PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851706

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851706

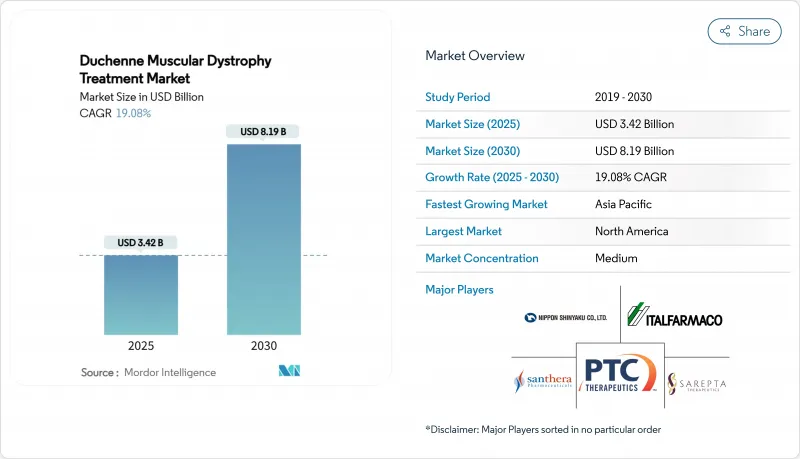

Duchenne Muscular Dystrophy Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Duchenne muscular dystrophy treatment market reached a market size of USD 3.42 billion in 2025 and is projected to expand at a 19.08% CAGR, culminating in USD 8.19 billion by 2030.

Breakthrough gene therapies, regulatory acceleration, and sustained venture investment are redefining therapeutic standards, shifting care from palliative regimens toward durable disease-modifying interventions. The FDA's broadened approval of delandistrogene moxeparvovec for children aged 4 and older, the first-in-class non-steroidal agent givinostat, and the corticosteroid alternative vamorolone together underpin a multimodal ecosystem where molecular approaches dominate . Investor appetite remains robust as platform technologies mature, illustrated by record capital raises for oligonucleotide and CRISPR innovators. Competitive realignment, sparked by program discontinuations among larger firms, has opened white-space opportunities for emerging players while intensifying focus on scalable vector manufacturing. Geographic momentum centers on Asia-Pacific, where regulators in Japan and China have accelerated reviews, positioning the region for above-average revenue growth and diversified clinical trial activity.

Global Duchenne Muscular Dystrophy Treatment Market Trends and Insights

Rising Disease Burden of DMD

Growing recognition that 1 in 3,500-6,000 male births are affected has prompted national registries and newborn screening programs that enlarge trial-eligible populations and encourage earlier therapeutic intervention . Point prevalence studies in England now cite 3.23 cases per 100,000, while direct medical costs rise nearly three-fold as patients transition from ambulatory to ventilator-assisted stages. Life expectancy improvements-from 18.2 years for those born before 1970 to 24 years for the 1990-1999 cohort-extend treatment duration and amplify market demand.

Increasing Investments in Novel Therapies

Venture and strategic capital continue to flow; CureDuchenne has catalyzed over USD 3 billion in follow-on funding since 2014, and Dyne Therapeutics secured USD 300 million in a single 2024 raise. Collaborations such as Sarepta-Arrowhead for siRNA and Sanofi-Fulcrum on epigenetic modulation illustrate big-pharma commitment to rare-disease portfolios, while philanthropic venture arms remain vital to early discovery .

Lack of Standardised Clinical Efficacy Endpoints

Variability in biomarkers such as creatine kinase complicates cross-study comparisons, prompting validation efforts for alternatives like urinary N-terminal titin, which correlates more closely with microdystrophin expression. Divergent FDA and EMA guidance adds planning complexity, while updated pediatric gait classifications expose gaps between historical outcome measures and contemporary standards.

Other drivers and restraints analyzed in the detailed report include:

- Approval Momentum for Antisense Exon-Skipping Drugs

- Orphan-Drug Incentives & Priority Review Vouchers

- High Therapy Cost & Reimbursement Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Molecular-based interventions generated the largest contribution to 2024 revenue, representing 61.34% of the Duchenne muscular dystrophy treatment market. That segment is projected to expand at 19.89% CAGR to 2030 on the back of first-to-market gene therapies, increasingly efficient exon-skipping chemistries, and emerging read-through agents. The Duchenne muscular dystrophy treatment market size for molecular categories is poised to reach USD 5.7 billion by 2030, reflecting sustained reimbursement for delandistrogene moxeparvovec and pipeline maturation among CRISPR constructs. Mutational-suppressing approaches continue to benefit from expanded labeling, while dystrophin-expressing chimeric cells are progressing through early trials without reliance on viral vectors.

Competitive dynamics within molecular modalities hinge on differentiated dystrophin expression; DYNE-251 delivered 3.71% expression versus 0.3% from legacy eteplirsen in head-to-head assessments. Manufacturing innovation remains a gating factor, yet recent optimizations in poly-A sequencing and transgene cassette architecture are lifting functional yields per liter of bioreactor capacity. Steroidal and non-steroidal anti-inflammatories retain a complementary role, particularly where gene therapy access is delayed, preserving revenue baselines for chronic care protocols and underpinning combination-therapy investigation.

The Duchenne Muscular Dystrophy Treatment Market Report is Segmented by Therapeutic Approach (Molecular-Based, Steroidal Therapy, Nsaids, Others), Route of Administration (Intravenous, Sub-Cutaneous, Oral), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 41.29% revenue contribution in 2024, buoyed by an established orphan-drug framework, broad private insurance coverage, and venture funding depth. The Duchenne muscular dystrophy treatment market size in the region surpassed USD 1.4 billion, and steady rollout of newborn screening mandates is expected to enlarge the treated population base. Canada and Mexico are adopting harmonized labeling, promoting cross-border treatment continuity while forging local pathways for gene-therapy reimbursement.

Asia-Pacific is forecast to be the fastest-advancing territory at 19.98% CAGR through 2030. Japan approved delandistrogene moxeparvovec under its regenerative medicine pathway in May 2025, granting seven-year conditional marketing rights. China's priority review of vamorolone positions the mainland for first-wave uptake once manufacturing transfers conclude, and state-supported CRISPR initiatives are drawing global sponsors into joint ventures for localized production capacity. India, South Korea, and Australia are scaling investigator networks and rare-disease registries, collectively widening clinical trial participation.

Europe maintains a pivotal role through coordinated regulatory accelerators and dense academic-medical networks. Conditional approval of givinostat in April 2025 underscored the EMA's willingness to accept surrogate endpoints while stipulating robust post-marketing commitments. Germany and France remain early adopters, backed by statutory insurance schemes that reimburse high-cost therapies under outcomes-based contracts. Eastern European nations are gradually introducing pilot reimbursement projects, anticipating price negotiations once additional therapeutic alternatives reach market.

- Sarepta Therapeutics

- PTC Therapeutics

- Nippon Shinyaku (NS Pharma)

- Pfizer

- Italfarmaco

- Santhera Pharmaceuticals

- FibroGen

- BioMarin

- Roche / Genentech

- Wave Life Sciences

- Solid Biosciences

- Dyne Therapeutics

- Edgewise Therapeutics

- Regenxbio

- Alexion (AstraZeneca Rare Disease)

- Genethon

- Eli Lilly and Company

- Dystrogen Therapeutics

- Entrada Therapeutics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising disease burden of DMD

- 4.2.2 Increasing investments in novel therapies

- 4.2.3 Approval momentum for antisense exon-skipping drugs

- 4.2.4 Orphan-drug incentives & priority review vouchers

- 4.2.5 CRISPR platform deals accelerating gene-editing pipelines

- 4.2.6 Decentralised trials improving patient recruitment

- 4.3 Market Restraints

- 4.3.1 Lack of standardised clinical efficacy endpoints

- 4.3.2 High therapy cost & reimbursement hurdles

- 4.3.3 Manufacturing bottlenecks for high-dose AAV vectors

- 4.3.4 Regulatory uncertainty on off-target gene editing

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Therapeutic Approach

- 5.1.1 Molecular-Based

- 5.1.1.1 Mutation Suppressing

- 5.1.1.2 Exon Skipping

- 5.1.2 Steroidal Therapy

- 5.1.3 NSAIDs

- 5.1.4 Others

- 5.1.1 Molecular-Based

- 5.2 By Route of Administration

- 5.2.1 Intravenous

- 5.2.2 Sub-cutaneous

- 5.2.3 Oral

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Retail Pharmacies

- 5.3.3 Online Pharmacies

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Sarepta Therapeutics

- 6.3.2 PTC Therapeutics

- 6.3.3 Nippon Shinyaku (NS Pharma)

- 6.3.4 Pfizer

- 6.3.5 Italfarmaco

- 6.3.6 Santhera Pharmaceuticals

- 6.3.7 FibroGen

- 6.3.8 BioMarin

- 6.3.9 Roche / Genentech

- 6.3.10 Wave Life Sciences

- 6.3.11 Solid Biosciences

- 6.3.12 Dyne Therapeutics

- 6.3.13 Edgewise Therapeutics

- 6.3.14 Regenxbio

- 6.3.15 Alexion (AstraZeneca Rare Disease)

- 6.3.16 Genethon

- 6.3.17 Eli Lilly

- 6.3.18 Dystrogen Therapeutics

- 6.3.19 Entrada Therapeutics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment