PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851724

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851724

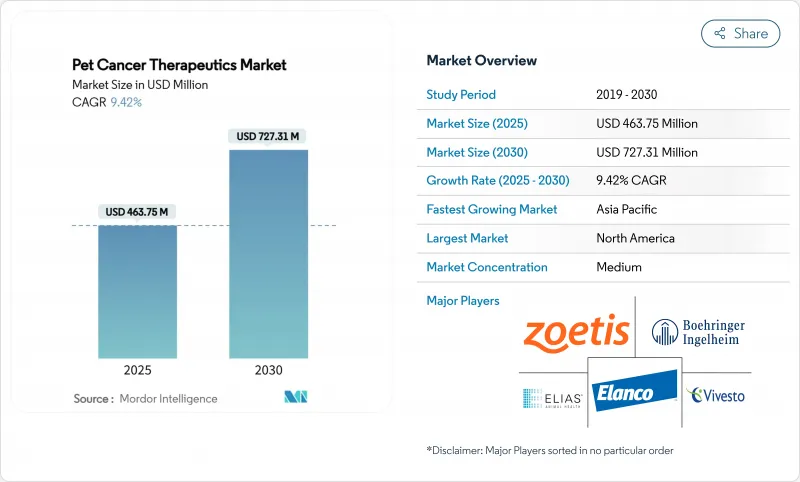

Pet Cancer Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Pet Cancer Therapeutics Market size is estimated at USD 463.75 million in 2025, and is expected to reach USD 727.31 million by 2030, at a CAGR of 9.42% during the forecast period (2025-2030).

Rising pet humanization, expanding insurance coverage, and regulatory incentives such as the U.S. FDA's Conditional Approval pathway are sustaining double-digit growth. Immunotherapy is advancing faster than any other therapy class, helped by canine-specific monoclonal antibodies that promise higher efficacy with fewer side effects. North America retains leadership through a 46.04% revenue share on the back of mature specialty hospitals, while Asia-Pacific is set to chart the quickest gains at 12.82% CAGR thanks to surging ownership of companion animals and growing disposable income. Intensifying competition among large incumbents and niche innovators combined with digital tele-oncology platforms widens treatment reach and accelerates product launches.

Global Pet Cancer Therapeutics Market Trends and Insights

Veterinary Tele-Oncology Expanding Access in Emerging Countries

Shortages of board-certified oncologists in Asia-Pacific and Latin America are mitigated by digital platforms that connect primary veterinarians with specialists. FidoCure's telemedicine interface supports protocol design and medication logistics across 50-plus markets, enabling standardized care despite geographic gaps. Tele-oncology also integrates e-pharmacies that legally ship therapies, accelerating adoption of novel drugs in second-tier cities. An 18.7% CAGR is projected for online channels through 2030, reflecting strong mobile penetration and rising comfort with virtual veterinary consults.

Growing Adoption of Precision Veterinary Oncology Platforms

Veterinary practices are rapidly embracing genomic testing that matches targeted drugs to the mutational profile of individual tumors. FidoCure's DNA-sequencing platform exemplifies this shifidocure.com. AI-enabled cytology tools such as Zoetis' AI Masses improve diagnostic speed in clinic settings, allowing practitioners to begin treatment earlier. The convergence of big-data analytics with lower-cost next-generation sequencing is expanding access beyond specialty oncology centers. As predictive algorithms learn from growing datasets, treatment efficacy is projected to rise, reinforcing demand for precision drugs and companion diagnostics. These developments collectively tighten the feedback loop between diagnosis and care, bolstering clinical outcomes and supporting stronger adoption curves across regions with high digital readiness.

Unharmonized Regulatory Pathways for Autologous Cancer Vaccines

Although the FDA awards conditional approvals that speed breakthrough medicines to clinics, rules vary widely elsewhere, inflating the cost and complexity of multinational launches. Autologous vaccines, which must be manufactured from each patient's cells, face divergent sterility, potency, and labeling standards that discourage broad commercialization. Small biotechnology firms shoulder higher compliance spend, delaying expansion and dampening revenue visibility in pivotal early years.

Other drivers and restraints analyzed in the detailed report include:

- Commercialization of Monoclonal Antibody Immunotherapies

- Rise in Pet Humanization and Oncology Awareness Among Pet Owners

- Limited Reimbursement for Advanced Radiation Modalities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chemotherapy remained the largest pillar of the pet cancer therapeutics market in 2024, holding 38.23% of revenue as combination protocols and metronomic regimens retained clinical familiarity. Immunotherapy, however, posted a blazing 14.62% CAGR and is set to narrow the gap by 2030 thanks to approvals of canine-tuned anti-PD-1 antibodies that deliver durable responses in oral adenocarcinoma and other solid tumors. The pet cancer therapeutics market size within immunotherapy is projected to shift the treatment mix toward biologics as owner acceptance rises alongside favorable safety profiles.

The commercialization journey is eased by the FDA's Veterinary Innovation Program, which offers rolling-review guidance and real-time chemistry, manufacturing, and controls support that compress regulatory timelines. Combination studies pairing monoclonal antibodies with low-dose chemotherapy or oncolytic viruses are underway and may improve complete-response rates. Sustained investor interest is evident in venture rounds flowing to startups building canine-feline antibody libraries.

Dogs generated 71.67% of 2024 sales, reflecting both higher cancer incidence and broader therapeutic armamentarium. The pet cancer therapeutics market share of canine products also benefits from decades of oncology research anchored by robust clinical-trial enrollment. Cats, historically underserved due to species-specific tolerability challenges, are now registering an 11.26% CAGR as feline-exclusive formulations emerge.

Advances in sedation protocols and palatable oral suspensions overcome administration hurdles, while growing diagnostic imaging in cat-preferred clinics unveils earlier malignancies. The successful launch of Varenzin-CA1 for anemia signals regulator openness to feline-first pathways, building confidence for oncology candidates in late-stage development.

The Pet Cancer Therapeutics Market Report is Segmented by Therapy (Chemotherapy, Radiation Therapy, and More), Animal (Dog, Cat, Other Companion Animals), Cancer Type (Lymphoma, Mast Cell Tumor, and More), Mode of Administration (Injectable, and More), Distribution Channel (Veterinary Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 46.04% of 2024 revenue thanks to early adoption of pet insurance, high specialty-clinic density, and a streamlined conditional-approval framework that accelerates novel drug launches. The PAW Act, now under Congressional review, seeks to offer tax advantages for veterinary expenses and could broaden access once enacted. Universities such as Florida and Colorado State maintain translational oncology programs that funnel scientific breakthroughs into commercial pipelines, further entrenching regional leadership.

Europe captured moderate market share, though penetration varies sharply. Sweden's 83% dog-insurance rate fosters robust uptake of premium therapies, whereas southern markets show softer demand due to lower reimbursement levels. Ongoing consolidation by private-equity-backed veterinary chains enhances service standardization but sparks pricing debates as consultation fees rise. The European Medicines Agency is updating its Veterinary Medicinal Products Regulation to create mutual-recognition pathways that could shrink launch timelines for biologicals.

Asia-Pacific posted the fastest 12.82% CAGR outlook, anchored by China's expanding middle class and rising pet longevity. Urban clinics in Tier-1 cities record double-digit oncology revenue growth as millennials allocate discretionary income to diagnostics such as CT and MRI. Regulatory capacity is still maturing; however, pilot programs in Japan and Australia allow recognition of selected U.S. or EU safety dossiers, potentially truncating approval cycles for high-need therapeutics. Venture capital is flowing into regional telemedicine start-ups that specialize in oncology triage, positioning Asia-Pacific to leapfrog traditional infrastructure constraints and capture share in the global pet cancer therapeutics market.

- AB Science

- Vivesto AB (AdvaVet)

- Boehringer Ingelheim (Merial)

- Elanco

- Zoetis

- Dechra Pharmaceuticals (Anivive)

- Karyopharm Therapeutics

- ELIAS Animal Health

- Torigen Pharmaceuticals

- Virbac

- Norbrook

- Elekta

- QBiotics Group

- Vetoquinol

- KindredBio

- Regeneus Ltd

- Orion Corp (Animal Health)

- Nippon Zenyaku Kogyo (Zenoaq)

- PetCure Oncology

- Heska Corp

- VCA Animal Hospitals (Mars Inc.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Veterinary Tele-Oncology Expanding Access in Emerging Countries

- 4.2.2 Growing Adoption of Precision Veterinary Oncology Platforms

- 4.2.3 Commercialization of Monoclonal Antibody Immunotherapies

- 4.2.4 Rise in Pet Humanization and Oncology Awareness Among Pet Owners

- 4.2.5 Expansion of Pet Insurance Covering Oncology

- 4.2.6 Advancements in Companion Animal Tumor Genomics

- 4.3 Market Restraints

- 4.3.1 Unharmonized Regulatory Pathways for Autologous Cancer Vaccines

- 4.3.2 Limited Reimbursement for Advanced Radiation Modalities

- 4.3.3 Shortage of Board-Certified Veterinary Oncologists in Emerging Markets

- 4.3.4 Limited Clinical Trial Infrastructure for Veterinary Oncology Products

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Therapy

- 5.1.1 Chemotherapy

- 5.1.2 Radiation Therapy

- 5.1.3 Immunotherapy

- 5.1.4 Targeted Small-Molecule TKIs

- 5.1.5 Gene Therapy & Oncolytic Viruses

- 5.1.6 Other Therapies

- 5.2 By Animal

- 5.2.1 Dog

- 5.2.2 Cat

- 5.2.3 Other Companion Animals

- 5.3 By Cancer Type

- 5.3.1 Lymphoma

- 5.3.2 Mast Cell Tumor

- 5.3.3 Melanoma

- 5.3.4 Mammary & Squamous-Cell Cancer

- 5.3.5 Osteosarcoma

- 5.3.6 Other Cancer Types

- 5.4 By Mode of Administration

- 5.4.1 Injectable

- 5.4.2 Oral

- 5.4.3 Topical

- 5.5 By Distribution Channel

- 5.5.1 Veterinary Hospitals & Specialty Clinics

- 5.5.2 Retail & Community Veterinary Clinics

- 5.5.3 Online Pharmacies & Tele-Oncology Platforms

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AB Science

- 6.3.2 Vivesto AB (AdvaVet)

- 6.3.3 Boehringer Ingelheim (Merial)

- 6.3.4 Elanco Animal Health

- 6.3.5 Zoetis

- 6.3.6 Dechra Pharmaceuticals (Anivive)

- 6.3.7 Karyopharm Therapeutics

- 6.3.8 ELIAS Animal Health

- 6.3.9 Torigen Pharmaceuticals

- 6.3.10 Virbac

- 6.3.11 Norbrook

- 6.3.12 Elekta

- 6.3.13 QBiotics Group

- 6.3.14 Vetoquinol

- 6.3.15 KindredBio

- 6.3.16 Regeneus Ltd

- 6.3.17 Orion Corp (Animal Health)

- 6.3.18 Nippon Zenyaku Kogyo (Zenoaq)

- 6.3.19 PetCure Oncology

- 6.3.20 Heska Corp

- 6.3.21 VCA Animal Hospitals (Mars Inc.)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment