PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851710

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851710

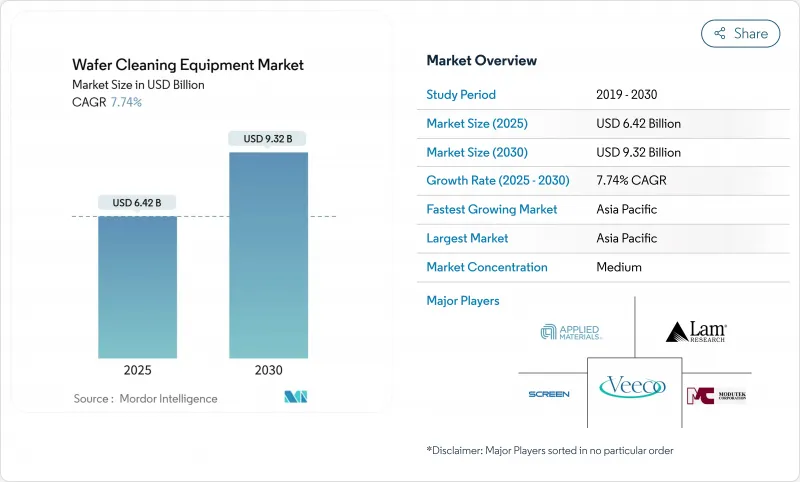

Wafer Cleaning Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The wafer cleaning equipment market size stood at USD 6.42 billion in 2025 and is forecast to reach USD 9.32 billion by 2030, reflecting a 7.74% CAGR during 2025-2030.

The expansion mirrors the semiconductor industry's move toward 1.6 nm process technology, where sub-10 nm particle removal becomes mandatory. EUV lithography adoption, foundry capacity build-outs in Taiwan, South Korea, China, and the United States, and the transition to 300 mm silicon-carbide and gallium-nitride wafers are amplifying demand across the wafer cleaning equipment market. Environmental mandates targeting fluorinated greenhouse gases and rising ultrapure-water costs are reshaping equipment selection criteria, but suppliers offering water-efficient or cryogenic solutions are capturing share. Competitive intensity remains moderate because sophisticated process know-how, long qualification cycles, and service footprints act as barriers to entry.

Global Wafer Cleaning Equipment Market Trends and Insights

Proliferation of 3-D NAND and DRAM Node Shrinks Driving Defect-Free FEOL Cleaning Demand

Mass-production roadmaps toward 1,000-layer 3-D NAND by 2030 multiply cleaning steps because every additional layer increase particle-induced yield loss. SK Hynix earmarked USD 75 billion for memory scaling through 2028, directing 80% to high-bandwidth memory. Lam Research introduced Cryo 3.0 etch to mitigate polymer residues in deep trenches. Equipment makers that deliver sub-angstrom removal precision are benefiting from rising layer counts, lifting the wafer cleaning equipment market. Memory fabs now contractually link tool purchase decisions to demonstrated removal efficiency below 10 nm, reinforcing long-term demand.

Foundry Capacity Expansion in the U.S., Korea and Taiwan Creating New Tool Install Base

The CHIPS Act triggered large-scale tool procurement in Arizona, where TSMC's complex requires thousands of process tools. Samsung and SK Hynix committed 622 trillion won (USD 471 billion) for 16 new fabs by 2047, intensifying immediate order cycles. Tokyo Electron nearly doubled R&D spend to JPY 1.5 trillion over five years to secure next-generation opportunities. Capacity additions focus on 3 nm and below, translating to tool specs that only advanced wafer cleaning equipment market participants can meet. Short tool lead-times and service proximity drove an immediate surge in orders for fully automatic cleaning platforms.

Stringent Discharge Regulations on Fluorinated Greenhouse Gases (F-GHGs)

The global semiconductor industry pledged to phase out PFOA, tightening chemical options. The U.S. EPA's accelerated PFAS review injects uncertainty into chemistry roadmaps. European fabs cut PFC emissions 42% from 2010-2020, mainly by retrofitting abatement modules. Equipment firms now bundle scrubbers and closed-loop chemical recycle units, raising acquisition cost and extending ROI timelines, moderating the wafer cleaning equipment market growth projection.

Other drivers and restraints analyzed in the detailed report include:

- Transition Toward 300 mm SiC and GaN Power Wafers Requiring New Wet-Bench Chemistries

- Adoption of EUV Lithography Necessitating Ultra-Low Particle Cleans <10 nm

- Rising Ultrapure-Water (UPW) Cost in Drought-Prone Semiconductor Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fully automatic platforms generated 74.5% of 2024 revenue thanks to strict contamination-control mandates on advanced logic lines, placing the wafer cleaning equipment market in an automation-first paradigm. Semi-automatic tools persisted in R&D cleanrooms, while manual systems stayed limited to specialty or legacy flows. The fully automatic segment, already dominant, is forecast to compound at 8.5% annually on the back of AI-driven recipe optimization. SCREEN's SS-3200 spin-scrubber processed 500 wafers per hour while cutting deionized-water use, underpinning replacement cycles.

Process analytics embedded in machine controllers now store millions of datapoints per lot, allowing fabs to predict excursions and prevent line stops. Vendors embed predictive-maintenance modules that flag nozzle fouling or flow instability. These digital workflows align with smart-manufacturing mandates, supporting premium pricing. Consequently, the wafer cleaning equipment market sees purchasing decisions shift from capex alone toward total cost-of-ownership anchored in uptime metrics and water savings.

Single-wafer spray lines earned 33.2% revenue share in 2024 by combining small footprint, chemistry savings, and recipe flexibility, helping maintain the wafer cleaning equipment market trajectory. Cryogenic CO2 variants, though newer, registered the fastest 12.2% CAGR outlook on the promise of near-zero liquid discharge. Batch immersion tools survived in high-volume commodity lines, while batch spray occupied the mid-tier. Scrubbers served blanket oxide removal tasks that chemicals alone could not address.

Tokyo Electron's cryogenic etch reduced CO2 emissions 80%, validating green-chemistry claims. ACM Research's Ultra C Tahoe slashed sulfuric-acid use 75% while matching legacy performance, winning multiple foundry installs. Technology decisions now revolve around water and greenhouse-gas metrics as much as particle-count specs, reinforcing the strategic importance of single-wafer innovation to the wafer cleaning equipment market.

Wafer Cleaning Equipment Market is Segmented by Operating Mode (Automatic Equipment, and More), Technology Type (Single-Wafer Spray, Single-Wafer Cryogenic, and More), Wafer Size (<=150 Mm, 200 Mm, 300 Mm, and >=450 Mm), Application (Smartphones and Tablets, Memory Devices, and More), End-User (Foundries, IDM, and OSAT), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific generated 72.5% of 2024 revenue, anchored by cluster investments in Taiwan, South Korea, and China that collectively installed more than 7.7 million wafers per month cleaning capacity. Foundry expansions in Kaohsiung and Hsinchu lifted near-term tool uptake, while China's IDM surge under export controls catalyzed domestic tool adoption.

North America's share rose on TSMC-Arizona and Intel's Ohio investments, leveraging CHIPS Act grants. These fabs specified US-based service teams and spare-parts hubs, altering vendor-selection dynamics inside the wafer cleaning equipment market.

Europe maintained specialty leadership: Infineon and STMicroelectronics expanded SiC output; the Netherlands launched the EUR 12 million ChipNL Centre to co-develop cleaning and metrology platforms. Automotive demand underpins steady tool renewal.

South America, and Middle East and Africa posted nascent demand from assembly plants. Government incentives in the UAE and Brazil aim to attract backend facilities that still need localized wafer cleaning services, hinting at longer-term geographic diversification for the wafer cleaning equipment market.

- SCREEN Semiconductor Solutions Co., Ltd.

- ACM Research Inc.

- MEI Wet Processing Systems & Services LLC

- Modutek Corporation

- Akrion Technologies LLC

- RENA Technologies GmbH

- JST Manufacturing Inc.

- Yield Engineering Systems (YES) Inc.

- AP&S International GmbH

- Semsysco GmbH

- MT Systems Co., Ltd.

- Expertech Systems Inc.

- Samco Inc.

- Naura Technology Group

- Applied Materials

- Tokyo Electron Limited (TEL)

- Kaijo Corporation

- Surpass Industry Co., Ltd.

- Kingsemi Co., Ltd.

- Hwatsing Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of 3-D NAND and DRAM node shrinks driving defect-free FEOL cleaning demand

- 4.2.2 Foundry capacity expansion in the U.S., Korea and Taiwan creating new tool install base

- 4.2.3 Transition toward 300 mm SiC and GaN power wafers requiring new wet-bench chemistries

- 4.2.4 Adoption of EUV lithography necessitating ultra-low particle cleans <10 nm

- 4.2.5 Rapid fab investments by Chinese IDMs despite U.S. export controls

- 4.3 Market Restraints

- 4.3.1 Stringent discharge regulations on fluorinated greenhouse gases (F-GHGs)

- 4.3.2 Rising ultrapure water (UPW) cost in drought-prone semiconductor hubs

- 4.3.3 High capex intensity versus alternative dry plasma cleans in BEOL

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Operating Mode

- 5.1.1 Automatic Equipment

- 5.1.2 Semi-automatic Equipment

- 5.1.3 Manual Equipment

- 5.2 By Technology Type

- 5.2.1 Single-wafer Spray

- 5.2.2 Single-wafer Cryogenic

- 5.2.3 Batch Immersion

- 5.2.4 Batch Spray

- 5.2.5 Scrubbers

- 5.3 By Wafer Size

- 5.3.1 <=150 mm

- 5.3.2 200 mm

- 5.3.3 300 mm

- 5.3.4 >=450 mm

- 5.4 By Application

- 5.4.1 Smartphones and Tablets

- 5.4.2 Memory Devices

- 5.4.3 RF Devices

- 5.4.4 LED

- 5.4.5 Power Discrete and IC

- 5.4.6 CMOS Image Sensors

- 5.5 By End-User

- 5.5.1 Foundries

- 5.5.2 Integrated Device Manufacturers (IDM)

- 5.5.3 Outsourced Semiconductor Assembly and Test (OSAT)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 United Kingdom

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Taiwan

- 5.6.3.3 South Korea

- 5.6.3.4 Japan

- 5.6.3.5 India

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Mexico

- 5.6.4.3 Argentina

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 SCREEN Semiconductor Solutions Co., Ltd.

- 6.4.2 ACM Research Inc.

- 6.4.3 MEI Wet Processing Systems & Services LLC

- 6.4.4 Modutek Corporation

- 6.4.5 Akrion Technologies LLC

- 6.4.6 RENA Technologies GmbH

- 6.4.7 JST Manufacturing Inc.

- 6.4.8 Yield Engineering Systems (YES) Inc.

- 6.4.9 AP&S International GmbH

- 6.4.10 Semsysco GmbH

- 6.4.11 MT Systems Co., Ltd.

- 6.4.12 Expertech Systems Inc.

- 6.4.13 Samco Inc.

- 6.4.14 Naura Technology Group

- 6.4.15 Applied Materials

- 6.4.16 Tokyo Electron Limited (TEL)

- 6.4.17 Kaijo Corporation

- 6.4.18 Surpass Industry Co., Ltd.

- 6.4.19 Kingsemi Co., Ltd.

- 6.4.20 Hwatsing Technology Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment