PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851730

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851730

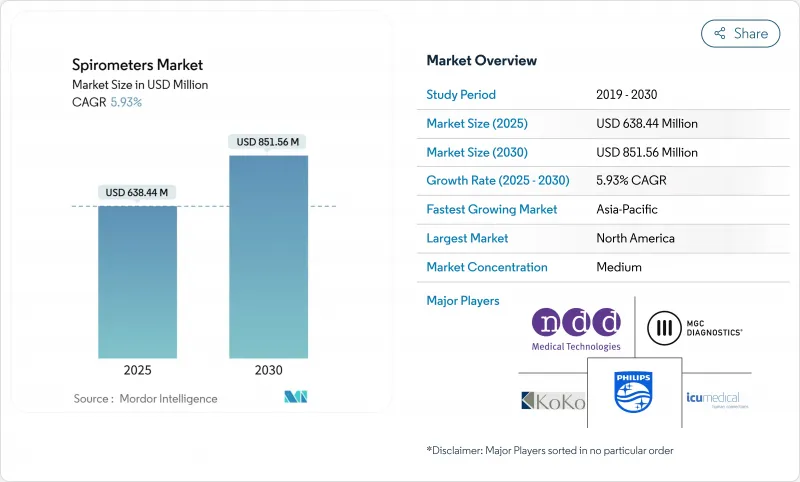

Spirometers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Spirometers Market size is estimated at USD 638.44 million in 2025, and is expected to reach USD 851.56 million by 2030, at a CAGR of 5.93% during the forecast period (2025-2030).

The expansion reflects growing respiratory disease prevalence, tighter environmental regulation, and rapid technology adoption in point-of-care and remote settings. COPD's heavy global burden, tighter PM2.5 limits, and employers' wellness programs continue to stimulate testing demand. Parallel advances in smartphone-linked micro-spirometers, AI-based analytics, and ultrasonic sensors strengthen clinical confidence while broadening use beyond tertiary hospitals. Strategic acquisitions among established vendors, coupled with new entrants focused on digital health, suggest sustained innovation and orderly competitive maturation.

Global Spirometers Market Trends and Insights

COPD prevalence surge drives diagnostic infrastructure expansion

The global COPD patient pool ranges between 213 million and 454 million, with prevalence peaking at 13.1% among adults over 40 in developing economies compared with 8.5% in developed markets. Intensifying exposure to biomass combustion and industrial pollutants magnifies disease incidence and encourages governments to deploy outreach screening. India's SAVE program screened 15,602 residents and confirmed 1,154 chronic respiratory diagnoses using portable "PFT in a Box" devices, proving the feasibility of large-scale community testing and underscoring latent demand for cost-effective solutions.

Smartphone integration accelerates clinical adoption

FDA clearance of NuvoAir's Bluetooth-enabled home spirometer in January 2024 validated remote testing workflows. Peer-reviewed trials reported correlation coefficients above 0.994 for FEV1 and 0.993 for FVC versus laboratory reference systems. Real-time data transfer into electronic records shortens decision cycles, and 95% of cystic-fibrosis centers now prescribe home spirometers, with 88% citing quality-of-care gains.

Device calibration challenges undermine clinical confidence

Variability among low-cost turbines erodes diagnostic reliability; some portables drift outside acceptable limits within six months. Ultrasonic sensors remove moving parts and lessen maintenance, but higher price points and regulatory lag defer mass uptake.

Other drivers and restraints analyzed in the detailed report include:

- AI-powered analytics transform respiratory care

- Ambient air quality regulations drive workplace screening

- Reimbursement disparities limit global market penetration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Table-top equipment retained 47.86% revenue in 2024, supported by multi-parameter testing and integration with hospital information systems. Their deep protocol catalog-bronchial challenge, respiratory muscle strength, and diffusing capacity-keeps them essential for pulmonology labs. Nonetheless, hand-held models are set to grow at a 7.84% CAGR, propelled by employer screenings, emergency triage, and home monitoring programs. The performance gap is narrowing; devices like HooHoo posted intraclass correlation scores above 0.887 versus lab reference instruments, satisfying ATS/ERS thresholds. Desktop-PC-attached units serve midsized clinics, marrying analytic software with modest portability.

Demand tilts toward lightweight solutions as reimbursement frameworks embrace remote care, and as clinicians favor quicker throughput. Battery life exceeding 30 hours, Bluetooth 5.0, and disposable mouthpieces align with infection-control mandates. Manufacturers answer with hybrid designs featuring detachable turbine heads, cloud dashboards, and automated acceptability grading. The shift indicates continued migration toward mobility without sacrificing accuracy, steering the spirometers market toward decentralized models.

Flow-based systems captured 53.81% of 2024 revenue, favored for real-time loop plotting and affordability. Turbine and Fleisch pneumotach designs dominate primary-care deployments, generating immediate flow-volume curves that underpin guideline-driven interpretation. Yet volume-measurement platforms led by ultrasonic arrays are climbing at an 11.27% CAGR. Their contactless architecture sidesteps condensation and microbial buildup, consequently cutting recalibration needs and boosting longevity.

The spirometers market size for ultrasonic technology is projected to expand as hospitals standardize on low-maintenance capital assets amid staffing constraints. Hybrid devices now combine differential pressure for low-flow accuracy with ultrasonic transit-time at higher ranges, improving linearity. Peak-flow meters keep a niche for pediatric asthma action plans due to simplicity and rock-bottom price. Over the forecast window, sensor miniaturization and AI-embedded firmware will reposition volume measurement as the premium standard, especially in infection-sensitive environments.

The Spirometers Market Report Segments the Industry Into by Product Type (Hand-Held, Table-Top), Technology (Volume Measurement, Flow Measurement, Peak-Flow Meter), Application (Asthma, COPD, Cystic Fibrosis, and More), by End-User (Hospitals and Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 37.61% of 2024 sales, underpinned by Medicare coverage, employer wellness mandates, and early uptake of digital platforms. The U.S. OSHA framework obliges spirometry across 14 hazardous-substance standards, guaranteeing recurrent demand. Canada's universal health plans reimburse baseline lung tests for smokers over 40, embedding spirometry in primary care. Advanced analytics vendors cluster around Boston and Silicon Valley, accelerating AI tool validation.

Europe follows with sustained investment driven by stringent ambient-air directives and ESG imperatives. The EU's "Zero Pollution" roadmap and member-state carbon-neutral hospital targets fuel procurement of low-maintenance ultrasonic units. Germany's DRG system reimburses pre-operative spirometry, while the UK's NHS Long Term Plan funds remote monitoring pilots for severe asthma. Regional focus on privacy elevates demand for on-premise data-hosting options and GDPR-compliant encryption.

Asia-Pacific represents the growth engine, projected to notch an 11.17% CAGR. India's SAVE initiative showcased scalable district-level deployments, while China's Healthy China 2030 blueprint earmarks respiratory disease screening expansion across 3,300 county hospitals. Japan's aging demographic drives per-capita testing volumes, complemented by government subsidies for home-monitoring kits. Southeast Asian economies experience rising occupational exposure amid construction booms, prompting corporate wellness investments.

Latin America and the Middle East & Africa together form an emerging opportunity frontier. Brazil's Clean Air Act spawned industrial health audits requiring pulmonary testing, whereas Saudi Arabia's Vision 2030 mandates employee health screenings in petrochemical corridors. However, fragmented reimbursement and shortages of trained technologists curb near-term penetration. Development banks and NGOs sponsor pilot projects using paper-based or smartphone-assisted devices to bridge accessibility gaps, laying groundwork for future scale-up.

- Baxter International (Hill-Rom)

- Vyaire Medical

- Vitalograph

- NDD Medical Technologies

- COSMED

- Schiller

- BD (CareFusion)

- Midmark

- KoKo PFT

- Koninklijke Philips

- MIR - Medical International Research

- Fukuda Denshi

- Contec Medical Systems

- Smiths Group

- Resmed

- ICU Medical

- Teleflex

- MGC Diagnostics

- Spirohome / Arik Medical

- NuvoAir AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 COPD Prevalence Surge in Low- & Middle-Income Countries

- 4.2.2 Ambient-Air Quality Regulation Tightening

- 4.2.3 Smartphone-Linked Micro-Spirometers Gain Clinical Acceptance

- 4.2.4 Employer-Funded Wellness Screening Programs

- 4.2.5 Ai Algorithms For Remote FEV1 Trending & Adherence Alerts

- 4.2.6 ESG-Driven Hospital Decarbonisation Budgets

- 4.3 Market Restraints

- 4.3.1 Device Inaccuracy Due to Poor Calibration Compliance

- 4.3.2 Reimbursement Gaps Outside OECD

- 4.3.3 Shortage of Trained Respiratory Technologists

- 4.3.4 Data-Privacy Concerns Around Cloud PFT Platforms

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Hand-held

- 5.1.2 Table-top

- 5.2 By Technology

- 5.2.1 Volume Measurement

- 5.2.2 Flow Measurement

- 5.2.3 Peak-flow Meter

- 5.3 By Application

- 5.3.1 Asthma

- 5.3.2 COPD

- 5.3.3 Cystic Fibrosis

- 5.3.4 Occupational Lung Disease

- 5.3.5 Other Applications

- 5.4 By End-User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Diagnostic Laboratories

- 5.4.3 Home Healthcare

- 5.4.4 Ambulatory Surgical Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 APAC

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of APAC

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of MEA

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Baxter International (Hill-Rom)

- 6.3.2 Vyaire Medical

- 6.3.3 Vitalograph

- 6.3.4 NDD Medical Technologies

- 6.3.5 COSMED

- 6.3.6 Schiller AG

- 6.3.7 BD (CareFusion)

- 6.3.8 Midmark Corp.

- 6.3.9 KoKo PFT

- 6.3.10 Koninklijke Philips N.V.

- 6.3.11 MIR - Medical International Research

- 6.3.12 Fukuda Denshi

- 6.3.13 Contec Medical Systems

- 6.3.14 Smiths Medical

- 6.3.15 ResMed

- 6.3.16 ICU Medical

- 6.3.17 Teleflex Inc.

- 6.3.18 MGC Diagnostics Corporation

- 6.3.19 Spirohome / Arik Medical

- 6.3.20 NuvoAir AB

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment