PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851737

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851737

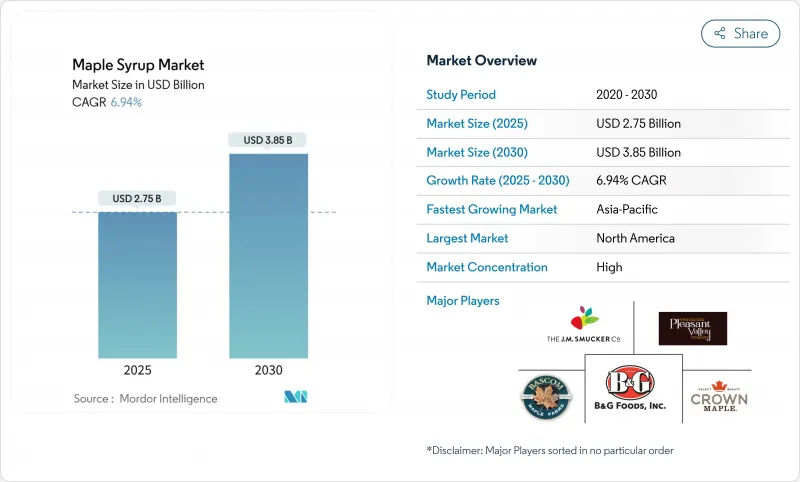

Maple Syrup - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The maple syrup market size is estimated at USD 2.75 billion in 2025 and is expected to reach USD 3.85 billion by 2030, advancing at a 6.94% CAGR.

Rising consumer preference for natural sweeteners, clean-label foods, and transparent sourcing underpins robust demand growth across all regions. Quebec's strategic reserve fell from 133 million pounds to 6.9 million pounds in 2024, tightening supply and pushing producers to adopt yield-optimization technology according to Statistics Canada. Furthermore, climate variability, evidenced by shorter sap seasons and lower sugar content, intensifies this supply pressure as per United States Environmental Protection Agency. Industrial buyers now integrate maple syrup into processed foods, beverages, and sports nutrition, broadening usage beyond retail staples. At the same time, geographic expansion into Asia-Pacific and diversification into organic formats create fresh revenue streams for stakeholders in the maple syrup market.

Global Maple Syrup Market Trends and Insights

Growing Consumer Demand for Natural and Low-Sugar Sweeteners

As consumers increasingly turn to natural alternatives, the maple syrup market is witnessing a notable uptick, especially as they distance themselves from refined sugars. According to the U.S. Department of Agriculture, organic retail sales hit USD 69.7 billion in 2023, with natural sweeteners carving out a larger share as consumers prioritize clean-label ingredients. A one-minute antioxidant test from McGill University empowers producers to validate nutritional benefits, bolstering health claims. In Europe, importers are ramping up procurement volumes, opting for sustainable syrups over artificial additives. The growing awareness of the environmental impact of food production is also driving demand for maple syrup, as it is perceived as a more eco-friendly option. Additionally, the rise of plant-based diets has further increased the appeal of maple syrup as a versatile and natural sweetener. Innovations in packaging and product formulations are also helping producers cater to evolving consumer preferences. Collectively, these dynamics are expanding the use of maple syrup beyond traditional breakfast applications and enhancing consumers' willingness to pay a premium, thus reshaping the competitive landscape of the maple syrup market.

Increasing Use in Processed and Ready-to-Eat Foods

In a nod to consumer preferences for recognizable ingredients, food manufacturers are increasingly incorporating maple syrup into a diverse range of products, from snacks and sauces to beverages and ready meals. According to CBI (Centre for the Promotion of Imports from developing countries), Europe's import value for natural syrup is on the rise, with Germany, France, and the United Kingdom actively seeking clean-label inputs. Highlighting the market's potential, B&G Foods has entered into long-term supply agreements for its Maple Grove Farms line, bolstering its shelf-stable product launches. Such industrial demand not only stabilizes off-season interest but also encourages processors to secure contracts, fortifying the overall resilience of the maple syrup market. Additionally, the growing consumer inclination toward natural sweeteners over artificial alternatives has further propelled the demand for maple syrup. The product's rich nutritional profile, including antioxidants and minerals, has also contributed to its popularity among health-conscious consumers. Furthermore, the increasing adoption of maple syrup in plant-based and vegan food products has opened new growth avenues for the market.

Competition from Alternative Sweeteners

The maple syrup market faces intensifying competition from diverse natural and artificial sweetener options, particularly in price-sensitive applications where cost considerations outweigh premium positioning. Alternative natural sweeteners like agave, honey, and stevia are gaining market share in health-conscious consumer segments, while artificial sweeteners maintain cost advantages in industrial applications. The competitive pressure is most acute in processed food applications where functionality and cost-effectiveness determine ingredient selection over flavor considerations. Consumer education about maple syrup's unique nutritional profile and sustainability credentials becomes critical for maintaining market position against aggressive marketing of alternative sweeteners. Price volatility in maple syrup, driven by climate-related production variability, creates opportunities for competitors to gain market share during periods of maple syrup scarcity or high pricing.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Role as a Flavoring Agent in Dairy, Bakery, and Beverages

- Emerging Use in Sports Nutrition and Functional Foods

- Climate Change Impacts on Maple Tree Health and Sap Production

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sugar maple accounted for 66.16% of maple syrup market share in 2024, underpinned by high sucrose content and entrenched processing infrastructure. Yet climate stress fuels black maple's 8.55% CAGR, as producers diversify stands to reduce weather risk. Red maple and even boxelder trials in Utah indicate that non-traditional species can extend production zones, signalling a gradual rebalancing of supply sources. Sugar maple's dominance is therefore expected to erode slightly, although its superior flavor keeps it central to premium positioning in the maple syrup market. Boxelder sap studies from Utah State University show yields up to 26.4 liters per tap, supporting expansion into arid western states.

Production economics revolve around tap density and sugar concentration. Sugar maple's higher sugar percentage still delivers favorable cost curves despite rising fuel and labor. However, black maple's hardiness and tolerance for warmer nights lower climate risk exposure, which may attract new investment. Producers weigh these trade-offs when planning long-term sugarbush composition, reinforcing a dynamic supply structure in the maple syrup market.

The Maple Syrup Market Report is Segmented by Type (Black Maple, Red Maple, and Sugar Maple), Category (Conventional Maple Syrup, and Organic Maple Syrup), End User (Retail, and Industrial), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounts for 72.15% of current demand, benefiting from dense forest resources and ingrained culinary traditions. Canada produced 19.9 million gallons in 2024, a 91.3% jump over the weather-impacted 2023 season according to Statistics Canada. The United States generated 4.18 million gallons, though Vermont's total fell 15% year on year due to erratic freeze-thaw cycles. Reserve depletion in Quebec tightens spot supply, which amplifies price swings across the maple syrup market.

Europe remains a premium destination, importing USD 100.55 million in 2023, with Germany, the Netherlands, and the United Kingdom as top buyers according to the World Bank. Food and beverage makers substitute refined sugars with maple to capture sustainability-minded shoppers. Regulatory alignment around organic and sustainable sourcing favors certified products, fostering stable growth even at higher price points.

Asia-Pacific is the fastest riser, recording a 9.51% CAGR through 2030 on the back of urban middle-class expansion and growing appetite for Western flavors. Japan leads imports courtesy of preferential tariffs and high purchasing power according to USDA (U.S. Department of Agriculture). Australian and South Korean retailers spotlight maple syrup in specialty aisles, while food processors incorporate it into sauces and ice creams. Limited local production keeps the region reliant on imports, extending long-term upside for global suppliers in the maple syrup market.

- B&G Foods Inc.

- The J.M. Smucker Company

- Vermont Pleasant Valley Maples

- Crown Maple LLC

- Bascom Maple Farms, Inc.

- Les Industries Bernard et Fils Ltee

- Butternut Mountain Farm

- Escuminac

- Coombs Family Farms.

- Anderson's Maple Syrup, Inc.

- Maple Terroir

- Citadelle

- Canadian Organic Maple Co. Ltd.

- Rock Maple Mountain

- Jakeman's Maple Syrup

- Maple Orchard Farms.

- Runamok Maple

- Amoretti

- Italian Beverage Company

- Judd's Wayeeses Farms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing consumer demand for natural and low-sugar sweeteners

- 4.2.2 Increasing use in processed and ready-to-eat foods

- 4.2.3 Expanding role as a flavoring agent in dairy, bakery, and beverages

- 4.2.4 Emerging use in sports nutrition and functional foods

- 4.2.5 Government support for maple syrup production and exports in canada

- 4.2.6 Rising adoption in plant-based and vegan diets

- 4.3 Market Restraints

- 4.3.1 Climate change impacts on maple tree health and sap production

- 4.3.2 Geographical constraints of sugar maple tree availability

- 4.3.3 Competition from alternative sweeteners

- 4.3.4 High initial investment costs for production equipment

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Sugar Maple

- 5.1.2 Black Maple

- 5.1.3 Red Maple

- 5.2 By Category

- 5.2.1 Conventional Maple Syrup

- 5.2.2 Organic Maple Syrup

- 5.3 By End User

- 5.3.1 Retail

- 5.3.2 Industrial

- 5.3.2.1 Food Processing Companies

- 5.3.2.2 Foodservice

- 5.3.2.3 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials (if available), Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 B&G Foods Inc.

- 6.4.2 The J.M. Smucker Company

- 6.4.3 Vermont Pleasant Valley Maples

- 6.4.4 Crown Maple LLC

- 6.4.5 Bascom Maple Farms, Inc.

- 6.4.6 Les Industries Bernard et Fils Ltee

- 6.4.7 Butternut Mountain Farm

- 6.4.8 Escuminac

- 6.4.9 Coombs Family Farms.

- 6.4.10 Anderson's Maple Syrup, Inc.

- 6.4.11 Maple Terroir

- 6.4.12 Citadelle

- 6.4.13 Canadian Organic Maple Co. Ltd.

- 6.4.14 Rock Maple Mountain

- 6.4.15 Jakeman's Maple Syrup

- 6.4.16 Maple Orchard Farms.

- 6.4.17 Runamok Maple

- 6.4.18 Amoretti

- 6.4.19 Italian Beverage Company

- 6.4.20 Judd's Wayeeses Farms.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK