PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851766

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851766

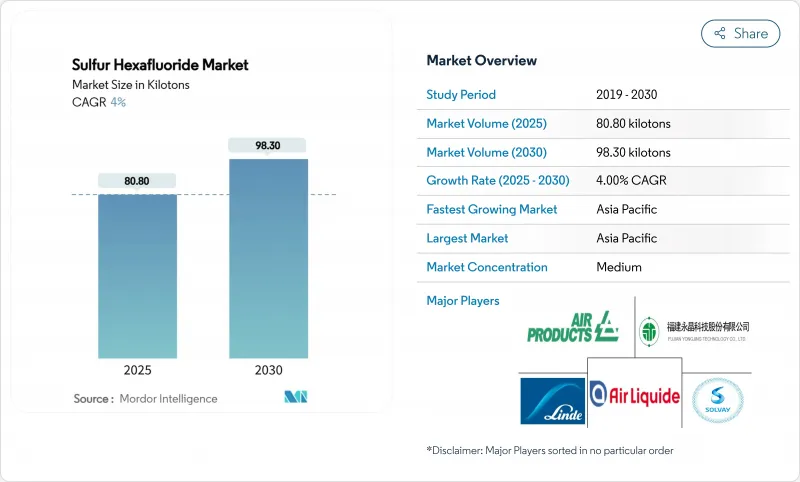

Sulfur Hexafluoride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Sulfur Hexafluoride Market size is estimated at 80.80 kilotons in 2025, and is expected to reach 98.30 kilotons by 2030, at a CAGR of 4% during the forecast period (2025-2030).

Robust grid-upgrade programs in emerging economies, surging semiconductor fabrication capacity, and offshore wind transmission projects are sustaining demand even as environmental regulations tighten. Electrical utilities continue to specify SF6 for gas-insulated switchgear because it delivers unrivalled dielectric strength, compact footprints, and rapid energization, advantages that existing alternatives still struggle to match. Semiconductor manufacturers require ultra-high-purity SF6 to achieve fast, clean plasma etching, and this requirement deepens as feature sizes shrink. Meanwhile, medical and magnesium die-casting uses provide incremental growth, creating diversified end-markets that help buffer regulatory shocks.

Global Sulfur Hexafluoride Market Trends and Insights

Grid-upgrade demand in emerging economies

China's SF6 emissions climbed from 2.6 Gg in 2011 to 5.1 Gg in 2021 as transmission developers installed compact gas-insulated substations to keep pace with record-setting grid expansions. India has earmarked INR 2,000 crore for network modernization that specifies SF6 switchgear to secure voltage stability during rapid urbanization. Because typical substation assets remain in service for 25 to 50 years, every installation decision effectively locks in future sulfur hexafluoride market demand. Gas-insulated stations can be energized 45% faster than air-insulated yards, a time saving valued by utilities racing to alleviate congestion. As a result, the sulfur hexafluoride market continues to deepen its presence across Asia-Pacific despite intensifying environmental policy debates.

Semiconductor and LCD plasma-etching growth

Korea's USD 471 billion semiconductor cluster, slated to add 16 fabs by 2047, exemplifies capital flows that elevate consumption of ultra-high-purity SF6. In deep-trench silicon etching, SF6 generates fluorine radicals that remove material up to 100 times faster than rival gases, ensuring throughput targets for 3 nm and below nodes. Although abatement systems curb direct emissions, a portion of feedstock still reaches the atmosphere, prompting regulatory scrutiny as fabrication capacity scales. Even so, process engineers continue to specify SF6 until drop-in alternatives can replicate its etching precision, keeping the sulfur hexafluoride market firmly embedded in advanced manufacturing value chains.

Stringent global-warming regulations

The European Union has banned SF6 in medium-voltage switchgear from 2026 and in high-voltage gear from 2032, forcing utilities to accelerate retrofit plans. California mandates complete phase-out by 2033 and restricts annual leak rates to 1%, compelling asset owners to fund costly monitoring systems. Similar trajectories in New York and Massachusetts compress investment horizons for SF6-dependent assets, dampening procurement volumes in developed regions. These overlapping policies subtract 1.8 percentage points from the sulfur hexafluoride market growth outlook.

Other drivers and restraints analyzed in the detailed report include:

- Renewable-integrated HVDC and offshore substations

- Magnesium die-casting oxidation prevention

- Price volatility and export quotas

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The electronic/technical-grade segment accounted for 61.18% of sulfur hexafluoride market share in 2024 as utilities prioritize proven insulation performance for switchgear, breakers, and gas-insulated lines. Technical-grade SF6 follows commodity price dynamics and benefits from established global distribution channels that permit bulk tanker deliveries to substation sites. Because retrofit projects continue through the forecast period, the segment maintains a sizable base-load volume that anchors the overall sulfur hexafluoride market.

Ultra-high-purity SF6, while representing a smaller absolute tonnage, is forecast to expand at 4.90% CAGR, the fastest among product types, propelled by advanced semiconductor and LCD fabrication. Maintaining contaminant thresholds below parts-per-billion requires multiple purification stages, specialised cylinders, and dedicated supply chains. Suppliers that master these production protocols secure higher margins, offsetting lower volumes and providing a strategic hedge as environmental policy squeezes traditional utility demand. Collectively, the two grade tiers ensure that the sulfur hexafluoride market retains a balanced portfolio across commodity and specialty niches.

The Sulfur Hexafluoride Market Report is Segmented by Product Type (Electronic/Technical Grade, Ultra-High Purity Grade), Application (Power and Energy, Electronics, Metal Manufacturing, Medical, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific dominated the sulfur hexafluoride market with 47.65% share in 2024 and is projected to log a 4.75% CAGR through 2030. China's grid operators are installing compact 550 kV gas-insulated substations across ultrahigh-voltage corridors to accommodate record renewable capacity, a strategy that cements multi-decade SF6 demand. India's program to reinforce inter-state transmission uses SF6 ring-main units to improve reliability in rapidly urbanizing load centers. South Korea's semiconductor expansion amplifies regional ultra-high-purity volumes, while Japan positions itself as a technology demonstrator for SF6-free solutions, creating a dual-track landscape that blends incumbent and emerging technologies.

North America shows mid-single-digit consumption growth as utilities balance ageing-asset replacements with regulatory compliance. California's 2033 phase-out and leak caps compel early adoption of monitoring and capture systems, but grid operators in other states continue to specify SF6 in high-voltage classes where field-ready alternatives remain scarce. Federal infrastructure funding for resilience upgrades keeps overall demand stable, although rising recycling rates help temper fresh supply needs. Canada's linkages to California's cap-and-trade system drive cross-border policy alignment, nudging Canadian utilities to explore SF6-free pilots while maintaining critical spares for legacy equipment.

Europe faces the most stringent policy environment: the revised F-gas regulation bans new medium-voltage SF6 switchgear from 2026 and high-voltage installations from 2032. Transmission system operators, led by entities in Germany and the Nordics, are piloting vacuum-interrupter and clean-air technologies but still rely on SF6 for brownfield extensions. The United Kingdom mirrors EU limits, adding compliance costs estimated at GBP 100-280 million for retrofit programs. Southern and Eastern European utilities with slower replacement cycles face cost pressures, potentially extending limited SF6 procurement beyond mid-decade. Latin America, the Middle East, and Africa collectively remain smaller yet high-growth territories as they expand base-line electrification and industrial capacity, offering future upside for the sulfur hexafluoride market.

- Advanced Specialty Gases

- Air Liquide

- Air Products and Chemicals, Inc.

- AIR WATER INC

- Airgas, Inc.

- Concorde Specialty Gases, Inc.,

- Fujian Yongjing Technology Co., Ltd

- Guangdong Huate Gas Co., Ltd.

- Honeywell International Inc.

- Kanto Denka Kogyo Co., Ltd.

- Linde plc

- Matheson Tri-Gas, Inc.

- Messer SE & Co. KGaA

- Resonac Holdings Corporation

- Solvay S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Grid-Upgrade Demand in Emerging Economies

- 4.2.2 Semiconductor and LCD Plasma-Etching Growth

- 4.2.3 Renewable-Integrated HVDC and Offshore Substations

- 4.2.4 Magnesium Die-Casting Oxidation Prevention

- 4.2.5 Increasing Demand in the Medical Sector

- 4.3 Market Restraints

- 4.3.1 Stringent Global-Warming Regulations

- 4.3.2 Price Volatility and Export Quotas

- 4.3.3 Potential Semiconductor-Process Bans

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Electronic / Technical Grade

- 5.1.2 Ultra-High Purity Grade

- 5.2 By Application

- 5.2.1 Power and Energy

- 5.2.2 Electronics

- 5.2.3 Metal Manufacturing

- 5.2.4 Medical

- 5.2.5 Other Applications (Window Insulation, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Advanced Specialty Gases

- 6.4.2 Air Liquide

- 6.4.3 Air Products and Chemicals, Inc.

- 6.4.4 AIR WATER INC

- 6.4.5 Airgas, Inc.

- 6.4.6 Concorde Specialty Gases, Inc.,

- 6.4.7 Fujian Yongjing Technology Co., Ltd

- 6.4.8 Guangdong Huate Gas Co., Ltd.

- 6.4.9 Honeywell International Inc.

- 6.4.10 Kanto Denka Kogyo Co., Ltd.

- 6.4.11 Linde plc

- 6.4.12 Matheson Tri-Gas, Inc.

- 6.4.13 Messer SE & Co. KGaA

- 6.4.14 Resonac Holdings Corporation

- 6.4.15 Solvay S.A.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment