By Application

- 5.2.1 Commercial Aviation

- 5.2.2 Defense Aviation

- 5.2.3 General Aviation

- 5.3 By Distribution Channel

- 5.3.1 Into-Plane (On-Airport)

- 5.3.2 Bulk Supply to Fixed-Base Operators (FBO)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Nordic Countries

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 ASEAN Countries

- 5.4.3.6 Australia

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Shell PLC

- 6.4.2 Exxon Mobil Corp

- 6.4.3 BP PLC (Air BP)

- 6.4.4 Chevron Corp

- 6.4.5 TotalEnergies SE

- 6.4.6 Qatar Jet Fuel Company (QJet)

- 6.4.7 Gazprom Neft PJSC

- 6.4.8 Bharat Petroleum Ltd

- 6.4.9 Indian Oil Corporation

- 6.4.10 China Petroleum & Chemical Corp (Sinopec)

- 6.4.11 PetroChina Co Ltd

- 6.4.12 Neste OYJ

- 6.4.13 LanzaJet Inc.

- 6.4.14 Gevo Inc.

- 6.4.15 World Fuel Services Corp

- 6.4.16 Phillips 66 Aviation

- 6.4.17 Vitol Aviation

- 6.4.18 PETRONAS Dagangan Berhad

- 6.4.19 Petrobras Distribuidora SA

- 6.4.20 OMV AG

- 6.4.21 Eni SpA

- 6.4.22 Saudi Aramco (SAF-focused JVs)

- 6.4.23 Idemitsu Kosan Co.

- 6.4.24 Rosneft PJSC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment