PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851716

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851716

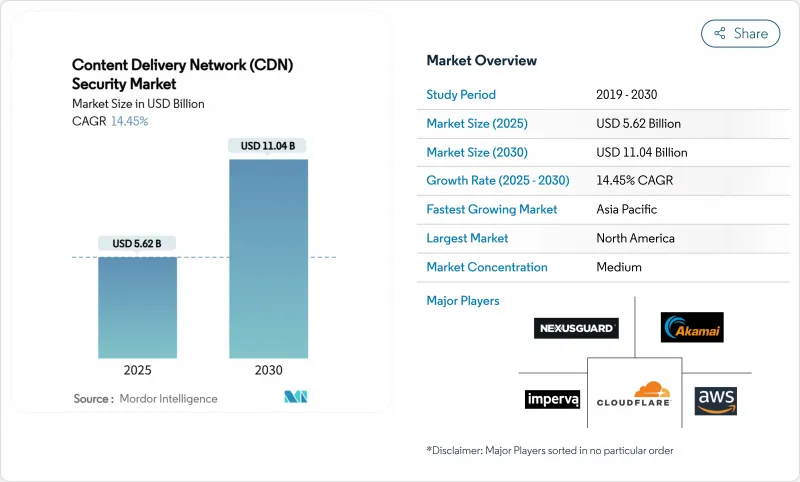

Content Delivery Network (CDN) Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The CDN Security market generated USD 5.62 billion in 2025 and is on track to reach USD 11.04 billion by 2030, advancing at a 14.45% CAGR.

Escalating attack volumes, aggressive regulatory deadlines, and the migration of workloads to multi-cloud and edge environments are the primary forces behind this expansion. Enterprises now insist on always-on, behavioral-based mitigation after Cloudflare documented a 358% jump in global DDoS events during Q1 2025, equal to 20.5 million blocked attacks. Mandates such as the EU's Digital Operational Resilience Act (DORA) and PCI DSS v4.0 elevate compliance risk, while OTT traffic growth pushes content owners to embed security deeper into delivery pipelines. A parallel shift toward cloud delivery enables rapid deployment, illustrated by the 65.7% share that cloud implementations already hold. Competitive intensity is rising as incumbents consolidate (Akamai's USD 450 million acquisition of Noname) while specialists such as Cloudflare expand AI-powered detection to counter evolving bots and scrapers.

Global Content Delivery Network (CDN) Security Market Trends and Insights

Rising Frequency and Sophistication of DDoS / L-7 Attacks

Cloudflare's telemetry shows network-layer assaults ballooned 509% year-over-year in Q1 2025, while terabit-scale floods are now routine. Multi-vector campaigns combine SYN floods with Mirai botnets, and reflection methods such as CLDAP and ESP have spiked 3,488% and 2,301% respectively.Carpet-bombing tactics, 82.78% of all observed attacks in 2024, force organizations to adopt always-on defenses instead of traffic-divert approaches. Financial services remain the primary target as geopolitical tensions spur hacktivism; Akamai logged a 154% rise in sector-focused events in 2023. CDN security vendors now embed ML-driven anomaly scoring at edge PoPs to distinguish legitimate microbursts from malicious floods.

Rapid Growth in OTT Video and Real-Time Streaming Traffic

Subscriber churn correlates directly with stream buffering, prompting platforms to deploy multi-CDN setups plus DRM watermarking. ContentArmor and Limelight upgraded forensic watermarking to curb piracy, integrating directly into delivery layers. Edge-native infrastructure from Qwilt reduces first-frame latency, but its proximity to viewers exposes surface area to credential-stuffing and token theft. Security stacks therefore integrate per-session entropy checks and token binding without inflating latency budgets crucial for live sports.

Global Shortage of Skilled Cyber-Security Practitioners

Forty-six percent of reported breaches hit firms with under 1,000 staff, and 82% of ransomware incidents target the same cohort. Universities average up to 1,580 public-facing domains yet often lack security teams to harden them. Providers now ship point-and-click configuration presets and AI triage, but a persistent talent gap slows CDN Security market adoption among resource-constrained buyers.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise Shift to Multi-Cloud and Edge Architectures

- Regulatory Uptime and Data-Protection Mandates

- High TCO of Always-On Mitigation for SMEs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large enterprises controlled 75.4% of 2024 revenue thanks to complex infrastructures and deep security budgets that span DDoS, WAF, bot and zero-trust layers. NEC rolled out Zscaler for 120,000 global employees to centralize internet and private-app access. Conversely, SMEs show the strongest 14.7% CAGR as managed cloud models democratize tools once reserved for Fortune 500. Cloudflare's partnership with Rakuten Mobile offers packaged zero-trust services aimed at Japan's small-business segment. Talent shortages and cost sensitivities persist, yet simplified dashboards and usage-based pricing unlock adoption.

Web Application Firewalls held 47.2% share in 2024, bolstered by PCI DSS v4.0 script-monitoring mandates. Fortinet's FortiAppSec Cloud combines WAF with performance analytics to streamline deployment. Bot mitigation, expanding 15.3% CAGR, addresses AI-driven scraping and credential abuse. Cloudflare's AI Labyrinth generates decoy pages to trap illegal crawlers, while HUMAN Security claims 99.9% detection accuracy via intelligent fingerprinting. As attackers weaponize machine learning, layered defenses that join WAF, bot and API protection will shape the CDN Security market trajectory.

Content Delivery Network (CDN) Security Market is Segmented by Organization Size (SMBs, Large Enterprises), Security Type (DDoS Protection, Web Application Firewall (WAF), and More), End-User Industry (Media and Entertainment, BFSI, and More), Deployment Mode (Cloud, On-Premises), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 32.9% of global revenue in 2024. Mature compliance regimes and high per-capita cyber spend underpin adoption. Oklahoma's statewide Zscaler roll-out blocked 34,000 encrypted threats and 17.6 million policy violations, proving zero-trust viability at scale.

Asia-Pacific is expanding at a 15.1% CAGR. Akamai logged 51 billion web-app attacks against APAC sites in 2024, a 73% jump, with Australia, India and Singapore worst hit. Rakuten Mobile's partnership with Cloudflare commercializes managed zero-trust for local SMEs, while Japan's cyber insurance market is growing nearly 50% a year.

Europe sees steady growth as DORA and GDPR tighten operational and data-protection requirements. Banks retrofit API and WAF controls for resilience testing, and Estonia's Information System Authority relies on Cloudflare to safeguard sovereign digital services. Latin America and Africa remain nascent; CDNetworks now operates PoPs in 20 LATAM countries to reach 600 million subscribers, laying groundwork for future CDN Security market uptake.

- Akamai Technologies Inc.

- Amazon Web Services Inc. (CloudFront)

- Cloudflare Inc.

- Google LLC (Cloud CDN)

- Microsoft Corp. (Azure Front Door)

- Imperva Inc.

- Fastly Inc.

- Edgio Inc. (Limelight Networks)

- Verizon Media Platform

- Radware Ltd.

- F5 Inc.

- StackPath LLC

- G-Core Labs S.A.

- Alibaba Cloud (Alibaba Group)

- Corero Network Security plc

- Nexusguard Ltd.

- CDNetworks Inc.

- Neustar Security Services

- Akamai (Prolexic)

- NETSCOUT Systems (Arbor)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising frequency and sophistication of DDoS / L-7 attacks

- 4.2.2 Rapid growth in OTT video and real-time streaming traffic

- 4.2.3 Enterprise shift to multi-cloud and edge architectures

- 4.2.4 Regulatory uptime and data-protection mandates (e.g., DORA, PCI DSS v4)

- 4.2.5 Edge PoP consolidation enabling embedded zero-trust controls

- 4.2.6 Algorithmic network-cost steering driving security-integrated CDNs

- 4.3 Market Restraints

- 4.3.1 Global shortage of skilled cyber-security practitioners

- 4.3.2 High TCO of always-on mitigation for SMEs

- 4.3.3 IPv6 traffic exposing gaps in legacy filtering appliances

- 4.3.4 Rising energy costs at edge PoPs slowing footprint expansion

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Organization Size

- 5.1.1 Small and Medium-Sized Businesses (SMBs)

- 5.1.2 Large Enterprises

- 5.2 By Security Type

- 5.2.1 DDoS Protection

- 5.2.2 Web Application Firewall (WAF)

- 5.2.3 Bot Mitigation and Screen-Scraping Protection

- 5.2.4 Data Security and Content Integrity

- 5.2.5 Others

- 5.3 By End-user Industry

- 5.3.1 Media and Entertainment

- 5.3.2 Retail and E-commerce

- 5.3.3 BFSI

- 5.3.4 IT and Telecom

- 5.3.5 Healthcare and Life Sciences

- 5.3.6 Government and Public Sector

- 5.3.7 Education

- 5.3.8 Others

- 5.4 By Deployment Mode

- 5.4.1 Cloud

- 5.4.2 On-Premise

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akamai Technologies Inc.

- 6.4.2 Amazon Web Services Inc. (CloudFront)

- 6.4.3 Cloudflare Inc.

- 6.4.4 Google LLC (Cloud CDN)

- 6.4.5 Microsoft Corp. (Azure Front Door)

- 6.4.6 Imperva Inc.

- 6.4.7 Fastly Inc.

- 6.4.8 Edgio Inc. (Limelight Networks)

- 6.4.9 Verizon Media Platform

- 6.4.10 Radware Ltd.

- 6.4.11 F5 Inc.

- 6.4.12 StackPath LLC

- 6.4.13 G-Core Labs S.A.

- 6.4.14 Alibaba Cloud (Alibaba Group)

- 6.4.15 Corero Network Security plc

- 6.4.16 Nexusguard Ltd.

- 6.4.17 CDNetworks Inc.

- 6.4.18 Neustar Security Services

- 6.4.19 Akamai (Prolexic)

- 6.4.20 NETSCOUT Systems (Arbor)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment