PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851704

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851704

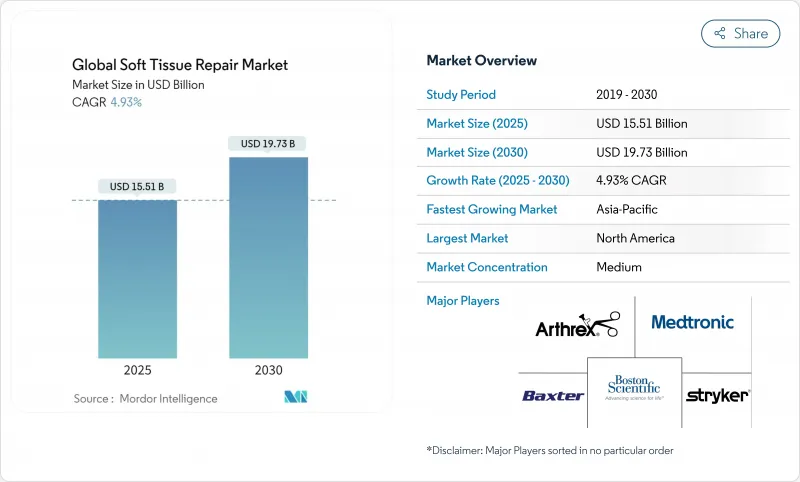

Global Soft Tissue Repair - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global soft tissue repair market size stood at USD 15.51 billion in 2025 and is projected to reach USD 19.73 billion by 2030, registering a 4.93% CAGR.

Demand is underpinned by aging demographics, a steady rise in sports injuries, and the accelerating shift of procedures to ambulatory surgical centers (ASCs). Rapid product innovation-spanning bio-engineered meshes, 3D-printed scaffolds, and suture-less fixation systems-continues to refresh the competitive landscape. Intensifying regulatory scrutiny of legacy synthetic meshes is steering surgeons toward biologic and hybrid alternatives that promise better biocompatibility. At the same time, payer cost-containment policies are amplifying the need for devices optimized for outpatient settings without sacrificing clinical outcomes.

Global Soft Tissue Repair Market Trends and Insights

Rising Sports-Related Injuries

A steady uptick in athletic participation across age groups keeps the soft tissue repair market on a growth trajectory. Incidence of surgically treated hamstring injuries climbed more than threefold in Sweden between 2001 and 2023. Similar trends appear in upper-extremity trauma, where hand injury cases rose 2% annually from 2007 to 2022. Older recreational athletes often present diminished tissue quality, fueling demand for advanced biologic grafts and load-sharing fixation systems that shorten rehabilitation timelines. Device makers able to document quicker functional recovery in this cohort gain a clear competitive edge.

Increasing Trauma & Road-Accident Cases

Road traffic accidents remain a major global health burden, markedly in emerging economies. Complex extremity injuries often involve multiple soft tissue layers, prompting surgeons to favor integrated repair platforms combining fixation, scaffold, and hemostatic functions. Regional disparities in trauma patterns compel manufacturers to tailor training and inventory models to local needs. As governments in Asia and Latin America roll out trauma system upgrades, procedure volumes are expected to lift the soft tissue repair market further.

High Procedure & Device Costs

Premium biologic matrices can cost multiples of standard polypropylene mesh. U.S. payers now cap the number of applications for certain skin substitutes and demand comparative evidence of superiority . Similar scrutiny by private insurers has tagged many novel grafts as investigational. Without sustained outcome data, adoption in cost-sensitive settings stalls, slowing the pace at which the soft tissue repair market converts to newer materials.

Other drivers and restraints analyzed in the detailed report include:

- Growing Geriatric Population

- Technological Advances in Bio-Engineered Meshes & Fixation Devices

- Outpatient ASC Expansion Driving Procedure Volumes

- 3D-Printed Patient-Specific Scaffolds

- Infection Litigation & Stringent Mesh Regulations

- Reimbursement Pushback on Novel Biologic Meshes

- Limited Surgeon Training in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fixation devices held a 38.35% share of the soft tissue repair market in 2024, underpinned by surgeon familiarity with suture anchors, interference screws, and medical adhesives. FDA clearance for CONMED's expanded BioBrace indications in 2025 adds over 50 orthopedic procedures to its label . TELA Bio's liquid adhesive, launched in 2024, offers a suture-less option for hernia closure. Continuous innovation secures this segment's revenue stream.

Tissue matrices are forecast to outpace all other categories at a 5.37% CAGR. Collagen-elastin hybrids and ECM-coated polypropylene meshes are demonstrating reduced recurrence and lower inflammatory profiles in pre-clinical models. As payers warm to the long-term cost savings of fewer re-operations, this fast-growing segment is poised to enlarge its slice of the soft tissue repair market size.

The Soft Tissue Repair Market Report is Segmented by Product (Tissue Fixation Devices, Tissue Matrix, Other Products), Application (Orthopedics & Sports Medicine, and More), End User (Hospitals, Ambulatory Surgical Centers, Others), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 42.81% of the soft tissue repair market in 2024 and is expected to maintain leadership through 2030. A mature ASC network now delivers 72% of U.S. surgeries, enhancing throughput while containing costs. The FDA continues to clear breakthrough devices such as Humacyte's acellular vessel for trauma repair, reinforcing the region's innovation ecosystem.

Europe retains solid positioning thanks to universal health systems and CE-mark harmonization. Nevertheless, fiscal pressures are prompting stricter health-technology assessments, which slow reimbursement for premium biologic matrices. Ongoing investments in robotics and additive manufacturing keep local suppliers competitive, sustaining the region's role in shaping next-generation solutions for the soft tissue repair market.

Asia-Pacific is the fastest-growing region, forecast at 6.15% CAGR. Regulatory modernization in China and India is clarifying approval pathways, while an aging population widens the candidate pool for hernia and rotator cuff procedures. Japan's adoption of bio-inductive implants underscores the region's appetite for advanced yet clinically validated technologies.

- Arthrex

- Medtronic

- Smith+Nephew plc

- Stryker

- Ethicon & DePuy Synthes (Johnson & Johnson)

- Baxter

- Integra LifeSciences Holdings

- Zimmer Biomet

- B. Braun

- Beckton Dickinson

- Conmed

- Organogenesis

- RTI Surgical

- Teleflex

- TELA Bio, Inc.

- Artivion, Inc. (CryoLife)

- Allergan Aesthetics (AbbVie)

- Wright Medical Group (Stryker)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Sports-Related Injuries

- 4.2.2 Increasing Trauma & Road-Accident Cases

- 4.2.3 Growing Geriatric Population

- 4.2.4 Technological Advancements In Bio-Engineered Meshes & Fixation Devices

- 4.2.5 Outpatient Asc Expansion Driving Soft-Tissue Procedure Volumes

- 4.2.6 3D-Printed Patient-Specific Scaffolds Enabling Complex Reconstructions

- 4.3 Market Restraints

- 4.3.1 High Procedure & Device Costs

- 4.3.2 Infection Litigation & Stringent Mesh Regulations

- 4.3.3 Reimbursement Pushback On Novel Biologic Meshes

- 4.3.4 Limited Surgeon Training In Emerging Markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Tissue Fixation Devices

- 5.1.1.1 Suture Anchors

- 5.1.1.2 Sutures & Staples

- 5.1.1.3 Interference Screws

- 5.1.1.4 Cyanoacrylate & Fibrin Glues

- 5.1.2 Tissue Matrix

- 5.1.2.1 Synthetic Mesh

- 5.1.2.2 Biologic / Hybrid Mesh

- 5.1.3 Other Products

- 5.1.1 Tissue Fixation Devices

- 5.2 By Application

- 5.2.1 Orthopedics & Sports Medicine

- 5.2.2 Dental Repair

- 5.2.3 Hernia Repair

- 5.2.4 Breast Reconstruction

- 5.2.5 Skin & Burn Repair

- 5.2.6 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers (ASCs)

- 5.3.3 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Arthrex, Inc.

- 6.3.2 Medtronic plc

- 6.3.3 Smith+Nephew plc

- 6.3.4 Stryker Corporation

- 6.3.5 Ethicon & DePuy Synthes (Johnson & Johnson)

- 6.3.6 Baxter International Inc.

- 6.3.7 Integra LifeSciences Holdings

- 6.3.8 Zimmer Biomet Holdings

- 6.3.9 B. Braun Melsungen AG

- 6.3.10 BD (Becton, Dickinson and Company)

- 6.3.11 CONMED Corporation

- 6.3.12 Organogenesis Holdings Inc.

- 6.3.13 RTI Surgical

- 6.3.14 Teleflex Incorporated

- 6.3.15 TELA Bio, Inc.

- 6.3.16 Artivion, Inc. (CryoLife)

- 6.3.17 Allergan Aesthetics (AbbVie)

- 6.3.18 Wright Medical Group (Stryker)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment