PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851734

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851734

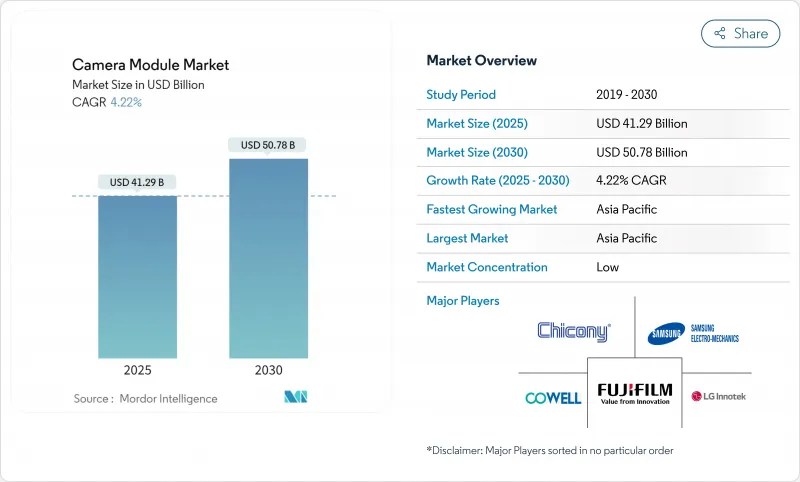

Camera Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The camera module market is valued at USD 41.29 billion in 2025 and is forecast to reach USD 50.78 billion by 2030, reflecting a 4.22% CAGR over the period.

Growth is shifting from pure volume expansion to feature-rich innovation, as handset saturation nudges manufacturers toward multi-camera arrays, folded-optics zoom, and on-device AI processing. Automotive safety mandates, edge-analytics surveillance, and emerging XR devices are broadening revenue streams beyond traditional mobile shipments. Component makers are prioritizing supply-chain resilience after the 2024 Taiwan earthquake exposed vulnerability in voice-coil motor (VCM) sourcing, while governments such as India are using production-linked incentives to localize assembly and attract fresh investment. Competitive intensity is rising as Korean, Japanese, and Chinese suppliers race to secure intellectual-property positions in high-value niches like under-display cameras and periscope modules.

Global Camera Module Market Trends and Insights

Multi-camera smartphone adoption exceeding three lenses in Chinese flagships

Chinese handset brands have turned multi-camera arrays into mainstream specifications, pushing the average lens count toward five by 2025. Larger sensor footprints, dedicated ultra-wide and macro shooters, and periscope telephoto modules reinforce smartphones as primary imaging tools. Combined with computational photography, these arrays enable night-mode, portrait, and high-zoom features that differentiate devices in a saturated handset field. Domestic supply chains scale rapidly, pressuring incumbents while elevating the camera module market as a critical arena for brand identity and consumer upgrade intent. Huawei's 200 MP periscope prototype illustrates the leap in optical ambition. AI-driven computational photography squeezes more dynamic range and noise control from small pixels, letting brands market professional-grade imagery without larger sensors.

Rear-visibility and ADAS camera mandates (FMVSS 111, EU GSR)

Safety regulations in the United States and European Union have transformed rear-view and surround-view cameras from optional accessories into compulsory components. Automakers integrate multiple lenses to satisfy blind-spot monitoring, lane-keeping, and pedestrian detection requirements, generating recurring demand for ruggedized, temperature-tolerant modules. The US NCAP now scores blind-spot warning, lane-keeping assist, and pedestrian automatic emergency braking, raising baseline camera count per vehicle. Automakers therefore order surround-view systems that exceed compliance minimums, multiplying sensor nodes and propelling the camera module market.

VCM actuator supply constraints post-2024 earthquake in Taiwan

he 2024 seismic event disrupted a tightly clustered VCM ecosystem, triggering shortages that rippled through smartphone assembly lines worldwide. OEMs accelerated dual-sourcing and pursued piezoelectric alternatives that promise lower power draw and faster response times. Component makers embarked on geographic diversification, erecting capacity in Southeast Asia to de-risk future disasters. The episode also fueled vertical-integration strategies among leading Korean and Chinese suppliers, as access to critical actuators became decisive for premium-camera launch schedule. Alps Alpine disclosed profit pressure from procurement premiums and is diversifying into dual-site manufacturing.Piezoelectric alternatives offer silent, low-power actuation and lower reliance on niche coil winders.

Other drivers and restraints analyzed in the detailed report include:

- AI-enabled edge-analytics surveillance roll-outs in Middle-East smart-city projects

- Periscope/folded-optics boom elevating lens count per module

- Wafer-level optics yield loss in under-display camera modules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

VCM actuators underpin rapid autofocus and optical image stabilization, making them strategic levers for differentiating photo and video performance. The segment's 7.2% CAGR surpasses the broader camera module market as handset brands spotlight low-light clarity and cinematic motion capture. Earthquake-induced shortages spurred exploration of piezoelectric and MEMS alternatives, yet VCMs retain cost and maturity advantages. Concurrently, image sensors held 48.8% revenue share in 2024, benefiting from stacked architectures that integrate on-sensor memory, enabling burst capture and multi-frame HDR. Advancements in back-side illumination have reduced noise floors, widening dynamic range for mobile and automotive applications.

Integration trends link VCMs with in-sensor phase-detection algorithms, allowing focus systems to swing from hardware to software symbiosis. Lens sets grow in complexity as folded-optics and variable-aperture designs proliferate, while module assemblers adopt active alignment robotics to hit micron-level tolerances. These changes reinforce the camera module market's shift toward higher value per unit even as smartphone growth plateaus. Suppliers investing in actuator innovation and sensor-lens co-development position themselves at the premium end of the camera module industry's margin curve.

CMOS technology owns 90.1% of shipments, its single-chip integration and low power making CCD largely obsolete. Back-side-illuminated (BSI) variants lead the innovation front, expanding at 4.24% CAGR as they boost quantum efficiency for night-mode photography and autonomous-vehicle vision. High-dynamic-range (HDR) CMOS designs now leverage lateral overflow capacitors to capture extreme luminance ranges in a single exposure, satisfying stringent automotive safety requirements.

Three-dimensional stacking pushes processing logic under the photodiode plane, trimming signal paths and opening doors to neuromorphic, event-based sensing that outputs only pixel-level changes. Such architectures reduce bandwidth and energy demand, critical for edge AI deployments. Continuous CMOS optimization ensures the camera module market remains driven by sensor advances that cascade into entire imaging subsystems.

The 8-13 MP band remains the industry's workhorse, controlling 34.7% revenue thanks to its balance of data load, battery drain, and perceived image clarity. Computational photography techniques upscale detail without proportionally larger files, letting OEMs prioritize software pipelines over larger pixel counts. Dual-gain sensors and multi-frame fusion extract superior dynamic range from mid-resolution hardware, reinforcing the segment's dominance across cost-sensitive smartphones and IoT vision nodes.

Conversely, resolutions above 13 MP are climbing at a 6.8% CAGR, driven by flagship periscope cameras, medical imaging probes, and industrial inspection systems that need granular detail. Quad-Bayer pixel-binning enables these high-res sensors to toggle between full-resolution daylight capture and low-noise night shots, guarding power budgets. As module thickness constraints persist, innovations in micro-lens design and deep-trench isolation help maintain quantum efficiency, anchoring the camera module market size gains in premium tiers.

The Camera Module Market Report is Segmented by Component (Image Sensor, Lens Set, and More), Sensor Type (CMOS, and CCD), Pixel/Resolution (Up To 7 MP, 8 - 13 MP, and More), Focus Type (Fixed-Focus, and Autofocus), Manufacturing Process (Chip-On-Board (COB), and More), Module Form-Factor (Compact/CCM, and More), Application (Mobile/Smartphones, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific controlled 59.7% of global revenue in 2024, propelled by dense supply chains spanning sensors in Japan and Taiwan, lens assemblies in mainland China, and finishing lines in Vietnam and India. New Delhi's Production Linked Incentive program reimburses capital expenditure for domestic module assembly, enticing multinational contract manufacturers to localize production and shorten delivery times. Taiwan's semiconductor depth supplies leading-edge logic for on-camera AI co-processors, reinforcing the region's systemic importance.

North America and Europe combine premium handset demand with stringent vehicle-safety standards, underpinning stable requirements for high-reliability modules. US-based XR headset programs add incremental pulls for depth-sensing arrays, while the European Union's EN 303645 cybersecurity baseline extends design cycles but yields hardened, upgradable connected cameras. Subsidy regimes for electric-vehicle autonomy further embed cameras as critical perception inputs.

Middle East & Africa, the fastest-growing region at 6.5% CAGR, banks on smart-city deployments in the Gulf that deploy edge AI cameras for traffic flow and public-safety analytics. Local integrators partner with global hardware vendors to roll out FIPS-compliant surveillance grids, catalyzing secondary demand for storage, compute, and network upgrades. South America offers longer-run upside as smartphone penetration rises and regional auto-safety standards converge with EU and US precedents.

- LG Innotek Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Sunny Optical Technology (Gp) Co. Ltd

- O-Film Group Co. Ltd

- Hon Hai Precision/Foxconn (incl. Sharp)

- Chicony Electronics Co. Ltd

- LuxVisions Innovation Ltd (Lite-On)

- Cowell E Holdings Inc.

- Sony Group Corporation

- OmniVision Technologies Inc.

- STMicroelectronics N.V.

- AMS Osram AG

- ON Semiconductor Corp.

- Panasonic Corp.

- Largan Precision Co. Ltd

- MinebeaMitsumi (Mitsumi Electric)

- Canon Inc.

- Robert Bosch GmbH

- Continental AG

- Magna International Inc.

- Valeo SA

- e-con Systems Pvt Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Multi-camera Smartphone Adoption Exceeding 3 Lenses in Chinese Flagships

- 4.2.2 Rear-Visibility and ADAS Camera Mandates (FMVSS 111, EU GSR)

- 4.2.3 AI-Enabled Edge-Analytics Surveillance Roll-outs in Middle-East Smart-City Projects

- 4.2.4 Periscope/Folded-Optics Boom Elevating Lens Count per Module

- 4.2.5 PLI Scheme-Driven Local Assembly of Modules in India

- 4.2.6 3D/Depth Sensing Demand for XR Headsets in United States and Korea

- 4.3 Market Restraints

- 4.3.1 VCM Actuator Supply Constraints Post 2024 Earthquake in Taiwan

- 4.3.2 Wafer-Level Optics Yield Loss in Under-Display Camera Modules

- 4.3.3 Escalating Patent Litigation on Stacked CIS Architectures

- 4.3.4 EN 303645 Cyber-Security Compliance Delays for Networked Modules in EU

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Pricing Analysis

- 4.8 Ultra-miniature Camera Module Dynamics

- 4.9 Investment Analysis (CapEx in Assembly and Test Lines)

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Image Sensor

- 5.1.2 Lens Set

- 5.1.3 Camera Module Assembly

- 5.1.4 Voice-Coil Motor (AF and OIS)

- 5.2 By Sensor Type

- 5.2.1 CMOS

- 5.2.2 CCD

- 5.3 By Pixel/Resolution

- 5.3.1 Up to 7 MP

- 5.3.2 8 - 13 MP

- 5.3.3 Above 13 MP

- 5.4 By Focus Type

- 5.4.1 Fixed-Focus

- 5.4.2 Autofocus

- 5.5 By Manufacturing Process

- 5.5.1 Chip-on-Board (COB)

- 5.5.2 Flip-Chip/Wafer-Level Packaging

- 5.6 By Module Form-Factor

- 5.6.1 Compact/CCM

- 5.6.2 MIPI-Interface Modules (CSI/DSI)

- 5.7 By Application

- 5.7.1 Mobile/Smartphones

- 5.7.2 Consumer Electronics (ex-Mobile)

- 5.7.3 Automotive

- 5.7.4 Healthcare and Medical Imaging

- 5.7.5 Security and Surveillance

- 5.7.6 Industrial and Robotics

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 Europe

- 5.8.2.1 Germany

- 5.8.2.2 United Kingdom

- 5.8.2.3 France

- 5.8.2.4 Italy

- 5.8.2.5 Spain

- 5.8.2.6 Rest of Europe

- 5.8.3 Asia-Pacific

- 5.8.3.1 China

- 5.8.3.2 Japan

- 5.8.3.3 South Korea

- 5.8.3.4 India

- 5.8.3.5 South East Asia

- 5.8.3.6 Australia

- 5.8.3.7 Rest of Asia-Pacific

- 5.8.4 South America

- 5.8.4.1 Brazil

- 5.8.4.2 Rest of South America

- 5.8.5 Middle East and Africa

- 5.8.5.1 Middle East

- 5.8.5.1.1 United Arab Emirates

- 5.8.5.1.2 Saudi Arabia

- 5.8.5.1.3 Rest of Middle East

- 5.8.5.2 Africa

- 5.8.5.2.1 South Africa

- 5.8.5.2.2 Rest of Africa

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, CapEx)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 LG Innotek Co. Ltd

- 6.4.2 Samsung Electro-Mechanics Co. Ltd

- 6.4.3 Sunny Optical Technology (Gp) Co. Ltd

- 6.4.4 O-Film Group Co. Ltd

- 6.4.5 Hon Hai Precision/Foxconn (incl. Sharp)

- 6.4.6 Chicony Electronics Co. Ltd

- 6.4.7 LuxVisions Innovation Ltd (Lite-On)

- 6.4.8 Cowell E Holdings Inc.

- 6.4.9 Sony Group Corporation

- 6.4.10 OmniVision Technologies Inc.

- 6.4.11 STMicroelectronics N.V.

- 6.4.12 AMS Osram AG

- 6.4.13 ON Semiconductor Corp.

- 6.4.14 Panasonic Corp.

- 6.4.15 Largan Precision Co. Ltd

- 6.4.16 MinebeaMitsumi (Mitsumi Electric)

- 6.4.17 Canon Inc.

- 6.4.18 Robert Bosch GmbH

- 6.4.19 Continental AG

- 6.4.20 Magna International Inc.

- 6.4.21 Valeo SA

- 6.4.22 e-con Systems Pvt Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment