PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851750

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851750

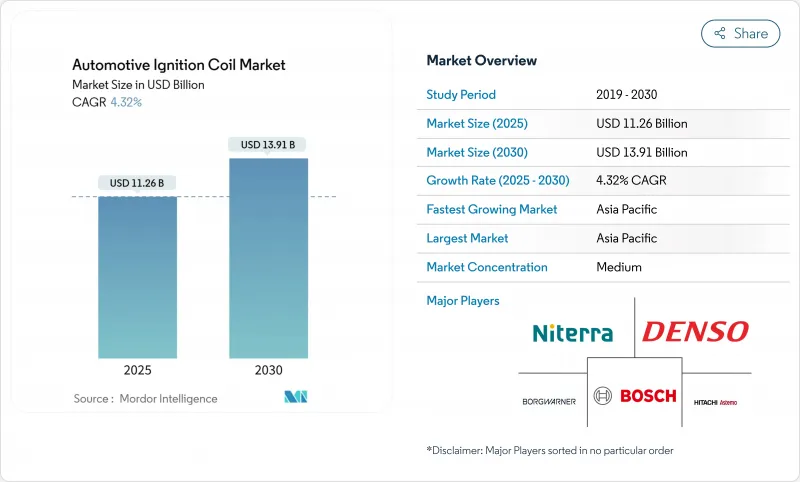

Automotive Ignition Coil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The automotive ignition coil market size is sized at USD 11.26 billion in 2025 and is forecast to touch USD 13.91 billion by 2030, advancing at a 4.32% CAGR.

Rising light-vehicle output in Asia Pacific, continued dominance of coil-on-plug (COP) technology, and a resilient replacement cycle in mature fleets collectively underpin growth. OEMs are fine-tuning ignition designs for turbocharged downsized engines that must comply with near-term Euro 7 limits, while the aftermarket benefits from the 12.5-year average vehicle age in the United States. At the same time, elevated copper prices and supply risks for rare-earth magnets are compressing supplier margins, and battery-electric-vehicle (BEV) penetration sets a clear upper bound on long-term demand. These crosscurrents place the automotive ignition coil market at a strategic pivot between legacy combustion needs and a rapidly electrifying future.

Global Automotive Ignition Coil Market Trends and Insights

Rising Global Production of Passenger and Light Commercial Vehicles

Vehicle volumes continue to rebound from pandemic lows, especially in Asia Pacific, where industry revenue climbed 7% in 1H 2024. Production upswings favor the automotive ignition coil market because light commercial electrification trails passenger adoption by roughly five years. Automakers are also rolling out 48V mild-hybrid platforms that keep internal-combustion engines (ICE) in play, extending coil demand while cutting emissions. The emphasis on precise ignition timing to satisfy Euro 7 creates tailwinds for COP assemblies that support individual-cylinder control. Together, these forces add a moderate uplift to the growth trajectory.

Aftermarket Replacement Demand From Ageing Parc

Average fleet age reached 12.5 years in the United States during 2024. Older vehicles require more frequent service, which supports a vibrant aftermarket for coils. Standard Motor Products already fields 800 SKUs with 99% coverage, while NGK's European range covers 420-part numbers that fit 87% of vehicles on the road. Independent workshops rely on broad compatibility, making the aftermarket an increasingly lucrative channel. The time buffer before legacy vehicles retire creates a durable revenue stream for at least one model cycle.

BEV Penetration Eliminates Conventional Ignition Systems

Electric cars remove the entire spark-ignition assembly, cutting maintenance costs by up to 40%. DENSO projects BEVs will dominate global production by 2035, prompting suppliers to pivot toward battery, inverter, and thermal-management modules . Passenger segments will see the sharpest drop first, while heavier commercial classes will transition later due to range and payload limits. Nonetheless, the directional shift places a ceiling on future coil volumes.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Emission Norms Pushing High-Performance Coils

- Turbo-Charged Downsized Gasoline Engines Need COP Coils

- Price Volatility of Copper and Rare-Earth Magnets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Coil-on-plug systems accounted for 51.33% of 2024 revenue, and their 6.32% CAGR positions them as the clear growth engine for the automotive ignition coil market. The design removes high-voltage leads, reduces electromagnetic loss, and supports advanced knock-control strategies demanded by turbocharged engines. Block coils and rail assemblies stay competitive in cost-sensitive models, especially in entry-level segments across emerging economies.

OEM case studies reinforce the shift: Bosch introduced a spring-contact COP for BMW models to improve spark-plug connection reliability, while DENSO's portfolio roadmap highlights distributor-less solutions as a core product line. Hybrid powertrains, which blend a 48 V e-motor with an ICE, still require one coil per cylinder, securing volume for COP units through 2030. Competitive pricing, simplified installation, and incremental engine-management gains will keep COP at the center of the automotive ignition coil market narrative.

Single-spark designs owned 62.41% of sales in 2024, reflecting mature manufacturing, proven reliability, and lower cost. Yet dual-spark units are tracking a 5.97% CAGR as premium OEMs chase further combustion efficiency. In Brazil's flex-fuel fleet, variable ethanol content makes multiple ignition points advantageous for stable flame propagation.

BorgWarner's multi-spark line illustrates how suppliers extend dwell time or deliver sequential pulses to optimize burn time. Dual-spark value scales when regulators tighten particulate limits. Even so, single-spark's sizeable installed base and compatibility with a broad engine mix mean that the automotive ignition coil market size for this configuration will remain substantial through the forecast horizon.

The Automotive Ignition Coil Market Report is Segmented by Type (Block Ignition Coils, Coil On Plug, and More), Operating Principle (Single Spark Technology and Dual Spark Technology), Distribution Channel (OEM and Aftermarket), Vehicle Type (Passenger Cars and Commercial Vehicles), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific leads the automotive ignition coil market with 46.21% share and is on pace for 6.97% CAGR. China recorded auto-industry revenue of 10 trillion yuan in 2024, and domestic brands accounted for 61.9% of sales, driving strong local coil demand. Japanese manufacturers such as NGK ship advanced units worldwide, while India's low-cost base draws investment for OEM supply and aftermarket export. North America is a mature but profitable arena; the 12.5-year average fleet age secures steady aftermarket pull, and strict U.S. EPA rules keep premium coils relevant for remaining ICE platforms.

Europe balances aggressive BEV policy with interim Euro 7 compliance. Automakers must fit high-output coils to meet particulate limits until battery platforms scale, and NGK's 87% aftermarket coverage ensures part availability for aging gasoline and mild-hybrid fleets. South America is driven by Brazil's flex-fuel ecosystem, where 82% of the light-vehicle park runs on ethanol blends, a scenario that raises coil stress and boosts demand for corrosion-resistant designs; Brazil's ethanol output reached 35.3 billion liters in 2023 .

The Middle East and Africa remain smaller contributors yet record incremental gains as motorization rates climb. Political instability and currency volatility complicate logistics, but localized assembly by Japanese and Chinese brands is opening coil opportunities in Nigeria, Egypt, and South Africa. Overall, geographic diversity cushions the automotive ignition coil market against single-region shocks.

- NGK Spark Plug Co. Ltd (Niterra)

- Denso Corporation

- Robert Bosch GmbH

- Hitachi Astemo Ltd

- Diamond Electric Holdings Co. Ltd

- Taiwan Ignition System Co. Ltd

- BorgWarner Inc. (incl. Delphi Technologies)

- Eldor Corporation

- Valeo SA

- Continental AG

- Mitsubishi Electric Corporation

- Standard Motor Products Inc.

- Federal-Mogul (Tenneco)

- Mahle GmbH

- Walker Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Production of Passenger and Light Commercial Vehicles

- 4.2.2 Aftermarket Replacement Demand From Ageing Parc

- 4.2.3 Stringent Emission Norms Pushing High-Performance Coils

- 4.2.4 Turbo-Charged Downsized Gasoline Engines Need COP Coils

- 4.2.5 Flex-Fuel Programs in Emerging Markets Require Robust Coils

- 4.2.6 Connected-Vehicle Smart-Diagnostic Coils Adoption

- 4.3 Market Restraints

- 4.3.1 BEV Penetration Eliminates Conventional Ignition Systems

- 4.3.2 Price Volatility of Copper and Rare-Earth Magnets

- 4.3.3 48 V Hybrid Architectures Cutting Coil Count per Vehicle

- 4.3.4 Emergence of Low-Tension Plasma Ignition Techs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Type

- 5.1.1 Block Ignition Coils

- 5.1.2 Coil-on-Plug (COP)

- 5.1.3 Ignition Coil Rail

- 5.2 By Operating Principle

- 5.2.1 Single Spark Technology

- 5.2.2 Dual Spark Technology

- 5.3 By Distribution Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Commercial Vehicles

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Egypt

- 5.5.5.4 Turkey

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 NGK Spark Plug Co. Ltd (Niterra)

- 6.4.2 Denso Corporation

- 6.4.3 Robert Bosch GmbH

- 6.4.4 Hitachi Astemo Ltd

- 6.4.5 Diamond Electric Holdings Co. Ltd

- 6.4.6 Taiwan Ignition System Co. Ltd

- 6.4.7 BorgWarner Inc. (incl. Delphi Technologies)

- 6.4.8 Eldor Corporation

- 6.4.9 Valeo SA

- 6.4.10 Continental AG

- 6.4.11 Mitsubishi Electric Corporation

- 6.4.12 Standard Motor Products Inc.

- 6.4.13 Federal-Mogul (Tenneco)

- 6.4.14 Mahle GmbH

- 6.4.15 Walker Products Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment