PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851748

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851748

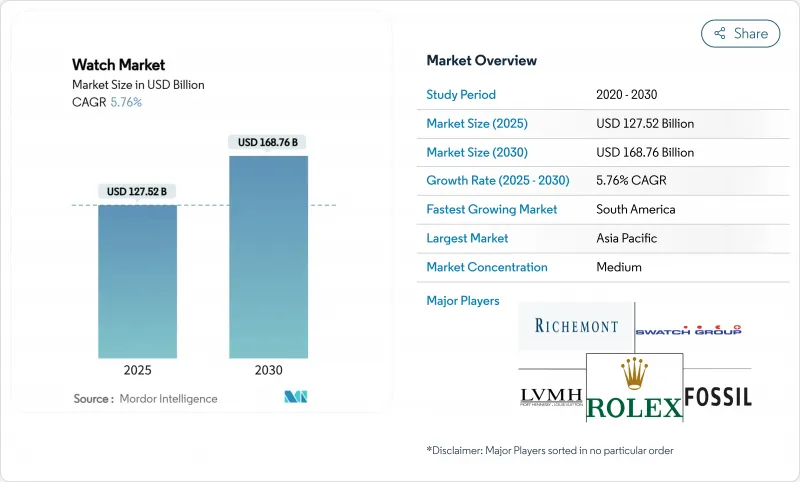

Watch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global watch market size is estimated to be worth USD 127.52 billion in 2025 and is expected to grow to USD 168.76 billion by 2030, registering a CAGR of 5.76% during the forecast period.

Several factors, including the continued demand for traditional craftsmanship, the increasing popularity of smart features in watches, and a growing preference for gender-neutral designs, drive this growth. Luxury brands are combining their expertise in traditional watchmaking with discreet digital technology to maintain their brand image while meeting the needs of tech-savvy consumers. The Asia-Pacific region is leading the growth due to the rising disposable income of the middle class, while South America, though starting from a smaller base, is showing signs of faster development. Specialty stores continue to attract customers by offering personalized services, while e-commerce platforms are gaining popularity due to improved authentication processes and better after-sales support. The global watch market has a moderate consolidation, which leaves room for emerging brands to compete. Major players like Swatch Group, Richemont, and LVMH dominate the market with their diverse product portfolios, which range from affordable fashion watches to high-end luxury timepieces.

Global Watch Market Trends and Insights

Rising demand for smartwatches with health features

Interest in preventive health has grown significantly, leading to a surge in smartwatch demand. According to the World Health Organization, cardiovascular diseases (CVDs) are the top cause of death worldwide, responsible for about 17.9 million deaths annually . Smartwatches like the Apple Watch Series 9 and Samsung Galaxy Watch 6 now come with advanced health features, including ECG monitoring, alerts for irregular heartbeats, and continuous tracking of heart rate, sleep patterns, and blood oxygen levels. These features help users keep a closer eye on their health and identify potential issues, such as atrial fibrillation, early on. As technology improves, with smaller sensors and longer-lasting batteries, smartwatch brands are rolling out regular health-focused updates, encouraging users to upgrade their devices more frequently. Traditional watchmakers are also adapting by introducing hybrid models that combine classic watch designs with modern health-tracking technology, offering a mix of style and functionality.

Increasing demand for luxury watches

The perception of luxury watches as investment assets has become increasingly popular, particularly among younger, financially aware buyers. Brands like Rolex and Patek Philippe have amplified this trend by limiting production and discontinuing iconic models like the Nautilus 5711, creating exclusivity and driving up resale values. This growing demand is also supported by rising disposable incomes, especially in regions with fast-growing economies. According to the International Monetary Fund, as of April 2025, the global GDP per capita in purchasing power parity terms is USD 206.88 thousand per capita . Additionally, the top three countries with the highest number of individuals having a net worth between USD 1 million and USD 5 million are the United States, China, and France . Luxury watchmakers are responding to this trend by focusing on limited production and showcasing artisanal craftsmanship. For instance, Richard Mille's RM 65-01 "King James," introduced in June 2025 in collaboration with LeBron James, was limited to just 150 pieces worldwide.

Availability of counterfeit products

The availability of counterfeit watches continues to undermine brand reputation and erode consumer trust in the global watch industry. According to the OECD, counterfeit watches accounted for 23% of the total value of seized counterfeit goods globally as of 2025 . Despite significant enforcement efforts, such as large-scale seizures by customs authorities in regions like the U.S., EU, and Asia, counterfeit sellers quickly reappear on digital marketplaces and social media platforms under new identities. For instance, in 2025, U.S. Customs and Border Protection seized over two dozen counterfeit Rolex watches and designer sunglasses in Pittsburgh. This issue is particularly harmful to entry-level luxury brands, where first-time buyers may unknowingly purchase counterfeit products, leading to mistrust and potential long-term disengagement with the brand. To combat this growing problem, leading brands like Rolex and Audemars Piguet are adopting advanced digital verification measures. These include serial-number tracking, scannable QR codes, and NFC-enabled certificates of authenticity, which aim to provide consumers with greater confidence in their purchases and protect brand equity.

Other drivers and restraints analyzed in the detailed report include:

- Growing social media influence and celebrity endorsements

- Technological advancements and innovation

- High production cost associated with luxury watches

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Quartz and mechanical watches made up 68.46% of the revenue in 2024, showcasing the enduring appeal of traditional craftsmanship and the reliability of these timepieces. Consumers continue to value the tactile experience and long-term durability that these watches offer, making them a cornerstone of the watch market. This dominance provides a stable base for the industry, even as newer technologies emerge. Meanwhile, hybrid models that combine classic features like sapphire crystals and mechanical hands with subtle digital displays are gaining traction. These designs prove that traditional and modern elements can coexist, appealing to a broader range of consumers without diminishing the value of either segment.

Digital watches, though currently holding a smaller share of the market, are projected to grow at a 5.86% CAGR through 2030, driven by increasing demand from tech-savvy and health-conscious buyers. These watches have evolved beyond simple timekeeping to offer advanced features such as fitness tracking, heart-rate monitoring, and contactless payment options. This expanded functionality has made them indispensable for many consumers, particularly those focused on wellness and convenience. Over-the-air updates ensure these devices remain relevant over time, enhancing their value proposition. Traditional watchmakers are also adapting by collaborating with semiconductor companies to integrate reliable smart components, allowing them to capture a share of this growing segment while maintaining their reputation for precision and quality.

The mass-tier segment accounted for 62.37% in 2024, driven by its affordability and frequent updates to align with fashion trends. However, the premium segment is experiencing faster revenue growth, with a projected CAGR of 6.23%, and is contributing significantly to the overall value growth of the watch market during the forecast period. Premium watches justify their higher price points through limited production runs, unique complications, and the use of high-quality materials, which appeal to consumers seeking exclusivity and craftsmanship.

The market is witnessing a clear divide in consumer preferences, with aspirational buyers either upgrading to high-end, investment-worthy watches or opting for affordable and feature-rich smartwatches. To address this, premium brands are enhancing customer experiences through concierge-driven online platforms, exclusive boutique collections, and personalized after-sales services to build customer loyalty. On the other hand, mass-market brands are focusing on cost-effective designs, collaborations with fashion labels, and frequent seasonal launches to maintain their appeal. This dual-speed dynamic fosters intense competition and drives continuous innovation across the watch market.

The Watch Market Report is Segmented by Product Type (Quartz/Mechanical and Digital Watch), Category (Mass and Premium), End User (Men, Women, and Unisex), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 39.54% of global watch sales in 2024, making it the largest regional market. The region's growth is driven by increasing disposable income among middle-class households and a strong cultural emphasis on luxury and status symbols. Key markets like China, Japan, and India dominate sales, while Southeast Asian countries are rapidly catching up due to expanding retail networks and tax-free shopping opportunities for tourists. The widespread use of smartphones supports omnichannel strategies, as consumers often research products online before making in-store purchases.

South America, led by Brazil and Argentina, is expected to grow at a 7.65% CAGR through 2030, making it the fastest-growing region in the watch market. This growth is fueled by rising urbanization, improving access to credit, and a growing demand for lifestyle upgrades. While challenges such as fluctuating import duties and currency instability persist, the region's favorable demographics and increasing consumer spending power provide a strong foundation for long-term growth. Both global luxury brands and local mid-tier players are capitalizing on these opportunities to expand their presence in the region.

North America and Europe remain mature but highly profitable markets for watches. In the United States, a strong community of watch collectors and a well-established pre-owned market drive consistent sales, even during economic slowdowns. Europe benefits from its proximity to Swiss watchmakers and its rich heritage in luxury craftsmanship, which ensures steady demand. While growth in these regions is slower compared to emerging markets, they continue to generate significant revenue. Meanwhile, the Middle East and Africa, though smaller contributors today, show promising potential. High-value transactions in Gulf Cooperation Council countries and increasing online penetration across Africa are expected to boost sales in the coming years.

- Rolex SA

- The Swatch Group

- Apple Inc.

- Casio Computer Co., Ltd.

- Fossil Group Inc.

- Citizen Watch Co., Ltd.

- Seiko Holdings Corporation

- Timex Group B.V.

- Garmin Ltd.

- Samsung Electronics Co., Ltd.

- Tata Group

- Movado Group, Inc.

- Daniel Wellington AB

- LVMH (Louis Vuitton Moet Hennessy)

- Compagnie Financiere Richemont S.A

- Xiaomi Corporation

- Patek Philippe SA

- Audemars Piguet Holding SA

- Richard Mille SA

- Breitling

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Smartwatches with Health Features

- 4.2.2 Technological Advancements and Innovation

- 4.2.3 Increasing Demand For Luxury Watches

- 4.2.4 Brand Heritage and Craftsmanship

- 4.2.5 Growing Demand For Sports Watches From Fitness Conscious Consumers

- 4.2.6 Growing Social Media Influence and Celebrity Endorsements

- 4.3 Market Restraints

- 4.3.1 Availability of Counterfeit Products

- 4.3.2 Surge in Demand For Smart Variables

- 4.3.3 High Production Cost Associated With Luxury Watches

- 4.3.4 Fluctuating Raw Material Prices

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Quartz/Mechanical

- 5.1.2 Digital Watch

- 5.1.2.1 Smart Watches

- 5.1.2.2 Other Digital Types

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Unisex

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Rolex SA

- 6.4.2 The Swatch Group

- 6.4.3 Apple Inc.

- 6.4.4 Casio Computer Co., Ltd.

- 6.4.5 Fossil Group Inc.

- 6.4.6 Citizen Watch Co., Ltd.

- 6.4.7 Seiko Holdings Corporation

- 6.4.8 Timex Group B.V.

- 6.4.9 Garmin Ltd.

- 6.4.10 Samsung Electronics Co., Ltd.

- 6.4.11 Tata Group

- 6.4.12 Movado Group, Inc.

- 6.4.13 Daniel Wellington AB

- 6.4.14 LVMH (Louis Vuitton Moet Hennessy)

- 6.4.15 Compagnie Financiere Richemont S.A

- 6.4.16 Xiaomi Corporation

- 6.4.17 Patek Philippe SA

- 6.4.18 Audemars Piguet Holding SA

- 6.4.19 Richard Mille SA

- 6.4.20 Breitling

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK