PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851739

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851739

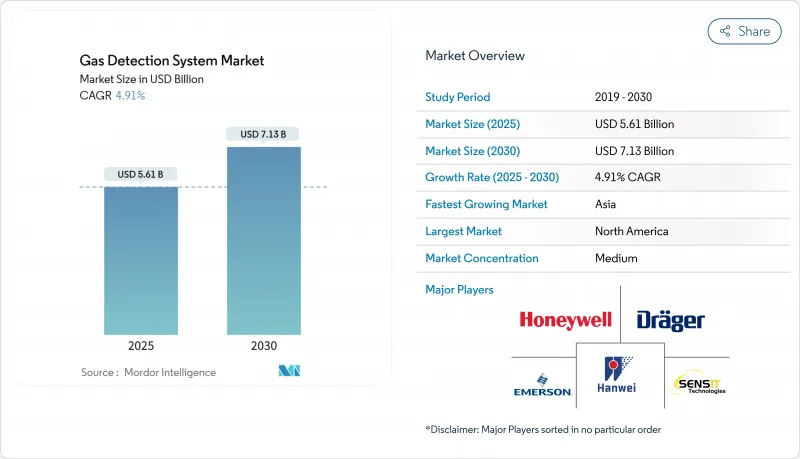

Gas Detection System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The gas detection system size is estimated USD 5.61 billion in 2025 and is forecast to reach USD 7.13 billion by 2030, expanding at a 4.91% CAGR.

A shift away from exclusive oil-and-gas dependence toward hydrogen infrastructure, battery energy storage, and low-GWP refrigerant applications supports steady demand. Mandatory IIoT safety upgrades in China, updated NFPA 855 codes for energy storage, and Europe's REPowerEU hydrogen targets collectively enlarge the addressable base. Growth accelerators include wireless networking, predictive analytics, and multi-gas integration, while technical barriers around sensor calibration and certified wireless spectrum temper momentum. Competitive activity remains moderate as established vendors secure technology breadth through acquisitions and joint ventures.

Global Gas Detection System Market Trends and Insights

Expansion of Hydrogen Economy

Europe's hydrogen build-out under the REPowerEU plan demands sensors able to track hydrogen alongside traditional combustibles and oxygen-deficiency risks. Palladium-nanotransistor prototypes now detect parts-per-billion H2 with minimal power draw. As projects scale, multi-gas devices become budgeted line items, embedding the gas detection system market deeper into European energy infrastructure. Procurement cycles favor vendors with hydrogen-specific analytics and ATEX certificates, elevating design complexity and average selling prices.

Rising Offshore Deepwater Exploration

Thirteen new Gulf of America fields scheduled online through 2026 will add 0.27 Bcf/d of gas, prompting operators to specify marine-certified methane detectors. Honeywell's Emissions Management Suite-approved for hazardous marine zones-illustrates product differentiation that meets stricter uptime and remote-maintenance criteria. Predictive algorithms trimming false alarms by 40% strengthen value propositions where offshore interventions run into millions of USD per call-out.

Faulty Calibrations in Sulfur-Rich Environments

Hydrogen sulfide above 50 ppm shortens electrochemical sensor life by 60%, inflating maintenance budgets and eroding operator trust. MEMS-based detectors mitigate poisoning but carry higher capital costs . Cross-sensitivities force redundant arrays, complicating wiring schemas and dampening the gas detection system market's short-term uptake in sour-gas facilities.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory IIoT Safety Upgrades in China

- Accelerating Battery Energy Storage Deployment

- Scarcity of Certified Wireless Spectrum

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wired installations accounted for 67.4% of 2024 revenue, anchoring the gas detection system market in legacy process industries. Modern plants now weigh material cost savings and installation agility; hence wireless revenues are advancing at 6.4% CAGR.

Mesh topologies preserve link resilience, while NB-IoT energy-harvesting prototypes underscore future autonomy. Certification roadblocks and interference management still cap near-term penetration, yet wireless remains the chief modernization lever across brownfield projects.

Reduced trenching costs appeal to temporary construction and turnaround scenarios, and battery-free sensor nodes promise maintenance relief. With wireless links feeding cloud dashboards, operators move from compliance-driven monitoring toward predictive asset health, reinforcing recurring-service revenue streams in the gas detection system market.

Fixed detectors retained 71.3% share in 2024, reflecting code requirements for continuous coverage in petrochemical and utility sites. Workforce mobility and shutdown activities fuel a 5.7% CAGR for portables, which now bundle CAT-M cellular modems and cloud APIs. Fleet-wide analytics streamline compliance documentation, improving ROI narratives.

Hybrid area monitors extend portable coverage with 100-day battery life, bridging gaps between personal and fixed layers. While fixed arrays remain foundational for process control integration, modular sensor cartridges and hot-swap designs cut downtime, fortifying their long-term position inside the gas detection system market.

Electrochemical cells delivered 44.9% of 2024 revenues, yet infrared devices are rising 7.1% CAGR on stability and low drift. Photoacoustic IR systems detect ammonia to 1 ppm without frequent recalibration. Mid-IR metasurface microspectrometers show promise for multi-gas analytics at chip-scale footprints.

Catalytic bead sensors still underpin basic hydrocarbon alarms, but sensor-fusion firmware now marries IR, PID, and electrochemical channels for selectivity gains. These advances cut lifetime ownership costs and expand the gas detection system market into environments where maintenance access is constrained.

The Gas Detection System Market Report is Segmented by Communication Type (Wired, and Wireless), Detector Type (Fixed, and Portable), Sensor Technology (Electrochemical, and More), Gas Type (Combustible Hydrocarbons, and More), Device Type (Single-Gas Detectors, and More), Power Source (Battery-Powered, and More), End-User Industry (Oil and Gas, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led revenue with 32.1% share in 2024, reflecting entrenched OSHA and NFPA frameworks that compel comprehensive safety monitoring. Offshore project starts and LNG build-outs sustain capital spending on marine-certified detectors, while battery energy storage rollouts widen scope into utility and commercial real estate. Canadian hydrogen pilots and carbon-capture hubs further reinforce demand across multi-gas platforms.

Europe follows with strong growth tied to hydrogen infrastructure and refrigerant phase-downs. ATEX and IECEx compliance requirements raise entry barriers, channeling contracts toward firms with established certification pedigrees. German chemical clusters and UK pharmaceuticals champion early adoption of wireless analytics, whereas Nordic operators specify low-temperature sensor packages calibrated to -40 °C.

Asia-Pacific records the fastest 5.8% CAGR, propelled by China's IIoT safety mandate and India's hazardous-chemical rules. Japanese updates to the High-Pressure Gas Safety Act and SEA petrochemical investments also boost uptake. Rapid industrialization, combined with maturing safety cultures, enlarges regional opportunity for both basic and advanced offerings, positioning APAC as the primary incremental engine for the gas detection system market through 2030.

- Honeywell International Inc.

- Dragerwerk AG and Co. KGaA

- MSA Safety Inc.

- Emerson Electric Co.

- Teledyne Gas and Flame Detection

- Industrial Scientific Corp.

- Riken Keiki Co. Ltd.

- GfG Gas Detection Germany

- Det-Tronics (Carrier)

- New Cosmos Electric Co.

- Sensidyne LP

- SENSIT Technologies

- Crowcon Detection Instruments Ltd.

- Trolex Ltd.

- Hanwei Electronics Group

- International Gas Detectors Ltd.

- OTIS Instruments Inc.

- GASTEC Corp.

- ABB Ltd.

- Xylem Inc. (YSI)

- General Monitors (United Technologies)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Hydrogen Economy Driving Demand for Multi-Gas Detectors in Europe

- 4.2.2 Rising Off-shore Deepwater E&P Activities Requiring High-Reliability Gas Monitoring (North America)

- 4.2.3 Mandatory IIoT-enabled Safety Upgrades under China State Administration of Work Safety

- 4.2.4 Accelerating Adoption of Battery Energy Storage Systems (BESS) with Fire/Gas Codes (Asia)

- 4.2.5 Surge in Green Ammonia Projects Boosting NH3 Leak Detection (EMEA)

- 4.2.6 Transition to Low-GWP Refrigerants Driving Refrigerant Gas Detection (HVAC-R)

- 4.3 Market Restraints

- 4.3.1 Faulty Calibrations in Sulphur-rich Environments Causing False Alarms

- 4.3.2 Scarcity of Certified Wireless Spectrum for Hazardous Locations (Zones 0/1)

- 4.3.3 High CapEx for Redundant Sensor Networks in Brown-field Refineries

- 4.3.4 Limited Availability of Long-life Solid-State NH3 Sensors Less than -40 degree C (Nordics)

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Intensity of Competitive Rivalry

- 4.6.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Communication Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Detector Type

- 5.2.1 Fixed

- 5.2.2 Portable

- 5.3 By Sensor Technology

- 5.3.1 Electrochemical

- 5.3.2 Infra-red (IR)

- 5.3.3 Catalytic Bead

- 5.3.4 Photo-ionization (PID)

- 5.3.5 Others (MOS, Optical)

- 5.4 By Gas Type

- 5.4.1 Combustible Hydrocarbons

- 5.4.2 Toxic Gases (CO, H2S, Cl2, SO2)

- 5.4.3 Oxygen Deficiency

- 5.4.4 Refrigerant Gases

- 5.4.5 Specialty and Rare Gases

- 5.5 By Device Type

- 5.5.1 Single-Gas Detectors

- 5.5.2 Multi-Gas Detectors

- 5.6 By Power Source

- 5.6.1 Battery-Powered

- 5.6.2 Hard-wired/Mains

- 5.7 By End-user Industry

- 5.7.1 Oil and Gas

- 5.7.2 Chemicals and Petrochemicals

- 5.7.3 Water and Wastewater

- 5.7.4 Metals and Mining

- 5.7.5 Power and Utilities

- 5.7.6 Food and Beverage

- 5.7.7 Pharma and Life-Sciences

- 5.7.8 Discrete Manufacturing (Semiconductor, Automotive, Battery)

- 5.7.9 Other Industries (Battery Energy Storage, and More)

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 Europe

- 5.8.2.1 Germany

- 5.8.2.2 United Kingdom

- 5.8.2.3 France

- 5.8.2.4 Nordics

- 5.8.2.5 Rest of Europe

- 5.8.3 South America

- 5.8.3.1 Brazil

- 5.8.3.2 Rest of South America

- 5.8.4 Asia-Pacific

- 5.8.4.1 China

- 5.8.4.2 Japan

- 5.8.4.3 India

- 5.8.4.4 South-East Asia

- 5.8.4.5 Rest of Asia-Pacific

- 5.8.5 Middle East and Africa

- 5.8.5.1 Middle East

- 5.8.5.1.1 Gulf Cooperation Council Countries

- 5.8.5.1.2 Turkey

- 5.8.5.1.3 Rest of Middle East

- 5.8.5.2 Africa

- 5.8.5.2.1 South Africa

- 5.8.5.2.2 Rest of Africa

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Honeywell International Inc.

- 6.4.2 Dragerwerk AG and Co. KGaA

- 6.4.3 MSA Safety Inc.

- 6.4.4 Emerson Electric Co.

- 6.4.5 Teledyne Gas and Flame Detection

- 6.4.6 Industrial Scientific Corp.

- 6.4.7 Riken Keiki Co. Ltd.

- 6.4.8 GfG Gas Detection Germany

- 6.4.9 Det-Tronics (Carrier)

- 6.4.10 New Cosmos Electric Co.

- 6.4.11 Sensidyne LP

- 6.4.12 SENSIT Technologies

- 6.4.13 Crowcon Detection Instruments Ltd.

- 6.4.14 Trolex Ltd.

- 6.4.15 Hanwei Electronics Group

- 6.4.16 International Gas Detectors Ltd.

- 6.4.17 OTIS Instruments Inc.

- 6.4.18 GASTEC Corp.

- 6.4.19 ABB Ltd.

- 6.4.20 Xylem Inc. (YSI)

- 6.4.21 General Monitors (United Technologies)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment