PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851721

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851721

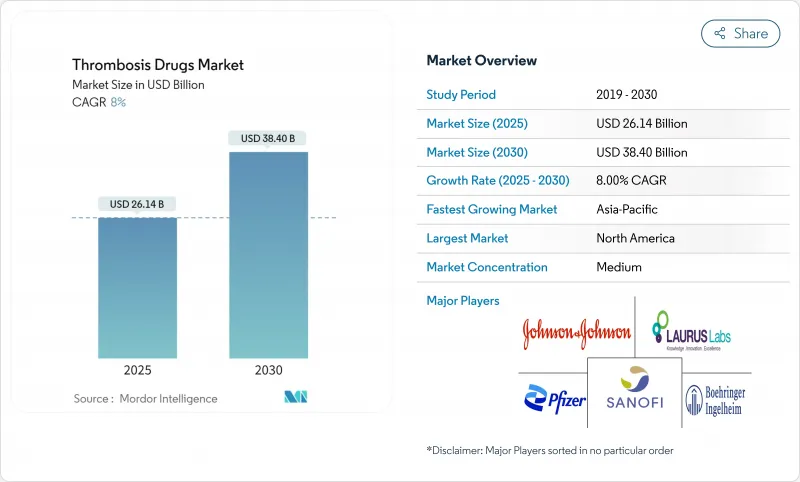

Thrombosis Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The thrombosis drugs market size stands at USD 26.14 billion in 2025 and is projected to attain USD 38.40 billion by 2030, advancing at an 8.0% CAGR during the forecast period.

Expanded life expectancy, rising venous thrombo-embolism (VTE) incidence, and accelerated adoption of direct oral anticoagulants (DOACs) are underpinning steady demand. Regulatory green lights for first-in-class Factor XI inhibitors, together with artificial-intelligence risk stratification tools, are recasting therapy selection beyond warfarin and heparin. Hospitals continue to favor rapid-onset injectables for acute care even as outpatient use of once-daily oral DOACs becomes the routine standard. Competitive responses to approaching patent cliffs include consolidation around safer mechanisms of action and discount programs aimed at sustaining loyalty during the shift from brands to generics.

Global Thrombosis Drugs Market Trends and Insights

Rising VTE prevalence

Higher life expectancy and a surge in cancer survival elevate VTE incidence, making long-term anticoagulation an essential component of chronic disease care. Lung-cancer patients face pulmonary-embolism rates roughly six times the population baseline, creating durable demand for safer oral agents. Hospitals respond by embedding thrombosis protocols within oncology pathways, shifting anticoagulation from episodic to continuous management.

Rapid adoption of DOACs

Evidence from ROCKET-AF and ARISTOTLE continues to drive prescriber confidence in rivaroxaban and apixaban. Bristol Myers Squibb and Pfizer recorded USD 3.2 billion in Eliquis sales in Q4 2024. Upcoming Medicare-negotiated prices effective January 2026 lower patient out-of-pocket costs, broadening eligibility without compromising margins.

High cost of novel anticoagulants

List prices often dwarf those of warfarin, curbing uptake in price-sensitive regions. Bristol Myers Squibb and Pfizer now sell Eliquis direct to patients at 40% discount, dropping monthly costs to USD 346. Policy shifts such as Medicare negotiations suggest broader price pressure is imminent.

Other drivers and restraints analyzed in the detailed report include:

- Growing surgical volumes & peri-operative prophylaxis

- Expanding pipeline of Factor XI inhibitors

- Patent expiries & generic erosion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

DOACs yielded 55.1% thrombosis drugs market share in 2024 and represent a USD 14.4 billion slice of the thrombosis drugs market size, expanding on the back of simplified dosing and fewer monitoring demands. Factor XI inhibitors are forecast to climb at an 8.61% CAGR, converting bleeding-averse clinicians and patients.

Heparin and LMWHs sustain relevance for in-patient bridging and oncology protocols. Vitamin K antagonists retreat to resource-limited settings, while thrombolytics retain niche roles in stroke and massive pulmonary-embolism emergencies. The arrival of once-monthly subcutaneous Factor XI agents could blur traditional oral-versus-injectable boundaries, recasting competitive alignment within the thrombosis drugs market.

Deep-vein thrombosis accounted for 31.81% of thrombosis drugs market size in 2024, driven by guideline-mandated anticoagulation post-orthopedic surgery. Pulmonary embolism is set to expand fastest at 8.43% CAGR, fueled by improved CT angiography diagnostics.

Adoption of Pulmonary Embolism Response Teams (PERTs) standardizes rapid treatment, while cancer-associated thrombosis gains visibility as survival rates rise. Stroke prevention in atrial-fibrillation patients remains a high-value application, especially with Factor XI safety data promising broader eligibility.

The Thrombosis Drugs Market Report is Segmented by Drug Class (Direct Oral Anticoagulants, Heparin & Low-Molecular-Weight Heparin, and More), Disease Type (Deep Vein Thrombosis, Pulmonary Embolism, and More), Route of Administration (Oral, Injectable, and More), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's reimbursement systems and early DOAC adoption anchored 38.2% thrombosis drugs market share in 2024. Federal price negotiations aim to balance affordability with innovation, potentially widening drug access without hampering R&D investments.

Europe maintains harmonized clinical guidelines that speed incorporation of breakthrough agents; the region shows consistent mid-single-digit growth supported by aging demographics.

Asia-Pacific, projected at 7.93% CAGR, benefits from infrastructure upgrades and higher elective-surgery volumes. China's tiered hospital reform and India's Ayushman Bharat scheme expand insured cohorts, while Japan's super-aged society sustains high per-capita anticoagulant use. Latin America and the Middle East & Africa trail but show rising awareness campaigns and imported generics that lower entry barriers, gradually enlarging their footprint in the thrombosis drugs market.

- Bristol-Myers Squibb

- Pfizer

- Bayer

- Johnson & Johnson

- Boehringer Ingelheim

- Daiichi Sankyo

- Sanofi

- Aspen Pharmacare

- Leo Pharma

- CSL Behring

- Grifols

- Roche

- Fresenius

- Viatris

- Cipla

- NATCO Pharma

- Glenmark Pharmaceuticals

- Alkem Laboratories

- Dr. Reddy's Laboratories

- Hikma Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising venous thrombo-embolism (VTE) prevalence

- 4.2.2 Rapid adoption of direct oral anticoagulants (DOACs)

- 4.2.3 Growing surgical volumes & peri-operative prophylaxis need

- 4.2.4 Pipeline of Factor XI inhibitors promising lower bleed risk

- 4.2.5 COVID-triggered protocols for inpatient thromboprophylaxis (under-reported)

- 4.2.6 Expansion of AI-based risk stratification enabling targeted therapy (under-reported)

- 4.3 Market Restraints

- 4.3.1 High cost of novel anticoagulants

- 4.3.2 Patent expiries & generic erosion

- 4.3.3 Safety concerns - major bleeding & limited reversal agents

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Drug Class (Value)

- 5.1.1 Direct Oral Anticoagulants (DOACs)

- 5.1.2 Heparin & Low-Molecular-Weight Heparin

- 5.1.3 Vitamin K Antagonists

- 5.1.4 Thrombolytics / Fibrinolytics

- 5.1.5 P2Y12 Platelet Inhibitors

- 5.1.6 Factor XI / XII Inhibitors (emerging)

- 5.1.7 Others

- 5.2 By Disease Type (Value)

- 5.2.1 Deep Vein Thrombosis

- 5.2.2 Pulmonary Embolism

- 5.2.3 Atrial Fibrillation

- 5.2.4 Peripheral Arterial Disease

- 5.2.5 Stroke & Transient Ischemic Attack

- 5.2.6 Others

- 5.3 By Route of Administration (Value)

- 5.3.1 Oral

- 5.3.2 Injectable

- 5.3.3 Topical

- 5.4 By Distribution Channel (Value)

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.4.4 Mail-Order Pharmacies

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.3.1 Bristol Myers Squibb

- 6.3.2 Pfizer Inc.

- 6.3.3 Bayer AG

- 6.3.4 Johnson & Johnson (Janssen)

- 6.3.5 Boehringer Ingelheim

- 6.3.6 Daiichi Sankyo

- 6.3.7 Sanofi S.A.

- 6.3.8 Aspen Pharmacare

- 6.3.9 LEO Pharma

- 6.3.10 CSL Behring

- 6.3.11 Grifols S.A.

- 6.3.12 F. Hoffmann-La Roche

- 6.3.13 Fresenius Kabi

- 6.3.14 Viatris

- 6.3.15 Cipla Ltd.

- 6.3.16 Natco Pharma

- 6.3.17 Glenmark Pharmaceuticals

- 6.3.18 Alkem Laboratories

- 6.3.19 Dr. Reddy's Laboratories

- 6.3.20 Hikma Pharmaceuticals

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment