PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851702

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851702

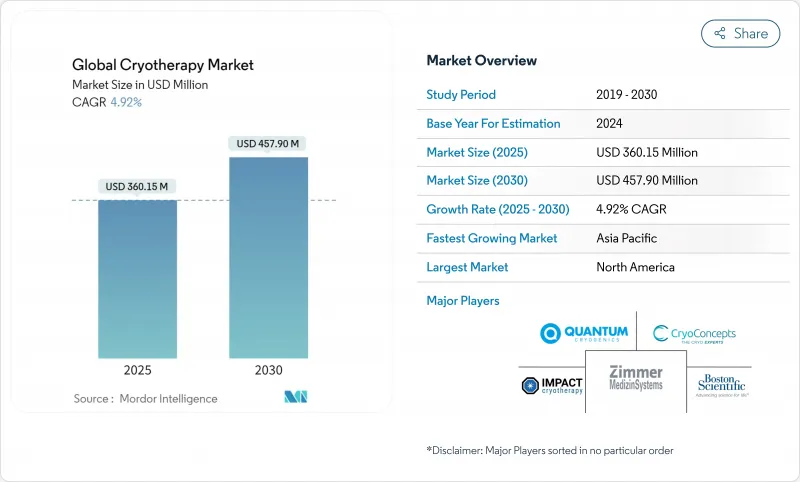

Global Cryotherapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global Cryotherapy market size stood at USD 360.15 billion in 2025 and is forecast to reach USD 457.90 billion by 2030, reflecting a 4.92% CAGR over 2025-2030.

The trajectory underscores how the Cryotherapy market is shifting from specialized medical use toward broad wellness adoption, supported by rising dermatology procedures, non-invasive pain management, and expanding franchise networks. Equipment innovation that lowers nitrogen consumption, emerging electric systems, and data-rich athlete recovery platforms are widening clinical and consumer acceptance. North America currently commands the highest regional share, yet the Cryotherapy market is beginning to rebalance as Asia-Pacific delivers the quickest regional CAGR, benefiting from urban wellness spending and local manufacturing scale. Regulatory duality also shapes growth: targeted devices gain FDA clearance while whole-body chambers remain wellness-only, steering pricing, reimbursement, and go-to-market strategies.

Global Cryotherapy Market Trends and Insights

Rapid Rise in Dermatology & Cosmetic Procedures

Dermatology clinics are shifting from general wellness claims to evidence-backed therapies that command premium pricing and win insurer recognition. Medicare billing codes for cryoneurolysis now reimburse cold-based nerve ablation, broadening physician adoption. Cryofacials priced at USD 50-300 per visit extend revenue beyond lesion removal, while controlled cryotherapy shows documented efficacy against viral warts with cold urticaria reported in fewer than 2% of cases. Rising patient demand, predictable reimbursement and low complication rates reinforce dermatology as an anchor use-case within the cryosurgery market.

Increasing Preference for Non-Invasive Pain Therapies

A 2025 Nature meta-analysis of 11 randomized trials confirmed whole-body cryotherapy lowered pro-inflammatory IL-1B and elevated anti-inflammatory IL-10, validating analgesic claims. Clinicians now recommend cold therapy as an adjunct for arthritis, fibromyalgia and postoperative pain, reducing reliance on opioids. Sports medicine has mainstreamed cryotherapy as wearables track lactate and creatine-kinase drop-offs, helping athletes fine-tune recovery windows. This biomarker validation keeps the cryosurgery market prominent in multidisciplinary pain protocols.

Adverse Events & Frostbite Litigations

A fatal nitrogen leak in Paris in April 2025 drew worldwide scrutiny of chamber design and ventilation. The European Industrial Gases Association warned that poor ventilation lets nitrogen displace oxygen, causing asphyxiation. U.S. FDA MAUDE files include frostbite and cellulitis linked to over-the-counter cryo-sprays. Liability premiums surge where state oversight is light, prompting operators to retrofit oxygen sensors and staff alarms, thus raising cost structures across the cryosurgery market.

Other drivers and restraints analyzed in the detailed report include:

- Whole-Body Cryo-Centers Scaling Through Franchising

- Medicare & Private Insurer Coverage Expansions

- High Capex for Multi-Chamber Installations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cryotherapy devices generated 44.00% of 2024 revenue, confirming the equipment-centric nature of therapeutic cold modalities. Tissue contact and spray probes serve dermatology and oncology, where centimeter-scale precision is paramount. Electric chambers now challenge nitrogen models through lower operating cost and quieter operation, widening non-clinical adoption. Simultaneously, a dependable consumables stream anchors vendor economics: liquid nitrogen, cryogenic gloves, oxygen sensors, filter cartridges and replacement seals ensure recurring margin. Consumables already outpace devices with a 5.29% CAGR, driven by multi-location franchises that bulk-purchase standardized supplies, reinforcing a durable annuity model for the Cryotherapy market.

The Cryotherapy Market Report is Segmented by Product Type (Devices Including Tissue Contact Probes, Tissue Spray Probes, Epidermal and Subcutaneous Cryoablation Devices, Cryochambers; Cryogenic Gas & Consumables; Accessories), Application (Oncology, Dermatology, and More), End-User (Hospitals & Specialty Clinics, and More), and Geography (North America, Europe, and More. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 42.23% of 2024 value. High disposable income, mature sports medicine and favorable franchise regulation underpin sustained demand. Federal code treats nitrogen chambers as wellness devices, sidelining FDA device premarket review for non-medical marketing, thereby accelerating rollout. Nonetheless, variability among state requirements-physician oversight in Colorado, age thresholds in Nevada-adds compliance complexity that favors nationwide operators able to tailor protocols.

Asia-Pacific represents the fastest-growing territory at 6.89% CAGR to 2030. Urbanization, rising middle-class income and a surge in boutique wellness chains drive uptake. Japan maintains early-mover status, leveraging decades of rheumatoid-arthritis data to broaden public acceptance of cold therapy. China and South Korea fast-track local chamber manufacturing, trimming import duties and shortening lead times. Regional operators integrate cryotherapy with facial aesthetics and traditional medicine, creating hybrid consumer propositions that expand the Cryotherapy market.

Europe sustains steady growth but faces intensified safety oversight after the April 2025 nitrogen-leak fatality. National occupational-health agencies now draft guidelines that mandate oxygen-monitoring systems and staff certification. Concurrently, EU climate legislation spurs adoption of green-ammonia-derived nitrogen and low-GWP cryosprays. Western European wellness hubs profit from affluent clientele, while Eastern European private hospitals introduce cryoablation suites tied to EU structural funds, balancing safety investment with clinical demand.

- Medtronic

- Zimmer MedizinSysteme

- The Cooper Companies

- Brymill Cryogenic Systems

- Metrum CryoFlex

- IceCure Medical Ltd.

- Erbe Elektromedizin

- Metcast Medical

- CryoScience Ltd.

- Impact Cryotherapy

- CryoBuilt

- MECOTEC GmbH

- Galil Medical (Boston Scientific)

- Cortex Technology

- Quantum Cryogenics

- Kriosystem Life

- Varian Medical Systems

- Sanarus Technologies

- Shanghai Med-X Scientific

- CPSI Biotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid rise in dermatology & cosmetic procedures

- 4.2.2 Increasing preference for non-invasive pain therapies

- 4.2.3 Whole-body cryo-centers scaling through franchising

- 4.2.4 Medicare & private insurer coverage expansions

- 4.2.5 Under-reported: athlete recovery data integration into wearables

- 4.2.6 Under-reported: liquid-nitrogen sourcing via green-ammonia plants

- 4.3 Market Restraints

- 4.3.1 Adverse events & frostbite litigations

- 4.3.2 High capex for multi-chamber installations

- 4.3.3 Under-reported: tightening fluorocarbon emission rules on cryosprays

- 4.3.4 Under-reported: nitrogen supply chain disruptions in fertiliser peaks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Devices

- 5.1.1.1 Tissue Contact Probes

- 5.1.1.2 Tissue Spray Probes

- 5.1.1.3 Epidermal and Subcutaneous Cryoablation Devices

- 5.1.2 Cryochambers

- 5.1.3 Cryogenic Gas & Consumables

- 5.1.4 Accessories

- 5.1.1 Devices

- 5.2 By Application

- 5.2.1 Oncology

- 5.2.2 Dermatology

- 5.2.3 Cardiology

- 5.2.4 Pain Management & Sports Recovery

- 5.2.5 Other Applications

- 5.3 By Therapy Type

- 5.3.1 Whole-body

- 5.3.2 Partial-body

- 5.3.3 Localized / Ice-pack Therapy

- 5.3.4 Cryosurgery

- 5.4 By End-user

- 5.4.1 Hospitals & Specialty Clinics

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of APAC

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Medtronic plc

- 6.4.2 Zimmer MedizinSysteme GmbH

- 6.4.3 CooperSurgical Inc.

- 6.4.4 Brymill Cryogenic Systems

- 6.4.5 Metrum CryoFlex

- 6.4.6 IceCure Medical Ltd.

- 6.4.7 Erbe Elektromedizin GmbH

- 6.4.8 Metcast Medical

- 6.4.9 CryoScience Ltd.

- 6.4.10 Impact Cryotherapy

- 6.4.11 CryoBuilt

- 6.4.12 MECOTEC GmbH

- 6.4.13 Galil Medical (Boston Scientific)

- 6.4.14 Cortex Technology

- 6.4.15 Quantum Cryogenics

- 6.4.16 Kriosystem Life

- 6.4.17 Varian Medical Systems

- 6.4.18 Sanarus Technologies

- 6.4.19 Shanghai Med-X Scientific

- 6.4.20 CPSI Biotech

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment