PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851761

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851761

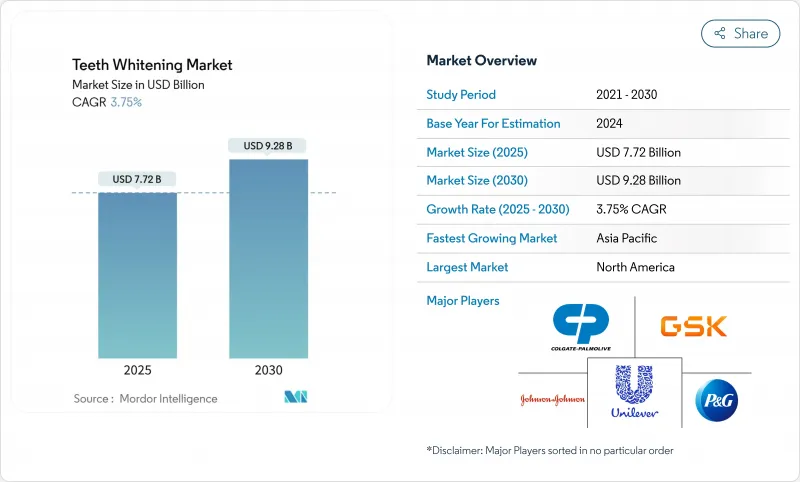

Teeth Whitening - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The teeth whitening market size stands at USD 7.72 billion in 2025 and is projected to hit USD 9.28 billion by 2030, advancing at a 3.75% CAGR over the period.

Uptake accelerates as whitening shifts from luxury service to routine self-care influenced by social-media visibility, aspirational lifestyle cues and continuous product upgrades. Demand for less-sensitising formulations pushes violet-LED mouthpieces and peroxide-free gels into the mainstream, while refillable applicators gain traction amid rising eco-awareness. Competitive forces intensify as direct-to-consumer challengers leverage subscription logistics, forcing incumbents to quicken innovation cycles, localise claims and strengthen digital engagement. Europe's strict peroxide caps and Asia-Pacific's cosmetic "skinification" trend collectively reshape formulation pipelines without altering core growth mathematics.

Global Teeth Whitening Market Trends and Insights

Rising Demand for Cosmetic Dental Aesthetics

White teeth signal wellness, discipline and social success, so consumers now view whitening as routine self-care rather than vanity spending. Delta Dental's 2024 survey confirms that 52% of adults rate tooth brightness as a top oral priority, and 91% equate dental check-ups with annual physicals, embedding whitening into preventive budgets. Millennials and Gen Z circulate before-and-after photos that normalise frequent bleaching and create peer pressure to maintain a bright smile. Employers in beauty, hospitality and customer-facing roles subtly reward candidates with confident smiles, reinforcing commercial value. This combination of personal vanity, social proof and professional incentives underpins steady market expansion even when discretionary income tightens.

Growing Availability of OTC Whitening Products

Mass retailers have widened shelf space for strips, pens and blue-filter pastes, moving whitening from pharmacy exclusivity into grocery and convenience channels. Private-label launches lower entry prices, letting first-time users trial simple formats without dentist visits. Harmonised safety standards-such as China's 2023 toothpaste rules-simplify cross-border roll-outs yet demand formal efficacy dossiers that weed out weak formulations. UK Trading Standards, however, still intercept high-peroxide kits online, showing the market's policing gap. Overall, wider physical and digital reach sparks trial, but enforcement pressure gradually boosts quality and brand trust.

Tooth-Sensitivity Concerns & Safety Warnings

Scientific American warns that frequent high-peroxide bleaching can thin enamel and ignite chronic sensitivity, prompting cautious buyers to delay repeat cycles. Dental associations amplify this message by spotlighting unlicensed kiosks that skip gum protection. Charcoal abrasives, although marketed as natural, have been shown to roughen enamel, adding another cautionary note. Brands respond with PAP creams and potassium-nitrate additives that promise "zero sensitivity" on pack. Even so, lingering fear tempers short-term uptake of aggressive DIY kits.

Other drivers and restraints analyzed in the detailed report include:

- Social-Media-Driven "Smile Perfection" Culture

- Technological Advances in LED & Peroxide-Free Kits

- Regulatory Clampdown on High-Peroxide DIY Kits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Whitening toothpaste retained 42.5% revenue in 2024, equating to USD 3.28 billion of the teeth whitening market size. Strips and films, though smaller, post the fastest 4.12% CAGR, popular among event-driven users needing swift shade lift. Purple-hued micropolishing formulations defend toothpaste shelf share against rapid-action rivals. Sustainability trends catalyse aluminium tubes and biodegradable strip substrates, aligning oral-care routines with broader eco-ethics.

Premium gels and LED kits blur lines between OTC and professional care, allowing consumers to purchase dentist-strength systems for home use. Teeth whitening market growth benefits as refillable gel syringes reduce packaging waste while reinforcing brand loyalty through proprietary cartridge locks. Safety assurances via smart mouthpieces that auto-pause on gum contact strengthen perceived value.

The Report Covers Whitening Toothpaste Consumer Reports - Manufacturers and is Segmented by Product (Whitening Toothpaste, Whitening Gels and Strips, White Light Teeth Whitening Devices, and Other Products), Distribution Channel (Offline Sales and Online Sales), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Report Offers the Value (in USD) for the Above Segments.

Geography Analysis

North America contributed 32.23% of 2024 sales, retaining leadership through advanced cosmetic dentistry, insurance coverage and cultural emphasis on aesthetic norms. The United States pilots most AI-driven whitening technologies, whereas Canada skews toward natural ingredient rosters and fluoride-free claims.

Europe's growth remains steady yet regulation-driven. Hydrogen-peroxide caps accelerate adoption of PAP and blue-filter technologies that promise sensitivity-free whitening, protecting enamel and complying with CE labeling norms. Germany invests in recyclable packaging, while Scandinavia mandates life-cycle disclosures on oral-care plastics.

Asia-Pacific posts the fastest 4.63% CAGR, propelled by urbanisation and beauty-conscious middle classes embedding whitening into grooming rituals. China's e-commerce festivals move high unit volumes of LED kits; India's dental chains bundle whitening with orthodontic aligners; Japan merges vitamin-C and collagen into pastes to satisfy synergy-seeking shoppers.

- Colgate-Palmolive Company

- Procter & Gamble

- Unilever PLC

- Johnson & Johnson

- Church & Dwight

- Koninklijke Philips

- Ultradent Products

- Haleon plc

- SmileDirectClub Inc.

- Henkel

- GC Corporation

- Dentsply Sirona

- SDI

- Beaming White LLC

- Evolve Dental Technologies Inc. (KoR Whitening)

- Temrex Corporation

- Snow Labs Inc.

- AuraGlow LLC

- White Dental Beauty (Optident)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for cosmetic dental aesthetics

- 4.2.2 Growing availability of OTC whitening products

- 4.2.3 Social-media-driven "smile perfection" culture

- 4.2.4 Technological advances in LED & peroxide-free kits (under-reported)

- 4.2.5 Surge in dental tourism for low-cost whitening (under-reported)

- 4.2.6 AI-enabled shade-matching & personalization (under-reported)

- 4.3 Market Restraints

- 4.3.1 Tooth-sensitivity concerns & safety warnings

- 4.3.2 Regulatory clampdown on high-peroxide DIY kits

- 4.3.3 Environmental scrutiny of single-use applicators (under-reported)

- 4.3.4 Rise of natural "whitening" fads diluting clinical demand (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Whitening Toothpaste

- 5.1.2 Whitening Strips & Films

- 5.1.3 Whitening Gels & Kits

- 5.1.4 Whitening Mouthwash

- 5.2 By End User

- 5.2.1 Individual / At-Home

- 5.2.2 Dental Clinics & Hospitals

- 5.3 By Distribution Channel

- 5.3.1 Offline Retail

- 5.3.2 Online Retail / E-commerce

- 5.3.3 Dental Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Colgate-Palmolive Company

- 6.3.2 Procter & Gamble Co.

- 6.3.3 Unilever PLC

- 6.3.4 Johnson & Johnson

- 6.3.5 Church & Dwight Co., Inc.

- 6.3.6 Koninklijke Philips N.V.

- 6.3.7 Ultradent Products Inc.

- 6.3.8 Haleon plc

- 6.3.9 SmileDirectClub Inc.

- 6.3.10 Henkel AG & Co. KGaA

- 6.3.11 GC Corporation

- 6.3.12 Dentsply Sirona Inc.

- 6.3.13 SDI Limited

- 6.3.14 Beaming White LLC

- 6.3.15 Evolve Dental Technologies Inc. (KoR Whitening)

- 6.3.16 Temrex Corporation

- 6.3.17 Snow Labs Inc.

- 6.3.18 AuraGlow LLC

- 6.3.19 White Dental Beauty (Optident)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment