PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851723

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851723

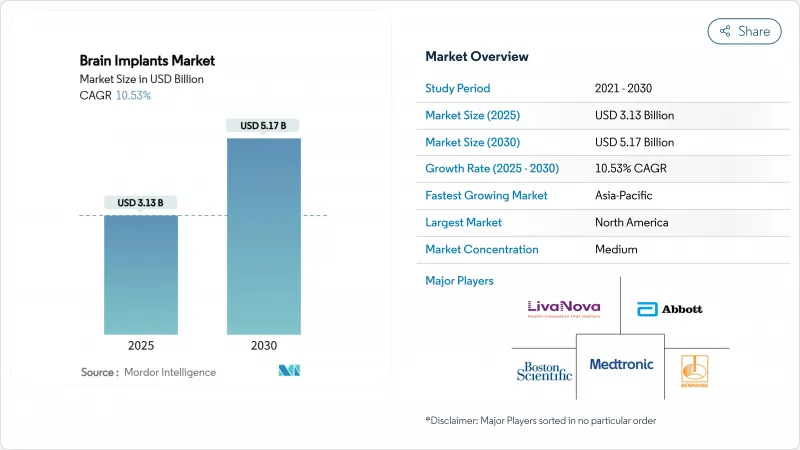

Brain Implants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The brain implants market size stands at USD 3.13 billion in 2025 and is projected to expand to USD 5.17 billion by 2030 at a robust 10.53% CAGR, underscoring sustained investment momentum and rapid regulatory clearances that shorten time-to-therapy for patients worldwide.

Broader payer acceptance, sensor miniaturization, and AI-enabled closed-loop systems are collectively redefining neuro-intervention strategies, creating new avenues for deep brain stimulation (DBS), vagus nerve stimulation (VNS), and emerging brain-computer interface (BCI) solutions. Players are aggressively integrating graphene electrodes and biocompatible coatings to extend device longevity, while flexible microelectrode arrays reduce tissue trauma and accelerate post-operative recovery. Venture capital inflows-led by nine-figure rounds such as Blackrock Neurotech's USD 200 million raise-validate commercial readiness across several therapeutic categories.Meanwhile, FDA Breakthrough Device and EU MDR fast-track pathways continue to compress approval timelines for next-generation neural technologies and cement North America's leadership position even as Asia-Pacific accelerates system-wide adoption.

Global Brain Implants Market Trends and Insights

Rising Prevalence of Neuro-degenerative & Movement Disorders

Global Parkinson's disease cases are on track to hit 25.2 million by 2050, doubling today's burden and widening the pool of DBS candidates. Drug-resistant epilepsy already affects 10.1 million people who remain eligible for surgical intervention, while treatment-resistant depression continues to drive psychiatric device adoption. Aging demographics in developed markets and improved diagnostic resources in emerging economies combine to ensure consistent procedure volumes. Health-economic studies showed 2024 DBS procedures saving USD 20,000-35,000 per patient annually in medication costs, keeping total expenditures below commonly accepted cost-effectiveness thresholds.

Miniaturization & Closed-loop Technology Advances

Graphene electrodes and nanoporous metals have shrunk implant footprints by up to 70%, improving signal fidelity and lowering post-surgical inflammation. Batteries now last longer thanks to neuromorphic processors that cut power draw, with rechargeable platforms such as Abbott's Infinity DBS allowing smartphone-based parameter updates. On-device machine-learning firmware adjusts stimulation in real time, moving therapy from static settings to dynamic, patient-specific protocols. These advances collectively accelerate outpatient recovery, lift long-term efficacy, and fuel wider physician acceptance.

High Device & Surgical Procedure Cost

A full DBS episode, including hardware, surgery, and year-one programming, ranges from USD 140,000 to 190,000, with follow-up maintenance at USD 4,500-7,800 per year. In many emerging countries these fees outstrip annual household income, curbing penetration. Value-based contracting between providers and manufacturers is evolving, yet remains confined to a handful of high-income settings, prolonging the affordability gap.

Other drivers and restraints analyzed in the detailed report include:

- Favorable Reimbursement Expansion in U.S./EU

- AI-driven Adaptive Stimulation Algorithms

- Cybersecurity & Data-privacy Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Deep brain stimulators held a commanding 42.52% of brain implants market share in 2024, anchored by three-decade clinical evidence for Parkinson's, essential tremor, and dystonia. More than 160,000 implants have been placed worldwide, giving the modality unrivalled procedural familiarity among surgeons and payers. Global growth remains healthy as new indications such as obsessive-compulsive disorder move past pivotal trials. Meanwhile, spinal cord stimulators maintain solid volumes across chronic pain and diabetic neuropathy cases, further diversifying revenue streams for incumbents.

Vagus nerve stimulators represent the fastest-moving opportunity, charting an 11.71% CAGR through 2030. Multipronged utility in drug-resistant epilepsy, treatment-resistant depression, and inflammatory disorders boosts cross-specialty adoption. Technology front-runners are miniaturising pulse generators and improving lead durability, allowing shorter operating times and fewer revision surgeries. Overall, the brain implants market remains product-innovation led, with closed-loop DBS systems and seizure-responsive neurostimulators expanding use cases while supporting stable ASPs.

Invasive stereotactic surgery continues to account for a 71.46% foothold within the brain implants market in 2024 thanks to precise electrode positioning and well-reimbursed care pathways. Meta-analyses covering 2025 cohorts document cerebrovascular events at 2.71%, permanent impairment at 1.0%, and mortality at 0.4%, numbers that reassure surgeons and regulators alike. Concurrent adoption of robot-assisted navigation and 3-Tesla MRI guidance keeps complication rates on a downward trajectory.

Yet, minimally-invasive approaches such as Synchron's endovascular Stentrode are gaining momentum with a forecast 12.18% CAGR. Implantation via the jugular vein eliminates craniotomy, cuts procedure time, and may allow expansion into ambulatory surgical centers. Flexible polymer leads coated with anti-inflammatory agents reduce foreign-body responses, while single-access delivery lowers infection risks. As these less-invasive strategies mature, they broaden candidate pools and speed geographic roll-outs, propelling incremental volume growth.

The Brain Implants Market Report is Segmented by Product Type (Deep Brain Stimulators, Spinal Cord Stimulators, Vagus Nerve Stimulators), by Technology (Invasive, Minimally-Invasive, Non-Invasive), by Application (Parkinson's Disease, Chronic Pain, Epilepsy, and More), by End User (Hospitals & Neurosurgical Centers, Specialty Clinics, and More), by Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America retains primacy, contributing 53.18% of global revenue, anchored by FDA fast-track pathways, deep capital pools, and entrenched reimbursement coverage for multiple indications. U.S. hospitals also benefit from a dense concentration of fellowship-trained functional neurosurgeons and a flourishing start-up ecosystem led by Neuralink, Precision Neuroscience, and Synchron. Canada amplifies regional totals through universal health insurance that recognises DBS as medically necessary for Parkinson's and essential tremor.

Europe follows closely, underpinned by coordinated HTA processes and EU MDR accelerated review tracks that expedite innovative implants. Germany, France, and the United Kingdom collectively host scores of DBS centers of excellence and continue to pilot large-scale VNS and RNS reimbursements. Nordic countries leverage digital health frameworks to support remote DBS programming, demonstrating efficient long-distance care models.

Asia-Pacific emerges as the most dynamic corridor with a 12.67% CAGR outlook. China invests heavily in neuroscience R&D and high-end device manufacturing, narrowing technology gaps with Western peers. Japan's aging population fuels strong demand for movement-disorder solutions, while the nation's universal insurance simplifies patient uptake. India, South Korea, and Australia round out regional growth by combining public-private partnerships with leading academic research to spur clinical trial throughput. The Middle East & Africa and South America remain nascent yet promising. GCC states back flagship neurosurgical hubs as part of national health-innovation agendas, while Brazil and Argentina push forward targeted reimbursement pilots despite macroeconomic volatility. Long-term upside hinges on scaling specialist training, stabilizing currency risk, and expanding tele-programming infrastructure in rural locales.

- Abbott Laboratories

- Boston Scientific

- Medtronic

- LivaNova

- NeuroPace

- Aleva Neurotherapeutics

- Newronika S.p.A.

- Saluda Medical

- Renishaw

- Paradromics

- MicroTransponder, Inc.

- Synchron

- Blackrock Neurotech

- Precision Neuroscience Corporation

- Synergia Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of neuro-degenerative & movement disorders

- 4.2.2 Miniaturization & closed-loop technology advances

- 4.2.3 Favorable reimbursement expansion in U.S./EU

- 4.2.4 AI-driven adaptive stimulation algorithms (under-reported)

- 4.2.5 FDA Breakthrough & EU MDR fast-track pathways (under-reported)

- 4.2.6 Surge in neurotech mega-funding & VC activity

- 4.3 Market Restraints

- 4.3.1 High device & surgical procedure cost

- 4.3.2 Limited long-term clinical evidence in some indications

- 4.3.3 Cyber-security & data-privacy concerns (under-reported)

- 4.3.4 Scarcity of specialist neurosurgeons in emerging markets (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Deep Brain Stimulators

- 5.1.2 Spinal Cord Stimulators

- 5.1.3 Vagus Nerve Stimulators

- 5.2 By Technology

- 5.2.1 Invasive (Surgical)

- 5.2.2 Minimally-Invasive / Percutaneous

- 5.2.3 Non-invasive (Trans-cranial)

- 5.3 By Application

- 5.3.1 Parkinson's Disease

- 5.3.2 Chronic Pain

- 5.3.3 Epilepsy

- 5.3.4 Depression & Psychiatric Disorders

- 5.3.5 Essential Tremor

- 5.3.6 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals & Neurosurgical Centers

- 5.4.2 Specialty Clinics

- 5.4.3 Ambulatory Surgical Centers

- 5.4.4 Academic & Research Institutes

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of APAC

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, ... Recent Developments)

- 6.4.1 Abbott

- 6.4.2 Boston Scientific Corporation

- 6.4.3 Medtronic

- 6.4.4 LivaNova PLC

- 6.4.5 NeuroPace, Inc.

- 6.4.6 Aleva Neurotherapeutics

- 6.4.7 Newronika S.p.A.

- 6.4.8 Saluda Medical Pty Ltd.

- 6.4.9 Renishaw plc.

- 6.4.10 Paradromics

- 6.4.11 MicroTransponder, Inc.

- 6.4.12 Synchron

- 6.4.13 Blackrock Neurotech

- 6.4.14 Precision Neuroscience Corporation

- 6.4.15 Synergia Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment