PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851756

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851756

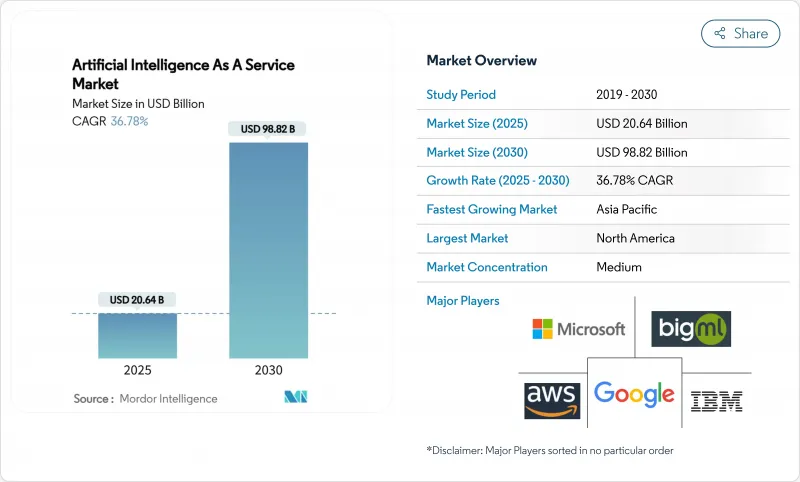

Artificial Intelligence As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Artificial Intelligence As A Service Market size is estimated at USD 20.64 billion in 2025, and is expected to reach USD 98.82 billion by 2030, at a CAGR of 36.78% during the forecast period (2025-2030).

Rapid migration from pilot projects to production workloads fuels this rise as enterprises embed generative-AI APIs in customer-facing and back-office systems. Subscription pricing lowers entry costs for small firms, while custom AI accelerators cut inference expenses by up to 80%, widening margins for providers. Government stimulus packages, such as Japan's USD 65 billion AI plan, add momentum, and hyperscale data-center build-outs keep compute capacity expanding despite near-term power constraints. Together, these forces push the Artificial Intelligence as a Service market toward broad, cross-industry penetration.

Global Artificial Intelligence As A Service Market Trends and Insights

Growing Demand for Predictive & Prescriptive Analytics

Enterprises now prize foresight over hindsight. Manufacturers using AI-driven analytics posted 61% revenue premiums, while supply-chain optimization shaved 15% off logistics costs. Healthcare systems gained 451% ROI over five years by automating radiology workflows. Banks boosted fraud-detection accuracy and see USD 170 billion additional profits by 2028 through AI forecasting. Real-time data ingestion plus agentic AI systems sustain this momentum, positioning predictive analytics as a core growth engine for the Artificial Intelligence as a Service market.

Subscription-Based AI Tools Lowering TCO for SMEs

Low-commitment pricing dismantles historic entry barriers. Global SME adoption of generative-AI tools reached 18%. In the United States, AI usage among firms with four workers rose from 4.6% to 5.8% in a single year. Retailers illustrate practical returns: Target deployed AI employee-assistance tools across 400 stores to raise productivity without large capital outlays. By turning AI from capex to opex, subscription platforms broaden the Artificial Intelligence as a Service market across micro-enterprise segments.

Escalating Cloud-Compute Cost Inflation

AI workloads strain infrastructure economics. Data centers may draw 9% of the United States' electricity by 2030. AI energy needs are set to top Bitcoin mining in 2025, reaching 23 GW. Forty-seven percent of Fortune 2000 firms now develop generative AI on-premises to tame runaway bills. Rising power prices plus tight chip supply lower near-term affordability and clip growth in the Artificial Intelligence as a Service market.

Other drivers and restraints analyzed in the detailed report include:

- Custom AI Accelerators Slashing Inference Cost

- Verticalised AIaaS Bundles for Regulated Sectors

- Persistent MLOps Talent Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Public-cloud delivery retained 78% share in 2024, ensuring the Artificial Intelligence as a Service market remains anchored to hyperscale infrastructure. Hybrid cloud, however, is the clear growth engine, registering a 32.1% CAGR for 2025-2030 as boards demand tighter cost control and regulators press for data residency safeguards. Many Fortune 2000 firms now train large models in the cloud yet run inference on-premises, balancing scale with sovereignty.

Hybrid uptake redirects procurement. Hospitals adopt cloud-burst architectures to keep personally identifiable health data within local servers while exploiting elastic compute for model training, meeting HIPAA rules without losing time-to-value. Manufacturers mirror this pattern, reserving edge nodes for latency-sensitive vision tasks while pushing bulk analytics to regional cloud zones. The twin priorities of compliance and budget certainty thus keep hybrid models central to the Artificial Intelligence as a Service market outlook.

Machine-learning platforms supplied 42% of 2024 revenue, but AI infrastructure services are growing faster at 44.5% CAGR. This shift places compute-optimized clusters and networking fabrics at the heart of the Artificial Intelligence as a Service market size expansion for backbone workloads. Custom chip adoption underpins the trend: Google's TPUs and Amazon's Trainium deliver multi-fold price-performance gains, prompting clients to favor providers offering such silicon.

Software layers evolve in lockstep. Managed distribution bundles now pair optimized kernels with orchestration tooling to ease multi-cloud scaling. Vendors embed self-healing functions, automated patching, and performance dashboards to shrink operational toil. Together, these enhancements tighten the nexus between raw infrastructure and developer productivity, reinforcing the revenue trajectory in this segment of the Artificial Intelligence as a Service market.

The Artificial Intelligence As A Service Market is Segmented by Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), Service Type (Machine-Learning Platform Services, Cognitive Services (NLP, CV, Speech) and More), Organisation Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (BFSI, Retail and E-Commerce, Manufacturing and More) and Geography

Geography Analysis

North America held 38% of global revenue in 2024, buoyed by an installed base of hyperscale data centers and a deep startup ecosystem. Cloud majors pledged more than USD 250 billion in fresh capacity during 2025, yet grid constraints loom as US data-center power draw may hit 9% of national supply by 2030. FTC probes into cloud-AI pacts could also recalibrate competitive boundaries.

Asia-Pacific charts the fastest ascent with a 27.9% CAGR. Japan earmarked USD 65 billion for AI and chips, and SoftBank invested USD 960 million in a generative-AI backbone. China's Alibaba allocated 380 billion yuan to cloud model services, while ByteDance's Volcano Engine processed nearly half of the country's public model calls. Corporate surveys show 54% of APAC firms now target long-term AI payouts, signalling depth beyond pilot activity.

Europe grows steadily, balancing innovation with strict oversight under draft AI regulations. The Middle East and Africa ride sovereign-AI strategies: the UAE expects USD 46.33 billion in sector value by 2030 as Microsoft injects USD 1.5 billion into G42. Saudi Arabia's USD 100 billion AI fund underscores regional ambition, and 75% of GCC enterprises deploy generative models, eclipsing global averages. Access to affordable energy and proactive policy frameworks position the region as a bridge market linking Europe, Africa, and South-Asia for Artificial Intelligence as a Service market rollouts.

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google LLC (Google Cloud)

- IBM Corporation

- Oracle Corporation

- Salesforce Inc.

- SAS Institute Inc.

- H2O.ai Inc.

- DataRobot Inc.

- Dataiku SAS

- BigML Inc.

- OpenAI LP

- Anthropic PBC

- C3.ai Inc.

- NVIDIA Corp. (DGX Cloud)

- Alibaba Cloud

- Tencent Cloud

- Baidu AI Cloud

- Huawei Cloud

- Craft AI

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study AssumptionsandMarket Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for predictiveandprescriptive analytics (mainstream)

- 4.2.2 Subscription-based AI tools lowering TCO for SMEs (mainstream)

- 4.2.3 Custom AI accelerators (TPU/Trainium) slashing inference cost (under-radar)

- 4.2.4 Verticalised AIaaS bundles for regulated sectors (under-radar)

- 4.2.5 Generative-AI APIs embedded in low-code platforms (mainstream)

- 4.3 Market Restraints

- 4.3.1 Escalating cloud-compute cost inflation (mainstream)

- 4.3.2 Persistent MLOps talent shortage (under-radar)

- 4.3.3 Heightened regulatory scrutiny on model provenance (mainstream)

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 Public Cloud

- 5.1.2 Private Cloud

- 5.1.3 Hybrid Cloud

- 5.2 By Service Type

- 5.2.1 Machine-Learning Platform Services

- 5.2.2 Cognitive Services (NLP, CV, Speech)

- 5.2.3 AI Infrastructure Services (GPU/TPU)

- 5.2.4 ManagedandProfessional AI Services

- 5.3 By Organisation Size

- 5.3.1 SmallandMedium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 RetailandE-commerce

- 5.4.3 HealthcareandLife Sciences

- 5.4.4 ITandTelecom

- 5.4.5 Manufacturing

- 5.4.6 EnergyandUtilities

- 5.4.7 Others (Media, Agriculture, Public)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 AustraliaandNew Zealand

- 5.5.4.6 South-East Asia

- 5.5.5 Middle EastandAfrica

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC (Saudi Arabia, UAE, Qatar)

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, ProductsandServices, and Recent Developments)

- 6.4.1 Amazon Web Services (AWS)

- 6.4.2 Microsoft Corporation

- 6.4.3 Google LLC (Google Cloud)

- 6.4.4 IBM Corporation

- 6.4.5 Oracle Corporation

- 6.4.6 Salesforce Inc.

- 6.4.7 SAS Institute Inc.

- 6.4.8 H2O.ai Inc.

- 6.4.9 DataRobot Inc.

- 6.4.10 Dataiku SAS

- 6.4.11 BigML Inc.

- 6.4.12 OpenAI LP

- 6.4.13 Anthropic PBC

- 6.4.14 C3.ai Inc.

- 6.4.15 NVIDIA Corp. (DGX Cloud)

- 6.4.16 Alibaba Cloud

- 6.4.17 Tencent Cloud

- 6.4.18 Baidu AI Cloud

- 6.4.19 Huawei Cloud

- 6.4.20 Craft AI

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-spaceandUnmet-need Assessment